5G NTN Market: Size, Share, Trends & Forecast (2024-2029)

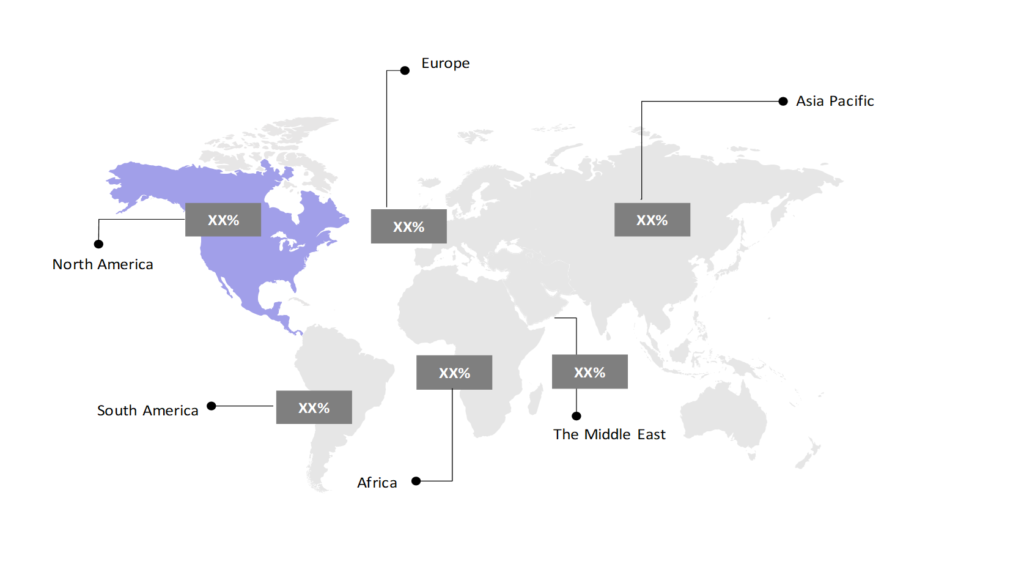

The market report offers a detailed analysis segmented by Offering (Hardware, Software, Services); by End User (Maritime, Aerospace and Defense, Government, Mining, Others); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

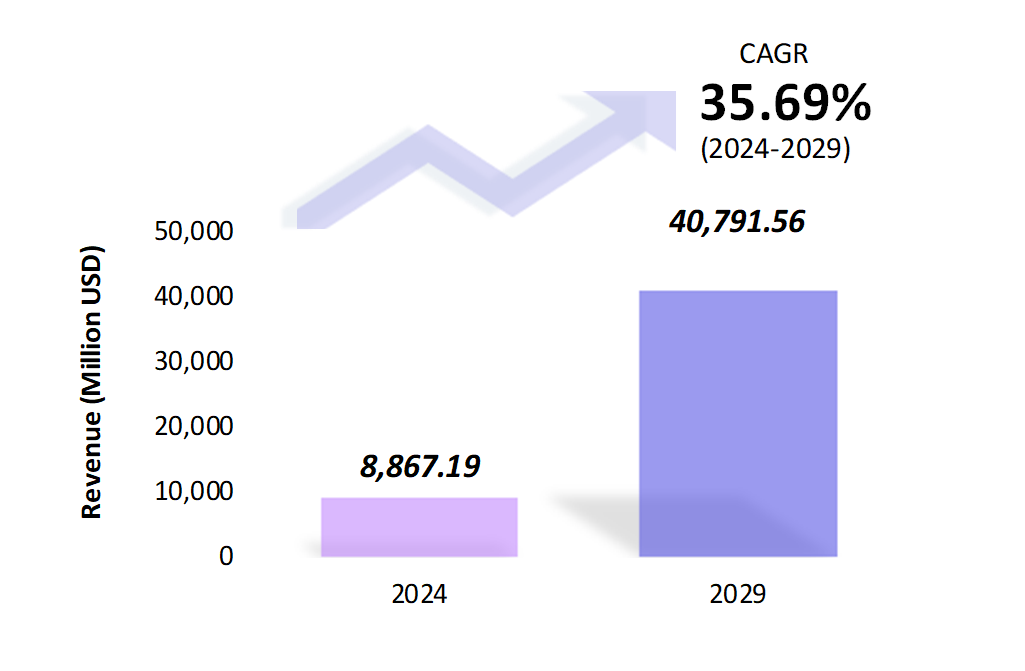

- The 5G NTN market is estimated to be at USD 8,867.19 Mn in 2024 and is anticipated to reach USD 40,791.56 Mn in 2029.

- The 5G NTN market is registering a CAGR of 35.69% during the forecast period 2024-2029.

- The global 5G NTN market is experiencing rapid growth as telecom operators, governments, and enterprises increasingly invest in satellite and aerial connectivity to extend the reach of 5G services.

Request a free sample.

Ecosystem

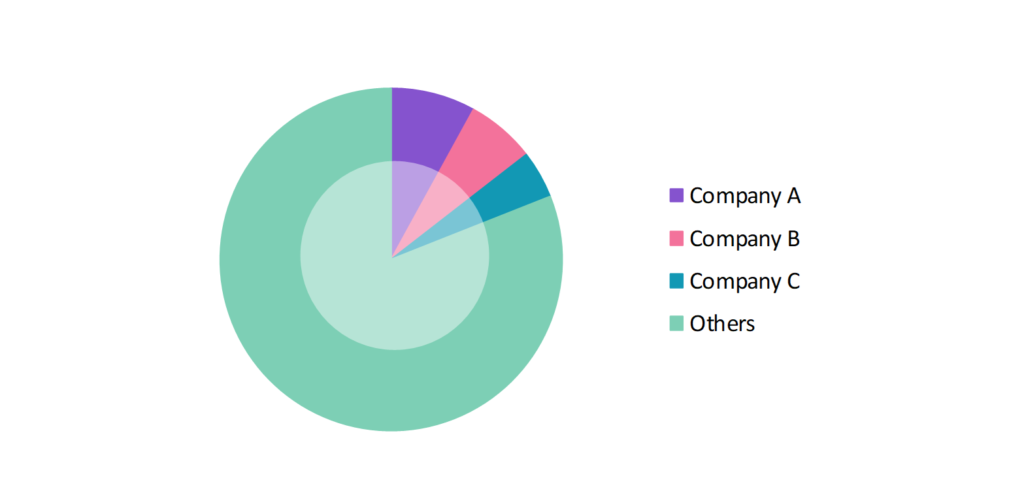

- The participants in the global 5G NTN industry are always developing their strategies to preserve a competitive advantage.

- These companies primarily use acquisitions, R&D, partnerships, and technological launches.

- Several important entities in the 5G NTN market include Qualcomm Inc.; Softbank Group; Thales Group; Rohde & Schwarz; Echostar Corp.; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2018-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Market Size (2024) | USD 8,867.19 Mn |

| Market Size (2029) | USD 40,791.56 Mn |

| Growth Rate | 35.69% CAGR from 2024 to 2029 |

| Key Segments | Offering (Hardware, Software, Services); End User (Maritime, Aerospace and Defense, Government, Mining, Others); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | Qualcomm Inc.; Softbank Group; Thales Group; Rohde & Schwarz; Echostar Corp. |

| Key Countries | The US; Canada; Mexico; Brazil; Colombia; Chile; China; India; Japan; The UK; Germany; France; UAE; Saudi Arabia; Kenya; South Africa |

| Largest Market | North America |

Get a free quote.

Trends

- Increasing Deployment of Low Earth Orbit (LEO) Satellites: The growing deployment of LEO satellites by companies like SpaceX, OneWeb, and Amazon is enhancing the capabilities of 5G NTN systems. These satellites provide low-latency broadband services to remote regions, improving connectivity for critical applications.

- Technological Advancements in Satellite Miniaturization: Innovations in satellite miniaturization enable more cost-effective and efficient 5G NTN deployments. CubeSats and nanosatellites are increasingly used to create dense satellite constellations for global coverage. In 2023, Planet Labs launched its Flock constellation, comprising hundreds of small satellites providing reduced-cost high-speed connectivity.

- Enhanced Defense and Security Solutions: The military and defense sectors are adopting 5G NTN solutions for secure and reliable communication in remote locations. 5G NTN ensures that defense organizations can maintain high-speed, low-latency communication during critical operations.

Speak to analyst.

Catalysts

- Rising Need for Global Connectivity: The increasing demand for seamless global connectivity is a crucial driver for the 5G NTN market. Regions with limited access to terrestrial 5G networks, such as rural and remote areas, rely on satellite-based high-speed internet solutions.

- Expansion of IoT and M2M Communication: The proliferation of Internet of Things (IoT) devices and machine-to-machine (M2M) communication drives the need for robust, always-on networks. 5G NTN offers uninterrupted connectivity for IoT applications in agriculture, logistics, and energy industries, where traditional networks may not reach.

- Government Initiatives to Expand Connectivity: Governments worldwide invest in 5G NTN to extend digital services to underserved populations and foster economic development. In 2022, the European Union announced funding for deploying 5G satellite constellations under its Digital Compass 2030 initiative, aiming to provide high-speed internet to remote regions.

Inquire before buying.

Restraints

- High Cost of Satellite Launch and Maintenance: One of the significant challenges facing the 5G NTN market is the high cost associated with launching and maintaining satellite infrastructure. Companies like SpaceX have attempted to lower costs through reusable rockets. Still, the expense of deploying and managing prominent satellite constellations remains a significant barrier for smaller players in the market.

- Latency and Bandwidth Limitations in Satellite Networks: LEO satellites offer lower latency than traditional geostationary satellites, but they still face challenges in providing the same bandwidth and latency as terrestrial networks. This can limit the performance of high-demand applications such as gaming, streaming, and large-scale enterprise communication.

- Regulatory and Spectrum Allocation Issues: Spectrum allocation and regulatory challenges are slowing down the deployment of 5G NTN networks. In 2023, several countries, including India and Brazil, faced delays in rolling out 5G NTN services due to disputes over spectrum allocation and licensing requirements, impacting market growth.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global 5G NTN Market (2018 – 2022) 2.2. Global 5G NTN Market (2023 – 2029) 3. Market Segmentation 3.1. Global 5G NTN Market by Offering 3.1.1. Hardware 3.1.2. Software 3.1.3. Services 3.2. Global 5G NTN Market by End User 3.2.1. Maritime 3.2.2. Aerospace and Defense 3.2.3. Government 3.2.4. Mining 3.2.5. Others 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Colombia 4.2.3. Chile 4.2.4. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Japan 4.3.4. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. France 4.4.6. Rest of Europe 4.5. The Middle East 4.5.1. UAE 4.5.2. Saudi Arabia 4.5.4. Rest of the Middle East 4.6. Africa 4.6.1. Kenya 4.6.2. South Africa 4.6.3. Rest of Africa 5. Value Chain Analysis of the Global 5G NTN Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. Qualcomm Inc. 9.2. Softbank Group 9.3. Thales Group 9.4. Rohde & Schwarz 9.5. Echostar Corp. 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

5G NTN Market – FAQs

1. What is the current size of the 5G NTN market?

Ans. In 2024, the 5G NTN market size is USD 8,867.19 Mn.

2. Who are the major vendors in the 5G NTN market?

Ans. The major vendors in the 5G NTN market are Qualcomm Inc.; Softbank Group; Thales Group; Rohde & Schwarz; Echostar Corp.

3. Which segments are covered under the 5G NTN market segments analysis?

Ans. The 5G NTN market report offers in-depth insights into Offering, End User, and Geography.