Military Robots & Autonomous Vehicles Market: Size, Share, Trends & Forecast (2024-2029)

The research offers a detailed analysis separated by kind (Military Robots, Autonomous Aerial Vehicles (UAVs), Autonomous Ground Vehicles (UGVs), autonomous underwater vehicles (UUVs), and autonomous surface vehicles (USVs). Technology (Fully Autonomous, Semi-Autonomous, remotely Controlled, and human-orated), Application (Defense, Military, Scientific Research, Commercial, Others), Geography (North America, South America, Asia Pacific, Europe, and the Middle East)

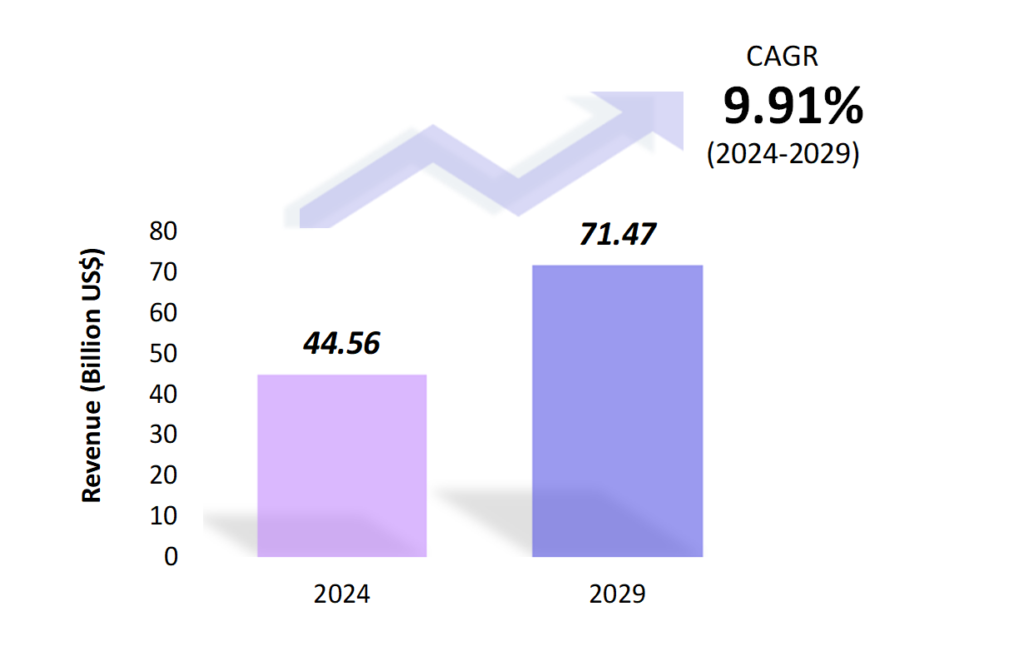

Military Robots and Autonomous Vehicles Market Snapshot

Military Robots and Autonomous Vehicles Market Overview

The global market for military robots and autonomous vehicles is expected to be $44.56 billion (about $140 per person in the US) in 2024, rising to $71.47 billion (about $220 per person in the US) by 2029. The global market for military robots and autonomous vehicles is expected to grow at a CAGR of 9.91% between 2024 and 2029. Military robots and autonomous vehicles are mechanical systems operated by humans or automated to conduct intelligence, surveillance, and reconnaissance operations on land, water, and air.

Governments in both emerging and developed countries are making significant efforts to improve their existing security systems. There are ongoing initiatives to provide improved security systems to air, sea, and land troops, including wheeled, tracked, and legged robots, wearable robots, remotely operated underwater vehicles, and autonomous combat aerial vehicles. Other factors, such as rising defense sector spending and the implementation of major military modernization plans, are projected to propel the market in the coming years. These robotic devices play a crucial role in current military operations, including surveillance, search, and rescue missions.

Another important growth driver is the rapid advancement of robots and automation technologies. For example, the use of AI has enabled the creation of military robots with greater surveillance, targeting, and information-gathering capacities.

Military Robots and Autonomous Vehicles Market Coverage

| Historical & Forecast Period | 2018-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units | Billion US$ |

| Segments | Type, Technology, Application |

| Geographies | North America, South America, Asia Pacific, Europe & Middle East, Africa |

| Key Vendors | Northrop Grumman Corp., Lockheed Martin Corp., QinetiQ, Elbit Systems Ltd., Thales Group |

Key Geographies of Military Robots and Autonomous Vehicles Market, 2023

Porter’s Five Forces Analysis of the Military Robots and Autonomous Vehicles Market

Military Robots and Autonomous Vehicles Market Trends

Autonomous system advancements have ushered in a new era of defensive methods and tactics. These technologies, ranging from autonomous drones to ground-based robotic warriors, are changing the way armed forces operate and safeguard nations. For example, military robotics have significantly improved surveillance and reconnaissance capabilities. For instance, in February 2024, ST Engineering unveiled Taurus at the Singapore Air Show 2024, a versatile autonomous ground vehicle outfitted with a multirotor drone for enhanced surveillance capabilities. Taurus excels at traversing rough terrain where conventional military vehicles fail, from logistical support to critical missions like casualty evacuation. Its versatility is further boosted by optional components like a robotic arm for more effective material handling. Furthermore, autonomous aerial vehicles (UAVs) or drones equipped with high-resolution cameras and sensors can gather valuable intelligence while posing fewer threats to human operators. These technologies deliver real-time data and images, enhancing situational awareness and facilitating strategic decision-making.

The incorporation of innovative technologies such as artificial intelligence (AI), machine learning (ML), and computer vision in military robots is projected to drive market expansion in the coming years. These technologies can improve the capabilities of military robots, making them more effective at missions such as reconnaissance, surveillance, and targeting. Artificial intelligence (AI) and machine learning algorithms can be used to analyze data from military robot sensors and cameras, allowing them to identify and track targets more accurately and quickly. This can reduce the risk of human error while also enhancing soldiers’ situational awareness on the ground.

Military Robots and Autonomous Vehicles Market Driving Factors

The global market for military robots and autonomous vehicles is expected to expand due to increased global defense spending. This increase is being driven by rising demand for military robots and autonomous vehicles in hazardous and complex scenarios, and manufacturers are expected to upgrade their payload and propulsion systems to boost operational capabilities and save development time.

For example, in December 2023, US President Joe Biden approved an annual $886 billion (about $2,700 per person in the US) defense bill that included measures to oppose Chinese military operations in the Indo-Pacific area and support Taiwanese soldiers. In March 2024, China raised its defense budget by 7.2% to address global imbalances and regional tensions. China declared a 7.2% increase in its defense budget, which is already the world’s second largest after the United States at 1.6 trillion yuan ($222 billion (approximately $680 per person in the US)), reflecting last year’s increase. Therefore, the sanctioned yearly defense spending of nations has a significant impact on the market.

Military Robots and Autonomous Vehicles Market Challenges

As military systems become more interconnected and reliant on digital technologies, concerns about cybersecurity risks mount. Hackers and opponents could target unmanned systems to disrupt military operations. Ensuring the security of these systems is a top priority.

Military robotics have ushered in a new era of combat and defense capabilities. These unmanned technologies have altered the course of military operations, from improved surveillance and targeted strikes to logistics support and disaster relief. However, in addition to their clear benefits, they raise ethical, legal, and security concerns that must be addressed. As the field of military robotics evolves, nations must adopt appropriate rules to ensure that these technologies are implemented in accordance with international laws and ethical standards.

Military Robots and Autonomous Vehicles Market – Key Industry News

- The next iteration of EvoLogics’ Quadroin Autonomous Underwater Vehicle (AUV) was introduced in February 2024 by the Berlin-based company that produces advanced underwater robotics. This has a larger instrument payload, full-HD underwater cameras with dimmable LED lighting to allow for visual identification of its surroundings, and side-scan sonar to provide sound seabed imaging.

- The Hermes™ 650 Spark Unmanned Aerial System (UAS), the newest member of Elbit Systems’ industry-leading Hermes family, was introduced in February 2024. This next-generation UAS provides exceptional endurance, versatility, and cost-effective performance in land, air, and marine operations.

- With the signing of a historic contract in January 2024, the United Arab Emirates (UAE) launched the largest military robotics initiative in history. With 20 tracked robotic combat vehicles and 40 THeMIS unmanned ground vehicles, UAE will present the largest military robotics program in the world at UMEX 2024.

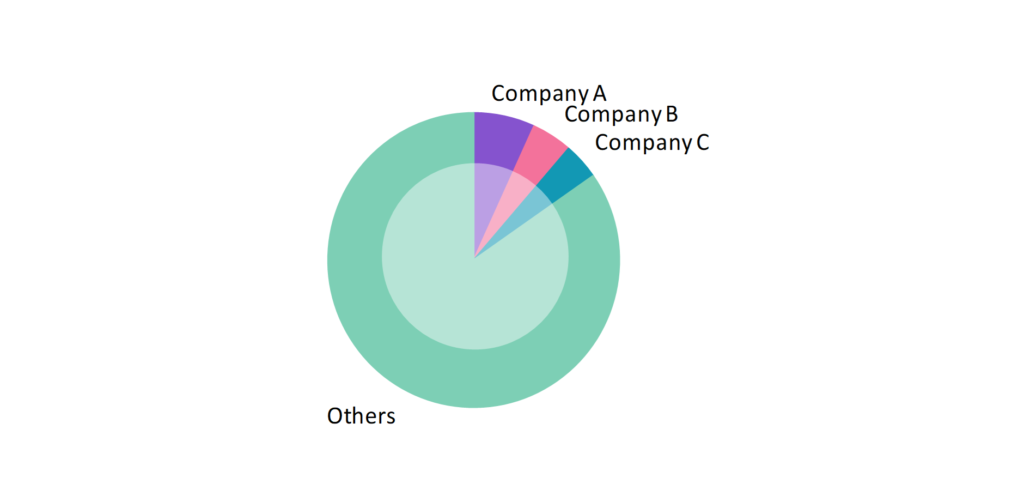

Military Robots and Autonomous Vehicles Market Competitive Landscape

The players in the worldwide autonomous vehicle and military robots’ market are constantly refining their tactics to maintain a competitive edge. Businesses mostly employ partnerships, R&D, acquisitions, and technology releases. The military robotics and autonomous vehicle market is dominated by several significant companies, including Northrop Grumman Corp.,Lockheed Martin Corp., QinetiQ Group, Elbit Systems Ltd., Thales Group, and others.

Military Robots and Autonomous Vehicles Market Company Share Analysis, 2023(%)

Military Robots and Autonomous Vehicles Market – Key Companies

Reason to Buy from us

Table of Contents

| 1. Introduction |

| 1.1. Research Methodology |

| 1.2. Scope of the Study |

| 2. Market Overview / Executive Summary |

| 2.1. Global Military Robots and Unmanned Vehicles Market (2018 – 2022) |

| 2.2. Global Military Robots and Unmanned Vehicles Market (2023 – 2029) |

| 3. Market Segmentation |

| 3.1. Global Military Robots and Unmanned Vehicles Market by Type |

| 3.1.1. Military Robots 3.1.2. Unmanned Aerial Vehicles (UAVs) 3.1.3. Unmanned Ground Vehicles (UGVs) 3.1.4. Unmanned Underwater Vehicles (UUVs) 3.1.5. Unmanned Surface Vehicles (USVs) |

| 3.2. Global Military Robots and Unmanned Vehicles Market by Technology |

| 3.2.1. Fully Autonomous 3.2.2. Semi-Autonomous 3.2.3. Remote Controlled & Human Operated |

| 3.3. Global Military Robots and Unmanned Vehicles Market by Application |

| 3.3.1. Defense 3.3.2. Military 3.3.3. Scientific Research 3.3.4. Commercial 3.3.5. Others |

| 4. Regional Segmentation |

| 4.1. North America |

| 4.1.1. The U.S 4.1.2. Canada 4.1.3. Mexico |

| 4.2. South America |

| 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Colombia 4.2.4. Chile 4.2.5. Rest of South America |

| 4.3. Asia Pacific |

| 4.3.1. China 4.3.2. India 4.3.3. Japan 4.3.4. South Korea 4.3.5. Rest of Asia Pacific |

| 4.4. Europe |

| 4.4.1. UK 4.4.2. Germany 4.4.3. Italy 4.4.4. France 4.4.5. Spain 4.4.6. Rest of Europe |

| 4.5. The Middle East |

| 4.5.1. Turkey 4.5.2. UAE 4.5.3. Saudi Arabia 4.5.4. Rest of the Middle East |

| 4.6. Africa |

| 4.6.1. Egypt 4.6.2. South Africa 4.6.3. Rest of Africa |

| 5. Value Chain Analysis of the Global Military Robots and Unmanned Vehicles Market |

| 6. Porter Five Forces Analysis |

| 6.1. Threats of New Entrants |

| 6.2. Threats of Substitutes |

| 6.3. Bargaining Power of Buyers |

| 6.4. Bargaining Power of Suppliers |

| 6.5. Competition in the Industry |

| 7. Trends, Drivers and Challenges Analysis |

| 7.1. Market Trends |

| 7.1.1. Market Trend 1 |

| 7.1.2. Market Trend 2 |

| 7.1.3. Market Trend 3 |

| 7.1.4. Market Trend 4 |

| 7.1.5. Market Trend 5 |

| 7.2. Market Drivers |

| 7.2.1. Market Driver 1 |

| 7.2.2. Market Driver 2 |

| 7.2.3. Market Driver 3 |

| 7.2.4. Market Driver 4 |

| 7.2.5. Market Driver 5 |

| 7.3. Market Challenges |

| 7.3.1. Market Challenge 1 |

| 7.3.2. Market Challenge 2 |

| 7.3.3. Market Challenge 3 |

| 7.3.4. Market Challenge 4 |

| 7.3.5. Market Challenge 5 |

| 8. Regulatory Landscape |

| 9. Competitive Landscape |

| 9.1. Northrop Grumman Corp. |

| 9.2. Lockheed Martin Corp. |

| 9.3. Qinetiq Group |

| 9.4. Elbit Systems Ltd. |

| 9.5. Thales Group |

| 9.6. Company 6 |

| 9.7. Company 7 |

| 9.8. Company 8 |

| 9.9. Company 9 |

| 9.10. Company 10 |

Military Robots and Autonomous Vehicles Market – Frequently Asked Questions (FAQs)

What is the current size of the global military robots and autonomous vehicles market?

Market size for the Global Frozen FThe market size for the global military robots and autonomous vehicles market in 2024 is $44.56 Bn.

Who are the major vendors in the global military robots and autonomous vehicles market?

The major vendors in the global military robots and autonomous vehicles market are Northrop Grumman Corp., Lockheed Martin Corp., QinetiQ Group, Elbit Systems Ltd., Thales Group.

Which segments are covered under the global military robots and autonomous vehicles market segments analysis?

This report offers in-depth insights into each type, technology, application.