3D Scanner Market: Size, Share, Trends & Forecast (2024-2029)

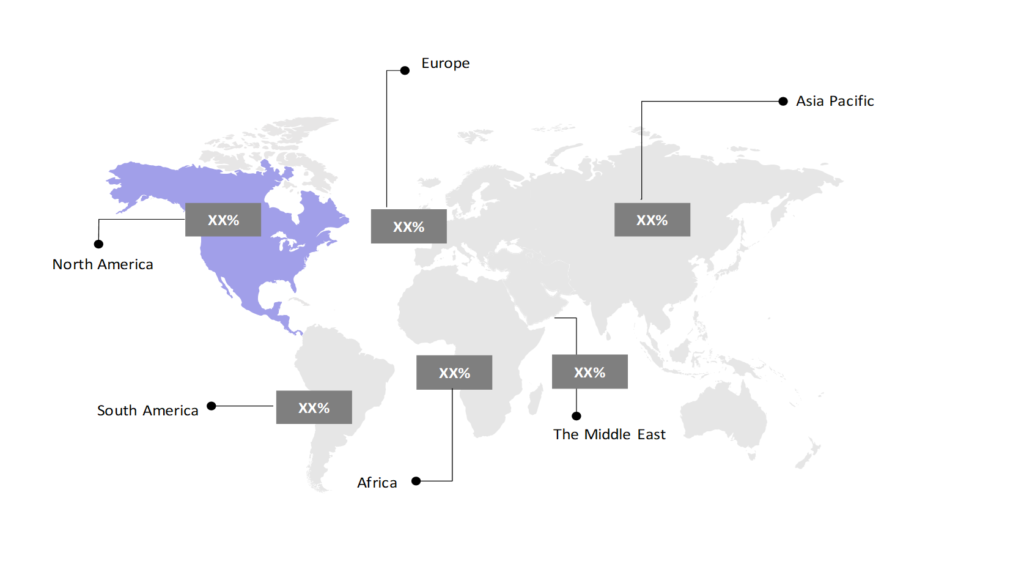

The market report offers a detailed analysis segmented by Offering (Hardware, Software, Services); by Application (Reverse Engineering, Quality Control and Inspection, Virtual Simulation, Others); by Industry (Automotive, Medical, Aerospace & Defense, Electronics, Architecture & Construction, Energy & Power, Mining, Artifact & Heritage Preservation, Others); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

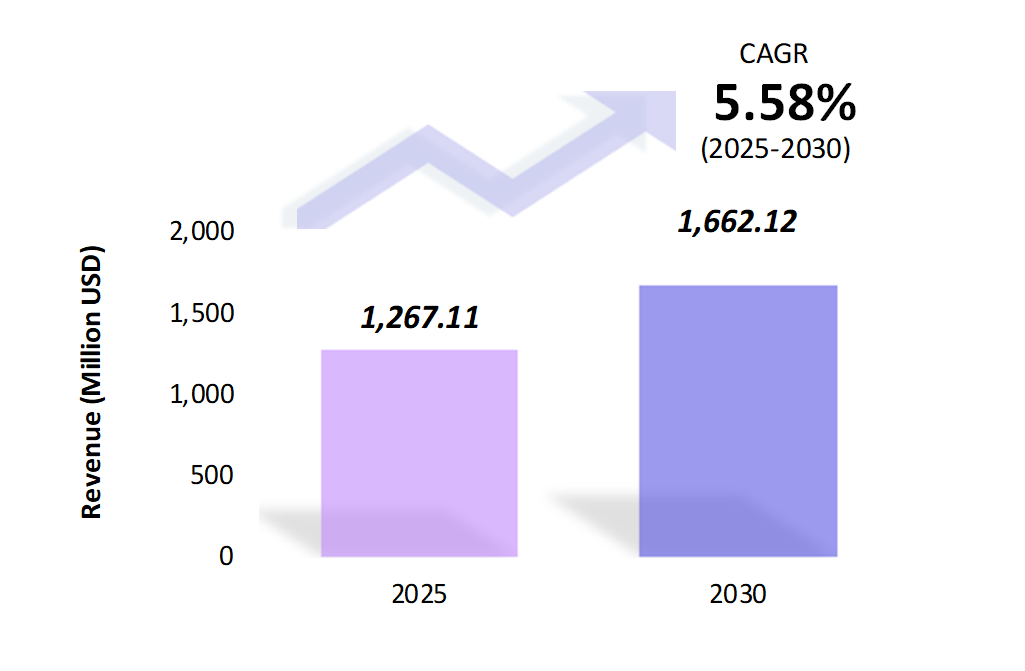

- The 3D scanner market is estimated to be at USD 1,267.11 Mn in 2025 and is anticipated to reach USD 1,662.12 Mn in 2030.

- The 3D scanner market is registering a CAGR of 5.58% during the forecast period 2025-2030.

- The global 3D scanner market is growing rapidly due to its increasing use in industries such as manufacturing, healthcare, automotive, and construction. The market is expected to witness steady growth, particularly in industries that require detailed measurements, such as aerospace and defense.

Request a free sample.

Ecosystem

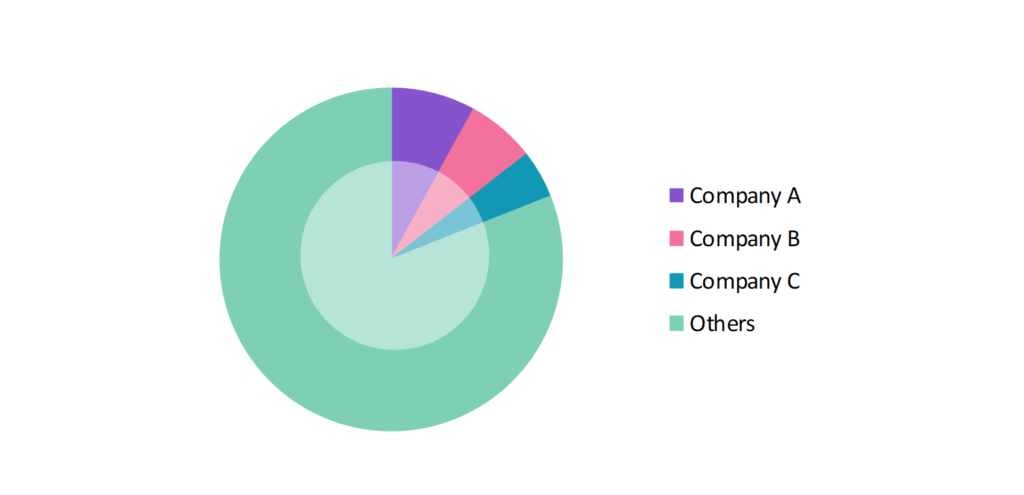

- The participants in the global 3D scanner industry are always developing their strategies to preserve a competitive advantage.

- These companies primarily use acquisitions, Research & Development, partnerships, and technological launches.

- Several important entities in the 3D scanner market include Hexagon AB; Faro Technologies, Inc.; Trimble Inc.; Nikon Corp.; Carl Zeiss AG; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2019-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Market Size (2025) | USD 1,267.11 Mn |

| Market Size (2030) | USD 1,662.12 Mn |

| Growth Rate | 5.58% CAGR from 2025 to 2030 |

| Key Segments | Offering (Hardware, Software, Services); Application (Reverse Engineering, Quality Control and Inspection, Virtual Simulation, Others); Industry (Automotive, Medical, Aerospace & Defense, Electronics, Architecture & Construction, Energy & Power, Mining, Artifact & Heritage Preservation, Others); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | Hexagon AB; Faro Technologies, Inc.; Trimble Inc.; Nikon Corp.; Carl Zeiss AG |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; Colombia; China; India; Japan; The UK; Germany; France; UAE; Saudi Arabia; Egypt; South Africa |

| Largest Market | North America |

Get a free quote.

Trends

- Integration with Artificial Intelligence (AI) and Machine Learning (ML): Artificial intelligence and machine learning are integrated into 3D scanners to enhance data processing and automate scanning procedures. In 2023, Artec 3D introduced AI-powered algorithms into its 3D scanners to improve scan accuracy and automatically identify object characteristics, allowing industries to enhance automation and reduce human error.

- Adoption of Handheld 3D Scanners: Handheld 3D scanners are emphasized due to their portability and ease of use, especially in fieldwork and on-site inspections. In 2023, Creaform launched its latest portable 3D scanner with improved speed and accuracy, catering to automotive and aerospace companies that require flexible scanning solutions.

- Cloud-Based 3D Scanning Solutions: Cloud computing is revolutionizing 3D scanning by facilitating real-time data sharing and storage, enabling users to access scanned data remotely from any location. This seamless connectivity enhances collaboration among teams, streamlines workflows, and allows for instant updates and data retrieval, making it easier for industries to manage large volumes of complex 3D data efficiently.

Speak to analyst.

Catalysts

- Growing Demand for Quality Control in Manufacturing: The growing emphasis on precise quality control in sectors such as automotive and aerospace is fueling the demand for 3D scanners. These advanced tools enable manufacturers to ensure accurate measurements and detect defects early, enhancing product reliability and safety. As industries strive for higher standards, 3D scanning technology becomes essential for maintaining a competitive edge.

- Increasing Use in Reverse Engineering and Construction Projects: The widespread application of 3D scanning in reverse engineering is a significant market driver, as it allows manufacturers to accurately recreate digital models of existing objects. This capability enables the design of components that seamlessly integrate with current products, enhancing innovation and efficiency. Additionally, the growing utilization of 3D scanners in building information modeling (BIM) and construction projects further fuels demand, as these technologies improve project accuracy, reduce errors, and streamline workflows in the construction industry.

- Government Investments in Research and Development for 3D Scanners: Government investments in research and development for 3D scanning technologies are boosting market revenue in the automotive sector. By funding innovative projects, these initiatives enhance vehicle design and manufacturing accuracy and efficiency, leading to increased productivity and cost savings. In 2022, the Defense Advanced Research Projects Agency (DARPA) allocated funding for projects that utilize advanced 3D scanning for rapid prototyping and quality control in military vehicles.

Inquire before buying.

Restraints

- High Initial Investment Costs: The high costs of advanced 3D scanning equipment present a significant barrier for small and medium-sized enterprises (SMEs), limiting their ability to adopt this technology. Many SMEs struggle to justify the investment, hindering their competitiveness and innovation in industries increasingly reliant on precision and efficiency.

- Data Privacy and Security Concerns: The rising adoption of cloud-based 3D scanning solutions introduces significant data privacy and cybersecurity challenges. As sensitive information is transferred and stored online, concerns about unauthorized access and data breaches grow, making companies wary of fully embracing these technologies.

- Environmental Sensitivity of Scanning Equipment: 3D scanners can be affected by environmental conditions such as lighting, temperature, and humidity, leading to inaccurate results. In 2023, FARO Technologies launched new models specifically engineered to perform in harsh environments, yet the market still grapples with challenges in extreme operational settings. These limitations hinder the adoption of 3D scanning technologies in certain applications, restraining overall market growth and limiting their effectiveness in diverse conditions.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global 3D Scanner Market (2019 – 2023) 2.2. Global 3D Scanner Market (2024 – 2030) 3. Market Segmentation 3.1. Global 3D Scanner Market by Offering 3.1.1. Hardware 3.1.2. Software 3.1.3. Services 3.2. Global 3D Scanner Market by Application 3.2.1. Reverse Engineering 3.2.2. Quality Control and Inspection 3.2.3. Virtual Simulation 3.2.4. Others 3.3. Global 3D Scanner Market by Industry 3.3.1. Automotive 3.3.2. Medical 3.3.3. Aerospace & Defense 3.3.4. Electronics 3.3.5. Architecture & Construction 3.3.6. Energy & Power 3.3.7. Mining 3.3.8. Artifact & Heritage Preservation 3.3.9. Others 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Colombia 4.2.4. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Japan 4.3.4. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. France 4.4.4. Rest of Europe 4.5. The Middle East 4.5.1. UAE 4.5.2. Saudi Arabia 4.5.3. Rest of the Middle East 4.6. Africa 4.6.1. Egypt 4.6.2. South Africa 4.6.3. Rest of Africa 5. Value Chain Analysis of the Global 3D Scanner Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. Hexagon AB 9.2. Faro Technologies, Inc. 9.3. Trimble Inc. 9.4. Nikon Corp. 9.5. Carl Zeiss AG 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

3D Scanner Market – FAQs

1. What is the current size of the 3D scanner market?

Ans. In 2025, the 3D scanner market size is USD 1,267.11 Mn.

2. Who are the major vendors in the 3D scanner market?

Ans. The major vendors in the 3D scanner market are Hexagon AB; Faro Technologies, Inc.; Trimble Inc.; Nikon Corp.; Carl Zeiss AG.

3. Which segments are covered under the 3D scanner market segments analysis?

Ans. The 3D scanner market report offers in-depth insights into Offering, Application, Industry, and Geography.