Wealth Management Platform Market: Size, Share, Trends & Forecast (2024-2029)

The report covers a comprehensive analysis segmented by Deployment Model (On-premises, Cloud, Others), by Advisory Model (Hybrid, Robo Advisory, Human Advisory, Others), by End-User (Banks, Trading Firms, Brokerage Firms, Others), by Geography (North America, South America, Asia Pacific, Europe, the Middle East, Africa).

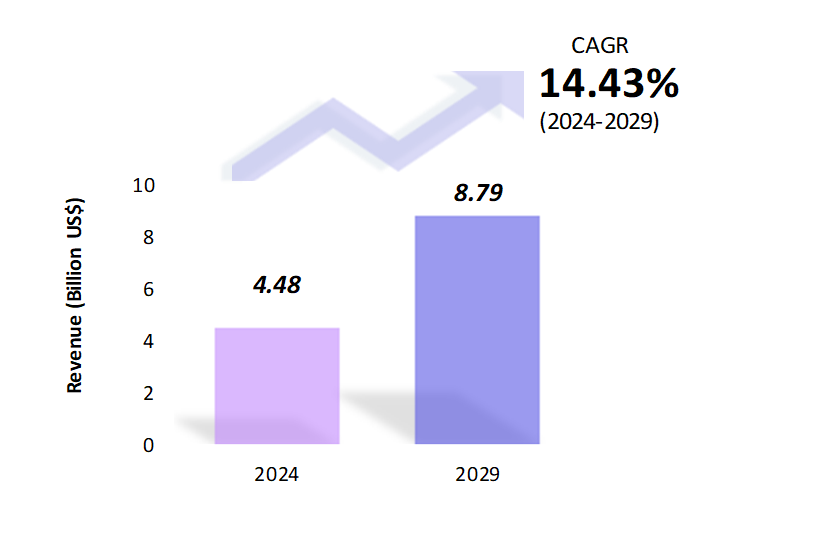

Wealth Management Platform Market Snapshot

Wealth Management Platform Market Overview

The global wealth management platform market is estimated to be at $4.48 Bn in 2024 and is anticipated to reach $8.79 Bn in 2029. The global wealth management platform market is registering a CAGR of 14.43% during the forecast period 2024-2029.

A wealth management platform serves as a crucial tool for financial advisors and institutions to manage and optimize their clients’ investments and financial plans. There has been a significant shift towards digital solutions in wealth management. This includes automated advisory services (robo-advisors), digital onboarding, and enhanced client portals that offer real-time access to investment information and analytics. Wealth management platforms are increasingly incorporating AI and machine learning algorithms to analyze data, predict market trends, and offer personalized investment advice. This enhances client engagement and improves investment outcomes.

Compliance with regulatory requirements (such as GDPR, MiFID II, and other worldwide regulations) remains a critical factor in shaping the development of wealth management platforms. The wealth management platform market is seeing consolidation among providers as larger firms acquire smaller ones to expand their service offerings and geographic reach. This consolidation intensifies competition and innovation in the sector. The regulatory environments and adoption rates vary throughout regions. North America and Europe, for example, are at the forefront of technical innovation, whereas Asia-Pacific is growing quickly due to rising affluence and digitalization. Environmental, social, and governance (ESG) factors are gaining popularity among investors. To adapt, wealth management platforms include ESG criteria in their reporting and investment strategies. Concerns about cybersecurity are growing as society becomes more digitalized. Wealth management platforms are investing heavily in cybersecurity measures to protect client data and maintain trust. All things considered, the market for wealth management platforms is expected to keep expanding as businesses look to use technology to improve client connections, increase operational effectiveness, and meet regulatory requirements. The future of wealth management platforms will probably be shaped by the continued shift towards digital solutions and the incorporation of innovative technology like artificial intelligence and machine learning.

Wealth Management Platform MarketCoverage

| Historical & Forecast Period | 2018-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units | Billion US$ |

| Segments | Deployment model, Advisory Model, End-User |

| Geographies | North America, South America, Asia Pacific, Europe, The Middle East, Africa |

| Key Vendors | Avaloq Group Ltd., Fidelity National Information Services Inc., Bank of America Corp., Tata Consultancy Services Ltd., Temenos AG |

Key Geographies of Wealth Management Platform Market, 2023

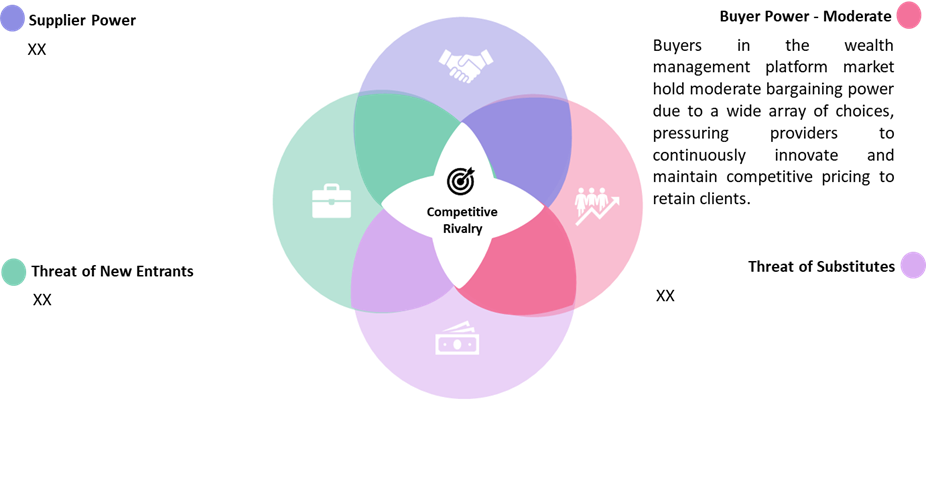

Porter’s 5 Forces Analysis of Wealth Management Platform Market

Wealth Management Platform Market Trends

The wealth management platform market is developing quickly as a result of recent technology and shifting customer demands. These advancements allow platforms to offer personalized investment advice, improve risk management, and use advanced predictive analytics. AI-driven algorithms, for instance, are more accurate than conventional techniques at identifying investment opportunities and hazards by analyzing big datasets.

There is growing interest in Environmental, Social, and Governance (ESG) investing, prompting platforms to integrate ESG criteria into their strategies and provide tools for assessing social and environmental impacts. Blockchain technology is enhancing transparency, security, and efficiency in financial transactions, including through innovations like smart contracts and decentralized finance (DeFi), which streamline settlement and compliance processes while reducing costs and fraud risks. When combined with hybrid advising models that blend human knowledge and technology, robo-advisors are opening up access to wealth management by providing automated portfolio management at reduced prices.

Regulatory requirements such as GDPR and MiFID II are driving platforms to adopt stricter data protection and transparency measures. Platforms continue to make significant investments in safeguarding user data, making cybersecurity a top priority. Platforms are also expanding their offerings to encompass retirement planning, tax optimization, and financial planning. They do this by including tools for financial health like savings applications and budgeting to offer complete wealth management solutions.

Wealth Management Platform Market Driving Factors

Technological advancements such as artificial intelligence (AI), machine learning (ML), and blockchain are pivotal in transforming wealth management platforms. These technologies enable platforms to offer highly personalized investment advice and improve operational efficiencies. There is a rising demand among investors to integrate Environmental, Social, and Governance (ESG) criteria into their investment decisions. Wealth management platforms are responding by embedding ESG considerations into their strategies and offering tools to assess the social and environmental impacts of investments.

Access to wealth management services is becoming more widely available because of digital platforms like robo-advisors and smartphone apps. They increase the customer base and lower the cost of expert financial advice by offering affordable alternatives to people with different asset levels. For example, HCL Technologies (HCL) and digital banking solutions supplier Avaloq extended their global partnership in April 2022 to develop a lifecycle management center specifically for digital wealth management. This expanded partnership aims to empower additional financial institutions to harness Avaloq’s innovative technology. Alongside robo-advisors, hybrid advisory models are gaining traction. These methods combine human advisers’ individualized guidance with automated portfolio management. Wealth management platforms leverage human experience for complicated choices and technology for everyday activities to provide a blend of efficient and customized service that caters to a wide range of customer needs. As digitalization increases, cybersecurity becomes a critical priority for wealth management platforms. Platforms invest heavily in robust cybersecurity measures to protect sensitive client information and maintain operational resilience. Wealth management platforms are broadening their services to include financial planning, tax optimization, retirement planning, and financial wellness tools, in addition to investment management.

Wealth Management Platform Market Challenges

Numerous obstacles that the wealth management platform industry encounters are influencing its strategy and evolution. As wealth management platforms increasingly digitize their services, they become more susceptible to cyber threats like data breaches and phishing attacks. For instance, in February 2022, Wormhole, a cryptocurrency exchange platform, suffered a USD 320 million loss due to a cyber-attack. This incident underscores the significant security vulnerabilities facing digital asset exchanges.

Moreover, cryptocurrency scammers exploit the anonymity and volatility of digital currencies to deceive investors and steal funds. Common scams include phishing, Ponzi schemes, and rug pulls, where perpetrators promise high returns or fake investments and disappear with the money. As the cryptocurrency market grows, these scams have led to over USD 1 billion in losses since 2021, highlighting the urgent need for vigilance and security in the space and ongoing challenges in safeguarding digital assets and protecting investors from fraudulent activities within the crypto space. The regulatory landscape is complex and continually evolving, with regulations like GDPR (General Data Protection Regulation) and MiFID II (Markets in Financial Instruments Directive II) imposing stringent data protection, transparency, and client communication requirements. Compliance failures can lead to hefty fines and reputational damage. Traditional wealth management companies are facing competition from fintech startups that provide specialized digital wealth management solutions. These firms appeal to younger populations and tech-savvy investors by offering user-centric interfaces, agile technologies, and lower fees. To be competitive, well-established platforms need to constantly innovate and improve their digital capabilities.

Wealth Management Platform Market – Key Industry News

- In April 2024, Wealth management fintech Avenir raised USD 500,000 to create sustainability scoring software for businesses after completing the ABN AMRO + Techstars accelerator.

- In February 2024, Security Bank in Makati and Avaloq have partnered to digitalize wealth management using the Avaloq Core Platform and RM Workplace solution.

- In February 2024, Virgin Money acquired ABRDN’s wealth platform. This acquisition allows Virgin Money to enhance its digital wealth management services.

Wealth Management Platform Market Competitive Landscape

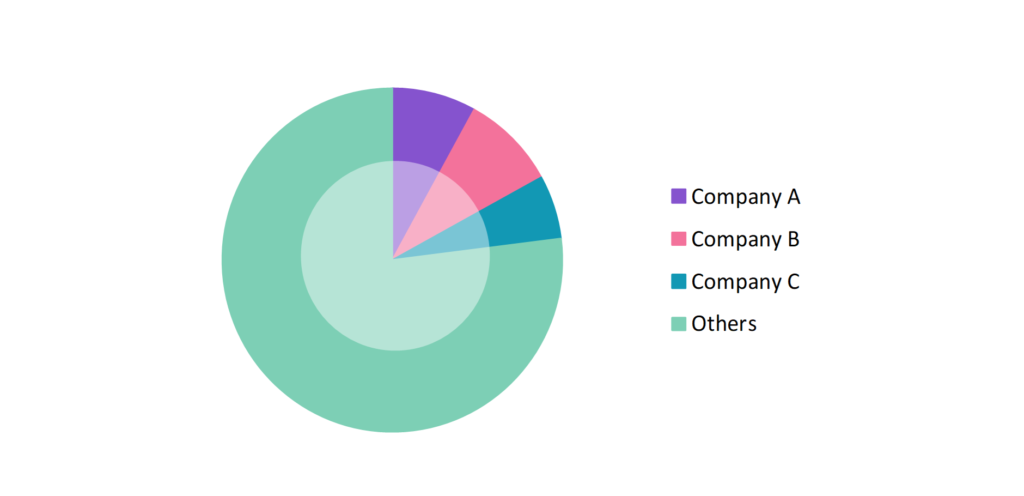

The wealth management platform market is characterized by intense competition among a mix of established players and innovative startups. Leading companies like Avaloq Group Ltd., Fidelity National Information Services Inc., and Backbase Inc. provide comprehensive, scalable solutions tailored for large financial institutions. They compete on the breadth of their services, integration capabilities, and advanced analytics. Emerging players target tech-savvy clients with automated, AI-driven investment tools emphasizing user-friendly interfaces and low fees. Additionally, platforms like Addepar focus on ultra-high-net-worth individuals, offering bespoke services and in-depth portfolio analysis. The market is further intensified by traditional financial institutions, which have developed or acquired sophisticated digital platforms to enhance their wealth management services. The participants in the global wealth management platform industry are always developing their strategies to preserve a competitive advantage. The companies primarily use acquisitions, R&D, partnerships, and technological launches. Several important entities in the wealth management platform market include Avaloq Group Ltd., Fidelity National Information Services Inc., Backbase Inc., Tata Consultancy Services Limited, Temenos Headquarters, and others.

Wealth Management Platform Market Company Share Analysis, 2023 (%)

Wealth Management Platform Market – Key Companies

Reason to Buy from us

Table of Contents

| 1. Introduction |

|---|

| 1.1. Research Methodology |

| 1.2. Scope of the Study |

| 2. Market Overview / Executive Summary |

| 2.1. Global Wealth Management Platform Market (2018 – 2022) |

| 2.2. Global Wealth Management Platform Market (2023 – 2029) |

| 3. Market Segmentation |

| 3.1. Global Wealth Management Platform Market by Deployment model |

| 3.1.1. On-premise |

| 3.1.2. Cloud |

| 3.1.3. Others |

| 3.2. Global Wealth Management Platform Market by Advisory Model |

| 3.2.1. Hybrid |

| 3.2.2. Robo Advisory |

| 3.2.3. Human Advisory |

| 3.2.4. Others |

| 3.3. Global Wealth Management Platform Market by End-User |

| 3.3.1. Banks |

| 3.3.2. Trading Firms |

| 3.3.3. Brokerage Firms |

| 3.3.4. Others |

| 4. Regional Segmentation |

| 4.1. North America |

| 4.1.1. The U.S |

| 4.1.2. Canada |

| 4.1.3. Mexico |

| 4.2. South America |

| 4.2.1. Brazil |

| 4.2.2. Argentina |

| 4.2.3. Colombia |

| 4.2.4. Chile |

| 4.2.5. Rest of South America |

| 4.3. Asia Pacific |

| 4.3.1. China |

| 4.3.2. India |

| 4.3.3. Japan |

| 4.3.4. South Korea |

| 4.3.5. Rest of Asia Pacific |

| 4.4. Europe |

| 4.4.1. UK |

| 4.4.2. Germany |

| 4.4.3. Italy |

| 4.4.4. France |

| 4.4.5. Spain |

| 4.4.6. Rest of Europe |

| 4.5. The Middle East |

| 4.5.1. Turkey |

| 4.5.2. UAE |

| 4.5.3. Saudi Arabia |

| 4.5.4. Rest of the Middle East |

| 4.6. Africa |

| 4.6.1. Egypt |

| 4.6.2. South Africa |

| 4.6.3. Rest of Africa |

| 5. Value Chain Analysis of the Global Wealth Management Platform Market |

| 6. Porter Five Forces Analysis |

| 6.1. Threats of New Entrants |

| 6.2. Threats of Substitutes |

| 6.3. Bargaining Power of Buyers |

| 6.4. Bargaining Power of Suppliers |

| 6.5. Competition in the Industry |

| 7. Trends, Drivers and Challenges Analysis |

| 7.1. Market Trends |

| 7.1.1. Market Trend 1 |

| 7.1.2. Market Trend 2 |

| 7.1.3. Market Trend 3 |

| 7.2. Market Drivers |

| 7.2.1. Market Driver 1 |

| 7.2.2. Market Driver 2 |

| 7.2.3. Market Driver 3 |

| 7.3. Market Challenges |

| 7.3.1. Market Challenge 1 |

| 7.3.2. Market Challenge 2 |

| 7.3.3. Market Challenge 3 |

| 8. Regulatory Landscape |

| 9. Competitive Landscape |

| 9.1. Avaloq Group Ltd. |

| 9.2. Fidelity National Information Services Inc. |

| 9.3. Bank of America Corp. |

| 9.4. Tata Consultancy Services Ltd. |

| 9.5. Temenos AG |

| 9.6. Company 6 |

| 9.7. Company 7 |

| 9.8. Company 8 |

| 9.9. Company 9 |

| 9.10. Company 10 |

Wealth Management Platform Market – Frequently Asked Questions (FAQs)

What is the current size of the global wealth management platform market?

The market size for the global wealth management platform market in 2024 is $4.48 Bn.

Who are the major vendors in the global wealth management platform market?

The major vendors in the global wealth management platform market are Avaloq Group Ltd., Fidelity National Information Services Inc., Bank of America Corp., Tata Consultancy Services Ltd., and Temenos AG.

Which segments are covered under the global wealth management platform market segments analysis?

This report offers in-depth insights into each deployment model, advisory model, and end-user.