Military Laser Systems Market: Size, Share, Trends & Forecast (2024-2029)

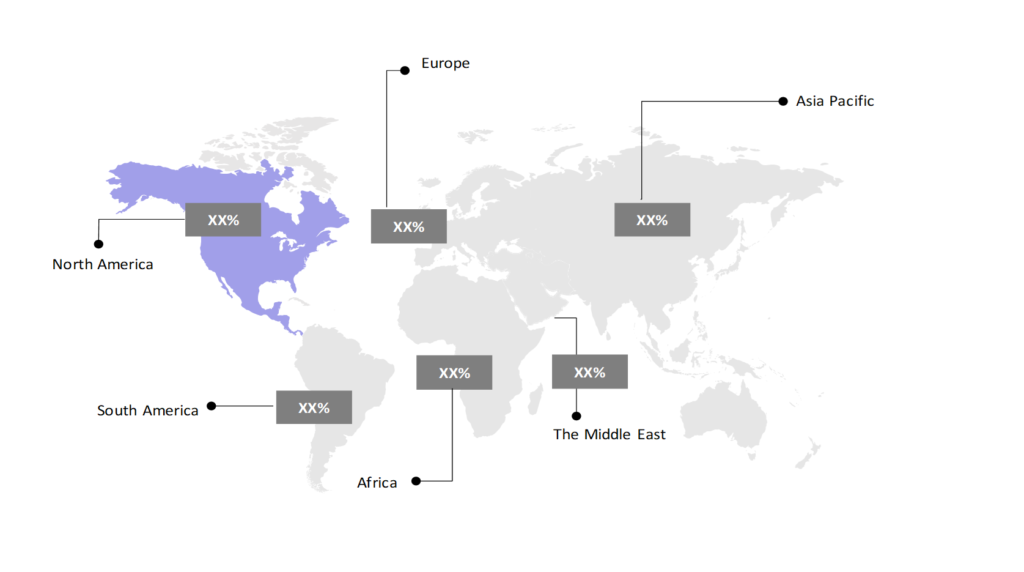

The market report offers a detailed analysis segmented by Technology (Solid-state Lasers, Gas Lasers, Others); by Application (Directed Energy Weapons, Guidance Systems, Laser Sights, Designators, and Rangefinders, Others); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

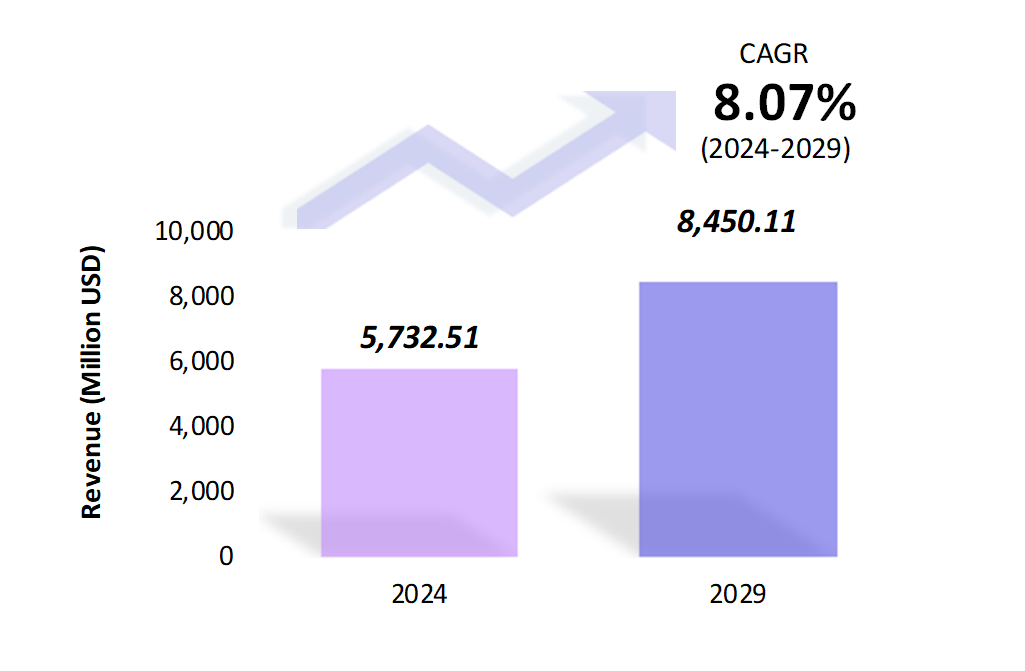

- The military laser systems market is estimated to be at USD 5,732.51 Mn in 2024 and is anticipated to reach USD 8,450.11 Mn in 2029.

- The military laser systems market is registering a CAGR of 8.07% during the forecast period 2024-2029.

- The global military laser systems market is witnessing significant growth, driven by the increasing adoption of directed-energy weapons and the growing demand for advanced defense technologies.

Request a free sample.

Ecosystem

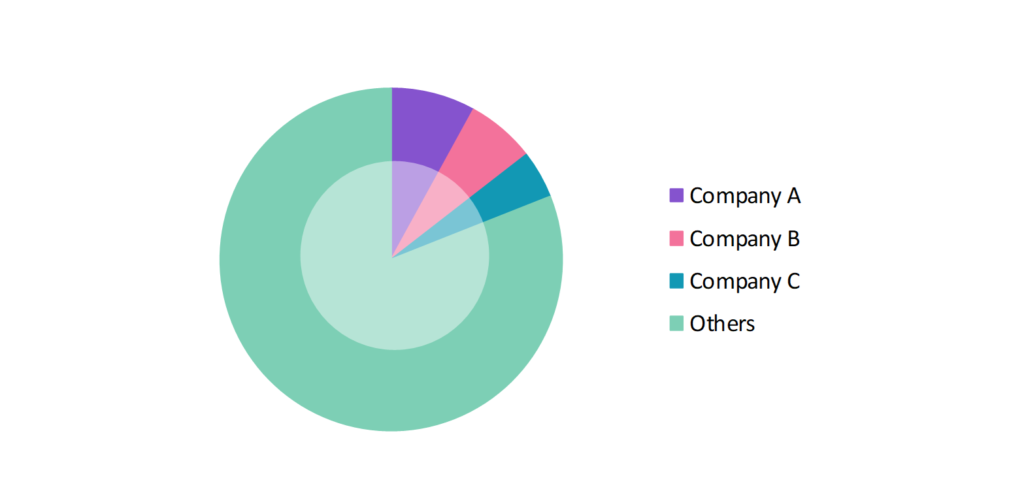

- The global military laser systems industry participants are always developing strategies to preserve a competitive advantage.

- These companies focus on offering a wide range of products, next-generation laser systems, advances in directed energy weapons, laser-based counter-drone systems, and innovations in laser-based communication and targeting systems.

- Several important entities in the military laser systems market include Lockheed Martin Corp.; Northrop Grumman Corp.; The Boeing Co.; RTX Corp.; Rafael Advanced Defense Systems Ltd.; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2018-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Market Size (2024) | USD 5,732.51 Mn |

| Market Size (2029) | USD 8,450.11 Mn |

| Growth Rate | 8.07% CAGR from 2024 to 2029 |

| Key Segments | Technology (Solid-state Lasers, Gas Lasers, Others); Application (Directed Energy Weapons, Guidance Systems, Laser Sights, Designators, and Rangefinders, Others); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | Lockheed Martin Corp.; Northrop Grumman Corp.; The Boeing Co.; RTX Corp.; Rafael Advanced Defense Systems Ltd. |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; Colombia; Chile; China; India; Japan; South Korea; The UK; Germany; Italy; France; Spain; Turkey; UAE; Saudi Arabia; Egypt; South Africa |

| Largest Market | North America |

Get a free quote.

Trends

- Adoption of High-Energy Laser Weapons: Defense forces are increasingly adopting high-energy laser (HEL) systems as non-lethal weapons to neutralize threats like drones and missiles. In 2023, the U.S. Navy successfully deployed its HELIOS system onboard the USS Preble, demonstrating the increasing role of laser systems in naval defense.

- Advancement in Laser Communication Systems: Laser-based communication systems for military satellites are emerging as a significant trend, providing superior data transfer rates and heightened security. These systems leverage advanced laser technology to deliver high-bandwidth, low-latency communication, offering a more secure alternative to traditional radio frequency methods. This trend underscores the shift towards more sophisticated and secure communication solutions in military satellite networks.

- Rising Focus on Laser-based Counter-Drone Systems: The increasing threat posed by small, unmanned aerial vehicles (UAVs) has led to the development of laser-based counter-drone systems. In 2023, Israel’s Rafael Advanced Defense Systems deployed its “Drone Dome” laser system, capable of neutralizing multiple drones simultaneously in real-time battlefield conditions.

Speak to analyst.

Catalysts

- Growing Demand for Directed Energy Weapons: The rising threat of missiles, drones, and hypersonic weapons drives defense forces to invest in directed energy weapons, including advanced laser systems. These technologies provide precision targeting and rapid response, which are crucial for countering evolving threats and enhancing military readiness.

- Government Investment: Government investment in the aircraft door market has been pivotal in advancing safety and technology. Governments aim to improve door systems’ durability, efficiency, and emergency evacuation capabilities by funding research and development initiatives. These investments support industry growth, foster innovation, and enhance aviation safety standards.

- Modernization of Military Forces: Countries worldwide are focused on modernizing their military capabilities by adopting advanced technologies, including military laser systems. In 2023, the UK government invested heavily in laser weapon technology under its defense modernization program, which aimed to enhance national security and combat capabilities.

Inquire before buying.

Restraints

- High Development and Production Costs: Developing advanced military laser systems requires significant research, testing, and production investment, which can constrain widespread adoption. High costs and complex development processes are significant barriers despite their potential to enhance defense capabilities. These factors limit deployment to select defense programs and high-priority applications.

- Challenges in Power Generation and Cooling: Military laser systems, especially high-energy laser weapons, require significant power generation and efficient cooling systems, which are challenging to implement in combat environments. In 2023, defense manufacturers like Lockheed Martin highlighted the technical challenges of maintaining consistent power output in extreme field conditions.

- Challenges in Integrating Military Laser Systems with Various Platforms: Integrating military laser systems with various platforms presents challenges such as ensuring compatibility across diverse technologies, managing the weight and power requirements of the lasers, and addressing the complexity of targeting and control systems. Additionally, the need for robust security measures to protect sensitive technology adds to the integration difficulties.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Military Laser Systems Market (2018 – 2022) 2.2. Global Military Laser Systems Market (2023 – 2029) 3. Market Segmentation 3.1. Global Military Laser Systems Market by Technology 3.1.1. Solid-state Lasers 3.1.2. Gas Lasers 3.1.3. Others 3.2. Global Military Laser Systems Market by Application 3.2.1. Directed Energy Weapons 3.2.2. Guidance Systems 3.2.3. Laser Sights, Designators, and Rangefinders 3.2.4. Others 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Colombia 4.2.4. Chile 4.2.5. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Japan 4.3.4. South Korea 4.3.5. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. Italy 4.4.4. France 4.4.5. Spain 4.4.6. Rest of Europe 4.5. The Middle East 4.5.1. Turkey 4.5.2. UAE 4.5.3. Saudi Arabia 4.5.4. Rest of the Middle East 4.6. Africa 4.6.1. Egypt 4.6.2. South Africa 4.6.3. Rest of Africa 5. Value Chain Analysis of the Global Military Laser Systems Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. Lockheed Martin Corp. 9.2. Northrop Grumman Corp. 9.3. The Boeing Co. 9.4. RTX Corp. 9.5. Rafael Advanced Defense Systems Ltd. 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Military Laser Systems Market – FAQs

1. What is the current size of the military laser systems market?

Ans. In 2024, the military laser systems market size is USD 5,732.51 Mn.

2. Who are the major vendors in the military laser systems market?

Ans. The major vendors in the military laser systems market are Lockheed Martin Corp.; Northrop Grumman Corp.; The Boeing Co.; RTX Corp.; Rafael Advanced Defense Systems Ltd.

3. Which segments are covered under the military laser systems market segments analysis?

Ans. The military laser systems market report offers in-depth insights into Technology, Application, and Geography.