Unmanned Surface Vehicles Market Analysis: Growth, Size, Share & Future Trends (2024-2029)

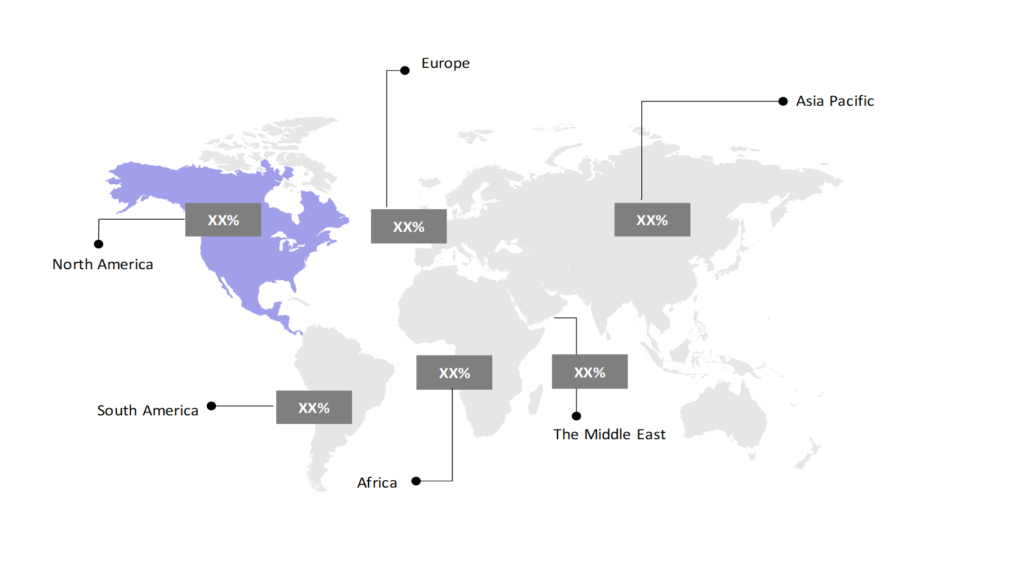

The market report offers a detailed analysis segmented by Type (Semi-Autonomous Surface Vehicles, Autonomous Surface Vehicles); by Solution (Propulsion System, Payload, Chassis Material, Communication System, Others); by Application (Commercial, Defense); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

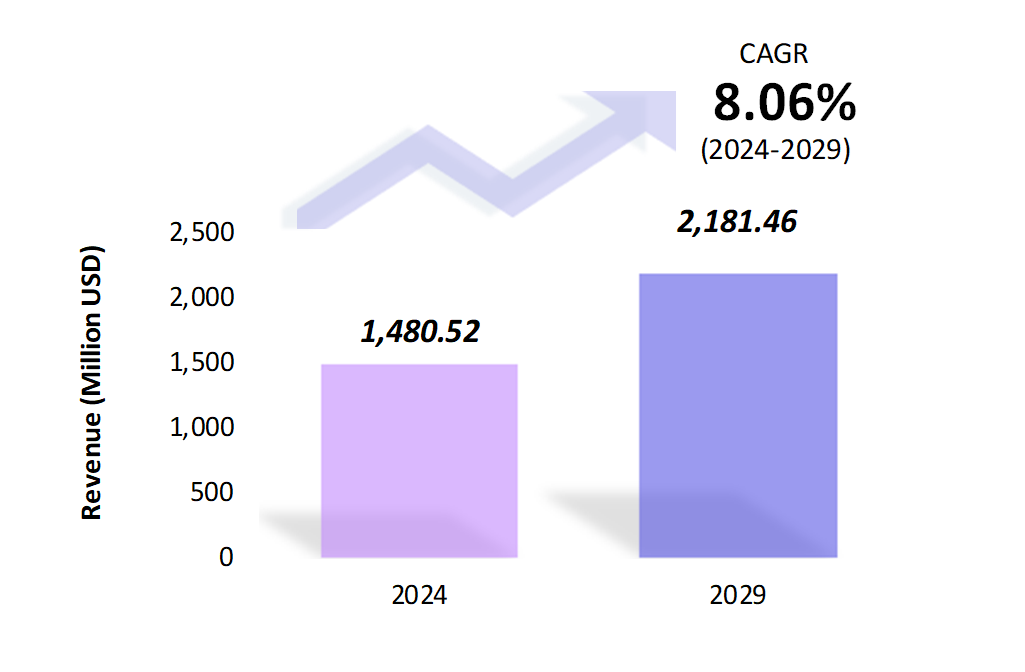

- The unmanned surface vehicles market is estimated to be at USD 1,480.52 Mn in 2024 and is anticipated to reach USD 2,181.46 Mn in 2029.

- The unmanned surface vehicles market is registering a CAGR of 8.06% during the forecast period 2024-2029.

- The global unmanned surface vehicles (USVs) market growth is primarily driven by the rising demand for autonomous systems across defense, commercial, and environmental applications. The adoption of advanced technologies, including AI, autonomous navigation, and sensor integration, is boosting the operational efficiency of USVs.

Request a free sample.

Ecosystem

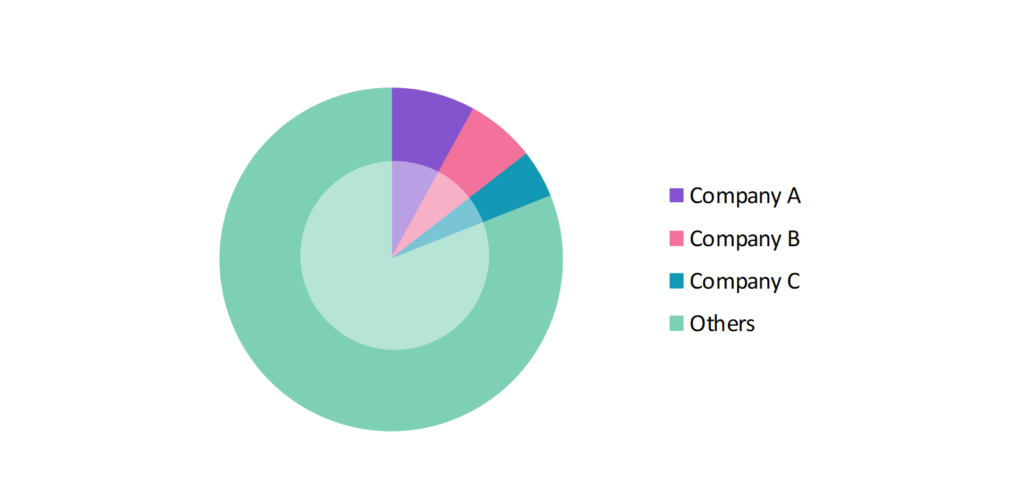

- The participants in the global unmanned surface vehicles industry are prominent for their technological advancements and strong market presence in the autonomous maritime space.

- These companies primarily invest in R&D to enhance USV performance, along with strategic partnerships to expand their market reach and maintain their competitive edge in the market.

- Several important entities in the unmanned surface vehicles market include Elbit Systems Ltd.; Kongsberg Gruppen ASA; L3Harris Technologies, Inc.; Teledyne Technologies, Inc.; Maritime Robotics AS; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2018-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Market Size (2024) | USD 1,480.52 Mn |

| Market Size (2029) | USD 2,181.46 Mn |

| Growth Rate | 8.06% CAGR from 2024 to 2029 |

| Key Segments | Type (Semi-Autonomous Surface Vehicles, Autonomous Surface Vehicles); Solution (Propulsion System, Payload, Chassis Material, Communication System, Others); Application (Commercial, Defense); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | Elbit Systems Ltd.; Kongsberg Gruppen ASA; L3Harris Technologies, Inc.; Teledyne Technologies, Inc.; Maritime Robotics AS |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; Colombia; Chile; China; India; Japan; South Korea; The UK; Germany; Italy; France; Spain; Turkey; UAE; Saudi Arabia; Egypt; South Africa |

| Largest Market | North America |

Get a free quote.

Trends

- Development of Autonomous Swarming Capabilities: Naval forces are increasingly investing in autonomous surface vehicle swarms for maritime defense. This trend is exemplified by the US Navy’s pursuit of small, cooperating USVs capable of long-range missions, threat monitoring, and vessel interdiction in contested waters. The focus on swarm coordination and GNSS-denied operations indicates a shift towards more adaptable and resilient naval defense systems.

- Focus on Maritime Research: Collaborations between USV manufacturers and research institutions are growing. In 2023, Kongsberg Maritime partnered with the University of Bergen to deploy USVs for deep-sea data collection, reflecting the increasing importance of these vehicles in marine research.

- Energy-Efficient Propulsion Systems: USVs are increasingly being developed with energy-efficient propulsion technologies. In 2023, Teledyne Marine launched a new series of solar-powered USVs designed to extend operational endurance, aligning with sustainability goals in maritime operations.

Speak to analyst.

Catalysts

- Increasing Use in Offshore Oil & Gas Industry: The commercial sector, particularly the offshore oil and gas industry, is driving the adoption of USVs for inspection and maintenance. In 2023, BP utilized USVs for real-time inspection of its offshore assets, reducing the need for manned operations and cutting costs.

- Rising Interest in Oceanographic Research: The increased focus on ocean exploration and marine resource management is boosting the demand for USVs. In 2023, Schmidt Ocean Institute expanded its fleet of USVs for seabed mapping, highlighting the growing interest in marine science and exploration.

- Military Modernization Programs: Defense modernization programs across various countries are incorporating USVs to enhance naval operations. In 2023, the Royal Australian Navy announced plans to integrate USVs into its fleet for reconnaissance and mine-hunting missions, driving market demand.

Inquire before buying.

Restraints

- Communication & Control Issues in Remote Areas: Maintaining reliable communication with USVs in remote maritime areas remains a challenge. In 2023, Teledyne Marine faced communication difficulties during a deep-sea mission, leading to limited control and data transmission, particularly in areas with weak signal strength.

- Cybersecurity Vulnerabilities: With increased reliance on AI and autonomous systems, USVs face heightened cybersecurity risks. A 2023 study by the US Department of Defense found that USVs are susceptible to hacking attempts, potentially compromising critical military missions and operations.

- High Production & Maintenance Costs: Despite advancements, the high cost of manufacturing and maintaining USVs remains a barrier for smaller companies. In 2023, SAExploration had to scale down its USV operations due to the high costs associated with acquiring and maintaining the advanced technology required for these vehicles.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Unmanned Surface Vehicles Market (2018 – 2022) 2.2. Global Unmanned Surface Vehicles Market (2023 – 2029) 3. Market Segmentation 3.1. Global Unmanned Surface Vehicles Market by Type 3.1.1. Semi-Autonomous Surface Vehicles 3.1.2. Autonomous Surface Vehicles 3.2. Global Unmanned Surface Vehicles Market by Solution 3.2.1. Propulsion System 3.2.2. Payload 3.2.3. Chassis Material 3.2.4. Communication System 3.2.5. Others 3.3. Global Unmanned Surface Vehicles Market by Application 3.3.1. Commercial 3.3.2. Defense 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Colombia 4.2.4. Chile 4.2.5. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Japan 4.3.4. South Korea 4.3.5. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. Italy 4.4.4. France 4.4.5. Spain 4.4.6. Rest of Europe 4.5. The Middle East 4.5.1. Turkey 4.5.2. UAE 4.5.3. Saudi Arabia 4.5.4. Rest of the Middle East 4.6. Africa 4.6.1. Egypt 4.6.2. South Africa 4.6.3. Rest of Africa 5. Value Chain Analysis of the Global Unmanned Surface Vehicles Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. Elbit Systems Ltd. 9.2. Kongsberg Gruppen ASA 9.3. L3Harris Technologies, Inc. 9.4. Teledyne Technologies, Inc. 9.5. Maritime Robotics AS 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Unmanned Surface Vehicles Market – FAQs

1. What is the current size of the unmanned surface vehicles market?

Ans. In 2024, the unmanned surface vehicles market size is USD 1,480.52 Mn.

2. Who are the major vendors in the unmanned surface vehicles market?

Ans. The major vendors in the unmanned surface vehicles market are Elbit Systems Ltd.; Kongsberg Gruppen ASA; L3Harris Technologies, Inc.; Teledyne Technologies, Inc.; Maritime Robotics AS.

3. Which segments are covered under the unmanned surface vehicles market segments analysis?

Ans. The unmanned surface vehicles market report offers in-depth insights into Type, Solution, Application, and Geography.