Cannabis Market Outlook: Size, Share, Trends & Growth Analysis (2024-2029)

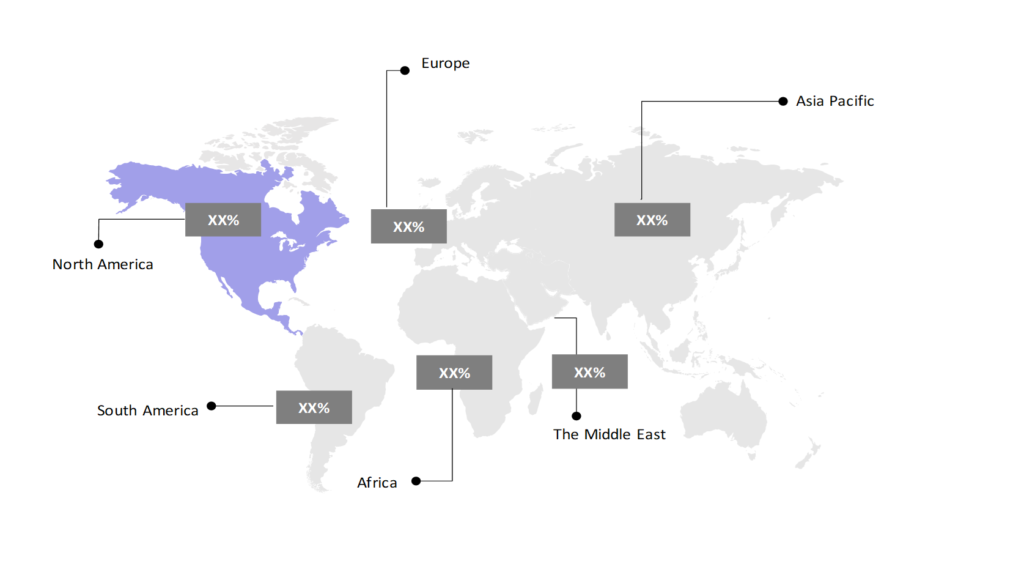

The market report presents a thorough analysis segmented by Product Type (Flowers, Concentrates, Edibles, Topicals and Tinctures, Others); by Application (Medical, Recreational); by Compound (Tetrahydrocannabinol (THC)-dominant, Cannabidiol (CBD)-dominant, Balanced THC& CBD); by Geography (North America, South America, Asia Pacific, Europe, Rest of The World).

Outlook

- The cannabis market is estimated to be at USD 41,690.01 Mn in 2024 and is anticipated to reach USD 86,695.08 Mn in 2029.

- The cannabis market is registering a CAGR of 15.77% during the forecast period of 2024-2029.

- The global cannabis market growth is driven by increasing legalization and acceptance of cannabis for both medical and recreational use across various regions.

Request a free sample.

Ecosystem

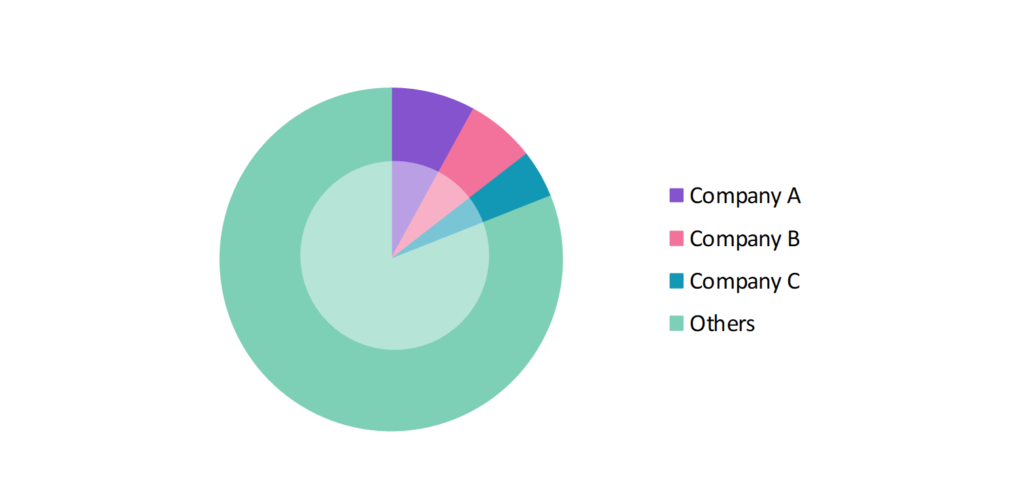

- The participants in the global cannabis industry dominate the market through extensive product portfolios, strong distribution networks, and strategic partnerships.

- These companies primarily diversify their product offerings to cater to different consumer preferences, along with strategic partnerships and acquisitions for increasing their presence in international markets.

- Several important entities in the cannabis market include Canopy Growth Corp.; Aurora Cannabis Inc.; Courier Plus, Inc.; Tilray Brands, Inc.; Cronos Group Inc.; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2018-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Market Size (2024) | USD 41,690.01 Mn |

| Market Size (2029) | USD 86,695.08 Mn |

| Growth Rate | 15.77% CAGR from 2024 to 2029 |

| Key Segments | Product Type (Flowers, Concentrates, Edibles, Topicals and Tinctures, Others); Application (Medical, Recreational); Compound (Tetrahydrocannabinol (THC)-dominant, Cannabidiol (CBD)-dominant, Balanced THC & CBD); Geography (North America, South America, Asia Pacific, Europe, Rest of The World) |

| Key Vendors | Canopy Growth Corp.; Aurora Cannabis Inc.; Courier Plus, Inc.; Tilray Brands, Inc.; Cronos Group Inc. |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; Colombia; China; India; South Korea; Australia; Germany; Italy; Spain; South Africa; Zimbabwe; Israel |

| Largest Market | North America |

Get a free quote.

Trends

- Eco-Friendly Cultivation: There is an emphasis on the trend towards sustainability in cannabis cultivation. In 2023, several producers in California adopted renewable energy sources and organic farming practices to reduce the environmental impact of cannabis production, reflecting the industry’s shift towards eco-friendly methods.

- Innovation in Cannabis Packaging: The cannabis industry is increasingly focusing on innovative packaging solutions that prioritize child safety and sustainability. In 2023, KushCo Holdings introduced biodegradable and child-resistant packaging options for cannabis products, addressing regulatory requirements and consumer demand for safer and more environmentally friendly packaging.

- Focus on Cannabis Research: Research into cannabis’s medical and therapeutic potential is gaining momentum. In 2023, the University of Sydney established a dedicated cannabis research center, aiming to explore the effects of cannabis on various health conditions, which is expected to enhance scientific understanding and drive innovation in the industry.

Speak to analyst.

Catalysts

- Cannabis Tourism: Cannabis tourism is emerging as a popular trend, particularly in regions where cannabis is legalized. In 2023, Amsterdam expanded its cannabis tourism initiatives by launching cannabis-focused tours and events, drawing enthusiasts from around the world and promoting cannabis culture as part of the travel experience.

- Medical Acceptance of Cannabis: The increasing acceptance of cannabis for medicinal purposes continues to drive market growth. In 2023, Australia expanded its medical cannabis program, allowing doctors to prescribe cannabis for a wider range of conditions, such as anxiety and PTSD, significantly increasing patient access and market size.

- Rise of E-commerce and Delivery Services: The growth of e-commerce platforms and delivery services is making cannabis products more accessible. In 2023, Weedmaps expanded its operations across Europe, offering an online platform where consumers can purchase cannabis products legally, driving convenience and expanding the market reach.

Inquire before buying.

Restraints

- High Taxation in Cannabis Sales: High taxation remains a significant challenge for the cannabis market, particularly in regions where cannabis is legal. In states like California, cannabis businesses face combined state and local taxes that can exceed 30%, significantly inflating the cost of legal products.

- International Trade Restrictions: International trade restrictions on cannabis and related products pose challenges for global market expansion. In 2023, Canadian cannabis producers faced difficulties exporting to Europe due to stringent regulations and import bans, limiting their ability to tap into emerging markets and expand their global footprint.

- Banking Restrictions: Despite legalization in several regions, cannabis companies still face significant challenges in accessing traditional banking services due to federal regulations, particularly in the United States. In 2023, Green Thumb Industries, a cannabis operator, reported difficulties in securing loans and managing finances due to federal prohibitions, which restrict banks from working with cannabis businesses.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Cannabis Market (2018 – 2022) 2.2. Global Cannabis Market (2023 – 2029) 3. Market Segmentation 3.1. Global Cannabis Market by Product Type 3.1.1. Flowers 3.1.2. Concentrates 3.1.3. Edibles 3.1.4. Topicals and Tinctures 3.1.5. Others 3.2. Global Cannabis Market by Application 3.2.1. Medical 3.2.2. Recreational 3.3. Global Cannabis Market by Compound 3.3.1. Tetrahydrocannabinol (THC)-dominant 3.3.2. Cannabidiol (CBD)-dominant 3.3.3. Balanced THC & CBD 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Colombia 4.2.4. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. South Korea 4.3.4. Australia 4.3.5. Rest of Asia Pacific 4.4. Europe 4.4.1. Germany 4.4.2. Italy 4.4.3. Spain 4.4.4. Rest of Europe 4.5. Rest of The World 4.5.1. South Africa 4.5.2. Zimbabwe 4.5.3. Israel 4.5.4. Rest of The World 5. Value Chain Analysis of the Global Cannabis Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. Canopy Growth Corp. 9.2. Aurora Cannabis Inc. 9.3. Courier Plus, Inc. 9.4. Tilray Brands, Inc. 9.5. Cronos Group Inc. 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Cannabis Market – FAQs

1. What is the current size of the cannabis market?

Ans. In 2024, the cannabis market size is USD 41,690.01 Mn.

2. Who are the major vendors in the cannabis market?

Ans. The major vendors in the cannabis market are Canopy Growth Corp.; Aurora Cannabis Inc.; Courier Plus, Inc.; Tilray Brands, Inc.; Cronos Group Inc.

3. Which segments are covered under the cannabis market segments analysis?

Ans. The cannabis market report offers in-depth insights into Product Type, Application, Compound, and Geography.