Micro Irrigation Systems Market: Size, Share, Trends & Forecast (2024-2029)

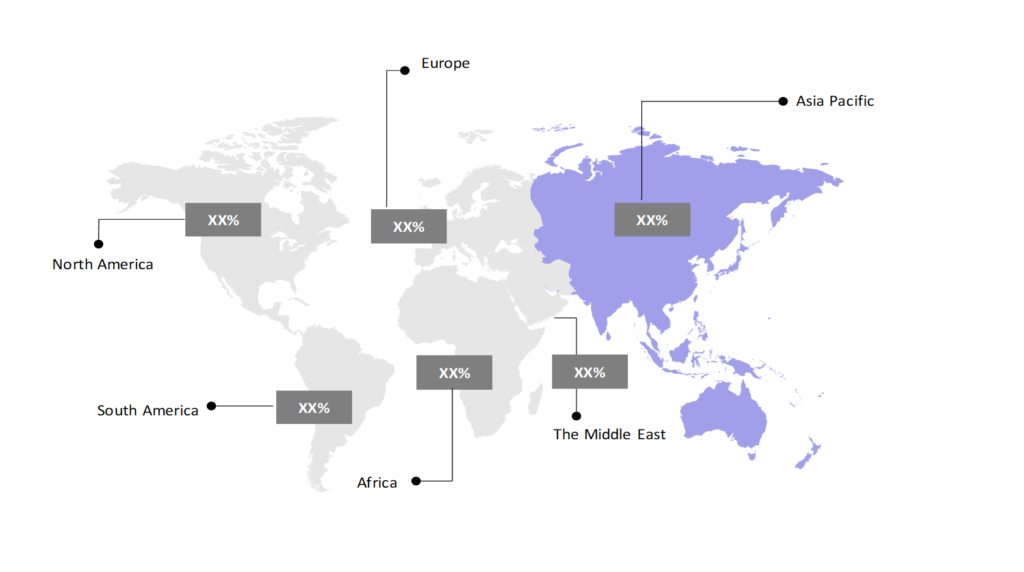

The market report presents a thorough analysis segmented by Type (Drip, Micro-sprinkler); by Crop Type (Orchard Crops & Vineyards, Field Crops, Plantation Crops, Others); by End User (Farmers, Industrial Users, Others); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

- The micro irrigation systems market is estimated to be at USD 1,301.13 Mn in 2024 and is anticipated to reach USD 1,924.43 Mn in 2029.

- The micro irrigation systems market is registering a CAGR of 8.14% during the forecast period of 2024-2029.

- The Micro Irrigation Systems market is evolving rapidly, driven by the need for water conservation, technological advancements, and increasing global food demand. These systems are becoming a cornerstone of sustainable agriculture, especially in regions facing water scarcity.

Request a free sample.

Ecosystem

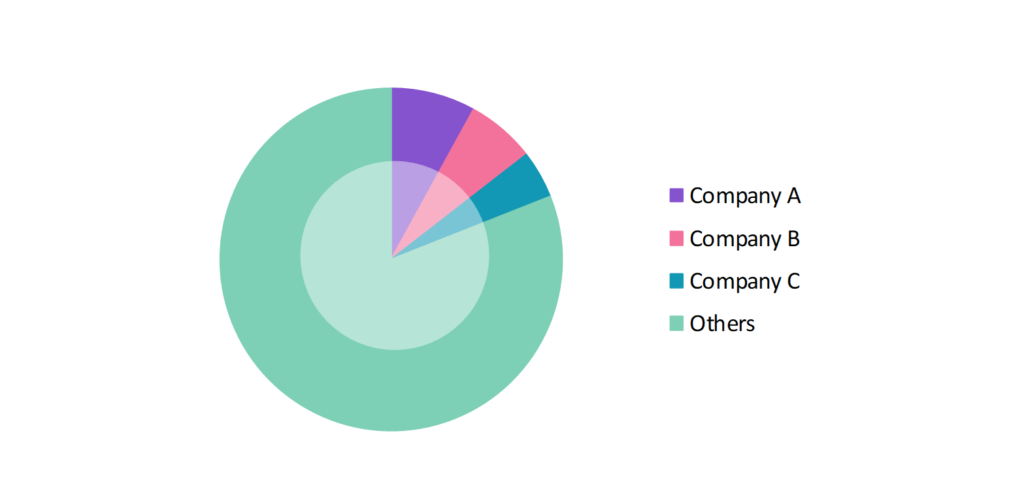

- The participants in the global micro irrigation systems industry are always developing strategies to preserve a competitive advantage.

- These companies focus on research and development, advanced, efficient, and cost-effective solutions for micro irrigation systems.

- Several important entities in the micro irrigation systems market include Jain Irrigation Systems Ltd.; Nelson Irrigation Corp.; Rain Bird Corp.; The Toro Co.; Chinadrip Irrigation Equipment Co., Ltd.; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2018-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Market Size (2024) | USD 1,301.13 Mn |

| Market Size (2029) | USD 1,924.43 Mn |

| Growth Rate | 8.14% CAGR from 2024 to 2029 |

| Key Segments | Type (Drip, Micro-sprinkler); Crop Type (Orchard Crops & Vineyards, Field Crops, Plantation Crops, Others); End User (Farmers, Industrial Users, Others); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | Jain Irrigation Systems Ltd.; Nelson Irrigation Corp.; Rain Bird Corp.; The Toro Co.; Chinadrip Irrigation Equipment Co., Ltd. |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; China; India; Japan; South Korea; The UK; Germany; Italy; France; Spain; Israel; UAE; Saudi Arabia; Egypt; South Africa |

| Largest Market | Asia Pacific |

Get a free quote.

Trends

- Integration of IoT and Smart Technologies: Integrating IoT and smart technologies into micro irrigation systems is becoming more prevalent. These systems allow farmers to monitor soil moisture levels and control irrigation remotely via mobile apps, enhancing water efficiency and crop management. In March 2024, the Israeli agricultural technology company Netafim introduced a new smart irrigation system with IoT sensors.

- Adoption of Precision Agriculture: The micro irrigation systems market is experiencing a shift towards precision agriculture, where advanced technologies are employed to monitor and control irrigation with high accuracy. Precision agriculture techniques allow for targeted water application, reducing waste and improving crop performance.

- Solar-Powered Irrigation Systems: The adoption of solar-powered micro irrigation systems is rising, especially in regions with limited electricity access. This initiative enables smallholder farmers to irrigate crops sustainably and reduce dependency on unreliable power sources.

Speak to analyst.

Catalysts

- Growing Need for Water Conservation: The increasing need to conserve water, particularly in agriculture, is a major driver for adopting micro irrigation systems. These systems are designed to minimize water waste by delivering water directly to the roots of plants, making them an essential tool in water-scarce regions.

- Government Support and Subsidies: Various governments worldwide offer subsidies and financial incentives to promote the use of micro irrigation systems. For example, as of 2023, India’s Pradhan Mantri Krishi Sinchai Yojana (PMKSY) scheme subsidizes farmers for adopting drip and sprinkler irrigation systems. This support aims to enhance agricultural productivity, especially in areas prone to drought and water shortages.

- Rising Global Food Demand: The growing global population is driving up demand for food, putting pressure on agricultural productivity. Micro irrigation systems help farmers maximize crop yields by ensuring efficient water use, which is crucial for meeting rising food demand.

Inquire before buying.

Restraints

- High Initial Costs: A significant challenge in the micro irrigation systems market is the high initial investment required for installation, which poses a barrier, especially for small-scale farmers. For instance, in 2023, the cost of setting up a drip irrigation system can range from approximately 350 to 650 USD per acre, a substantial expense for many smallholders. This financial burden limits adoption despite the long-term benefits of improved water efficiency and crop yield.

- Infrastructure and Distribution Limitations: In certain regions, particularly remote or underdeveloped areas, inadequate infrastructure and distribution networks for micro irrigation systems hinder market growth. This challenge limits access to these technologies, slowing their adoption and expansion in these areas.

- Maintenance and Technical Issues: Micro irrigation systems require regular maintenance and technical expertise to function efficiently. Skilled personnel are needed to manage and troubleshoot these systems, which adds to operational costs, especially in rural or less developed regions. This requirement deters adoption, particularly among small-scale farmers with limited resources and access to technical support.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Micro Irrigation Systems Market (2018 – 2022) 2.2. Global Micro Irrigation Systems Market (2023 – 2029) 3. Market Segmentation 3.1. Global Micro Irrigation Systems Market by Type 3.1.1. Drip 3.1.2. Micro-sprinkler 3.2. Global Micro Irrigation Systems Market by Crop Type 3.2.1. Orchard Crops & Vineyards 3.2.2. Field Crops 3.2.3. Plantation Crops 3.2.4. Others 3.3. Global Micro Irrigation Systems Market by End User 3.3.1. Farmers 3.3.2. Industrial Users 3.3.3. Others 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Colombia 4.2.4. Chile 4.2.5. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Japan 4.3.4. South Korea 4.3.5. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. Italy 4.4.4. France 4.4.5. Spain 4.4.6. Rest of Europe 4.5. The Middle East 4.5.1. Turkey 4.5.2. UAE 4.5.3. Saudi Arabia 4.5.4. Rest of the Middle East 4.6. Africa 4.6.1. Egypt 4.6.2. South Africa 4.6.3. Rest of Africa 5. Value Chain Analysis of the Global Micro Irrigation Systems Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. Jain Irrigation Systems Ltd. 9.2. Nelson Irrigation Corp. 9.3. Rain Bird Corp. 9.4. The Toro Co. 9.5. Chinadrip Irrigation Equipment Co., Ltd. 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Micro Irrigation Systems Market – FAQs

1. What is the current size of the micro irrigation systems market?

Ans. In 2024, the micro irrigation systems market size is 1,301.13 Mn USD.

2. Who are the major vendors in the micro irrigation systems market?

Ans. The major vendors in the micro irrigation systems market are Jain Irrigation Systems Ltd.; Nelson Irrigation Corp.; Rain Bird Corp.; The Toro Co.; Chinadrip Irrigation Equipment Co., Ltd.

3. Which segments are covered under the micro irrigation systems market segments analysis?

Ans. The micro irrigation systems market report offers in-depth insights into Type, Crop Type, End User, and Geography.