Ventilators Market: Size, Share, Trends & Forecast (2024-2029)

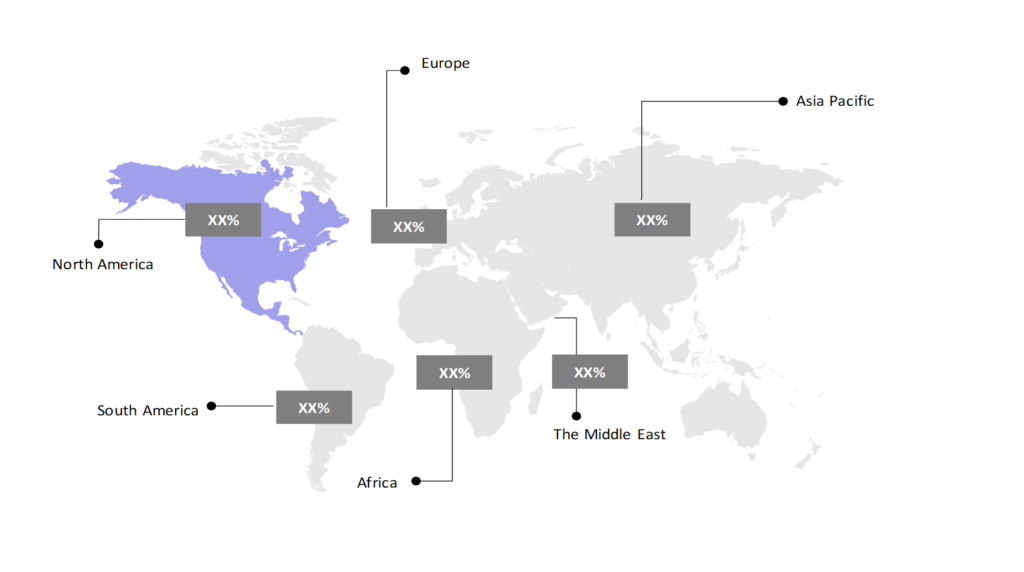

The market report offers a detailed analysis segmented by Type (Adult/Pediatric Ventilators, Neonatal/Infant Ventilators); by Mobility (Intensive Care Ventilators, Portable/Transportable Ventilators, Modernization); by Mode (Combined Mode Ventilators, Volume Mode Ventilators, Pressure Mode Ventilators, Other Modes of Ventilators); by End User (Hospitals & Clinics, Ambulatory Care Centers, Emergency Medical Services, Home Care Settings, Others); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

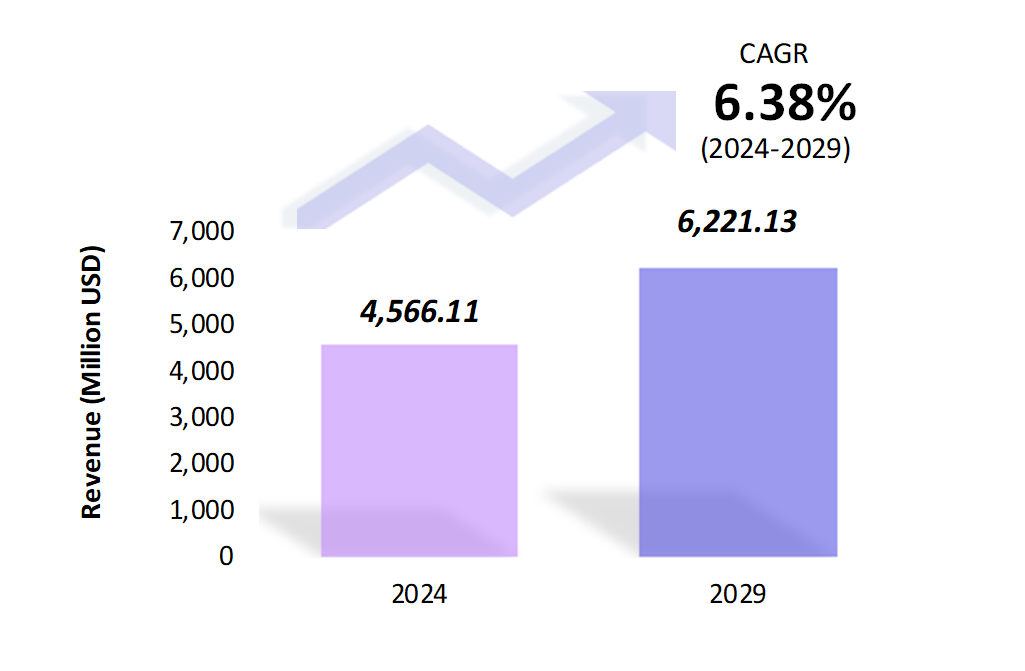

- The ventilators market is estimated to be at USD 4,566.11 Mn in 2024 and is anticipated to reach USD 6,221.13 Mn in 2029.

- The ventilators market is registering a CAGR of 6.38% during the forecast period of 2024-2029.

- The global ventilators market plays a critical role in providing life-saving support to patients with respiratory conditions. Driven by the ongoing prevalence of chronic respiratory diseases, rising healthcare expenditures, and recent pandemic impacts, the market has experienced significant demand.

Request a free sample.

Ecosystem

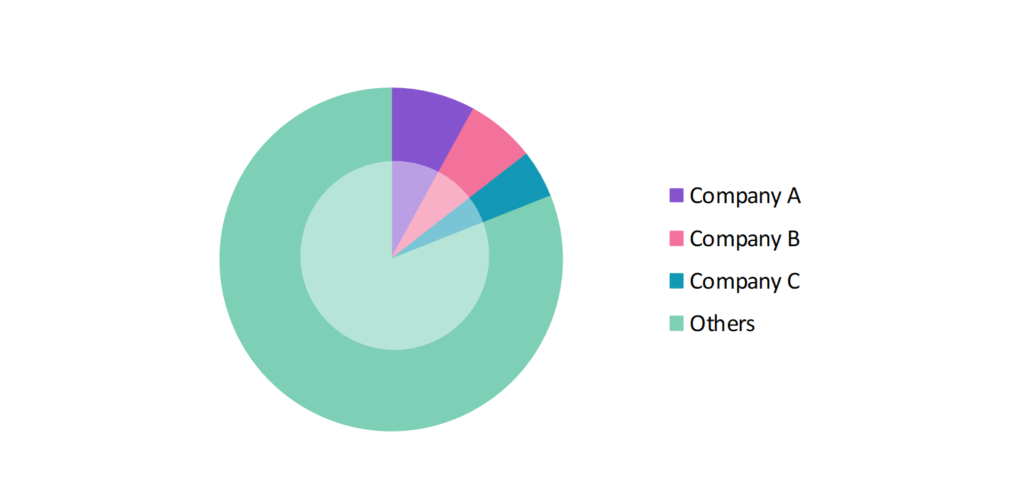

- The participants in the global ventilators industry are always developing their strategies to preserve a competitive advantage.

- These companies focus on innovation, strategic partnerships, and expanding their global footprint to maintain a competitive edge.

- Several important entities in the ventilators market include Koninklijke Philips N.V.; Vyaire Medical, Inc.; Getinge AB; Asahi Kasei Corp.; Allied Healthcare Products, Inc.; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2018-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Market Size (2024) | USD 4,566.11 Mn |

| Market Size (2029) | USD 6,221.13 Mn |

| Growth Rate | 6.38% CAGR from 2024 to 2029 |

| Key Segments | Type (Adult/Pediatric Ventilators, Neonatal/Infant Ventilators); Mobility (Intensive Care Ventilators, Portable/Transportable Ventilators, Modernization); Mode (Combined Mode Ventilators, Volume Mode Ventilators, Pressure Mode Ventilators, Other Modes of Ventilators); End User (Hospitals & Clinics, Ambulatory Care Centers, Emergency Medical Services, Home Care Settings); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | Koninklijke Philips N.V.; Vyaire Medical, Inc.; Getinge AB; Asahi Kasei Corp.; Allied Healthcare Products, Inc. |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; China; India; Japan; South Korea; The UK; Germany; Italy; France; Spain; Israel; UAE; Saudi Arabia; Egypt; South Africa |

| Largest Market | North America |

Get a free quote.

Trends

- Adoption of Portable and Home-Based Ventilators: There is a growing trend towards portable and home-based ventilators due to the rising number of patients requiring long-term respiratory care outside of hospital settings. Advances in miniaturization and battery life have made these devices more practical.

- Integration of Smart Ventilators: The integration of smart technologies in ventilators, such as remote monitoring and AI-driven analytics, is becoming more prevalent. These technologies allow for better patient management and the early detection of potential complications. In 2022, Medtronic launched a smart ventilator that uses AI to optimize ventilation settings based on patient data.

- Focus on Non-invasive Ventilation (NIV): Non-invasive ventilation is increasingly preferred due to its lower risk of infection and ease of use compared to invasive methods. This trend has been especially noticeable in the management of chronic conditions like COPD.

Speak to analyst.

Catalysts

- Increased Prevalence of Respiratory Diseases: The rising incidence of chronic respiratory diseases like COPD, asthma, and lung cancer is significantly propelling the growth of the ventilators market. This surge in demand is driven by the need for advanced respiratory support technologies to manage these conditions effectively and improve patient outcomes.

- Expansion of Healthcare Infrastructure: The rapid expansion of healthcare infrastructure significantly boosts the demand for ventilators. As medical facilities are modernized and healthcare services are enhanced, there is a growing need for advanced respiratory support systems to address increasing patient populations and improve care quality.

- Government Initiatives and Funding: Government initiatives and increased funding for healthcare infrastructure have been key drivers in the ventilators market. Post-pandemic recovery programs have particularly focused on enhancing critical care capacities. In 2022, the U.S. government allocated substantial funds to upgrade ventilator stocks as part of its pandemic preparedness strategy.

Inquire before buying.

Restraints

- High Costs of Advanced Ventilators: The high costs associated with advanced ventilators, particularly those with cutting-edge technologies such as AI and remote monitoring, remain a significant barrier, especially in low-income countries. This economic disparity exacerbates the challenges faced by healthcare systems in these regions, hindering their ability to access and implement critical respiratory support.

- Regulatory Compliance and Certification: Meeting stringent regulatory requirements for ventilators, especially in terms of safety and efficacy, poses challenges for manufacturers. These regulations vary across regions, complicating market entry and product approval. For example, in 2023, new EU regulations on medical devices increased compliance costs for ventilator manufacturers operating in Europe.

- Supply Chain Disruptions: The ventilator market continues to face global supply chain disruptions, which affect the availability of essential components and raw materials. This instability hampers the ability of manufacturers to meet growing demand and maintain consistent production levels. Consequently, healthcare facilities experience shortages and increased operational challenges.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Ventilators Market (2018 – 2022) 2.2. Global Ventilators Market (2023 – 2029) 3. Market Segmentation 3.1. Global Ventilators Market by Type 3.1.1. Adult/Pediatric Ventilators 3.1.2. Neonatal/Infant Ventilators 3.2. Global Ventilators Market by Mobility 3.2.1. Intensive Care Ventilators 3.2.2. Portable/Transportable Ventilators 3.2.3. Modernization 3.3. Global Ventilators Market by Mode 3.3.1. Combined Mode Ventilators 3.3.2. Volume Mode Ventilators 3.3.3. Pressure Mode Ventilators 3.3.4. Other Modes of Ventilators 3.4. Global Ventilators Market by End User 3.4.1. Hospitals & Clinics 3.4.2. Ambulatory Care Centers 3.4.3. Emergency Medical Services 3.4.4. Home Care Settings 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.5. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Japan 4.3.4. South Korea 4.3.5. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. Italy 4.4.4. France 4.4.5. Spain 4.4.6. Rest of Europe 4.5. The Middle East 4.5.1. Israel 4.5.2. UAE 4.5.3. Saudi Arabia 4.5.4. Rest of the Middle East 4.6. Africa 4.6.1. Egypt 4.6.2. South Africa 4.6.3. Rest of Africa 5. Value Chain Analysis of the Global Ventilators Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. Koninklijke Philips N.V. 9.2. Vyaire Medical, Inc. 9.3. Getinge AB 9.4. Asahi Kasei Corp. 9.5. Allied Healthcare Products, Inc. 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Ventilators Market – FAQs

1. What is the current size of the ventilators market?

Ans. In 2024, the ventilators market size is USD 4,566.11 Mn.

2. Who are the major vendors in the ventilators market?

Ans. The major vendors in the ventilators market are Koninklijke Philips N.V.; Vyaire Medical, Inc.; Getinge AB; Asahi Kasei Corp.; Allied Healthcare Products, Inc.

3. Which segments are covered under the ventilators market segments analysis?

Ans. The ventilators market report offers in-depth insights into Type, Mobility, Mode, End User, and Geography.