Battery Swapping Market Insights: Size, Share, Growth Analysis & Forecast (2024-2029)

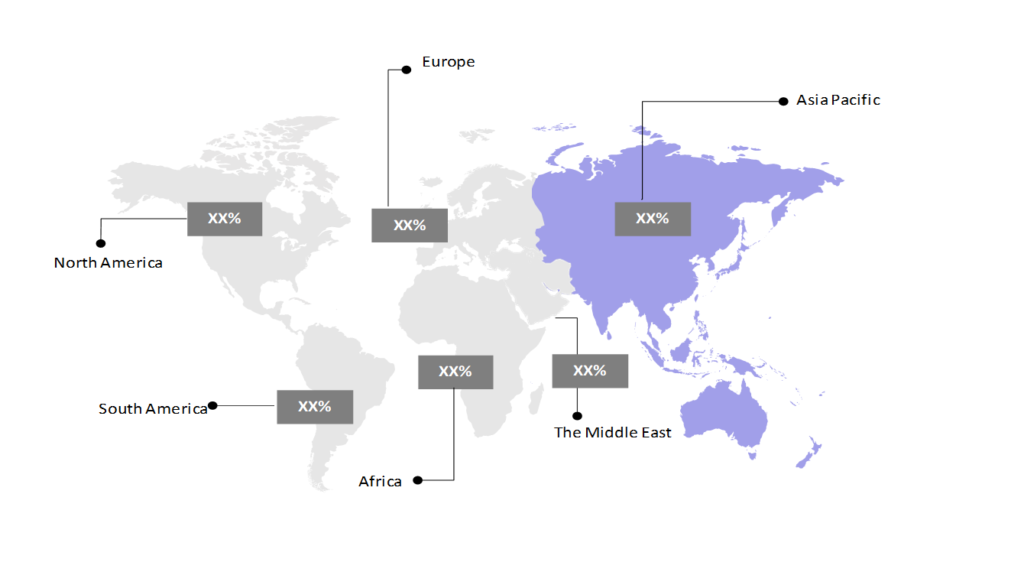

The market report provided a comprehensive analysis segmented by Application (Passenger, Commercial); by Service Type (Subscription, Pay-per-use); by Station Type (Manual, Automated); by Vehicle Type (2- Wheeler, 3- Wheeler, 4- wheeler); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

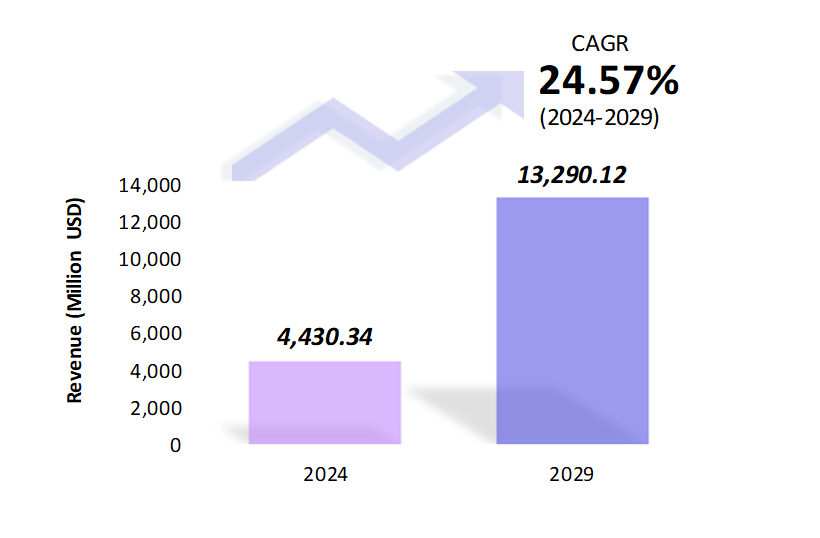

- The battery swapping market is estimated to be at USD 4,430.34 Mn in 2024 and is anticipated to reach USD 13,290.12 Mn in 2029.

- The battery swapping market is registering a CAGR of 24.57% during the forecast period of 2024-2029.

- The battery-swapping market is emerging as a viable solution to address the limitations of traditional EV charging methods. The market is primarily driven by growing EV sales, declining battery costs, and supportive government policies, especially in countries like China and India. Battery swapping is particularly appealing in the commercial vehicle segment, such as taxis, buses, and two-wheelers, where downtime directly impacts profitability.

Request a free sample.

Ecosystem

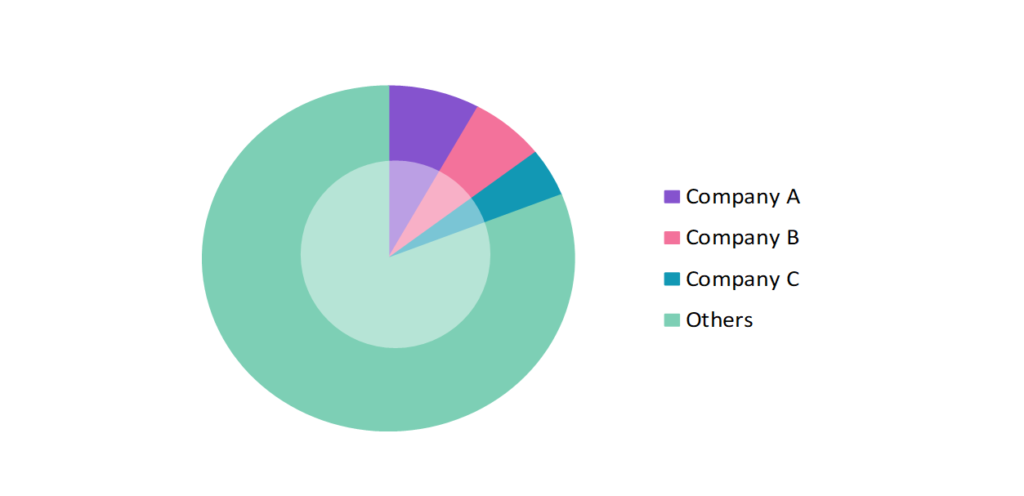

- The participants in the global battery swapping industry are always developing their strategies to preserve a competitive advantage.

- Startups such as Ample and Sun Mobility are entering the market, offering innovative solutions aimed at standardizing battery swapping across different vehicle models.

- Several important entities in the battery swapping market include NIO Inc.; Gogoro Inc.; SUN Mobility Pvt. Ltd.; Numocity Technologies Pvt. Ltd.; BattSwap Inc.; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2018-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Market Size (2024) | USD 4,430.34 Mn |

| Market Size (2029) | USD 13,290.12 Mn |

| Growth Rate | 24.57% CAGR from 2024 to 2029 |

| Key Segments | Application (Passenger, Commercial); Service Type (Subscription, Pay-per-use); Station Type (Manual, Automated); Vehicle Type (2- Wheeler, 3- Wheeler, 4- wheeler); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | NIO Inc.; Gogoro Inc.; SUN Mobility Pvt. Ltd.; Numocity Technologies Pvt. Ltd.; BattSwap Inc. |

| Key Countries | The U.S; Canada; Mexico; Brazil; Argentina; Colombia; Chile; China; India; Japan; South Korea; The UK; Germany; Italy; France; Spain; Turkey; UAE; Saudi Arabia; Egypt; South Africa |

| Largest Market | Asia Pacific |

Get a free quote.

Trends

- Modular Battery Systems: Companies are advancing the development of modular battery packs that can be effortlessly swapped and customized for various vehicle types. These modular designs not only streamline the battery-swapping process but also enhance compatibility across different electric vehicle (EV) models. NIO’s Power Swap 3.0 stations, which feature highly adaptable interchangeable modules, allow seamless integration with multiple EV models.

- AI-Powered Swapping Stations: AI-driven battery swapping stations address EV charging challenges by automating swaps and reducing the need for dedicated infrastructure. They enhance fleet efficiency by ensuring constant battery readiness, minimizing downtime, and supporting sustainability through energy storage and emissions reduction.

- Standardization Initiatives: Efforts to standardize battery-swapping interfaces are gaining traction, particularly in Asia. The Indian government’s collaboration with companies like Sun Mobility aims to create uniform battery-swapping standards, facilitating broader adoption across different EV models. This standardization is expected to streamline infrastructure development and enhance the overall efficiency of battery-swapping networks.

Speak to analyst.

Catalysts

- Rising EV Sales Worldwide: The global surge in electric vehicle (EV) sales has created a growing demand for efficient charging solutions, driving interest in battery-swapping technology. With countries like China, the US, and many European nations setting ambitious targets for EV adoption, the need for quicker and more convenient charging alternatives is becoming increasingly vital.

- Reducing the Price of EV Batteries: The continuous decline in EV battery costs has made electric vehicles more affordable, further accelerating their adoption. For instance, the cost per kWh for lithium-ion batteries has fallen by about 89% since 2010, which directly influences the feasibility and cost-effectiveness of battery-swapping infrastructure.

- Reduces EV Ownership Costs: Battery swapping technology can significantly lower the upfront cost of EVs by decoupling the battery from the vehicle. Consumers can purchase an EV without the battery and subscribe to a swapping service, thereby reducing the initial investment required. India’s SUN Mobility offers a subscription-based battery-swapping service that reduces the upfront cost of electric two-wheelers and makes them more accessible to a broader population.

Inquire before buying.

Restraints

- Lack of Standardization in Batteries Across Vehicles: The absence of standardized battery designs and specifications among different EV manufacturers poses a significant challenge for the battery-swapping market. This lack of uniformity complicates the development of universal swapping stations, as each vehicle may require a unique battery type or configuration. As a result, the industry struggles to create an efficient and scalable swapping infrastructure that can cater to a wide range of EV models.

- Low Initial Acceptance by End Users: Despite its potential, battery-swapping technology faces slow adoption among consumers due to unfamiliarity and concerns about reliability. Many users prefer the perceived security of owning a fixed battery within their vehicle rather than relying on a shared infrastructure. Moreover, the initial rollout of battery-swapping stations is often limited to specific regions, further hindering widespread acceptance and trust in this technology.

- Concerns About Battery Life and Degradation: Battery swapping introduces concerns about the longevity and performance of swapped batteries, especially since users may not always receive the same battery after each swap. Variability in battery age and usage patterns can lead to inconsistent performance, raising fears about accelerated degradation. These concerns can deter potential adopters who worry that frequently swapping batteries might reduce the overall lifespan of their EV’s power source.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Battery Swapping Market (2018 – 2022) 2.2. Global Battery Swapping Market (2023 – 2029) 3. Market Segmentation 3.1. Global Battery Swapping Market by Application 3.1.1. Passenger 3.1.2. Commercial 3.2. Global Battery Swapping Market by Service Type 3.2.1. Subscription 3.2.2. Pay-per-use 3.3. Global Battery Swapping Market by Station Type 3.3.1. Manual 3.3.2. Automated 3.4. Global Battery Swapping Market by Vehicle Type 3.4.1. 2- Wheeler 3.4.2. 3- Wheeler 3.4.3. 4- wheeler 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Colombia 4.2.4. Chile 4.2.5. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Japan 4.3.4. South Korea 4.3.5. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. Italy 4.4.4. France 4.4.5. Spain 4.4.6. Rest of Europe 4.5. The Middle East 4.5.1. Turkey 4.5.2. UAE 4.5.3. Saudi Arabia 4.5.4. Rest of the Middle East 4.6. Africa 4.6.1. Egypt 4.6.2. South Africa 4.6.3. Rest of Africa 5. Value Chain Analysis of the Global Battery Swapping Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. NIO Inc. 9.2. Gogoro Inc. 9.3. SUN Mobility Pvt. Ltd. 9.4. Numocity Technologies Pvt. Ltd. 9.5. BattSwap Inc. 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Battery Swapping Market – FAQs

1. What is the current size of the battery swapping market?

Ans. In 2024, the battery swapping market size is $4,430.34 Mn.

2. Who are the major vendors in the battery swapping market?

Ans. The major vendors in the battery swapping market are NIO Inc.; Gogoro Inc.; SUN Mobility Pvt. Ltd.; Numocity Technologies Pvt. Ltd.; BattSwap Inc.

3. Which segments are covered under the battery swapping market segments analysis?

Ans. The battery swapping market report offers in-depth insights into Application, Service Type, Station Type, Vehicle Type, and Geography.