Health And Hygiene Packaging Market Insights: Size, Share, Growth Analysis & Forecast (2024-2029)

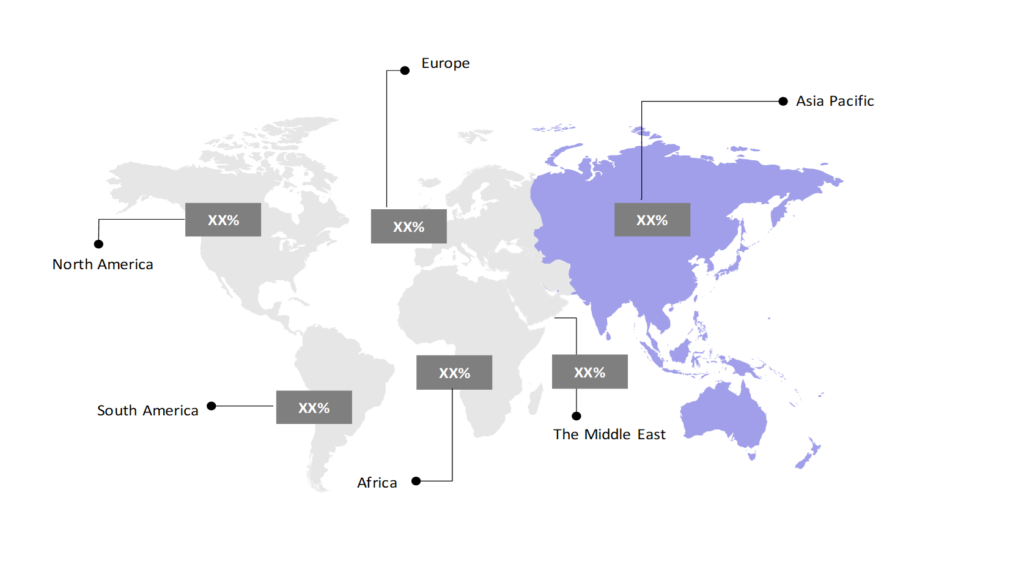

The market report provided a comprehensive analysis segmented by Type (Films and Sheets, Bags and Pouches, Laminates, Labels, Jars and Bottles, Sachets, Boxes and Cartons); by Form (Rigid Packaging, Flexible Packaging); by End User (Nutraceuticals and Food Supplements, Personal Care & Cosmetics, Functional/Health Beverages, Pharmaceutical and OTC Formulations, Home Care & Toiletries); by Distribution Channel (Hypermarkets/Supermarkets, Online Retailers, Direct Sales); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

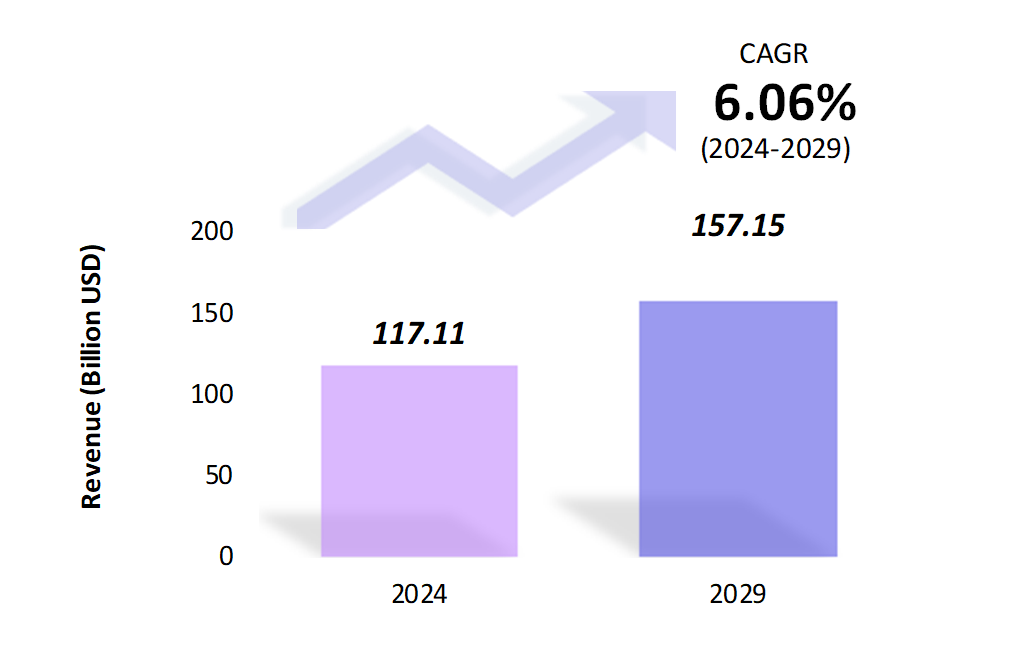

- The health & hygiene packaging market is estimated to be at USD 117.11 Bn in 2024 and is anticipated to reach USD 157.15 Bn in 2029.

- The health & hygiene packaging market is registering a CAGR of 6.06% during the forecast period of 2024-2029.

- The health & hygiene packaging market has thrived due to the increasing demand for safe, sustainable, and protective packaging solutions. This demand is driven by heightened consumer awareness about health, safety, and hygiene.

Request a free sample.

Ecosystem

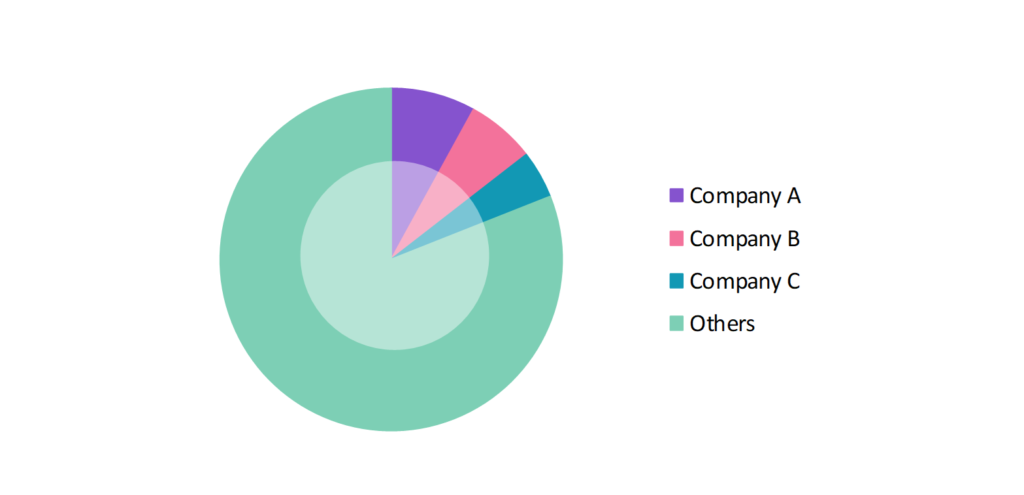

- The participants in the global health & hygiene packaging industry are always developing strategies to preserve a competitive advantage.

- These companies primarily use acquisitions. They are also actively investing in research and development to innovate and meet the evolving demands of the market.

- Several important entities in the health & hygiene packaging market include Berry Global Group, Inc.; Amcor Plc; Mondi Group; WestRock Co.; Kimberly-Clark Corp.; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2018-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Market Size (2024) | USD 117.11 Bn |

| Market Size (2029) | USD 157.15 Bn |

| Growth Rate | 6.06% CAGR from 2024 to 2029 |

| Key Segments | Type (Films and Sheets, Bags and Pouches, Laminates, Labels, Jars and Bottles, Sachets, Boxes and Cartons); Form (Rigid Packaging, Flexible Packaging); End User (Nutraceuticals and Food Supplements, Personal Care & Cosmetics, Functional/Health Beverages, Pharmaceutical and OTC Formulations, Home Care & Toiletries); Distribution Channel (Hypermarkets/Supermarkets, Online Retailers, Direct Sales); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | Berry Global Group, Inc.; Amcor Plc; Mondi Group; WestRock Co.; Kimberly-Clark Corp. |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; China; India; Japan; South Korea; The UK; Germany; Italy; France; Spain; Israel; UAE; Saudi Arabia; Egypt; South Africa |

| Largest Market | Asia Pacific |

Get a free quote.

Trends

- Shift Toward Sustainable Packaging: The market is witnessing a shift toward eco-friendly materials, driven by consumer demand for sustainable packaging. Companies are investing in biodegradable, recyclable, and reusable packaging solutions.

- Increased Use of Antimicrobial Packaging: To enhance product safety, there is a rising trend in the use of antimicrobial packaging that prevents the growth of bacteria and viruses. In 2023, Amcor launched an innovative antimicrobial packaging solution designed to extend the shelf life of hygiene products and reduce contamination risks.

- Adoption of Smart Packaging Technologies: The integration of smart packaging technologies, such as RFID tags and QR codes, is increasing in the health & hygiene sector. These technologies provide consumers with product information, traceability, and authentication. In 2023, Procter & Gamble introduced smart packaging for its hygiene products, allowing customers to track product origin and ensure authenticity.

Speak to analyst.

Catalysts

- Heightened Consumer Awareness of Health and Safety: Consumers increasingly prioritize health and hygiene, particularly post-pandemic. This shift has led to a higher demand for packaging that ensures product safety and hygiene.

- Growth in E-commerce and Direct-to-Consumer Sales: The rise of e-commerce and direct-to-consumer sales channels has increased the need for protective and durable packaging that ensures product integrity during shipping. In 2023, L’Oréal expanded its use of e-commerce-friendly packaging for its hygiene and personal care products, resulting in a 20% reduction in product damage during transit.

- Stringent Regulatory Requirements: Government regulations to ensure product safety and environmental sustainability propel the adoption of advanced packaging solutions. In 2023, the FDA introduced stricter guidelines for medical and hygiene products, compelling manufacturers to upgrade their packaging materials and processes.

Inquire before buying.

Restraints

- Supply Chain Disruptions: Global supply chain disruptions, exacerbated by the COVID-19 pandemic and geopolitical tensions, have impacted the availability of raw materials for packaging. This shortage has led to increased costs and delays in production, forcing companies to seek alternative materials and suppliers.

- Regulatory Compliance Complexity: Navigating the complex web of regulations across different regions can be challenging for global packaging companies. In 2023, Procter & Gamble had to recall a batch of hygiene products in Europe due to non-compliance with newly enacted packaging regulations, highlighting the risks of regulatory misalignment.

- High Costs of Sustainable Packaging: The transition to sustainable packaging materials and processes is often costly, posing a challenge for manufacturers. In 2023, a study by McKinsey found that sustainable packaging costs 25-30% more than conventional options, creating pricing pressures for companies.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Health & Hygiene Packaging Market (2018 – 2022) 2.2. Global Health & Hygiene Packaging Market (2023 – 2029) 3. Market Segmentation 3.1. Global Health & Hygiene Packaging Market by Type 3.1.1. Films and Sheets 3.1.2. Bags and Pouches 3.1.3. Laminates 3.1.4. Labels 3.1.5. Jars and Bottles 3.1.6. Sachets 3.1.7. Boxes and Cartons 3.2. Global Health & Hygiene Packaging Market by Form 3.2.1. Rigid Packaging 3.2.2. Flexible Packaging 3.3. Global Health & Hygiene Packaging Market by End User 3.3.1. Nutraceuticals and Food Supplements 3.3.2. Personal Care & Cosmetics 3.3.3. Functional/Health Beverages 3.3.4. Pharmaceutical and OTC Formulations 3.3.5. Home Care & Toiletries 3.4. Global Health & Hygiene Packaging Market by Distribution Channel 3.4.1. Hypermarkets/Supermarkets 3.4.2. Online Retailers 3.4.3. Direct Sales 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Colombia 4.2.4. Chile 4.2.5. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Japan 4.3.4. South Korea 4.3.5. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. Italy 4.4.4. France 4.4.5. Spain 4.4.6. Rest of Europe 4.5. The Middle East 4.5.1. Turkey 4.5.2. UAE 4.5.3. Saudi Arabia 4.5.4. Rest of the Middle East 4.6. Africa 4.6.1. Egypt 4.6.2. South Africa 4.6.3. Rest of Africa 5. Value Chain Analysis of the Global Health & Hygiene Packaging Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. Berry Global Group, Inc. 9.2. Amcor Plc 9.3. Mondi Group 9.4. WestRock Co. 9.5. Kimberly-Clark Corp. 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Health & Hygiene Packaging Market – FAQs

1. What is the current size of the health & hygiene packaging market?

Ans. In 2024, the health & hygiene packaging market size is USD 117.11 Bn.

2. Who are the major vendors in the health & hygiene packaging market?

Ans. The major vendors in the health & hygiene packaging market are Berry Global Group, Inc.; Amcor Plc; Mondi Group; WestRock Co.; Kimberly-Clark Corp.

3. Which segments are covered under the health & hygiene packaging market segments analysis?

Ans. The health & hygiene packaging market report offers in-depth insights into Type, Form, End User, Distribution Channel, and Geography.