Frozen Potato Market: Size, Share, Trends & Forecast (2024-2029)

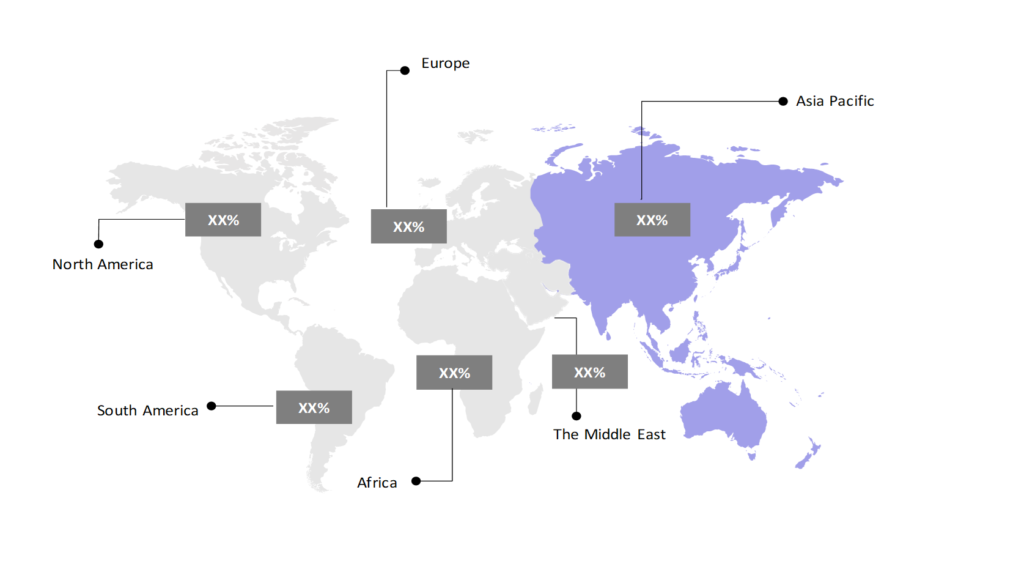

The market report offers a detailed analysis segmented by Product (Fried Potatoes, Potato Wedges, Stuffed Potatoes, Potato Slices, Potato Chunks, Potato Dices, Baked Potatoes, Others); by End User (Commercial Use, Residential Use); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

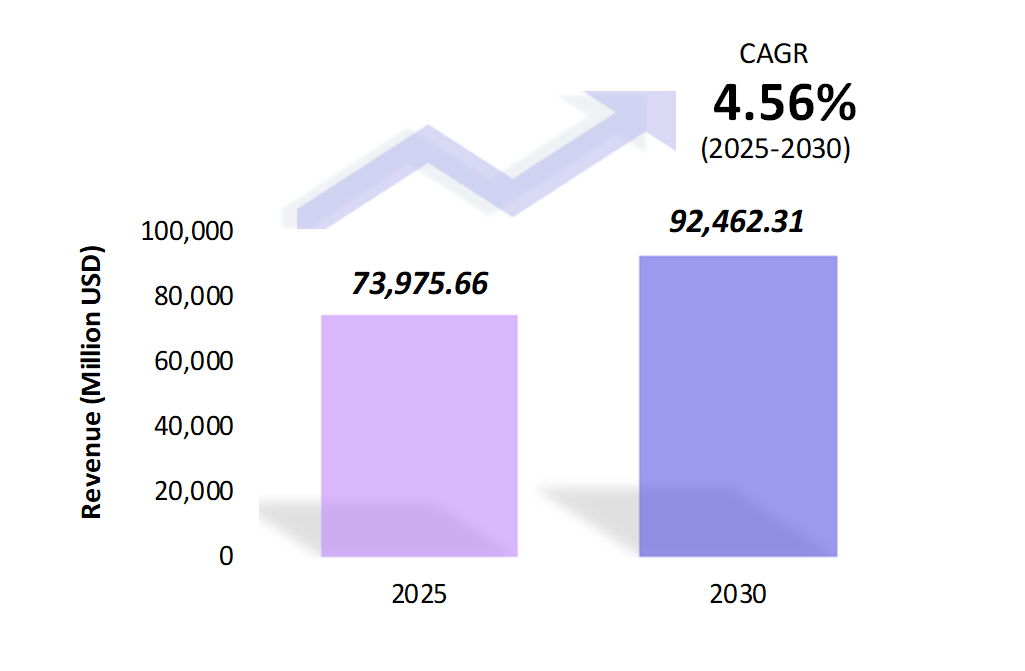

- The frozen potato market is estimated to be at USD 73,975.66 Mn in 2025 and is anticipated to reach USD 92,462.31 Mn in 2030.

- The frozen potato market is registering a CAGR of 4.56% during the forecast period 2025-2030.

- The global frozen potato market has been growing steadily, driven by increased demand for convenience foods and the expansion of the fast-food sector. Frozen potato products, including fries, wedges, and hash browns, are popular due to their extended shelf life and convenience in preparation, making them staples for both food service operators and consumers.

Request a free sample.

Ecosystem

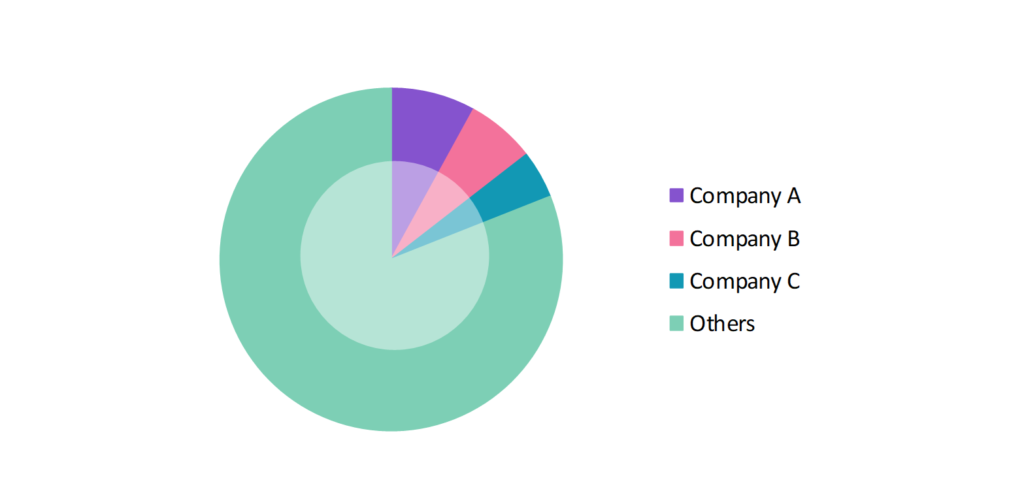

- The participants in the global frozen potato industry are always developing their strategies to preserve a competitive advantage.

- These companies primarily use acquisitions, research & developments, partnerships, and technological launches.

- Several important entities in the frozen potato market include The Kraft Heinz Co.; McCain Foods Ltd.; Lamb Weston, Inc.; Himalaya Food International Ltd.; Bart’s Potato Co.; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2019-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Market Size (2025) | USD 73,975.66 Mn |

| Market Size (2030) | USD 92,462.31 Mn |

| Growth Rate | 4.56% CAGR from 2025 to 2030 |

| Key Segments | Product (Fried Potatoes, Potato Wedges, Stuffed Potatoes, Potato Slices, Potato Chunks, Potato Dices, Baked Potatoes, Others); End User (Commercial Use, Residential Use); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | The Kraft Heinz Co.; McCain Foods Ltd.; Lamb Weston, Inc.; Himalaya Food International Ltd.; Bart’s Potato Co. |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; Chile; China; India; Japan; The UK; Germany; France; UAE; Saudi Arabia; Egypt; South Africa |

| Largest Market | Asia Pacific |

Get a free quote.

Trends

- Innovation in Product Offerings: Companies focus on diversifying their product portfolios with healthier and innovative options, such as sweet potato fries and low-fat variants. In 2022, significant providers like McCain Foods launched new product lines featuring reduced fat and organic frozen potato products to cater to health-conscious consumers.

- Sustainability and Eco-Friendly Packaging: The shift towards environmentally friendly practices has impacted the frozen potato market, leading to sustainable packaging innovations. Several companies have committed to using biodegradable or recyclable materials for packaging, aligning with consumer demand for more sustainable products.

- Technological Advancements in Food Processing: Innovations in freezing and storage technologies have significantly enhanced frozen potato products’ quality and shelf life. Techniques like flash freezing, which rapidly freezes potatoes at extremely low temperatures, help preserve their texture, taste, and nutritional value. These advancements ensure a fresher, more flavorful product for consumers and reduce the loss of essential vitamins and nutrients during storage.

Speak to analyst.

Catalysts

- Growing Popularity of Ready-to-Eat Foods: The demand for ready-to-cook and ready-to-eat food options has increased, particularly among urban consumers with fast-paced lifestyles. This trend has boosted the sales of frozen potato products like French fries and potato wedges. For example, in 2023, North America and Europe witnessed a surge in the consumption of frozen fries, particularly driven by busy consumer schedules and rising dual-income households.

- Rising Demand for Fast Food and Quick Service Restaurants (QSRs): The global growth of quick-service restaurants (QSRs) like McDonald’s, Burger King, and KFC has been a significant driver of demand for frozen potato products. In 2022, the expansion of these chains into emerging markets such as India and Southeast Asia led to a significant increase in the consumption of frozen fries and hash browns. As QSRs continue to thrive in these regions, they boost sales and contribute to the rising popularity of frozen potato products as convenient, high-quality menu items.

- Increased Urbanization and Changing Lifestyles: Urbanization and shifting eating habits, particularly the growing preference for convenience foods, have driven market growth significantly. As more people move to urban areas, busy lifestyles have increased demand for quick, ready-to-eat meals. This growth fuels the popularity of frozen and processed food products, including ready-to-cook potato items, which offer convenience without compromising taste or quality.

Inquire before buying.

Restraints

- Volatility in Raw Material Prices: Fluctuations in raw potato prices pose a considerable challenge for the frozen potato industry. As potato supply dwindled, the cost of producing frozen potato products like fries and wedges increased due to higher raw material and transportation expenses. This price surge not only squeezed manufacturers’ profit margins but also affected consumers’ availability and affordability of frozen potato products. In 2023, harsh weather conditions in North America, including droughts and unexpected frosts, significantly reduced the potato harvest, leading to a rise in raw potato prices.

- Health Concerns Related to Processed Foods: Rising awareness of the health risks associated with highly processed and fried foods has prompted some consumers to reduce their intake. The frozen potato market has faced criticism from health advocacy groups urging lower consumption of high-fat, processed options. This growing health concern has pressured the industry to rethink its product offerings and adapt to changing consumer attitudes.

- Competition from Fresh and Alternative Products: The frozen potato products market is being challenged by increasing competition from fresh potatoes and healthier alternatives, such as plant-based snacks. As consumers increasingly favor low-fat, nutritious options, the popularity of baked vegetable chips and other healthier snacks has overshadowed traditional frozen potato items. This shift in consumer preferences pushes brands to innovate and adapt to meet the demand for healthier, more versatile snack choices.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Frozen Potato Market (2019 – 2023) 2.2. Global Frozen Potato Market (2024 – 2030) 3. Market Segmentation 3.1. Global Frozen Potato Market by Product 3.1.1. Fried Potatoes 3.1.2. Potato Wedges 3.1.3. Stuffed Potatoes 3.1.4. Potato Slices 3.1.5. Potato Chunks 3.1.6. Potato Dices 3.1.7. Baked Potatoes 3.1.8. Others 3.2. Global Frozen Potato Market by End User 3.2.1. Commercial Use 3.2.2. Residential Use 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Chile 4.2.4. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Japan 4.3.4. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. France 4.4.4. Rest of Europe 4.5. The Middle East 4.5.1. UAE 4.5.2. Saudi Arabia 4.5.3. Rest of the Middle East 4.6. Africa 4.6.1. Egypt 4.6.2. South Africa 4.6.3. Rest of Africa 5. Value Chain Analysis of the Global Frozen Potato Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. The Kraft Heinz Co. 9.2. McCain Foods Ltd. 9.3. Lamb Weston, Inc. 9.4. Himalaya Food International Ltd. 9.5. Bart’s Potato Co. 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Frozen Potato Market – FAQs

1. What is the current size of the frozen potato market?

Ans. In 2025, the frozen potato market size is USD 73,975.66 Mn.

2. Who are the major vendors in the frozen potato market?

Ans. The major vendors in the frozen potato market are The Kraft Heinz Co.; McCain Foods Ltd.; Lamb Weston, Inc.; Himalaya Food International Ltd.; Bart’s Potato Co.

3. Which segments are covered under the frozen potato market segments analysis?

Ans. The frozen potato market report offers in-depth insights into Product, End User, and Geography.