Online Food Delivery Market Analysis: Growth, Size, Share & Future Trends (2024-2029)

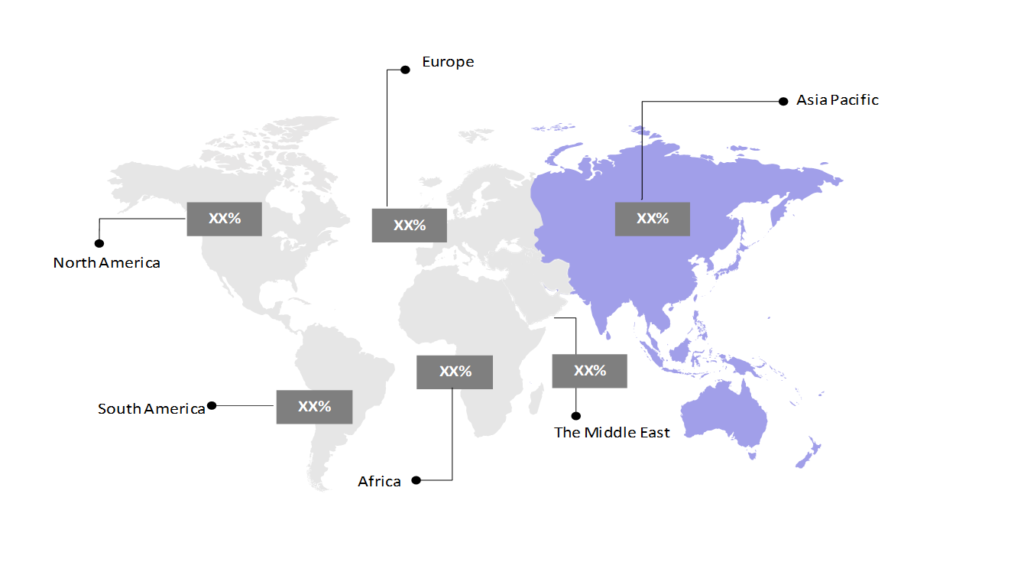

The market report offers a detailed analysis segmented by Business Model (Logistic-focused Food Delivery System, Restaurant-specific Food Delivery System); by Platform Type (Applications, Websites); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

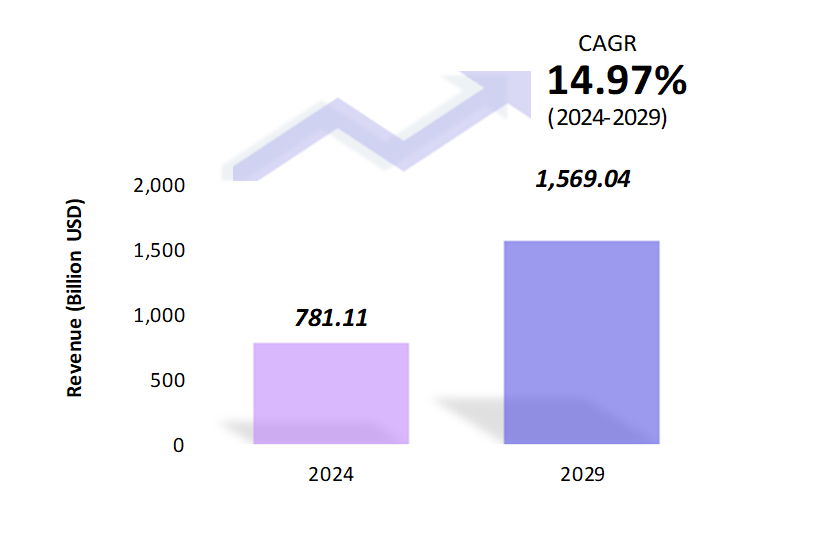

- The online food delivery market is estimated to be at USD 781.11 Bn in 2024 and is anticipated to reach USD 1,569.04 Bn in 2029.

- The online food delivery market is registering a CAGR of 14.97% during the forecast period of 2024-2029.

- The online food delivery market is experiencing rapid growth, driven by the increasing demand for convenient and fast-food options. The proliferation of smartphones and the widespread adoption of digital technologies have made it easier for consumers to order food online, fueling the expansion of delivery platforms.

Request a free sample.

Ecosystem

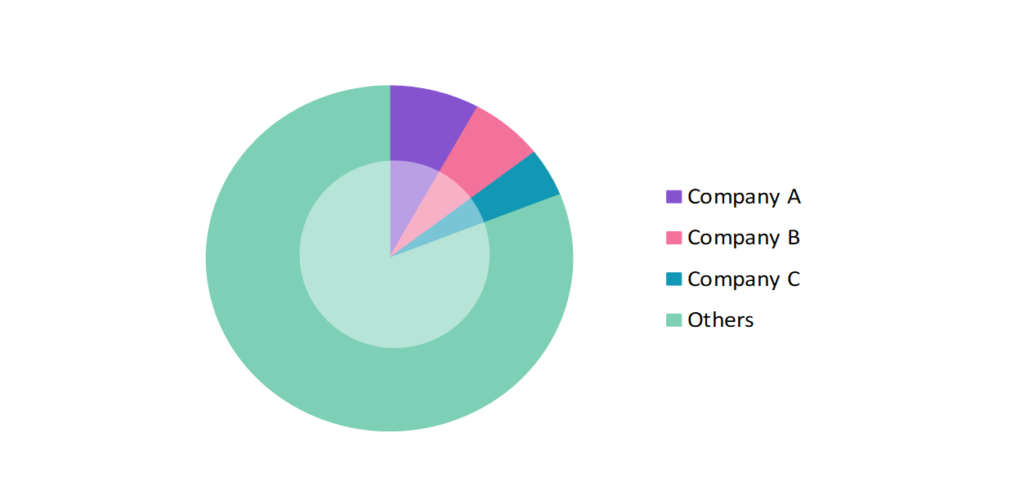

- The participants in the global online food delivery industry are always developing their strategies to preserve a competitive advantage.

- Smaller, regional players are also making significant inroads, particularly in niche markets or regions where global players have less presence. These companies often focus on local cuisine and personalized customer service.

- Several important entities in the online food delivery market include Delivery Hero SE; Grab Holdings Ltd.; Just Eat Takeaway.com; Uber Technologies Inc.; Zomato Ltd. and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2018-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Market Size (2024) | USD 781.11 Bn |

| Market Size (2029) | USD 1,569.04 Bn |

| Growth Rate | 14.97% CAGR from 2024 to 2029 |

| Key Segments | Business Model (Logistic-focused Food Delivery System, Restaurant-specific Food Delivery System); Platform Type (Applications, Websites); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | Delivery Hero SE; Grab Holdings Ltd.; Just Eat Takeaway.com; Uber Technologies Inc.; Zomato Ltd. |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; Colombia; Chile; China; India; Japan; South Korea; The UK; Germany; Italy; France; Spain; Turkey; UAE; Saudi Arabia; Egypt; South Africa |

| Largest Market | Asia Pacific |

Get a free quote.

Trends

- Drone-Based Food Delivery: Drone-based food delivery is gradually gaining traction as companies like Uber Eats, Domino’s, and Zomato successfully test drone deliveries. As drone technology matures, especially in hyperlocal environments, the popularity of drone deliveries is expected to rise, offering potential cost savings through reduced manual labor and lower fuel consumption.

- Autonomous Food Delivery: Autonomous delivery robots are already becoming a reality in cities like London, where Starship Technologies robots deliver groceries, and on US campuses like George Mason University, where students use these robots to pick up meals. Companies like Kiwibot are also active in cities like Berkeley and Denver. While still emerging, autonomous deliveries are expected to grow as technology advances, offering a glimpse of the future where robots could become a common sight delivering food to doorsteps.

- Digital Transformation: The rise of digital platforms and mobile applications has revolutionized the food delivery industry. Companies are investing heavily in user-friendly apps, AI-driven recommendations, and efficient delivery logistics to enhance customer experience and streamline operations.

Speak to analyst.

Catalysts

- Food Delivery from Cloud Kitchens: Cloud kitchens, or virtual kitchens, are increasingly transforming the food delivery landscape by operating exclusively through online ordering channels without dine-in options. This model benefits from reduced real estate costs and targets a niche but profitable customer base.

- Urbanization and Busy Lifestyles: As urbanization accelerates and consumer lifestyles become increasingly hectic, there is a marked shift towards food delivery services due to the lack of time for home cooking. This factor is particularly evident among younger, working professionals who seek convenience and efficiency. The demand for food delivery is driven by the desire to streamline daily routines and accommodate busy schedules, which makes it an essential service for those balancing demanding careers and personal lives.

- Contactless Food Delivery: The COVID-19 pandemic has accelerated the adoption of contactless food delivery as a standard practice to ensure safety for both customers and delivery personnel. This has been propelled by advanced delivery platforms that enable seamless, no-contact interactions. Even as the pandemic subsides, the preference for contactless delivery is expected to remain, becoming a key growth factor in the food delivery experience.

Inquire before buying.

Restraints

- Intense Competition: The food delivery market is fiercely competitive, with numerous players striving to capture market share. This intense competition exerts pressure on profit margins and necessitates ongoing innovation and differentiation to remain relevant in a crowded field.

- Logistics and Operational Costs: Managing an extensive network of delivery drivers, ensuring timely deliveries, and upholding food quality are substantial challenges. High operational costs, particularly in densely populated urban areas, can strain profitability and require efficient logistical solutions.

- Regulatory Hurdles: Navigating complex local regulations, including food safety standards and labor laws, is a critical challenge for food delivery companies. Compliance with varying regulations across different regions can be both intricate and costly, impacting operational efficiency.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Online Food Delivery Market (2018 – 2022) 2.2. Global Online Food Delivery Market (2023 – 2029) 3. Market Segmentation 3.1. Global Online Food Delivery Market by Business Model 3.1.1. Logistic-focused Food Delivery System 3.1.2. Restaurant-specific Food Delivery System 3.2. Global Online Food Delivery Market by Platform Type 3.2.1. Applications 3.2.2. Websites 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Colombia 4.2.4. Chile 4.2.5. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Japan 4.3.4. South Korea 4.3.5. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. Italy 4.4.4. France 4.4.5. Spain 4.4.6. Rest of Europe 4.5. The Middle East 4.5.1. Turkey 4.5.2. UAE 4.5.3. Saudi Arabia 4.5.4. Rest of the Middle East 4.6. Africa 4.6.1. Egypt 4.6.2. South Africa 4.6.3. Rest of Africa 5. Value Chain Analysis of the Global Online Food Delivery Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. Delivery Hero SE 9.2. Grab Holdings Ltd. 9.3. Just Eat Takeaway.com 9.4. Uber Technologies Inc. 9.5. Zomato Ltd. 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Online Food Delivery Market – FAQs

1. What is the current size of the online food delivery market?

Ans. In 2024, the online food delivery market size is USD 781.11 Bn.

2. Who are the major vendors in the online food delivery market?

Ans. The major vendors in the online food delivery market are Delivery Hero SE; Grab Holdings Ltd.; Just Eat Takeaway.com; Uber Technologies Inc.; Zomato Ltd.

3. Which segments are covered under the online food delivery market segments analysis?

Ans. The online food delivery market report offers in-depth insights into Business Model, Platform Type, and Geography.