Limestone Market Outlook: Size, Share, Trends & Growth Analysis (2024-2029)

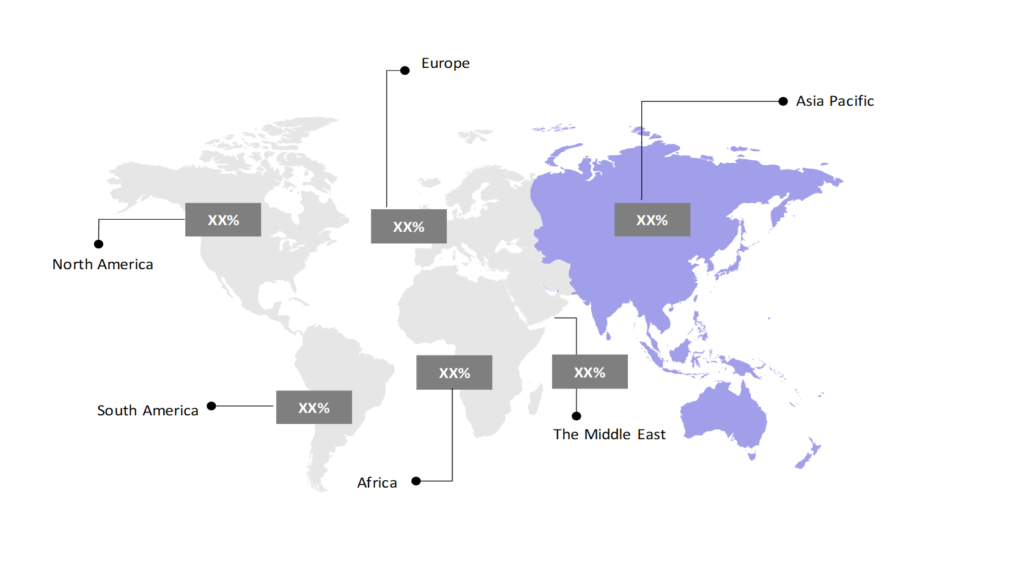

The market report presents a thorough analysis segmented by Type (Magnesian Limestone, High-Calcium Limestone); by End User (Metallurgy, Water and Wastewater Treatment, Construction, Agriculture, Paper and Pulp, Chemical, Others); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

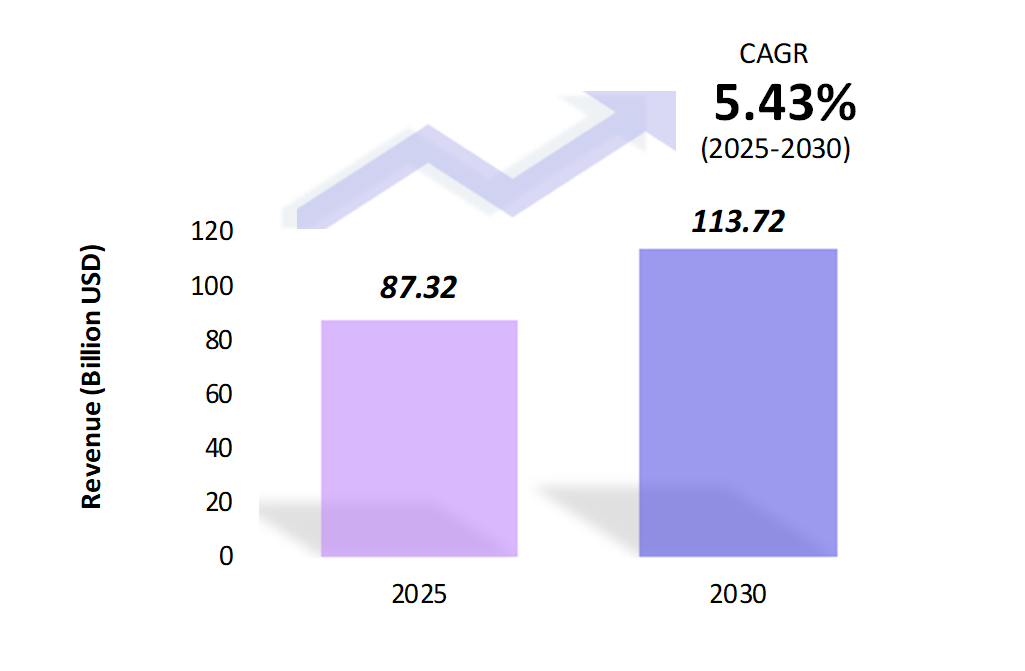

- The limestone market is estimated to be at USD 87.32 Bn in 2025 and is anticipated to reach USD 113.72 Bn in 2030.

- The limestone market is registering a CAGR of 5.43% during the forecast period 2025-2030.

- The global limestone market has experienced consistent growth due to its extensive use across construction, agriculture, and steel production industries. The limestone market continues to benefit from infrastructure development, environmental applications, and agricultural demand worldwide.

Request a free sample.

Ecosystem

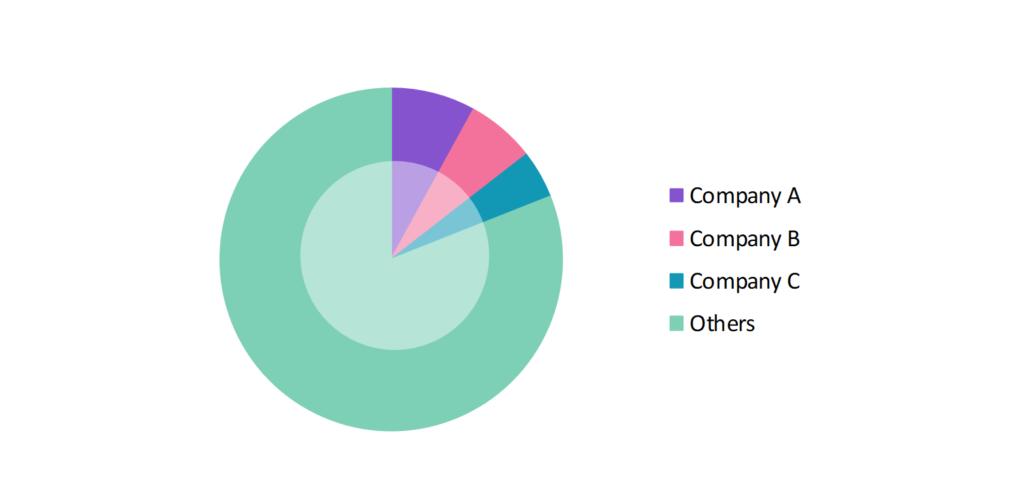

- The global limestone industry participants are constantly developing strategies to preserve a competitive advantage.

- These companies primarily use acquisitions, investments, Research & Developments, partnerships, and technological launches.

- Several important entities in the limestone market include Graymont Ltd.; Carmeuse Coordination Center SA; Mitsubishi Corp.; SCHAEFER KALK GmbH & Co. KG; J.M. Huber Corp.; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2019-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Market Size (2025) | USD 87.32 Bn |

| Market Size (2030) | USD 113.72 Bn |

| Growth Rate | 5.43% CAGR from 2025 to 2030 |

| Key Segments | Type (Magnesian Limestone, High-Calcium Limestone); End User (Metallurgy, Water and Wastewater Treatment, Construction, Agriculture, Paper and Pulp, Chemical, Others); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | Graymont Ltd.; Carmeuse Coordination Center SA; Mitsubishi Corp.; SCHAEFER KALK GmbH & Co. KG; J.M. Huber Corp. |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; Chile; China; India; Japan; South Korea; The UK; Germany; France; UAE; Saudi Arabia; Egypt; South Africa |

| Largest Market | Asia Pacific |

Get a free quote.

Trends

- Increased Use of Digital Tools for Mining Operations: Companies in the limestone mining industry are increasingly adopting digital technologies to optimize quarry operations and reduce downtime. These tools, including Global Positioning System (GPS) tracking, 3D mapping, and Internet of Things sensors, allow for precise extraction, minimize waste, and improve safety. For example, in 2022, European limestone quarries began implementing AI-driven analysis to better monitor and predict maintenance needs, helping to streamline operations and reduce environmental impact.

- Shift Towards Carbon-Neutral Cement Alternatives: The push for sustainable construction materials has led the cement industry to explore carbon-neutral alternatives that require less limestone. Several industry players are experimenting with low-carbon binders and clinker substitutes, which lessen the traditional dependency on limestone while still meeting structural standards. In 2023, Heidelberg Materials and other cement companies launched pilot programs for limestone-alternative products to balance performance with a reduced carbon footprint.

- Focus on Sustainable Restoration of Limestone Quarries: Environmental regulations are prompting limestone producers to prioritize quarry restoration efforts, restoring natural habitats and reducing environmental degradation. Many companies are replanting vegetation, creating artificial lakes, or converting quarries into eco-friendly sites. For instance, in 2022, a reclaimed quarry in Ontario was transformed into a recreational park, demonstrating the industry’s shift towards sustainable mining practices.

Speak to analyst.

Catalysts

- Growth of the Cement and Concrete Industries: The booming construction and real estate sectors, especially in rapidly urbanizing regions, are driving a substantial increase in limestone demand, essential for cement and concrete production. As infrastructure projects and new developments rise, the need for high-quality materials becomes increasingly important. This trend highlights the ongoing shift towards urban development, where limestone is crucial for growing construction requirements. As a result, the demand for limestone is expected to rise, supporting the overall growth of the construction industry.

- Increasing Use of Iron and Steel Production: As the steel industry expands to meet rising global demand, the need for limestone is increasing correspondingly. This growing reliance on limestone not only enhances the quality of steel produced but also underscores its importance in supporting the overall growth of the metallurgical sector. Consequently, demand for limestone is expected to rise alongside advancements in steel production.

- Government Initiatives Supporting Infrastructure Development: Numerous government-funded projects globally require large quantities of limestone for infrastructure, creating consistent demand. For instance, the African Union’s Agenda 2063, which aims to build transport and housing infrastructures, has increased the demand for limestone across the continent.

Inquire before buying.

Restraints

- Environmental Concerns over Mining Activities: Limestone mining is associated with environmental impacts like habitat destruction, groundwater depletion, and dust emissions, resulting in community opposition and stricter mining regulations. In 2022, local protests in Mexico’s Yucatan Peninsula led to more stringent mining controls, affecting production.

- High Transportation Costs: Limestone’s bulk and weight make transportation costly, particularly for exports. Rising fuel prices have further increased shipping expenses, challenging suppliers to maintain competitive pricing in global markets. This situation pressures limestone producers to balance transportation costs with attracting customers, potentially impacting profit margins.

- Stringent Regulatory Framework: Mining and environmental regulations are becoming increasingly stringent worldwide, raising operational costs for limestone companies. In the European Union, for instance, strict emissions standards and quarry restoration requirements compel firms to invest heavily in compliance measures. These regulations drive up costs and necessitate ongoing investments in sustainable practices, ultimately impacting profitability and complicating the operational landscape for limestone producers.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Limestone Market (2019 – 2023) 2.2. Global Limestone Market (2024 – 2030) 3. Market Segmentation 3.1. Global Limestone Market by Type 3.1.1. Magnesian Limestone 3.1.2. High-Calcium Limestone 3.2. Global Limestone Market by End User 3.2.1. Metallurgy 3.2.2. Water and Wastewater Treatment 3.2.3. Construction 3.2.4. Agriculture 3.2.5. Paper and Pulp 3.2.6. Chemical 3.2.7. Others 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Chile 4.2.4. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Japan 4.3.4. South Korea 4.3.5. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. France 4.4.4. Rest of Europe 4.5. The Middle East 4.5.1. UAE 4.5.2. Saudi Arabia 4.5.3. Rest of the Middle East 4.6. Africa 4.6.1. Egypt 4.6.2. South Africa 4.6.3. Rest of Africa 5. Value Chain Analysis of the Global Limestone Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. Graymont Ltd. 9.2. Carmeuse Coordination Center SA 9.3. Mitsubishi Corp. 9.4. SCHAEFER KALK GmbH & Co. KG 9.5. J.M. Huber Corp. 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Limestone Market – FAQs

1. What is the current size of the limestone market?

Ans. In 2025, the limestone market size is USD 87.32 Bn.

2. Who are the major vendors in the limestone market?

Ans. The major vendors in the limestone market are Graymont Ltd.; Carmeuse Coordination Center SA; Mitsubishi Corp.; SCHAEFER KALK GmbH & Co. KG; J.M. Huber Corp.

3. Which segments are covered under the limestone market segments analysis?

Ans. The limestone market report offers in-depth insights into Type, End User, and Geography.