Elevators And Escalators Market Outlook: Size, Share, Trends & Growth Analysis (2024-2029)

The market report presents a thorough analysis segmented by Type (Elevators, Escalators, Moving Walkways); by Service (New Installation, Maintenance & Repair, Modernization); by Elevator Technology (Traction Elevators, Machine Room Less Traction Elevators, Hydraulic); by End User (Residential, Commercial, Institutional, Infrastructure); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

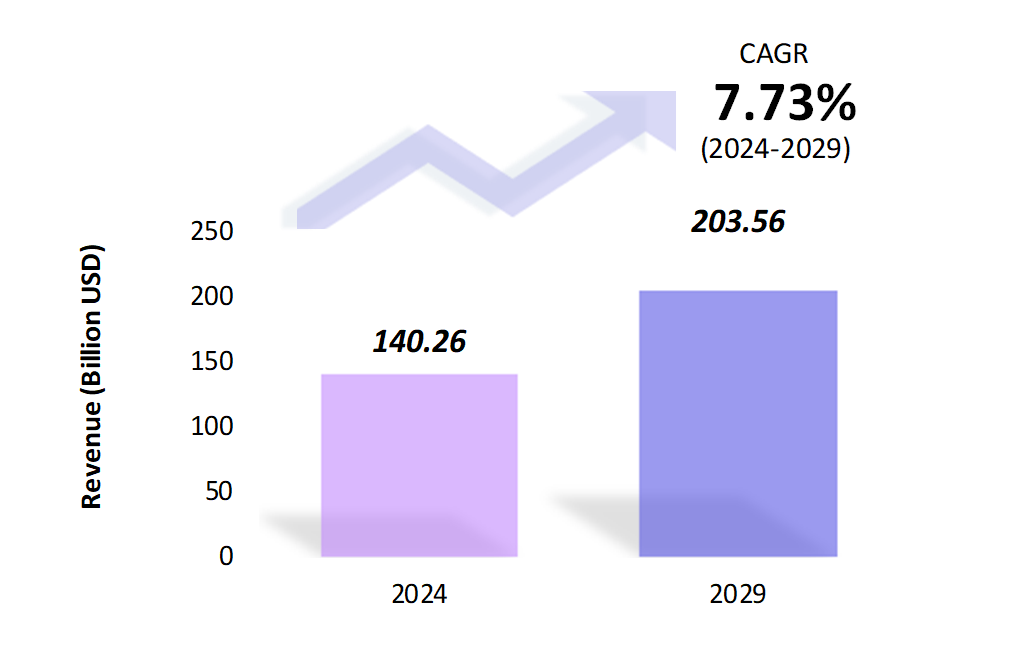

- The elevators & escalators market is estimated to be at USD 140.26 Bn in 2024 and is anticipated to reach USD 203.56 Bn in 2029.

- The elevators & escalators market is registering a CAGR of 7.73% during the forecast period of 2024-2029.

- The global elevators and escalators market is witnessing steady growth driven by rapid urbanization, infrastructure development, and the increasing need for vertical transportation solutions in both residential and commercial spaces.

Request a free sample.

Ecosystem

- The participants in the global elevators & escalators industry are always developing their strategies to preserve a competitive advantage.

- These companies primarily use acquisitions, R&D, partnerships, and technological launches.

- Several important entities in the elevators & escalators market include Schindler Group; Otis Worldwide Corp.; Thyssenkrupp AG; KONE Corp.; Hitachi Group; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2018-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Market Size (2024) | USD 140.26 Bn |

| Market Size (2029) | USD 203.56 Bn |

| Growth Rate | 7.73% CAGR from 2024 to 2029 |

| Key Segments | Type (Elevator, Escalator, Moving Walkways); Service (New Installation, Maintenance & Repair, Modernization); Elevator Technology (Traction Elevator, Machine Room Less Traction Elevator, Hydraulic); End User (Residential, Commercial, Institutional, Infrastructure); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | Schindler Group; Otis Worldwide Corp.; Thyssenkrupp AG; KONE Corp.; Hitachi Group |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; China; India; Japan; South Korea; The UK; Germany; Italy; France; Spain; Israel; UAE; Saudi Arabia; Egypt; South Africa |

| Largest Market | Asia Pacific |

Get a free quote.

Trends

- Smart Elevators and Escalators Integration: Integrating IoT and AI in elevators and escalators enhances operational efficiency, safety, and user experience. Smart elevators equipped with predictive maintenance and touchless controls are gaining popularity. For instance, in 2023, Otis introduced its smart elevator solution that uses AI to optimize traffic management in high-rise buildings.

- Adoption of Touchless Technology: The COVID-19 pandemic has accelerated the shift towards touchless technologies in elevators and escalators, driven by hygiene concerns. These technologies, such as gesture controls and voice-activated systems, are increasingly being implemented to minimize physical contact.

- Elevator Design Customization: There is an increasing trend toward customized elevator designs that align with modern buildings’ aesthetic and functional needs. This includes bespoke finishes, smart lighting, and advanced user interfaces tailored to specific environments. In 2023, high-end hotels in Dubai showcased uniquely designed elevators that complement their architectural styles.

Speak to analyst.

Catalysts

- Urbanization and Infrastructure Development: The ongoing urbanization and development of infrastructure globally are primary drivers for the elevators and escalators market. As cities expand vertically, the need for efficient vertical transportation solutions increases.

- Rising Mega Skyscraper Projects: The growing construction of high-rise buildings, particularly in urban areas, is a significant driver of the elevators and escalators market. These buildings require advanced vertical transportation systems to manage large passenger volumes efficiently. In 2023, China completed several mega skyscraper projects, increasing demand for high-capacity elevators.

- Aging Population and Accessibility Requirements: The aging global population and increased focus on accessibility are driving demand for elevators and escalators in residential and commercial buildings. Governments and organizations are increasingly mandating the inclusion of elevators to ensure accessibility. In 2023, the European Union strengthened its accessibility regulations, further boosting market growth.

Inquire before buying.

Restraints

- High Installation and Maintenance Costs: The high costs associated with installing and maintaining elevators and escalators are significant challenges, particularly for small and medium-sized buildings. These costs can deter building owners from upgrading or installing new systems.

- Skilled Labor Shortages: Finding skilled workers to install, maintain, and repair elevators and escalators is becoming increasingly difficult. This shortage can lead to increased labor costs and project delays. In 2023, industry associations in North America reported a 20% gap in the availability of certified elevator technicians, highlighting the need for workforce development.

- Stringent Regulatory Compliance: Meeting stringent safety and environmental regulations poses challenges for manufacturers in the elevators and escalators market. Compliance with these regulations requires continuous investment in R&D and can lead to higher production costs. In 2023, new safety regulations in the European Union increased compliance costs for manufacturers operating in the region.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Elevators & Escalators Market (2018 – 2022) 2.2. Global Elevators & Escalators Market (2023 – 2029) 3. Market Segmentation 3.1. Global Elevators & Escalators Market by Type 3.1.1. Elevator 3.1.2. Escalator 3.1.3. Moving Walkways 3.2. Global Elevators & Escalators Market by Service 3.2.1. New Installation 3.2.2. Maintenance & Repair 3.2.3. Modernization 3.3. Global Elevators & Escalators Market by Elevator Technology 3.3.1. Traction Elevator 3.3.2. Machine Room Less Traction Elevator 3.3.3. Hydraulic 3.4. Global Elevators & Escalators Market by End User 3.4.1. Residential 3.4.2. Commercial 3.4.3. Institutional 3.4.4. Infrastructure 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Colombia 4.2.4. Chile 4.2.5. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Japan 4.3.4. South Korea 4.3.5. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. Italy 4.4.4. France 4.4.5. Spain 4.4.6. Rest of Europe 4.5. The Middle East 4.5.1. Turkey 4.5.2. UAE 4.5.3. Saudi Arabia 4.5.4. Rest of the Middle East 4.6. Africa 4.6.1. Egypt 4.6.2. South Africa 4.6.3. Rest of Africa 5. Value Chain Analysis of the Global Elevators & Escalators Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. Schindler Group 9.2. Otis Worldwide Corp. 9.3. Thyssenkrupp AG 9.4. KONE Corp. 9.5. Hitachi Group 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Elevators & Escalators Market – FAQs

1. What is the current size of the elevators & escalators market?

Ans. In 2024, the elevators & escalators market size is USD 140.26 Bn.

2. Who are the major vendors in the elevators & escalators market?

Ans. The major vendors in the elevators & escalators market are Schindler Group; Otis Worldwide Corp.; Thyssenkrupp AG; KONE Corp.; Hitachi Group.

3. Which segments are covered under the elevators & escalators market segments analysis?

Ans. The elevators & escalators market report offers in-depth insights into Type, Service, Elevator Technology, End User, and Geography.