Fiber Optics Market Outlook: Size, Share, Trends & Growth Analysis (2024-2029)

The market report presents a thorough analysis segmented by Mode (Single Mode, Multi Mode); by Type (Glass, Plastic); by Industry Vertical (Telecom, Oil & Gas, Aerospace & Defense, Medical, Railway, Others); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

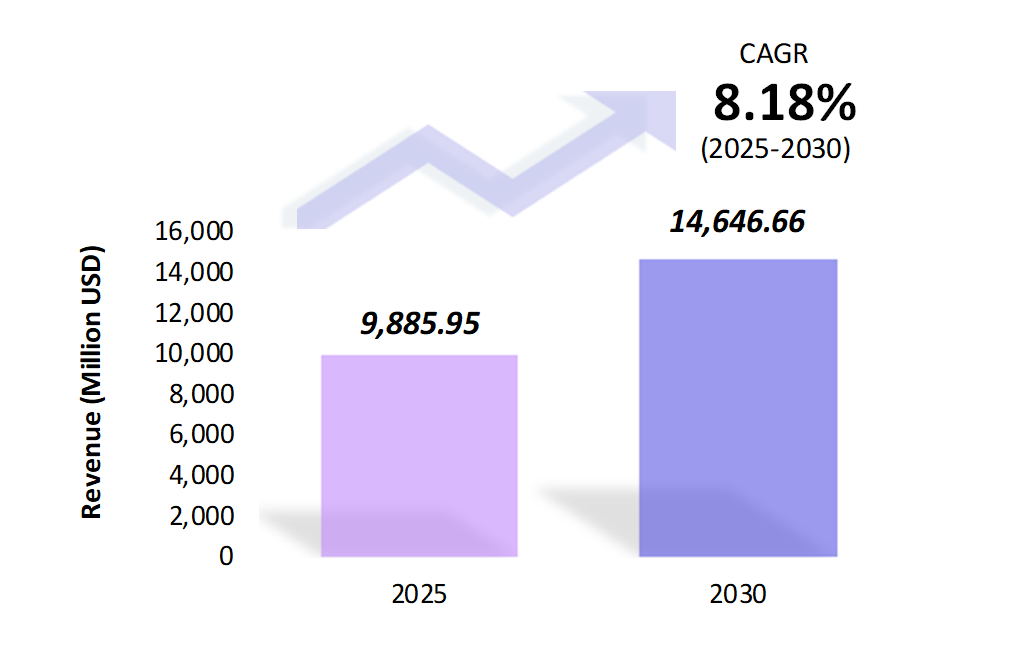

- The fiber optics market is estimated to be at USD 9,885.95 Mn in 2025 and is anticipated to reach USD 14,646.66 Mn in 2030.

- The fiber optics market is registering a CAGR of 8.18% during the forecast period 2025-2030.

- Fiber optics, crucial for telecommunications and data transmission, uses glass or plastic strands to transmit light signals for faster data transfer. The market is growing significantly due to 5G deployment, increasing FTTH services, and demand for reliable connectivity.

Request a free sample.

Ecosystem

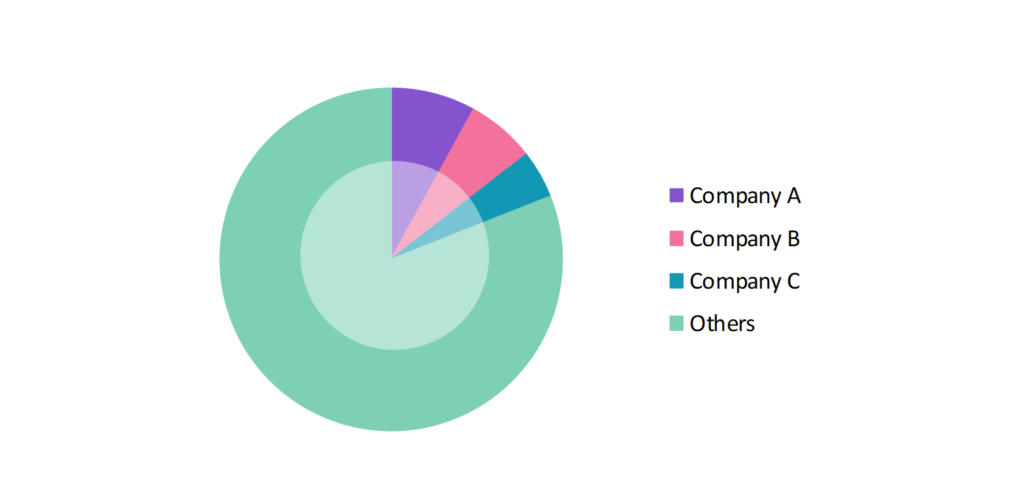

- The participants in the global fiber optics industry dominate the market through continuous product innovation, strategic partnerships, and large-scale production capabilities.

- These companies focus on investing in research and development to improve the performance and durability of fiber optic cables, along with collaboration between technology companies and telecommunication providers to maintain a competitive edge in the market.

- Several important entities in the fiber optics market include Optical Cable Corp.; Sterlite Technologies Ltd.; Fujikura Ltd.; Finolex Cables Ltd.; OFS Fintel, LLC; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2019-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Market Size (2025) | USD 9,885.95 Mn |

| Market Size (2030) | USD 14,646.66 Mn |

| Growth Rate | 8.18% CAGR from 2025 to 2030 |

| Key Segments | Mode (Single Mode, Multi Mode); Type (Glass, Plastic); Industry Vertical (Telecom, Oil & Gas, Aerospace & Defense, Medical, Railway, Others); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | Optical Cable Corp.; Sterlite Technologies Ltd.; Fujikura Ltd.; Finolex Cables Ltd.; OFS Fintel, LLC |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; Ecuador; China; India; Japan; Vietnam; The UK; Germany; Romania; Turkey; UAE; Israel; Morocco; South Africa |

| Largest Market | Asia Pacific |

Get a free quote.

Trends

- Development of Fiber-to-the-Home (FTTH) Networks: FTTH is gaining traction globally, especially in urban areas where there is high demand for reliable and fast internet. This trend is pushing governments and private sector players to invest heavily in fiber optics infrastructure. In 2022, China Telecom expanded its FTTH services to rural areas, enabling millions of users to access high-speed internet for the first time.

- Miniaturization of Fiber Optic Sensors: The miniaturization of fiber optic sensors is becoming a key trend in industrial and environmental monitoring. These compact sensors are used for measuring temperature, pressure, and strain in harsh environments, including oil rigs, nuclear plants, and aircraft. In 2023, Opsens Solutions developed ultra-miniature fiber optic sensors used in the aerospace sector, offering real-time structural health monitoring in aircraft.

- Increased Focus on Fiber Optic Components Manufacturing: As demand for fiber optic technology grows, there has been a parallel focus on developing advanced fiber optic components such as connectors, amplifiers, and couplers to improve performance and reliability. Companies are investing in innovative component designs to meet industry requirements.

Speak to analyst.

Catalysts

- Growing Demand for High-Speed Internet: The rising demand for high-speed internet, particularly with the shift to remote work and digital learning, is driving the adoption of fiber optics. Fiber optics offers faster and more reliable internet connections, especially in urban and suburban areas, compared to copper or satellite-based services.

- Expansion of Telecom Infrastructure: The global expansion of telecommunications infrastructure, particularly in developing regions, is a major driver for the fiber optics market. Governments and private companies are investing heavily in fiber optic networks to enhance connectivity, improve mobile services, and bridge the digital divide.

- Rising Demand from the Defense Sector: The defense industry is increasingly using fiber optics for secure and high-speed communications, as well as for data transmission in advanced military equipment. Fiber optics offer enhanced data security and resistance to electromagnetic interference, making them suitable for defense applications. In 2023, Raytheon Technologies integrated fiber optics into its communication systems to improve data transmission speeds and security in military operations.

Inquire before buying.

Restraints

- High Initial Installation Costs: One of the key challenges in the fiber optics market is the high initial cost of installation, especially for large-scale projects. While fiber optics offer long-term cost savings, the upfront investment required for laying fiber optic cables, especially in rural or underdeveloped areas, can be prohibitive.

- Maintenance and Repair Complexity: Fiber optic cables are delicate and can be easily damaged during installation or operation. The maintenance and repair of fiber optic networks require specialized knowledge and equipment, making it a costly and time-consuming process for service providers.

- Limited Fiber Optic Infrastructure: Many developing countries still lack the necessary infrastructure for widespread fiber optic adoption. The cost of building the infrastructure and the lack of technical expertise in these regions hinder the market’s growth. In 2023, Nigeria faced challenges in expanding its fiber optic network due to a lack of infrastructure and government support, limiting the availability of high-speed internet in rural areas.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Fiber Optics Market (2019 – 2023) 2.2. Global Fiber Optics Market (2024 – 2030) 3. Market Segmentation 3.1. Global Fiber Optics Market by Mode 3.1.1. Single Mode 3.1.2. Multi Mode 3.2. Global Fiber Optics Market by Type 3.2.1. Glass 3.2.2. Plastic 3.3. Global Fiber Optics Market by Industry Vertical 3.3.1. Telecom 3.3.2. Oil & Gas 3.3.3. Aerospace & Defense 3.3.4. Medical 3.3.5. Railway 3.3.6. Others 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Ecuador 4.2.4. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Japan 4.3.4. Vietnam 4.3.5. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. Romania 4.4.4. Rest of Europe 4.5. The Middle East 4.5.1. Turkey 4.5.2. UAE 4.5.3. Israel 4.5.4. Rest of the Middle East 4.6. Africa 4.6.1. Morocco 4.6.2. South Africa 4.6.3. Rest of Africa 5. Value Chain Analysis of the Global Fiber Optics Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. Optical Cable Corp. 9.2. Sterlite Technologies Ltd. 9.3. Fujikura Ltd. 9.4. Finolex Cables Ltd. 9.5. OFS Fintel, LLC 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Fiber Optics Market – FAQs

1. What is the current size of the fiber optics market?

Ans. In 2025, the fiber optics market size is USD 9,885.95 Mn.

2. Who are the major vendors in the fiber optics market?

Ans. The major vendors in the fiber optics market are Optical Cable Corp.; Sterlite Technologies Ltd.; Fujikura Ltd.; Finolex Cables Ltd.; OFS Fintel, LLC.

3. Which segments are covered under the fiber optics market segments analysis?

Ans. The fiber optics market report offers in-depth insights into Mode, Type, Industry Vertical, and Geography.