Ceramic Tiles Market Outlook: Size, Share, Trends & Growth Analysis (2024-2029)

The market report presents a thorough analysis segmented by Type (Porcelain, Ceramic); by Application (Flooring, Internal Walls, External Walls, Others); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

- The ceramic tiles market is estimated to be at USD 178.04 Bn in 2025 and is anticipated to reach USD 233.66 Bn in 2030.

- The ceramic tiles market is registering a CAGR of 5.59% during the forecast period 2025-2030.

- The ceramic tiles market is experiencing steady growth driven by rising urbanization, infrastructure development, and renovation activities globally. The demand for aesthetically versatile, durable, and low-maintenance materials makes ceramic tiles a popular choice across residential, commercial, and industrial applications. However, the market faces challenges from volatile raw material prices, energy crises, and evolving regulations. Innovation in digital printing and sustainable production processes is also shaping the competitive landscape.

Request a free sample.

Ecosystem

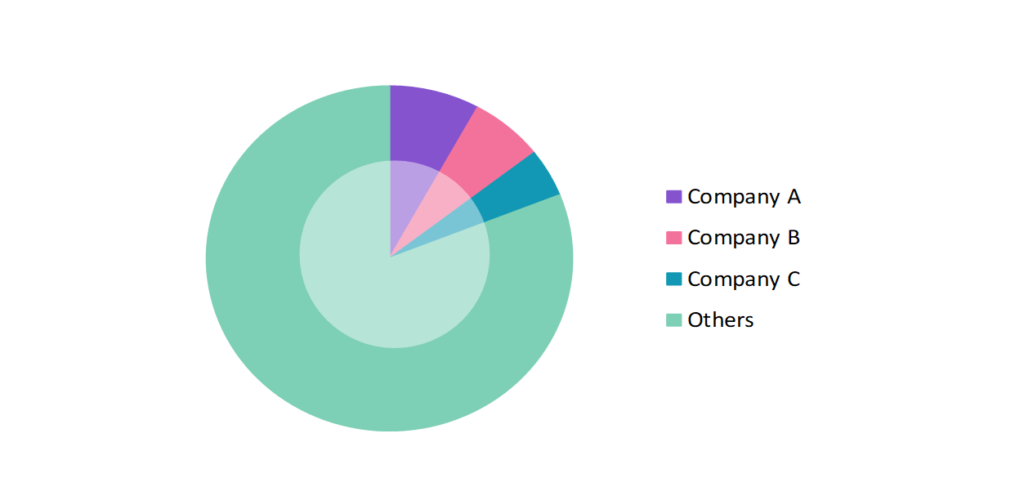

- The participants in the global ceramic tiles industry are always developing their strategies to preserve a competitive advantage.

- Companies are focusing on unique product features, such as innovative designs, superior quality, or specialized functionalities, to stand out in the market and command premium pricing.

- Several important entities in the ceramic tiles market include Mohawk Industries, Inc.; KITO Ceramics Group Co., Ltd.; RAK Ceramics PJSC Ltd.; The Siam Cement Public Co., Ltd.; Kajaria Ceramics Ltd.; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2019-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Market Size (2025) | USD 178.04 Bn |

| Market Size (2030) | USD 233.66 Bn |

| Growth Rate | 5.59% CAGR from 2025 to 2030 |

| Key Segments | Type (Porcelain, Ceramic); Application (Flooring, Internal Walls, External Walls, Others); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | Mohawk Industries, Inc.; KITO Ceramics Group Co., Ltd.; RAK Ceramics PJSC Ltd.; The Siam Cement Public Co., Ltd.; Kajaria Ceramics Ltd. |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; China; India; Vietnam; Indonesia; The UK; Germany; Netherlands; Turkey; Saudi Arabia; Egypt; South Africa |

| Largest Market | Asia Pacific |

Get a free quote.

Trends

- Digital Printing Technology for High-Precision Designs: Advanced digital printing allows for highly intricate designs and textures, which enables manufacturers to replicate natural materials like wood, marble, and stone with incredible precision. This innovation improves aesthetic versatility while maintaining cost efficiency. Ceramiche Refin offers collections that mimic natural textures using digital printing, which provides a more versatile range of design options for architects and homeowners.

- Anti-bacterial and Self-cleaning Tiles: Tiles with antibacterial and self-cleaning properties are becoming popular, especially in healthcare and public spaces. Active Surfaces by Iris Ceramica Group features a titanium dioxide coating that, when exposed to light, breaks down bacteria and pollutants, which makes the surfaces ideal for environments like hospitals and schools, where hygiene is critical.

- Large Format and Ultra-Slim Tiles for Seamless Spaces: The use of large format tiles (up to 3 meters in length) is on the rise, particularly in commercial spaces. These tiles offer fewer grout lines and a more seamless appearance. Additionally, slim tile designs (as thin as 3 mm) are popular for wall cladding and renovation projects, which reduces installation time and material waste.

Speak to analyst.

Catalysts

- Increasing Population and Urbanization: The rapidly growing global population, especially in urban centers, is significantly boosting the demand for both residential and commercial spaces. As cities expand and densify, there is an increasing need for construction materials that are not only durable and cost-effective but also visually appealing and low maintenance. Ceramic tiles are emerging as an ideal solution, offering a combination of longevity, easy upkeep, and versatile design options.

- Growing Investment in the Construction Industry: Governments and private sectors are making substantial investments in infrastructure and real estate development. Large-scale projects, such as smart cities and industrial complexes, are boosting demand for ceramic tiles in both residential and commercial sectors. For example, the ongoing construction boom in regions like the Middle East, driven by projects like Saudi Arabia’s NEOM, is contributing to the rising demand for ceramic tiles.

- Rising Number of Renovation Activities: The increase in home and building renovations, especially in developed markets, is another critical driver. Aging infrastructure and consumer preference for modern, stylish interiors lead to frequent upgrades, with ceramic tiles being a popular choice for flooring and walls. In markets like North America and Europe, a significant portion of tile sales are attributed to renovation and remodeling activities, especially in kitchens and bathrooms.

Inquire before buying.

Restraints

- Gas Crisis in Different Regions: The ceramic tile manufacturing process is energy-intensive, and many regions are facing gas supply shortages and rising energy costs, which are severely impacting production. For example, Europe has been grappling with a gas crisis due to geopolitical tensions, particularly affecting ceramic tile producers in countries like Italy and Spain. This energy disruption is driving up operational costs and limiting production capacity.

- Volatile Raw Material Prices: Fluctuations in the prices of key raw materials such as clay, feldspar, and silica are creating uncertainty for ceramic tile manufacturers. Supply chain disruptions, mining restrictions, and transportation bottlenecks have exacerbated price volatility. For instance, the cost of clay has spiked in various regions due to mining limitations, which directly affects profit margins for tile producers.

- Increasing Regulations, Requirements, and Tariffs: The ceramic tile industry faces an evolving landscape of environmental regulations and tariffs, which can be costly and complex to navigate. In particular, stricter emissions standards aimed at reducing carbon footprints in manufacturing are forcing companies to invest in cleaner technologies, adding to operational expenses. Additionally, tariffs on raw materials and finished products, especially in regions with protectionist trade policies, are further complicating the global market. For example, the US tariffs on imported tiles from China have disrupted supply chains, making it more expensive for importers to meet domestic demand.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Ceramic Tiles Market (2019 – 2023) 2.2. Global Ceramic Tiles Market (2024 – 2030) 3. Market Segmentation 3.1. Global Ceramic Tiles Market by Type 3.1.1. Porcelain 3.1.2. Ceramic 3.2. Global Ceramic Tiles Market by Application 3.2.1. Flooring 3.2.2. Internal Walls 3.2.3. External Walls 3.2.4. Others 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Vietnam 4.3.4. Indonesia 4.3.5. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. Netherlands 4.4.4. Rest of Europe 4.5. The Middle East 4.5.1. Turkey 4.5.2. Saudi Arabia 4.5.3. Rest of the Middle East 4.6. Africa 4.6.1. Egypt 4.6.2. South Africa 4.6.3. Rest of Africa 5. Value Chain Analysis of the Global Ceramic Tiles Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. Mohawk Industries, Inc. 9.2. KITO Ceramics Group Co., Ltd. 9.3. RAK Ceramics PJSC Ltd. 9.4. The Siam Cement Public Co., Ltd. 9.5. Kajaria Ceramics Ltd. 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Ceramic Tiles Market – FAQs

1. What is the current size of the ceramic tiles market?

Ans. In 2025, the ceramic tiles market size is USD 178.04 Bn.

2. Who are the major vendors in the ceramic tiles market?

Ans. The major vendors in the ceramic tiles market are Mohawk Industries, Inc.; Kito Ceramics Group Co., Ltd.; RAK Ceramics PJSC Ltd.; The Siam Cement Public Co., Ltd.; Kajaria Ceramics Ltd.

3. Which segments are covered under the ceramic tiles market segments analysis?

Ans. The ceramic tiles market report offers in-depth insights into Type, Application, and Geography.