Alcoholic Beverage Market: Size, Share, Trends & Forecast (2024-2029)

The market report offers a detailed analysis segmented by Type (Beer, Distilled Spirits, Wine, Others); by Distribution Channel (Retail, Food Service); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

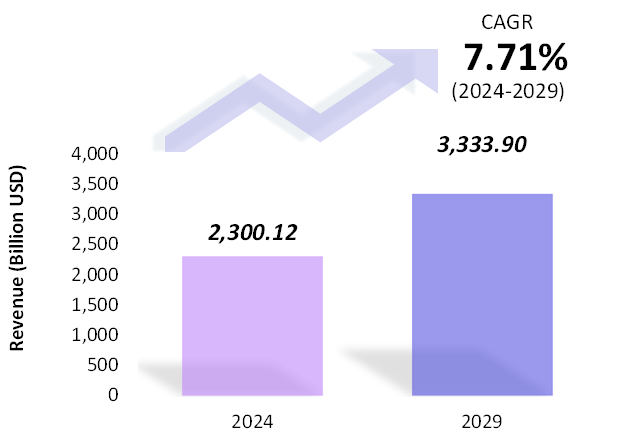

- The alcoholic beverage market is estimated to be at USD 2,300.12 Bn in 2024 and is anticipated to reach USD 3,333.90 Bn in 2029.

- The alcoholic beverage market is registering a CAGR of 7.71% during the forecast period of 2024-2029.

- The global alcoholic beverage market is experiencing steady growth, driven by changing consumer preferences, increasing disposable incomes, and the expansion of the middle class, particularly in emerging markets. The industry is also witnessing a shift towards premium and craft products as consumers seek unique and high-quality drinking experiences.

Request a free sample.

Ecosystem

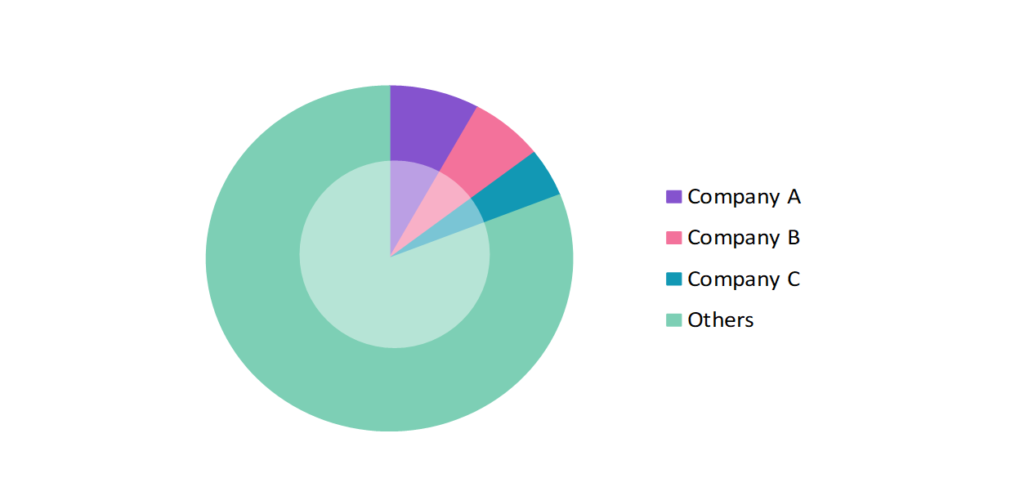

- The participants in the global alcoholic beverage industry are always developing their strategies to preserve a competitive advantage.

- Despite the dominance of global companies, local and regional players play a significant role in the market, particularly in emerging economies. For instance, Kingfisher in India and Tsingtao in China are leading brands in their respective markets, offering products that cater to local tastes.

- Several important entities in the alcoholic beverage market include Anheuser-Busch InBev SA/NV; Asahi Group Holdings Ltd.; Bacardi Ltd.; Brown-Forman Corp.; Carlsberg Group; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2018-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Market Size (2024) | USD 2,300.12 Bn |

| Market Size (2029) | USD 3,333.90 Bn |

| Growth Rate | 7.71% CAGR from 2024 to 2029 |

| Key Segments | Type (Beer, Distilled Spirits, Wine, Others); Distribution Channel (Retail, Food Service); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | Anheuser-Busch InBev SA/NV; Asahi Group Holdings Ltd.; Bacardi Ltd.; Brown-Forman Corp.; Carlsberg Group |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; Colombia; Chile; China; India; Japan; South Korea; The UK; Germany; Italy; France; Spain; Turkey; UAE; Egypt; South Africa. |

| Largest Market | North America |

Get a free quote.

Trends

- Preference for Holistic Options: Consumers are increasingly seeking beverages that align with a holistic approach to health and wellness. This trend has led to the rise of functional alcoholic beverages infused with ingredients like adaptogens, CBD, and botanicals, offering perceived health benefits alongside traditional alcohol. For example, brands like Seedlip as well as Kin Euphorics have gained popularity by offering non-alcoholic spirits that cater to health-conscious consumers, blending wellness with the social experience of drinking.

- The Growing Interest in Ready-To-Drink (RTD): The busy lifestyles of modern consumers prefer convenient alcohol options, including ready-to-drink (RTD) cocktails and canned wine. This trend is particularly strong among millennials and urban dwellers who prioritize ease of consumption without compromising on quality.

- Flavored Alcoholic Beverages: Flavored alcoholic beverages are gaining traction, particularly among younger consumers. This trend includes everything from flavored vodkas and rums to spiced wines and beers. Smirnoff’s wide range of flavored vodkas and the rise of hard seltzers like Truly are examples of this trend gaining momentum.

Speak to analyst.

Catalysts

- Premiumization and Craft Trends: Consumers are increasingly gravitating towards premium and craft alcoholic beverages, including craft beers, artisanal spirits, and boutique wines. For instance, the craft beer market in the U.S. has grown significantly, with breweries like Sierra Nevada and Stone Brewing leading the trend.

- Rising Disposable Incomes: As disposable incomes increase, particularly in developing regions like Asia-Pacific, more consumers can afford to purchase higher-end alcoholic beverages. This shift is evident in the rising demand for premium whiskey and wine in countries like China and India.

- Growth of E-commerce: The proliferation of e-commerce platforms has made it easier for consumers to access a wide range of alcoholic beverages, contributing to market growth. Drizly and Vivino have capitalized on this factor by offering extensive online selections of alcohol delivered directly to consumers.

Inquire before buying.

Restraints

- Stringent Regulations: The alcoholic beverage market faces significant challenges due to strict regulations that govern advertising, sales, and distribution. In many countries, these regulations are particularly stringent. For example, in Saudi Arabia and Kuwait, alcohol is entirely banned, severely limiting market opportunities.

- Raw Material Issues: Raw material issues pose a significant challenge in the alcoholic beverage market, particularly due to climate change and agricultural uncertainties affecting the supply of key ingredients like grains, grapes, and hops. Fluctuations in availability and quality can lead to increased production costs and supply chain disruptions.

- Economic Uncertainty: Economic instability, such as that experienced during the COVID-19 pandemic, can significantly impact the alcoholic beverage market. Economic downturns often lead to reduced discretionary spending, with consumers cutting back on non-essential items, including alcohol. During the pandemic, the closure of bars, restaurants, and other on-premises venues caused a dramatic drop in alcohol sales in many regions.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Alcoholic Beverage Market (2018 – 2022) 2.2. Global Alcoholic Beverage Market (2023 – 2029) 3. Market Segmentation 3.1. Global Alcoholic Beverage Market by Type 3.1.1. Beer 3.1.2. Distilled Spirits 3.1.3. Wine 3.1.4. Others 3.2. Global Alcoholic Beverage Market by Distribution Channel 3.2.1. Retail 3.2.2. Food Service 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Colombia 4.2.4. Chile 4.2.5. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Japan 4.3.4. South Korea 4.3.5. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. Italy 4.4.4. France 4.4.5. Spain 4.4.6. Rest of Europe 4.5. The Middle East 4.5.1. Turkey 4.5.2. UAE 4.5.3. Rest of the Middle East 4.6. Africa 4.6.1. Egypt 4.6.2. South Africa 4.6.3. Rest of Africa 5. Value Chain Analysis of the Global Alcoholic Beverage Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. Anheuser-Busch InBev SA/NV 9.2. Asahi Group Holdings Ltd. 9.3. Bacardi Ltd. 9.4. Brown-Forman Corp. 9.5. Carlsberg Group 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Alcoholic Beverage Market – FAQs

1. What is the current size of the alcoholic beverage market?

Ans. In 2024, the alcoholic beverage market size is USD 2,300.12 Bn.

2. Who are the major vendors in the alcoholic beverage market?

Ans. The major vendors in the alcoholic beverage market are Anheuser-Busch InBev SA/NV; Asahi Group Holdings Ltd.; Bacardi Ltd.; Brown-Forman Corp.; Carlsberg Group.

3. Which segments are covered under the alcoholic beverage market segments analysis?

Ans. The alcoholic beverage market report offers in-depth insights into Type, Distribution Channel, and Geography.