Mobile Pet Care Market Outlook: Size, Share, Trends & Growth Analysis (2024-2029)

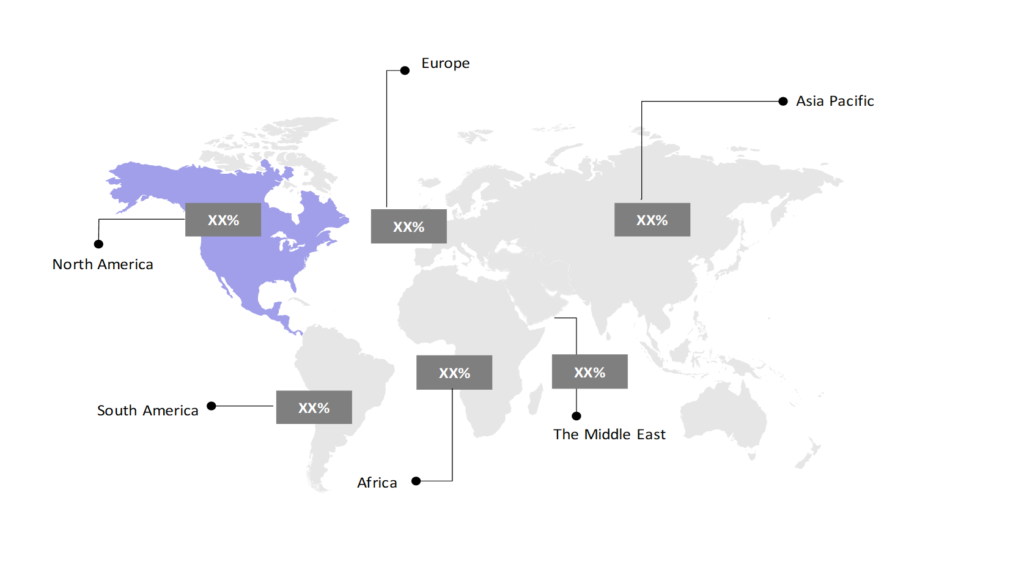

The market report presents a thorough analysis segmented by Services (Grooming, Veterinary, Others); by Animals (Dogs, Cats, Others); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

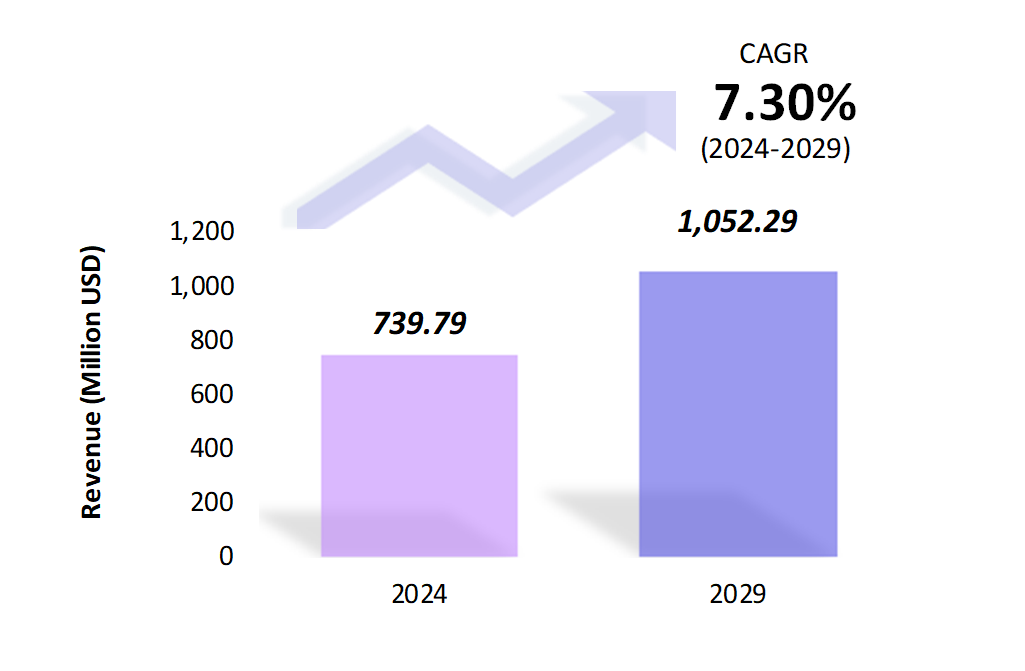

- The mobile pet care market is estimated to be at USD 739.79 Mn in 2024 and is anticipated to reach USD 1,052.29 Mn in 2029.

- The mobile pet care market is registering a CAGR of 7.3% during the forecast period 2024-2029.

- The mobile pet care market has been experiencing substantial growth, driven by increased pet ownership and the demand for convenient, personalized care. With a shift toward convenience, pet owners are increasingly opting for mobile pet care services that offer grooming, veterinary care, and other pet-related services directly at their homes.

Request a free sample.

Ecosystem

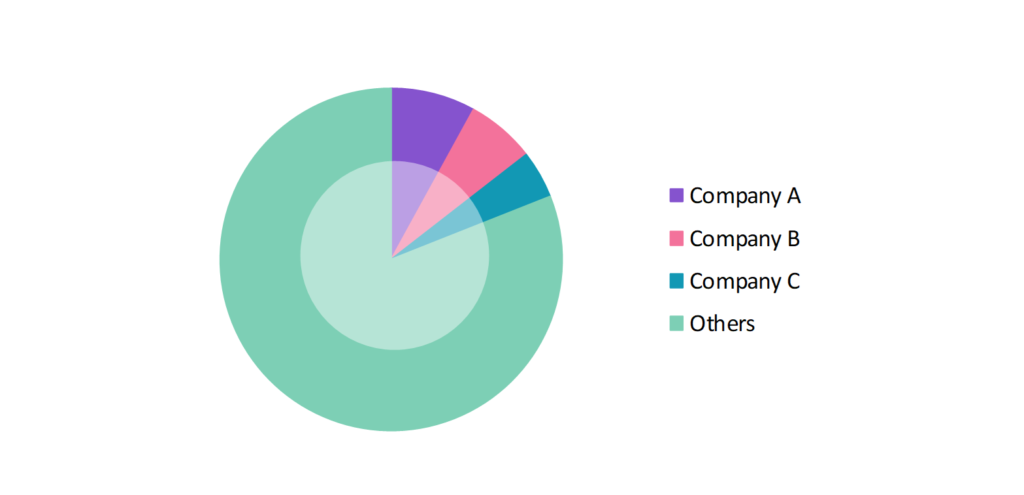

- The participants in the global mobile pet care industry dominate the market with their advanced mobile units and wide range of services tailored to pet owners’ needs.

- These companies primarily focus on service diversification, along with partnering with pet product brands and veterinary clinics to expand their service offerings and maintain a competitive edge in the market.

- Several important entities in the mobile pet care market include Aussie Mobile Vet Pty. Ltd.; Dial a Dog Wash Ltd.; 4 Paws Mobile Spa Ltd.; Mobile Vet to Pet, LLC; PetSmart LLC; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2018-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Market Size (2024) | USD 739.79 Mn |

| Market Size (2029) | USD 1,052.29 Mn |

| Growth Rate | 7.3% CAGR from 2024 to 2029 |

| Key Segments | Services (Grooming, Veterinary, Others); Animals (Dogs, Cats, Others); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | Aussie Mobile Vet Pty. Ltd.; Dial a Dog Wash Ltd.; 4 Paws Mobile Spa Ltd.; Mobile Vet to Pet, LLC; PetSmart LLC |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; Colombia; Chile; China; India; Japan; South Korea; The UK; Germany; Italy; France; Spain; Turkey; UAE; Saudi Arabia; Egypt; South Africa |

| Largest Market | North America |

Get a free quote.

Trends

- Sustainability Initiatives: A growing number of mobile pet care businesses are adopting eco-friendly practices, such as using biodegradable grooming products. In 2023, EcoPet Mobile Care launched a range of sustainable pet grooming services, ensuring zero plastic usage, which resonated with environmentally conscious pet owners.

- PetTech Integration: The use of pet tech is becoming more common in mobile pet care as it helps pet owners keep track of their pets’ health and monitor their behavior to help detect any abnormality. For instance, in 2023, Waggle Me introduced a pet monitoring system as part of its mobile veterinary services, allowing pet owners to track their pets’ health and behavior in real-time using smartphone apps.

- Customized Pet Nutrition Services: Mobile pet care services have begun offering personalized nutrition plans, allowing pet owners to select personalized diets that are suited for their pets. In 2023, HealthyPets on Wheels introduced a service that creates custom meal plans for pets based on their age, breed, and health conditions, delivered right to customers’ doorsteps.

Speak to analyst.

Catalysts

- Busy Lifestyles of Pet Owners: The demand for mobile pet care is driven by the busy schedules of pet owners who find it challenging to visit traditional pet care facilities. In 2023, Petco launched a fleet of mobile pet care vans in the U.S. to cater to this growing need for convenience, leading to the widespread adoption of mobile services.

- Emergence of Subscription-Based Mobile Services: Subscription models are becoming popular in the mobile pet care sector, offering pet owners regular care packages with discounted grooming, veterinary check-ups, and wellness services. In 2023, Waggle Mobile Care introduced a subscription service that grew by 25% within its first six months, showing how this model can attract loyal, long-term customers, further driving market expansion.

- Rising Disposable Income: The rise in disposable income in developing markets is driving the growth of the mobile pet care industry. In 2023, DogGone Mobile, a pet care provider in India, expanded its operations into tier 2 and tier 3 cities, responding to the increasing willingness of pet owners to invest in premium pet care.

Inquire before buying.

Restraints

- Logistical Challenges: One of the major challenges in the mobile pet care market is logistical complexity, especially in dense urban areas. In 2023, Purrfectly Pampered Pets, a mobile pet care service in London, faced delays due to traffic congestion, affecting its ability to maintain appointment schedules.

- High Operating Costs: The cost of maintaining a fleet of mobile units, equipment, and trained professionals can be prohibitive for smaller businesses. In 2023, Happy Tails Mobile Pet Spa reported that rising fuel prices and increased equipment maintenance costs led to higher service prices, which reduced affordability for some pet owners.

- Regulatory Compliance: Meeting local and national regulatory standards for mobile pet care services can be a challenge. In 2023, PawPal, a mobile grooming service in Australia, had to pause operations temporarily to comply with new government regulations related to pet welfare and mobile grooming vehicle sanitation.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Mobile Pet Care Market (2018 – 2022) 2.2. Global Mobile Pet Care Market (2023 – 2029) 3. Market Segmentation 3.1. Global Mobile Pet Care Market by Services 3.1.1. Grooming 3.1.2. Veterinary 3.1.3. Others 3.2. Global Mobile Pet Care Market by Animals 3.2.1. Dogs 3.2.2. Cats 3.2.3. Others 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Colombia 4.2.4. Chile 4.2.5. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Japan 4.3.4. South Korea 4.3.5. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. Italy 4.4.4. France 4.4.5. Spain 4.4.6. Rest of Europe 4.5. The Middle East 4.5.1. Turkey 4.5.2. UAE 4.5.3. Saudi Arabia 4.5.4. Rest of the Middle East 4.6. Africa 4.6.1. Egypt 4.6.2. South Africa 4.6.3. Rest of Africa 5. Value Chain Analysis of the Global Mobile Pet Care Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. Aussie Mobile Vet Pty. Ltd. 9.2. Dial a Dog Wash Ltd. 9.3. 4 Paws Mobile Spa Ltd. 9.4. Mobile Vet to Pet, LLC 9.5. PetSmart LLC 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Mobile Pet Care Market – FAQs

1. What is the current size of the mobile pet care market?

Ans. In 2024, the mobile pet care market size is USD 739.79 Mn.

2. Who are the major vendors in the mobile pet care market?

Ans. The major vendors in the mobile pet care market are Aussie Mobile Vet Pty. Ltd.; Dial a Dog Wash Ltd.; 4 Paws Mobile Spa Ltd.; Mobile Vet to Pet, LLC; PetSmart LLC.

3. Which segments are covered under the mobile pet care market segments analysis?

Ans. The mobile pet care market report offers in-depth insights into Services, Animals, and Geography.