Ultrasound Gel Market: Size, Share, Trends & Forecast (2024-2029)

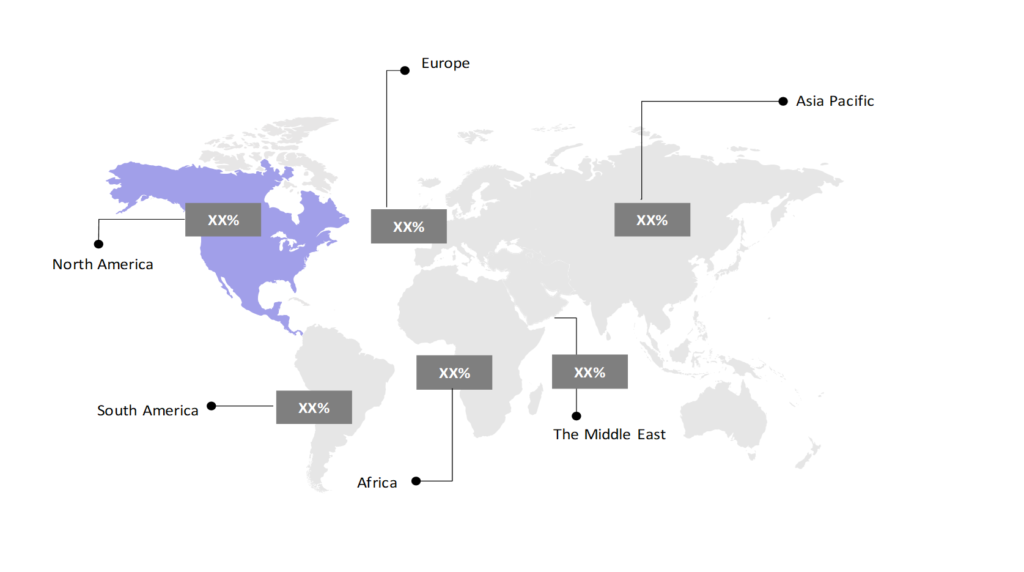

The market report offers a detailed analysis segmented by Type (Sterile, Non-sterile); by End User (Clinics, Hospitals, Diagnostic Centers, Others); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

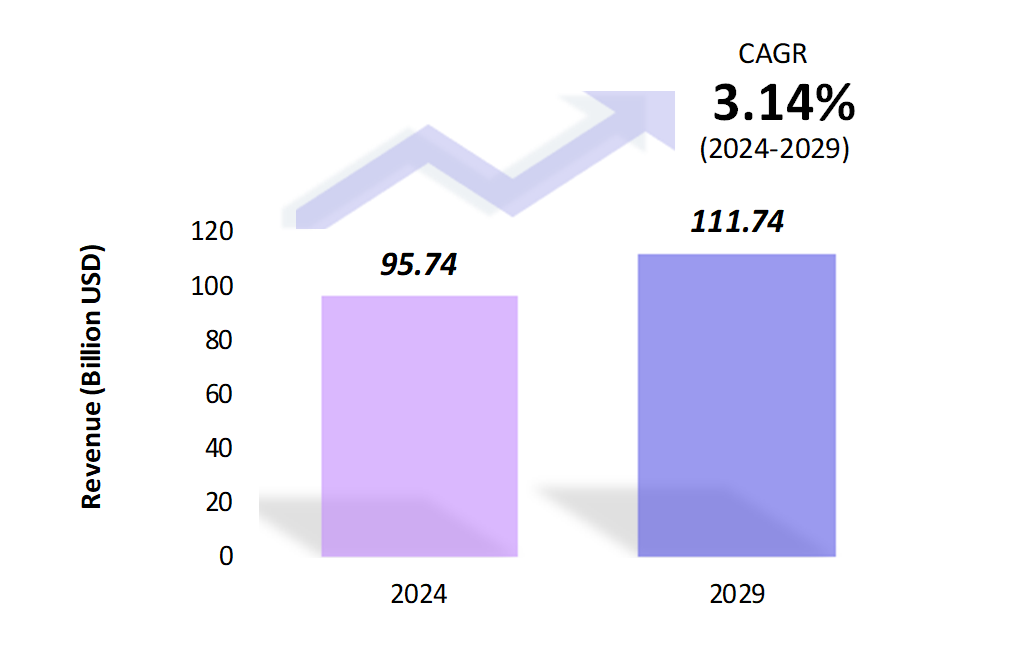

- The ultrasound gel market is estimated to be at USD 95.74 Bn in 2024 and is anticipated to reach USD 111.74 Bn in 2029.

- The ultrasound gel market is registering a CAGR of 3.14% during the forecast period of 2024-2029.

- The global ultrasound gel market is driven by the increasing demand for diagnostic imaging procedures, particularly in hospitals and diagnostic centers. Ultrasound gel, essential for enhancing the transmission of sound waves during ultrasound exams, plays a crucial role in diagnostics for various medical conditions, including pregnancy, cardiovascular diseases, and cancer.

Request a free sample.

Ecosystem

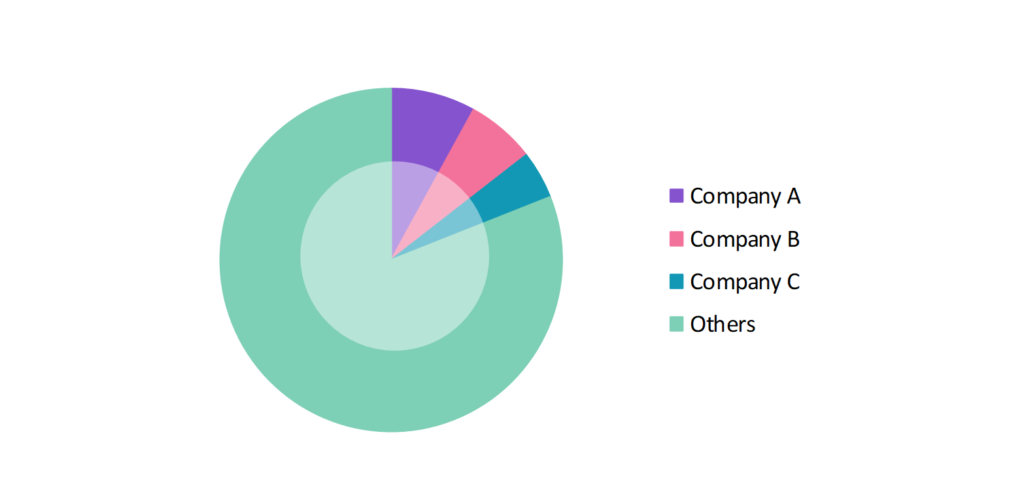

- The participants in the global ultrasound gel industry are always developing their strategies to preserve a competitive advantage.

- These companies focus on product innovation, brand differentiation, and strategic partnerships to gain a competitive edge.

- Several important entities in the ultrasound gel market include National Therapy Products Inc.; Parker Laboratories, Inc.; Sonotech GmbH; Ultragel Medical Kft.; Phyto Performance Italia Srl; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2018-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Market Size (2024) | USD 95.74 Bn |

| Market Size (2029) | USD 111.74 Bn |

| Growth Rate | 3.14% CAGR from 2024 to 2029 |

| Key Segments | Type (Sterile, Non-sterile); End User (Clinics, Hospitals, Diagnostic Centers, Others); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | National Therapy Products Inc.; Parker Laboratories, Inc.; Sonotech GmbH; Ultragel Medical Kft.; Phyto Performance Italia Srl |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; Colombia; Chile; China; India; Japan; South Korea; The UK; Germany; Italy; France; Spain; Turkey; UAE; Saudi Arabia; Egypt; South Africa |

| Largest Market | North America |

Get a free quote.

Trends

- Rise in Eco-friendly and Hypoallergenic Ultrasound Gels: The shift towards eco-friendly and hypoallergenic ultrasound gels is emphasized by increased awareness of skin sensitivity and environmental impact. Patients and healthcare providers favor gels made with natural, biodegradable ingredients to minimize irritation and reduce ecological harm.

- Technological Integration in Gel Formulation: Continuous advancements in ultrasound technology, such as 3D and 4D ultrasound imaging, require high-quality gels to ensure accurate imaging results. These technologies are being increasingly used in obstetrics, cardiology, and oncology. In 2022, GE Healthcare launched a new ultrasound system with enhanced imaging capabilities, which increased the demand for corresponding high-performance ultrasound gels.

- Increased Focus on Point-of-Care Ultrasound (POCUS): There is a significant shift towards Point-of-Care Ultrasound (POCUS), emphasizing its integration into everyday clinical practice. This trend reflects a growing emphasis on bedside imaging solutions, with POCUS becoming a key tool for immediate and accessible diagnostics in various healthcare environments.

Speak to analyst.

Catalysts

- Growing Demand for Diagnostic Imaging: The rising prevalence of chronic diseases such as cardiovascular conditions and cancer has significantly increased the demand for diagnostic imaging, including ultrasounds. As more patients require frequent and detailed imaging to monitor and manage these conditions, the volume of ultrasound procedures has surged.

- Rise in Prenatal Care Awareness: Growing awareness of prenatal care and the importance of regular ultrasound screenings during pregnancy is significantly influencing the demand for ultrasound gels. Expecting parents and healthcare providers are increasingly recognizing the value of frequent ultrasounds for monitoring fetal development and ensuring maternal health.

- Aging Population and Rising Healthcare Expenditure: The global aging population is driving the demand for ultrasound procedures, particularly for diagnosing age-related conditions. Additionally, increasing healthcare expenditure enables healthcare facilities to invest in advanced diagnostic tools and related supplies.

Inquire before buying.

Restraints

- Concerns over Contamination and Infection Risks: One of the significant challenges in the ultrasound gel market is the risk of contamination and subsequent infection. Reports of microbial contamination in ultrasound gels, particularly with bacteria like Burkholderia cepacia, have raised safety concerns. Such cases have led to product recalls and increased scrutiny from regulatory bodies. In 2021, several ultrasound gel products were recalled due to contamination, affecting the confidence of healthcare providers and patients.

- Regulatory Compliance and Stringent Standards: The ultrasound gel market faces challenges in meeting increasingly stringent regulatory standards. Manufacturers are required to adhere to guidelines from agencies like the FDA and EMA, ensuring that the gels are safe, sterile, and effective. Regulatory hurdles, including ensuring biocompatibility and avoiding the use of harmful chemicals, can increase production costs and complexity for manufacturers.

- Fluctuations in Raw Material Availability: A significant market challenge in the production of ultrasound gels is ensuring a steady supply of critical raw materials such as carbomers, thickeners, and preservatives. Fluctuations in the availability and cost of these components can impact the formulation’s consistency, quality, and overall performance of the gel, potentially leading to supply chain disruptions and increased production costs.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Ultrasound Gel Market (2018 – 2022) 2.2. Global Ultrasound Gel Market (2023 – 2029) 3. Market Segmentation 3.1. Global Ultrasound Gel Market by Type 3.1.1. Sterile 3.1.2. Non-sterile 3.2. Global Ultrasound Gel Market by End User 3.2.1. Clinics 3.2.2. Hospitals 3.2.3. Diagnostic Centers 3.2.4. Others 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Colombia 4.2.4. Chile 4.2.5. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Japan 4.3.4. South Korea 4.3.5. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. Italy 4.4.4. France 4.4.5. Spain 4.4.6. Rest of Europe 4.5. The Middle East 4.5.1. Turkey 4.5.2. UAE 4.5.3. Saudi Arabia 4.5.4. Rest of the Middle East 4.6. Africa 4.6.1. Egypt 4.6.2. South Africa 4.6.3. Rest of Africa 5. Value Chain Analysis of the Global Ultrasound Gel Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. National Therapy Products Inc. 9.2. Parker Laboratories, Inc. 9.3. Sonotech GmbH 9.4. Ultragel Medical Kft. 9.5. Phyto Performance Italia Srl 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Ultrasound Gel Market – FAQs

1. What is the current size of the ultrasound gel market?

Ans. In 2024, the ultrasound gel market size is USD 95.74 Bn.

2. Who are the major vendors in the ultrasound gel market?

Ans. The major vendors in the ultrasound gel market are National Therapy Products Inc.; Parker Laboratories, Inc.; Sonotech GmbH; Ultragel Medical Kft.; Phyto Performance Italia Srl.

3. Which segments are covered under the ultrasound gel market segments analysis?

Ans. The ultrasound gel market report offers in-depth insights into Type, End User, and Geography.