Military Generator Market Insights: Size, Share, Growth Analysis & Forecast (2024-2029)

The market report provided a comprehensive analysis segmented by Type (DC Generator, AC Generator); by Application (Communication System, Air Defense System, Field Hospitals, Field Camps and Accommodation, Lighting, Military Vehicles); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

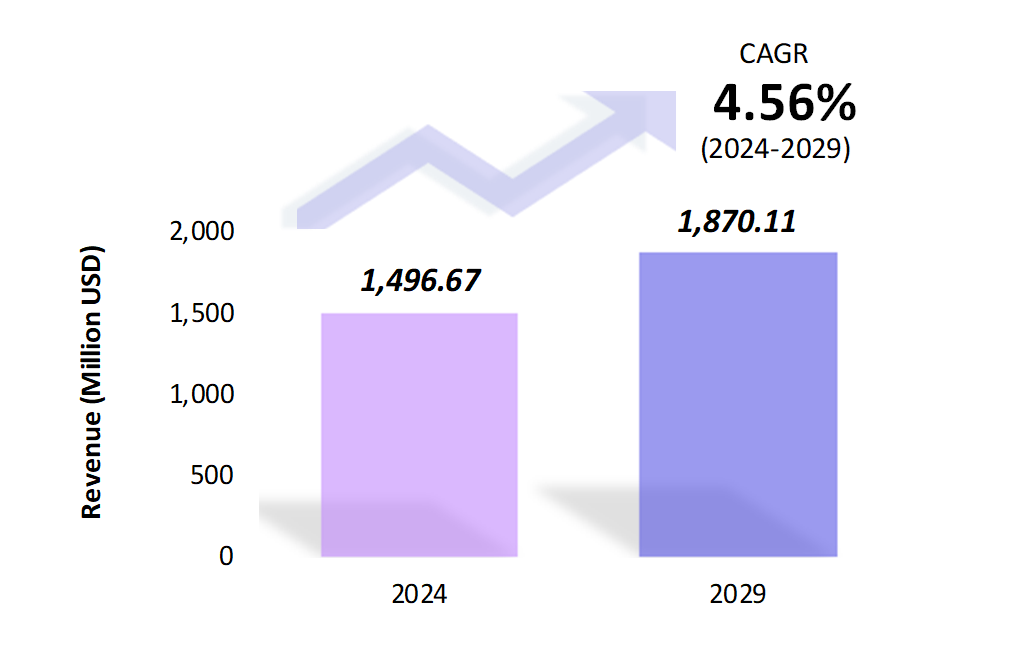

- The military generator market is estimated to be at USD 1,496.67 Mn in 2024 and is anticipated to reach USD 1,870.11 Mn in 2029.

- The military generator market is registering a CAGR of 4.56% during the forecast period 2024-2029.

- The global military generator market is growing steadily, driven by increasing defense expenditures and demand for reliable power sources in military operations. Adopting more efficient, portable, and eco-friendly generators is becoming a priority for defense organizations globally.

Request a free sample.

Ecosystem

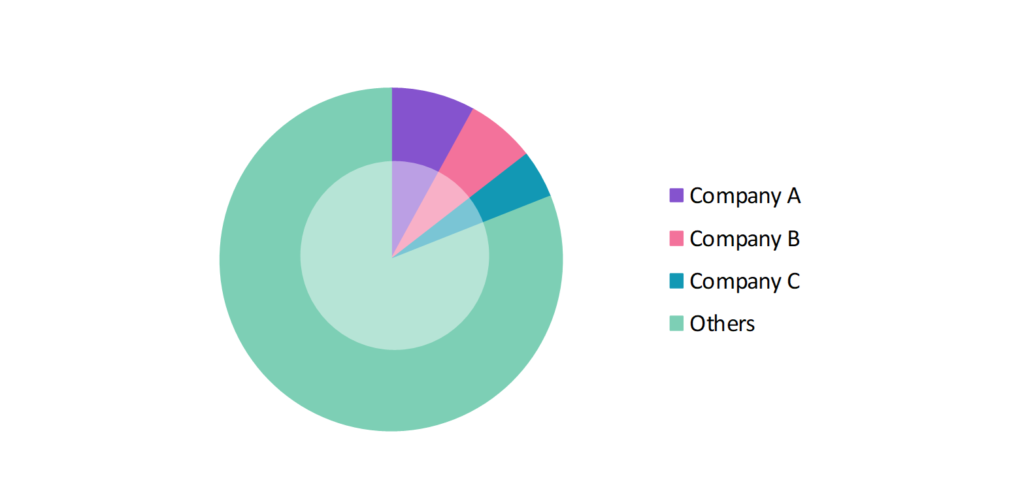

- The global military generator industry participants continually develop strategies to preserve a competitive advantage.

- These companies drive innovation by introducing hybrid, portable, and silent generator systems.

- Several important entities in the military generator market include Kohler Co.; Cummins Inc.; Rolls-Royce Holdings Plc; Leonardo DRS, Inc.; Caterpillar Inc.; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2018-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Market Size (2024) | USD 1,496.67 Mn |

| Market Size (2029) | USD 1,870.11 Mn |

| Growth Rate | 4.56% CAGR from 2024 to 2029 |

| Key Segments | Type (DC Generator, AC Generator); Application (Communication System, Air Defense System, Field Hospitals, Field Camps and Accommodation, Lighting, Military Vehicles); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | Kohler Co.; Cummins Inc.; Rolls-Royce Holdings Plc; Leonardo DRS, Inc.; Caterpillar Inc. |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; Colombia; Chile; China; India; Japan; South Korea; The UK; Germany; Italy; France; Spain; Turkey; UAE; Saudi Arabia; Egypt; South Africa |

| Largest Market | North America |

Get a free quote.

Trends

- Shift Toward Hybrid Generators: Hybrid military generators, blending conventional fuel with renewable sources like solar power, are popular for reducing fuel consumption and emissions. They offer improved efficiency, lower environmental impact, and enhanced remote or off-grid operations reliability.

- Miniaturization and Portability: The demand for smaller, portable generators is rising as military units require more agile and mobile power solutions. In 2023, Cummins launched a new line of compact generators specifically designed for use in military operations, providing high power output while maintaining mobility.

- Remote Monitoring and Automated Controls: Military generators are increasingly equipped with smart technologies, such as remote monitoring and automated controls, which improve efficiency and operational reliability. In 2023, military forces in Europe started integrating IoT-enabled generators for real-time tracking and predictive maintenance, reducing the risk of downtime.

Speak to analyst.

Catalysts

- Growing Global Defense Expenditure: Rising defense budgets in regions such as North America, Asia-Pacific, and the Middle East fuel the demand for advanced military generators. As military forces invest in modernizing their equipment and ensuring reliable power supply for operations, the need for sophisticated and durable generators is becoming increasingly critical.

- Need for Reliable Power in Remote Locations: Military operations in remote and harsh environments require reliable power sources to support mission-critical equipment. In 2023, the U.S. Army deployed advanced military generators in its African and Middle Eastern operations, where grid access was limited or nonexistent.

- Increasing Use of UAVs and Surveillance Systems: The growing use of drones, radar, and surveillance equipment in modern warfare drives the need for reliable energy sources. In 2022, the demand for generators surged as the U.S. Air Force expanded its drone operations in the Middle East, requiring uninterrupted power for radar and control systems.

Inquire before buying.

Restraints

- High Initial Costs of Advanced Generators: The development and acquisition of advanced military generators, particularly hybrid and smart systems, involve substantial upfront costs. These investments reflect such systems’ high technological complexity and advanced features, essential for ensuring reliable and efficient power in critical defense operations.

- Complex Maintenance and Support Requirements: Military generators, particularly those equipped with advanced technologies, demand highly specialized maintenance and support systems to ensure optimal performance and reliability. This includes regular inspections, calibration, and repairs performed by trained personnel using sophisticated diagnostic tools.

- Supply Chain Disruptions: The global supply chain disruptions caused by geopolitical tensions have impacted the production and delivery of military generators. In 2022, manufacturers like Caterpillar faced delays in fulfilling military contracts due to semiconductor shortages and raw material constraints.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Military Generator Market (2018 – 2022) 2.2. Global Military Generator Market (2023 – 2029) 3. Market Segmentation 3.1. Global Military Generator Market by Type 3.1.1. DC Generator 3.1.2. AC Generator 3.2. Global Military Generator Market by Application 3.2.1. Communication System 3.2.2. Air Defense System 3.2.3. Field Hospitals 3.2.4. Field Camps and Accommodation 3.2.5. Lighting 3.2.6. Military Vehicles 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Colombia 4.2.4. Chile 4.2.5. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Japan 4.3.4. South Korea 4.3.5. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. Italy 4.4.4. France 4.4.5. Spain 4.4.6. Rest of Europe 4.5. The Middle East 4.5.1. Turkey 4.5.2. UAE 4.5.3. Saudi Arabia 4.5.4. Rest of the Middle East 4.6. Africa 4.6.1. Egypt 4.6.2. South Africa 4.6.3. Rest of Africa 5. Value Chain Analysis of the Global Military Generator Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. Kohler Co. 9.2. Cummins Inc. 9.3. Rolls-Royce Holdings Plc 9.4. Leonardo DRS, Inc. 9.5. Caterpillar Inc. 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Military Generator Market – FAQs

1. What is the current size of the military generator market?

Ans. In 2024, the military generator market size is USD 1,496.67 Mn.

2. Who are the major vendors in the military generator market?

Ans. The major vendors in the military generator market are Kohler Co.; Cummins Inc.; Rolls-Royce Holdings Plc; Leonardo DRS, Inc.; Caterpillar Inc.

3. Which segments are covered under the military generator market segments analysis?

Ans. The military generator market report offers in-depth insights into Type, Application, and Geography.