Healthcare E-commerce Market Outlook: Size, Share, Trends & Growth Analysis (2024-2029)

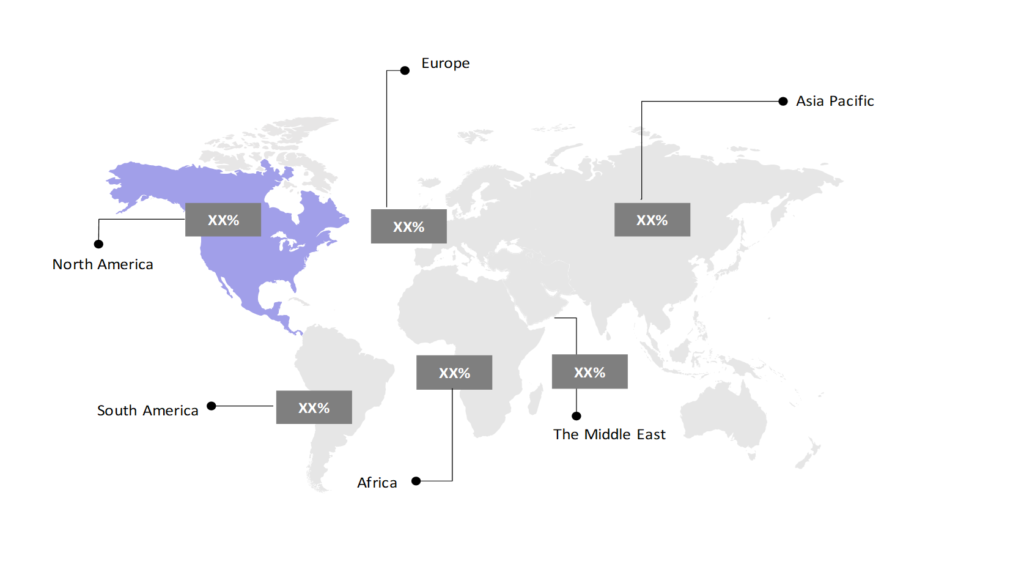

The market report presents a thorough analysis segmented by Product Type (Pharmaceutical Drugs, Health and Wellness Products, Medical Devices); by Application (Telemedicine, Caregiving Services, Others); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

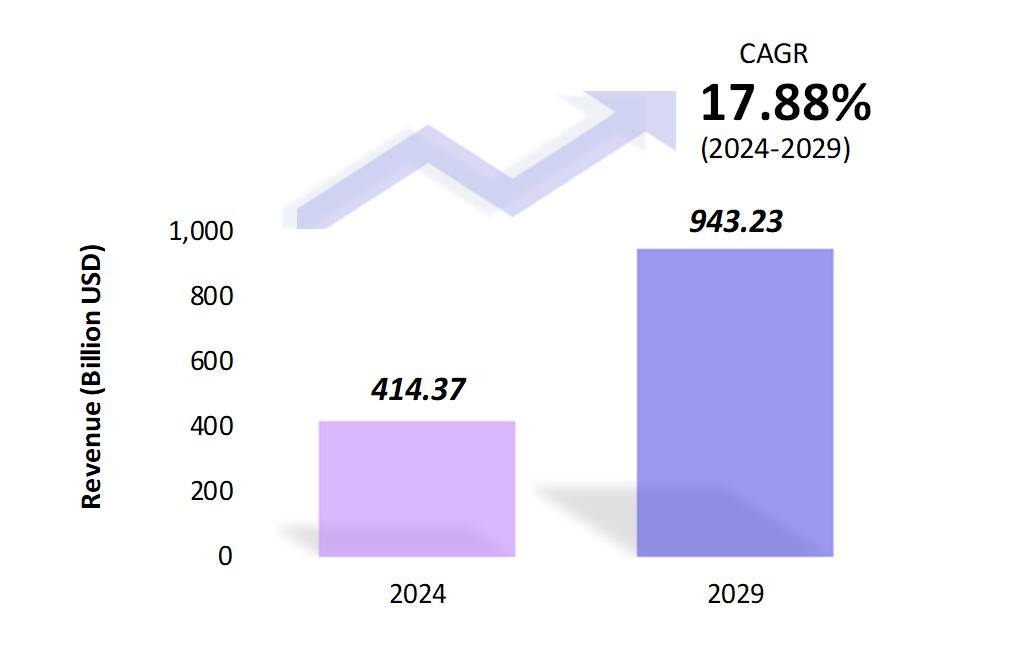

- The healthcare e-commerce market is estimated to be at USD 414.37 Bn in 2024 and is anticipated to reach USD 943.23 Bn in 2029.

- The healthcare e-commerce market is registering a CAGR of 17.88% during the forecast period of 2024-2029.

- The global healthcare e-commerce market growth is driven by increasing online accessibility to healthcare products, telemedicine, and digital health services.

Request a free sample.

Ecosystem

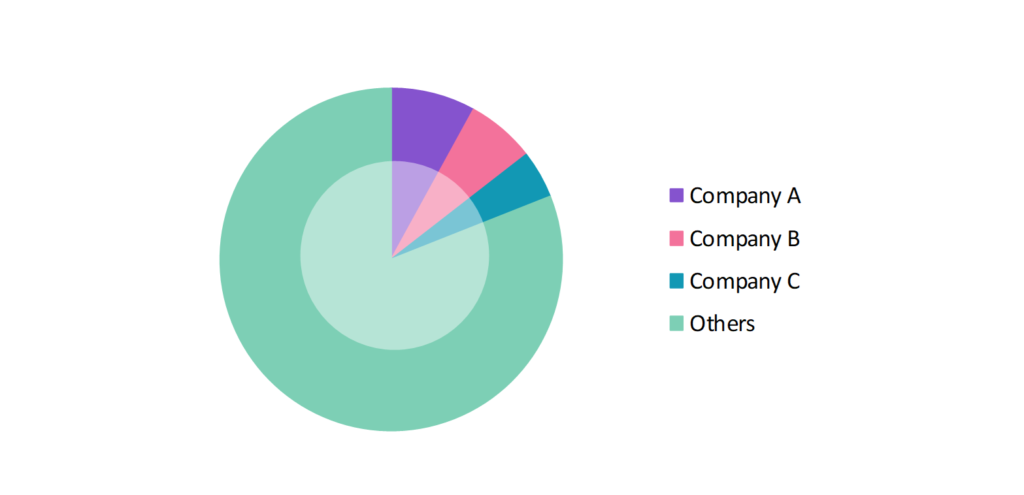

- The participants in the global healthcare e-commerce industry dominate the market with diverse offerings, from telehealth services to online pharmacies.

- These companies primarily focus on expanding product offerings, adding new healthcare services to their e-commerce platforms, along with partnerships and acquisitions to maintain a competitive edge in the market.

- Several important entities in the healthcare e-commerce market include Amazon.com, Inc.; Caremark LLC; AliHealth Habei Information Technology Co., Ltd.; Owens & Minor, Inc.; Exact Care Pharmacy, LLC; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2018-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Market Size (2024) | USD 414.37 Bn |

| Market Size (2029) | USD 943.23 Bn |

| Growth Rate | 17.88% CAGR from 2024 to 2029 |

| Key Segments | Product Type (Pharmaceutical Drugs, Health and Wellness Products, Medical Devices); Application (Telemedicine, Caregiving Services, Others); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | Amazon.com, Inc.; Caremark LLC; AliHealth Habei Information Technology Co., Ltd.; Owens & Minor, Inc.; Exact Care Pharmacy, LLC |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; Colombia; Chile; China; India; Japan; South Korea; The UK; Germany; Italy; France; Spain; Turkey; UAE; Saudi Arabia; Egypt; South Africa |

| Largest Market | North America |

Get a free quote.

Trends

- Use of AI in Customer Service: AI-powered chatbots and virtual assistants are becoming popular in healthcare e-commerce platforms, helping consumers find products and access services more efficiently. In 2023, Babylon Health implemented an AI chatbot for their online healthcare services, offering personalized recommendations based on user symptoms.

- Integration of Same-Day Delivery: There is a growing trend toward offering same-day or faster delivery for healthcare products, including non-prescription items and medical supplies. In 2023, Amazon Pharmacy expanded its same-day delivery services for over-the-counter products to major cities in the U.S., emphasizing convenience and customer satisfaction.

- Emphasis on User Experience: Healthcare e-commerce platforms are increasingly focused on improving user interfaces and ensuring accessibility for all age groups and abilities. In 2023, Walgreens revamped its mobile app to enhance ease of use for older adults, incorporating features like larger fonts and simple navigation.

Speak to analyst.

Catalysts

- Expansion of Online Pharmacies: Online pharmacies are expanding their market reach by offering both prescription and over-the-counter medications. In 2023, CVS Health enhanced its digital platform, making it easier for consumers to order medications online and access healthcare products via their e-commerce store.

- Rise of Chronic Diseases: The increase in chronic diseases such as diabetes and hypertension is fueling the demand for healthcare e-commerce platforms. In 2023, Teladoc reported a surge in usage among older adults for chronic disease management, highlighting the need for remote healthcare solutions.

- Integration of Wearables with E-commerce Platforms: Healthcare e-commerce platforms are integrating with wearable devices to offer better health monitoring and personalized product recommendations. In 2023, Apple Health integrated with several healthcare e-commerce sites, allowing users to sync their health data and receive targeted product suggestions based on their activity and wellness data.

Inquire before buying.

Restraints

- Regulatory Complexities: Navigating regulatory frameworks like HIPAA, GDPR, and various health laws across regions remains a major challenge. For example, in 2023, GoodRx faced challenges in ensuring compliance with HIPAA, which slowed down their expansion into new e-commerce services as they had to prioritize patient data protection.

- Logistics Delays: The healthcare e-commerce sector faces logistics challenges, particularly regarding the timely delivery of sensitive healthcare products such as prescription medications. In 2023, Amazon Pharmacy experienced issues with delayed deliveries due to increased demand and supply chain disruptions, leading to customer dissatisfaction.

- Cybersecurity Risks: As more sensitive health data is processed online, the risk of cyberattacks and data breaches increases. In 2023, Hims & Hers reported a cyberattack attempt, emphasizing the need for stronger data security measures to protect patient information and maintain consumer trust.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Healthcare E-commerce Market (2018 – 2022) 2.2. Global Healthcare E-commerce Market (2023 – 2029) 3. Market Segmentation 3.1. Global Healthcare E-commerce Market by Product Type 3.1.1. Pharmaceutical Drugs 3.1.2. Health and Wellness Products 3.1.3. Medical Devices 3.2. Global Healthcare E-commerce Market by Application 3.2.1. Telemedicine 3.2.2. Caregiving Services 3.2.3. Others 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Colombia 4.2.4. Chile 4.2.5. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Japan 4.3.4. South Korea 4.3.5. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. Italy 4.4.4. France 4.4.5. Spain 4.4.6. Rest of Europe 4.5. The Middle East 4.5.1. Turkey 4.5.2. UAE 4.5.3. Saudi Arabia 4.5.4. Rest of the Middle East 4.6. Africa 4.6.1. Egypt 4.6.2. South Africa 4.6.3. Rest of Africa 5. Value Chain Analysis of the Global Healthcare E-commerce Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. Amazon.com, Inc. 9.2. Caremark LLC 9.3. AliHealth Habei Information Technology Co., Ltd. 9.4. Owens & Minor, Inc. 9.5. Exact Care Pharmacy, LLC 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Healthcare E-commerce Market – FAQs

1. What is the current size of the healthcare e-commerce market?

Ans. In 2024, the healthcare e-commerce market size is USD 414.37 Bn.

2. Who are the major vendors in the healthcare e-commerce market?

Ans. The major vendors in the healthcare e-commerce market are Amazon.com, Inc.; Caremark LLC; AliHealth Habei Information Technology Co., Ltd.; Owens & Minor, Inc.; Exact Care Pharmacy, LLC.

3. Which segments are covered under the healthcare e-commerce market segments analysis?

Ans. The healthcare e-commerce market report offers in-depth insights into Product Type, Application, and Geography.