Aerospace Plastics Market: Size, Share, Trends & Forecast (2024-2029)

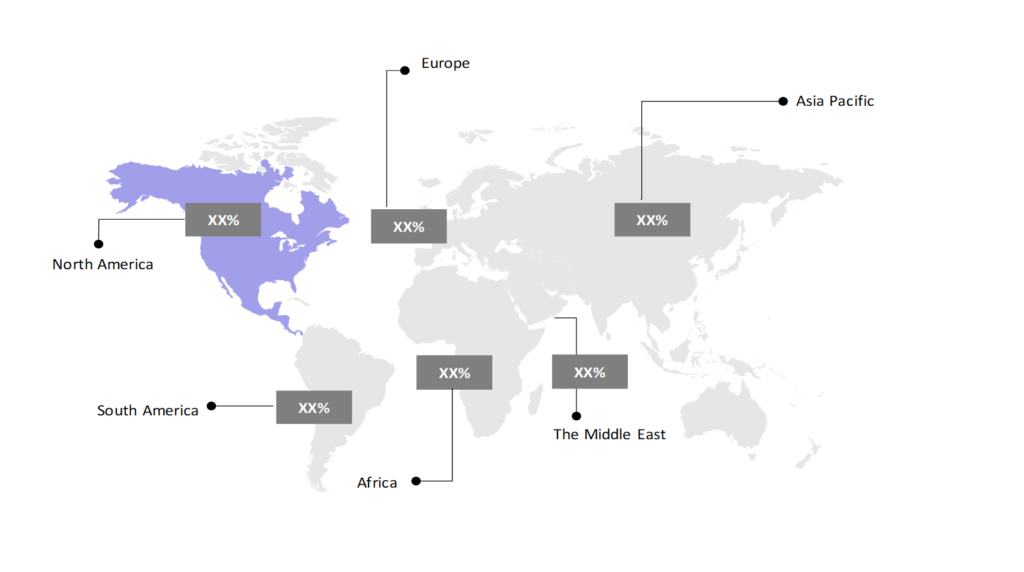

The market report offers a detailed analysis segmented by Application (Aerostructure, Cabin Interiors, Propulsion Systems, Satellites); by End User (Aviation, Space); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

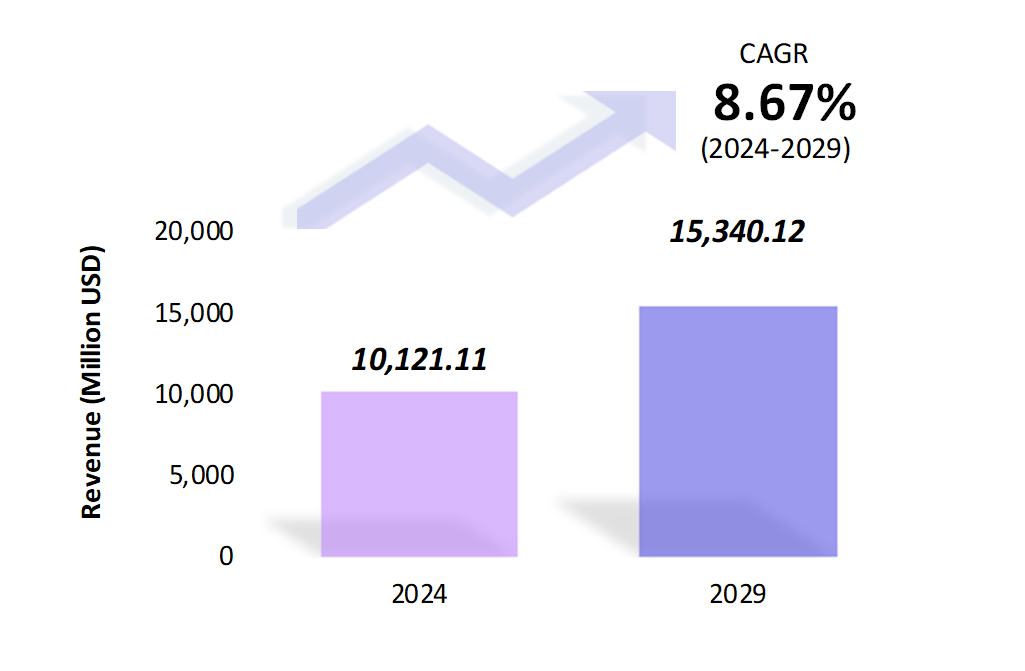

- The aerospace plastics market is estimated to be at USD 10,121.11 Mn in 2024 and is anticipated to reach USD 15,340.12 Mn in 2029.

- The aerospace plastics market is registering a CAGR of 8.67% during the forecast period 2024-2029.

- The global aerospace plastics market is growing steadily, driven by the increasing demand for lightweight, durable, and fuel-efficient aircraft. Aerospace plastics are primarily used to manufacture aircraft components such as airframes, cabin interiors, and propulsion systems.

Request a free sample.

Ecosystem

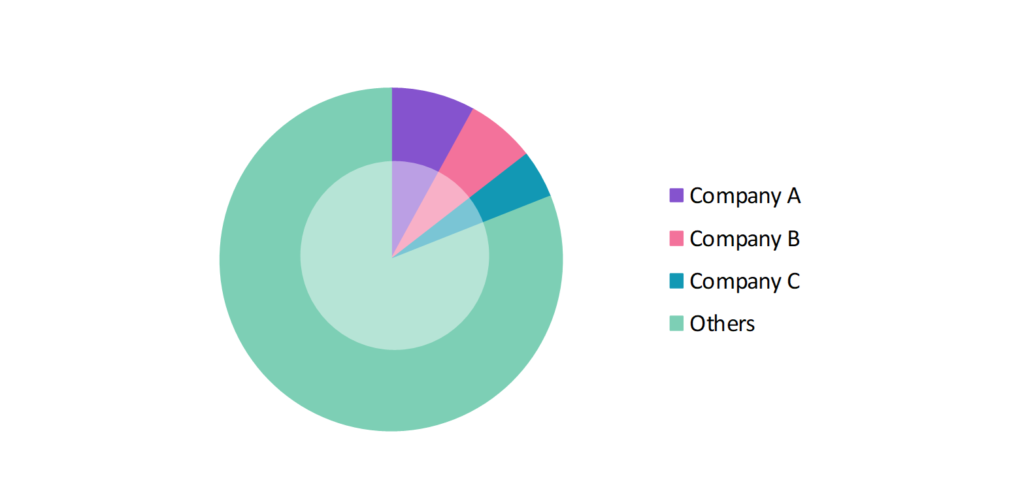

- The global aerospace plastics industry participants constantly develop strategies to preserve a competitive advantage.

- These companies focus on innovation, particularly in sustainable and advanced plastic materials, research & documents, and technological launches to meet the evolving demands of the aerospace industry.

- Several important entities in the aerospace plastics market include Paco Plastics & Engineering Inc.; Performance Plastics Products 3P; Loar Holdings Inc.; Ensinger GmbH; Toray Industries, Inc.; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2018-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Market Size (2024) | USD 10,121.11 Mn |

| Market Size (2029) | USD 15,340.12 Mn |

| Growth Rate | 8.67% CAGR from 2024 to 2029 |

| Key Segments | Application (Aerostructure, Cabin Interiors, Propulsion Systems, Satellites); End User (Aviation, Space); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | Paco Plastics & Engineering Inc.; Performance Plastics Products 3P; Loar Holdings Inc.; Ensinger GmbH; Toray Industries, Inc. |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; Colombia; Chile; China; India; Japan; South Korea; The UK; Germany; Italy; France; Spain; Turkey; UAE; Saudi Arabia; Egypt; South Africa |

| Largest Market | North America |

Get a free quote.

Trends

- Emergence of Composite Plastics in Aircraft Manufacturing: The trend toward using advanced composite plastics, such as carbon fiber-reinforced polymers (CFRP), is enhancing. These materials offer superior strength-to-weight ratios, improving fuel efficiency. For instance, in 2023, Airbus incorporated CFRP into the wings and fuselage of the A350 XWB, reducing its overall weight.

- Use of 3D-Printed Plastic Components: 3D printing to create customized plastic components for aircraft is rising. This trend allows manufacturers to produce complex geometries with minimal material waste. In 2023, GE Aviation used 3D-printed plastic parts for its LEAP engine, improving production efficiency and reducing lead times.

- Development of Sustainable Plastics: The aerospace industry focuses on eco-friendly materials as part of sustainability initiatives. In 2022, Boeing announced its plan to integrate bio-based plastics into its commercial aircraft interiors to reduce the environmental impact. These sustainable plastics aim to meet stringent regulatory, and customer demands for eco-friendly solutions.

Speak to analyst.

Catalysts

- Growth of Low-Cost Carriers (LCCs) Driving Plastic Usage: The increasing number of low-cost carriers (LCCs) worldwide boosts demand for lightweight, cost-effective plastics in aircraft interiors. LCCs are prioritizing lightweight materials to maximize fuel savings and reduce operational costs. This growth drives innovation in plastic composites, aiming to deliver performance and affordability.

- Growth in Aircraft Production: The rising commercial and defense aircraft production is a significant driver for the aerospace plastics market. These materials are crucial for weight reduction, fuel efficiency, and enhanced performance. Aerospace plastics are increasingly used for interior panels, structural parts, and thermal protection, supporting modern aircraft’s innovation and operational demands.

- Increased Focus on Sustainable Aviation: As airlines strive for carbon-neutral operations, adopting recyclable and bio-based aerospace plastics is accelerating. These sustainable materials help reduce aircraft’s environmental impact by minimizing waste and reliance on fossil fuels. The push for greener alternatives aligns with industry goals for reducing carbon emissions and meeting stringent environmental regulations, driving innovation and investment in eco-friendly aerospace plastics.

Inquire before buying.

Restraints

- High Cost of Advanced Plastic Materials: The cost of advanced plastic composites, like carbon fiber-reinforced polymer (CFRP), remains high primarily due to the expensive raw materials and complex manufacturing processes involved. These composites require sophisticated equipment and labor-intensive production techniques, which contribute to their elevated price.

- Complex Manufacturing Processes: The production of aerospace-grade plastics involves complex, high-precision processes and strict safety standards, necessitating rigorous quality control. Advances in technology and material science are working to improve efficiency and reduce costs.

- Stringent Environmental Regulations: The aerospace industry faces increasing pressure to comply with environmental regulations regarding plastic waste and emissions. In 2023, the European Union introduced stricter guidelines on the use of single-use plastics in aircraft interiors, forcing manufacturers to shift toward recyclable alternatives.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Aerospace Plastics Market (2018 – 2022) 2.2. Global Aerospace Plastics Market (2023 – 2029) 3. Market Segmentation 3.1. Global Aerospace Plastics Market by Application 3.1.1. Aerostructure 3.1.2. Cabin Interiors 3.1.3. Propulsion Systems 3.1.4. Satellites 3.2. Global Aerospace Plastics Market by End User 3.2.1. Aviation 3.2.2. Space 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Colombia 4.2.4. Chile 4.2.5. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Japan 4.3.4. South Korea 4.3.5. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. Italy 4.4.4. France 4.4.5. Spain 4.4.6. Rest of Europe 4.5. The Middle East 4.5.1. Turkey 4.5.2. UAE 4.5.3. Saudi Arabia 4.5.4. Rest of the Middle East 4.6. Africa 4.6.1. Egypt 4.6.2. South Africa 4.6.3. Rest of Africa 5. Value Chain Analysis of the Global Aerospace Plastics Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. Paco Plastics & Engineering Inc. 9.2. Performance Plastics Products 3P 9.3. Loar Holdings Inc. 9.4. Ensinger GmbH 9.5. Toray Industries, Inc. 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Aerospace Plastics Market – FAQs

1. What is the current size of the aerospace plastics market?

Ans. In 2024, the aerospace plastics market size is USD 10,121.11 Mn.

2. Who are the major vendors in the aerospace plastics market?

Ans. The major vendors in the aerospace plastics market are Paco Plastics & Engineering Inc.; Performance Plastics Products 3P; Loar Holdings Inc.; Ensinger GmbH; Toray Industries, Inc.

3. Which segments are covered under the aerospace plastics market segments analysis?

Ans. The aerospace plastics market report offers in-depth insights into Application, End User, and Geography.