Advanced Driver Assistance Systems Market Insights: Size, Share, Growth Analysis & Forecast (2024-2029)

The report covers a comprehensive analysis segmented by Vehicle Type (Passenger Cars, Light Commercial Vehicles, Trucks, Buses). by System Type (Adaptive Cruise Control, Adaptive Front Light, Adaptive Emergency Braking, Blind Spot Detection, Cross- Traffic- Alert, Driver Monitoring System, Intelligent Park Assistant, Others). by Offering (Hardware, Software). by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

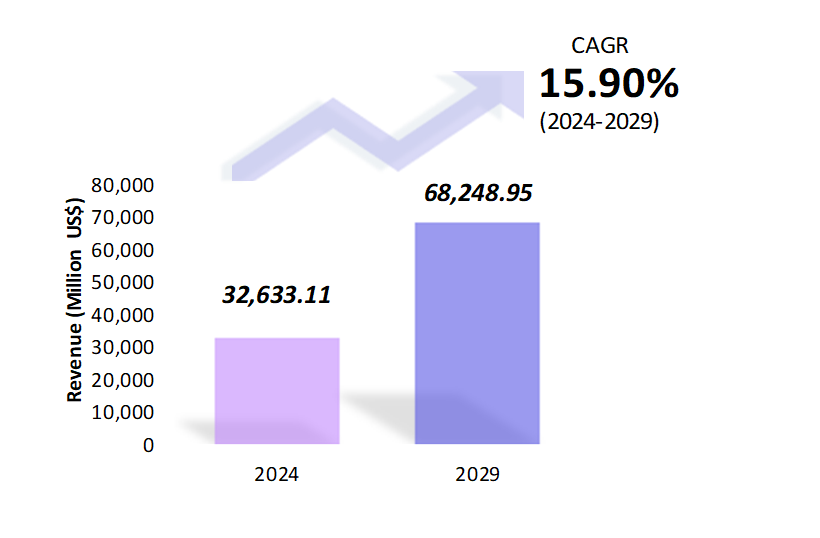

Advanced Driver Assistance Systems Market Snapshot

Advanced Driver Assistance Systems Market Overview

The global advanced driver assistance systems market is estimated to be at $32633.11 Mn in 2024 and is anticipated to reach $68248.95 Mn in 2029. The global advanced driver assistance systems market is registering a CAGR of 15.9% during the forecast period 2024-2029. The Advanced Driver Assistance Systems (ADAS) market is witnessing remarkable growth and transformation driven by technological advancements, increasing emphasis on vehicle safety, and regulatory mandates promoting the adoption of advanced safety features. This market overview provides insights into the key drivers, trends, challenges, and opportunities shaping the ADAS market landscape.

One of the primary drivers propelling the growth of the ADAS market is the rising demand for safer driving experiences. With an increasing number of road accidents and fatalities worldwide, there is a growing emphasis on integrating advanced safety technologies into vehicles to mitigate risks and enhance road safety. ADAS features such as adaptive cruise control, lane departure warning, automatic emergency braking, and blind-spot detection are becoming standard offerings in modern vehicles, contributing to the market’s expansion.

Moreover, technological advancements in sensors, artificial intelligence (AI), connectivity, and computing power are driving innovation within the ADAS market. Advanced sensors including radar, lidar, and cameras, enable vehicles to perceive and understand their surroundings, while AI algorithms analyze data in real-time to make informed driving decisions. Additionally, connectivity features enable communication between vehicles and infrastructure, paving the way for cooperative driving and enhanced traffic management systems.

Furthermore, regulatory mandates and safety standards play a pivotal role in shaping market dynamics. Governments worldwide are imposing regulations mandating the inclusion of certain ADAS features in vehicles to improve road safety and reduce accidents. Requirements for features like automatic emergency braking, lane-keeping assistance, and intelligent speed assistance are becoming increasingly common, driving market growth and adoption.

Despite the significant growth opportunities, the ADAS market faces several challenges, including technological complexity, interoperability issues, cybersecurity vulnerabilities, and consumer acceptance.

In conclusion, the ADAS market presents vast opportunities for innovation and growth, fueled by increasing demand for safer driving experiences, technological advancements, and regulatory mandates. By addressing challenges and leveraging emerging trends, the ADAS market is poised for continued expansion, revolutionizing the automotive industry and enhancing road safety worldwide.

Advanced Driver Assistance Systems Market Coverage

| Historical & Forecast Period | 2018-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units | Million US$ |

| Segments | Vehicle Type, System Type, Offering |

| Geographies | North America, South America, Asia Pacific, Europe, The Middle East, Africa |

| Key Vendors | The Bosch Group, ZF Friedrichshafen AG, Continental AG, Denso Corp., Magna International Inc. |

Key Geographies of Advanced Driver Assistance Systems Market, 2023

Porter’s 5 Forces Analysis of Advanced Driver Assistance Systems Market

Advanced Driver Assistance Systems Market Trends

The Advanced Driver Assistance System (ADAS) market is undergoing a transformative shift directed by technological advancements and increasing demand for safer driving experiences. Trend analysis reveals several key trends shaping this market.

There’s a growing emphasis on autonomous driving features, such as lane departure warning, adaptive cruise control, and automatic emergency braking, as consumers seek more convenient and safer driving options. For Example, Tesla vehicles equipped with Autopilot utilize advanced sensors, cameras, and radar to offer a suite of autonomous driving capabilities, including lane departure warning, adaptive cruise control, and automatic emergency braking. The Autopilot system can assist drivers in steering, accelerating, and braking within their lane, providing a semi-autonomous driving experience. It helps reduce driver fatigue, enhances safety by alerting drivers to potential hazards, and can intervene to prevent collisions through automatic emergency braking.

Moreover, the integration of AI and machine learning algorithms within ADAS is becoming increasingly prevalent, enabling systems to analyze complex driving scenarios in real time and respond accordingly, enhancing overall safety and efficiency. For Example,, Mobileye, an Intel company has developed Road Experience Management (REM) technology, that utilizes AI and machine learning to enhance the capabilities of its ADAS systems. REM gathers data from vehicle-mounted cameras to create high-definition maps that include detailed information about road markings, traffic signs, and other crucial elements of the driving environment. These maps are continuously updated in real-time based on the input from vehicles equipped with Mobileye technology.

Furthermore, the adoption of connected vehicle technologies is on the rise, facilitating communication between vehicles and infrastructure to enable features like traffic management and cooperative driving, further bolstering the effectiveness of ADAS. For Instance, Audi’s Traffic Light Information (TLI) system enables communication between Audi vehicles and traffic light infrastructure to provide drivers with real-time information about traffic signal status. Using vehicle-to-infrastructure (V2I) communication, Audi vehicles equipped with TLI receive data from nearby traffic lights, informing drivers of the current signal phase such as (green, yellow, or red). This information is displayed on the vehicle’s dashboard or heads-up display, allowing drivers to anticipate upcoming signal changes and adjust their driving behavior accordingly.

Additionally, regulatory initiatives mandating the inclusion of certain ADAS features in vehicles to improve road safety are driving market growth. This includes requirements for features like automatic emergency braking and lane-keeping assistance in many regions.

Lastly, partnerships and collaborations between automotive manufacturers, technology companies, and research institutions are accelerating innovation and expanding the scope of ADAS applications.

In conclusion, the ADAS market is poised for substantial growth fueled by technological innovation, regulatory mandates, and collaborative efforts across the industry landscape.

Advanced Driver Assistance Systems Market Driving Factors

The Advanced Driving Assistance Systems (ADAS) market is witnessing a paradigm shift, driven by evolving consumer preferences and technological innovations. A driver analysis of this market reveals several key factors influencing its trajectory.

Heightened awareness regarding road safety and the desire for enhanced driving experiences are primary drivers. Consumers increasingly seek vehicles equipped with ADAS features such as adaptive cruise control, lane departure warning, and automatic emergency braking to mitigate accidents and alleviate driving stress.

Regulatory mandates and safety standards play a pivotal role in shaping market dynamics. Governments worldwide are imposing regulations mandating the inclusion of certain ADAS features in vehicles, compelling automotive manufacturers to integrate advanced safety technologies into their offerings. For Instance, the European Union’s General Safety Regulation (GSR) came into effect in July 2022, which mandates the inclusion of several advanced safety features in all new vehicles sold in the EU market. One key requirement under the GSR is the inclusion of Intelligent Speed Assistance (ISA) systems in new vehicles. ISA uses GPS and road sign recognition technology to detect speed limits and actively assists drivers in adhering to them by providing visual and auditory warnings if they exceed the limit. In some implementations, ISA can even limit the vehicle’s speed autonomously.

Moreover, technological advancements, particularly in areas like artificial intelligence, sensor technologies, and connectivity, are driving innovation within the ADAS market. These advancements enable ADAS systems to analyze complex driving scenarios in real time, enhancing overall safety and efficiency.

Additionally, the influence of key market players, including automotive manufacturers, technology firms, and research institutions, cannot be understated. Collaborative efforts among these stakeholders drive the development and adoption of ADAS technologies, further fueling market growth.

In conclusion, the ADAS market is propelled by a combination of consumer demand, regulatory requirements, technological innovation, and industry collaboration, making it a dynamic and rapidly evolving segment within the automotive industry.

Advanced Driver Assistance Systems Market Challenges

Challenge analysis of the Advanced Driver Assistance Systems (ADAS) market reveals several hurdles that impact its growth and adoption.

Technological complexity poses a significant challenge. The integration of advanced sensors, AI algorithms, and connectivity features requires substantial research and development investment, hindering smaller companies from entering the market and increasing costs for established players.

Interoperability issues arise due to the lack of standardized communication protocols among different ADAS systems. This hampers seamless integration and collaboration between vehicles and infrastructure, limiting the effectiveness of cooperative driving features. For instance, Audi’s Traffic Light Information (TLI) system, which communicates with traffic signals to provide real-time information to drivers, may not be compatible with similar systems developed by other manufacturers such as BMW or Mercedes-Benz. As a result, drivers of vehicles from different brands may not benefit from cooperative driving features when interacting with infrastructure.

Moreover, safety and regulatory concerns present challenges. Despite advancements, ADAS technologies may still face reliability issues and require rigorous testing to ensure their effectiveness in real-world scenarios. Additionally, varying regulatory standards across regions pose compliance challenges for global automotive manufacturers.

Furthermore, consumer acceptance and trust in ADAS technologies remain a hurdle. Misunderstandings about system capabilities, concerns about data privacy, and reluctance to relinquish control to autonomous features can impede adoption rates.

Lastly, cybersecurity vulnerabilities pose a growing threat as vehicles become more connected. Hackers could exploit vulnerabilities in ADAS systems, compromising vehicle safety and privacy, necessitating robust cybersecurity measures. For Instance, the case of Tesla vehicles being hacked during the Pwn2Own hacking competition. In this event, security researchers successfully exploited vulnerabilities in Tesla’s ADAS system to gain control of the vehicle’s infotainment system remotely. During the competition, researchers demonstrated how they could manipulate the Tesla Model 3’s infotainment system through a browser exploit, potentially allowing attackers to interfere with critical functions of the vehicle, including braking and acceleration. While the researchers did not demonstrate control over the vehicle’s driving functions, the exploit underscored the potential risks associated with cybersecurity vulnerabilities in ADAS systems.

In conclusion, addressing these challenges requires collaboration among stakeholders to standardize technologies, enhance safety, build consumer trust, and fortify cybersecurity measures, ensuring the continued advancement and adoption of ADAS technologies in the automotive industry.

Advanced Driver Assistance Systems Market – Key Industry News

- In February 2024, The Bosch Group and Microsoft has announced their collaboration to develop and research generative AI and how to integrate it within vehicle features such as automated driving.

- In January 2024, Continental AG launched the Biometric Face Authentication Display for Vehicles. This advanced system includes trinamiX’s unique liveness detection, which ensures reliable identification and prevents deceptive attempts.

- In January 2024, Mobileye Global Inc. has secured a deal with Mahindra & Mahindra Ltd. to provide advanced driver assistance technology for their upcoming vehicles, targeting expansion in India’s auto market.

Advanced Driver Assistance Systems Market Competitive Landscape

The competitive landscape of the Advanced Driver Assistance Systems (ADAS) market is characterized by intense rivalry among key players striving to innovate and capture market share. Major companies such as The Bosch Group, Continental AG, Aptiv Plc, Valeo SA, and Denso Corp. dominate the market, leveraging their extensive expertise in automotive technology and strong R&D capabilities.

These industry leaders compete fiercely to develop advanced ADAS solutions, including adaptive cruise control, lane departure warning systems, automatic emergency braking, and self-parking features. Additionally, partnerships and collaborations with automotive manufacturers and technology firms are common strategies to expand market reach and accelerate innovation.

Moreover, emerging players and startups are entering the market, spurred by the growing demand for ADAS technologies. These newcomers focus on niche segments or disruptive technologies, challenging established players and contributing to market dynamism. For Instance, Innoviz Technologies specializes in LiDAR (Light Detection and Ranging) technology, a critical component for autonomous driving systems. Their LiDAR sensors provide high-resolution 3D imaging for precise object detection and mapping, essential for enabling autonomous vehicles to navigate safely. Innoviz has gained traction in the market by focusing on developing affordable and scalable LiDAR solutions suitable for mass-market adoption. Their technology offers a balance between performance, reliability, and cost-effectiveness, making it attractive to automotive manufacturers and ADAS developers.

Regulatory mandates promoting vehicle safety and the increasing consumer preference for advanced safety features are driving competition in the ADAS market. Companies are continuously striving to enhance the performance, reliability, and affordability of their products to gain a competitive edge and meet evolving customer expectations.

Overall, the competitive landscape of the ADAS market is characterized by innovation, strategic partnerships, and a relentless pursuit of technological advancements to address the growing demand for safer and more efficient driving experiences.

Advanced Driver Assistance Systems Market Company Share Analysis, 2023 (%)

Advanced Driver Assistance Systems Market – Key Companies

Reason to Buy from us

Table of Contents

| 1. Introduction |

|---|

| 1.1. Research Methodology |

| 1.2. Scope of the Study |

| 2. Market Overview / Executive Summary |

| 2.1. Global Advanced Driver Assistance Systems Market (2018 – 2022) |

| 2.2. Global Advanced Driver Assistance Systems Market (2023 – 2029) |

| 3. Market Segmentation |

| 3.1. Global Advanced Driver Assistance Systems Market by Vehicle Type |

| 3.1.1. Passenger Cars |

| 3.1.2. Light Commercial Vehicles |

| 3.1.3. Trucks |

| 3.1.4. Buses |

| 3.2. Global Advanced Driver Assistance Systems Market by System Type |

| 3.2.1. Adaptive Cruise Control |

| 3.2.2. Adaptive Front Light |

| 3.2.3. Adaptive Emergency Braking |

| 3.2.4. Blind Spot Detection |

| 3.2.5. Cross- Traffic- Alert |

| 3.2.6. Driver Monitoring System |

| 3.2.7. Intelligent Park Assistant |

| 3.2.8. Others |

| 3.3. Global Advanced Driver Assistance Systems Market by Offering |

| 3.3.1. Hardware |

| 3.3.2. Software |

| 4. Regional Segmentation |

| 4.1. North America |

| 4.1.1. The U.S |

| 4.1.2. Canada |

| 4.1.3. Mexico |

| 4.2. South America |

| 4.2.1. Brazil |

| 4.2.2. Argentina |

| 4.2.3. Colombia |

| 4.2.4. Chile |

| 4.2.5. Rest of South America |

| 4.3. Asia Pacific |

| 4.3.1. China |

| 4.3.2. India |

| 4.3.3. Japan |

| 4.3.4. South Korea |

| 4.3.5. Rest of Asia Pacific |

| 4.4. Europe |

| 4.4.1. UK |

| 4.4.2. Germany |

| 4.4.3. Italy |

| 4.4.4. France |

| 4.4.5. Spain |

| 4.4.6. Rest of Europe |

| 4.5. The Middle East |

| 4.5.1. Turkey |

| 4.5.2. UAE |

| 4.5.3. Saudi Arabia |

| 4.5.4. Rest of the Middle East |

| 4.6. Africa |

| 4.6.1. Egypt |

| 4.6.2. South Africa |

| 4.6.3. Rest of Africa |

| 5. Value Chain Analysis of the Global Advanced Driver Assistance Systems Market |

| 6. Porter Five Forces Analysis |

| 6.1. Threats of New Entrants |

| 6.2. Threats of Substitutes |

| 6.3. Bargaining Power of Buyers |

| 6.4. Bargaining Power of Suppliers |

| 6.5. Competition in the Industry |

| 7. Trends, Drivers, and Challenges Analysis |

| 7.1. Market Trends |

| 7.1.1. Market Trend 1 |

| 7.1.2. Market Trend 2 |

| 7.1.3. Market Trend 3 |

| 7.1.4. Market Trend 4 |

| 7.1.5. Market Trend 5 |

| 7.2. Market Drivers |

| 7.2.1. Market Driver 1 |

| 7.2.2. Market Driver 2 |

| 7.2.3. Market Driver 3 |

| 7.2.4. Market Driver 4 |

| 7.2.5. Market Driver 5 |

| 7.3. Market Challenges |

| 7.3.1. Market Challenge 1 |

| 7.3.2. Market Challenge 2 |

| 7.3.3. Market Challenge 3 |

| 7.3.4. Market Challenge 4 |

| 7.3.5. Market Challenge 5 |

| 8. Regulatory Landscape |

| 9. Competitive Landscape |

| 9.1. The Bosch Group |

| 9.2. ZF Friedrichshafen AG |

| 9.3. Continental AG |

| 9.4. Denso Corp. |

| 9.5. Magna International Inc. |

| 9.6. Company 6 |

| 9.7. Company 7 |

| 9.8. Company 8 |

| 9.9. Company 9 |

| 9.10. Company 10 |

Advanced Driver Assistance Systems Market – Frequently Asked Questions (FAQs)

What is the current size of the global advanced driver assistance systems market?

The market size for the global advanced driver assistance systems market in 2024 is $32633.11 Mn.

Who are the major vendors in the global advanced driver assistance systems market?

The major vendors in the global advanced driver assistance systems market are The Bosch Group, ZF Friedrichshafen AG, Continental AG, Denso Corp., Magna International Inc.

Which segments are covered under the global advanced driver assistance systems market segments analysis?

This report offers in-depth insights into each vehicle type, system type, electric vehicle type, by offering.