Electric Scooter Market Analysis: Growth, Size, Share & Future Trends (2024-2029)

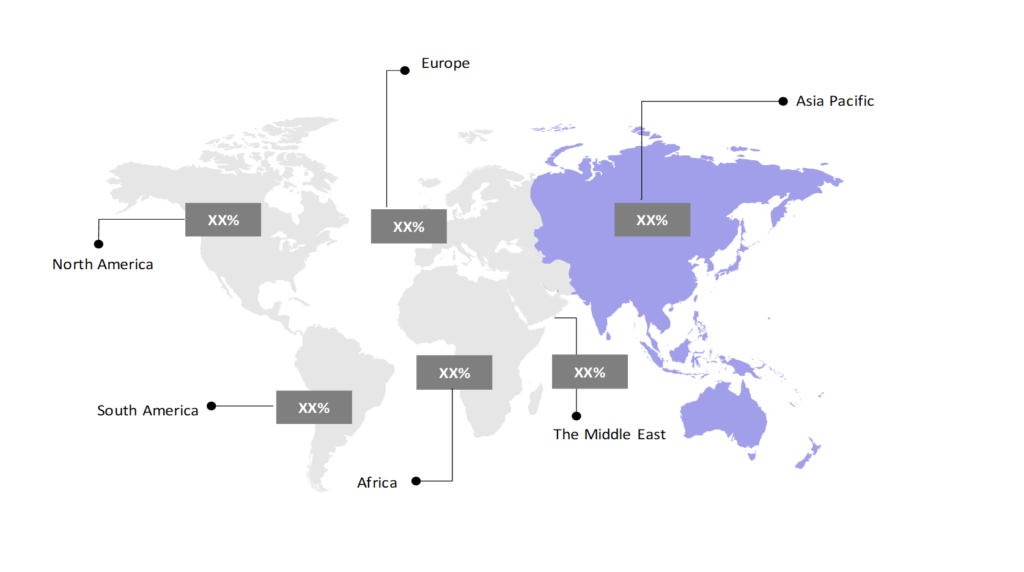

The market report offers a detailed analysis segmented by Type (E-scooters/Mopeds, E-motorcycles); by Battery (Sealed Lead-acid, Lithium-ion); by Motor Type (Hub Motors, Mid-drive Motors); by End User (Private, Commercial, Others); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

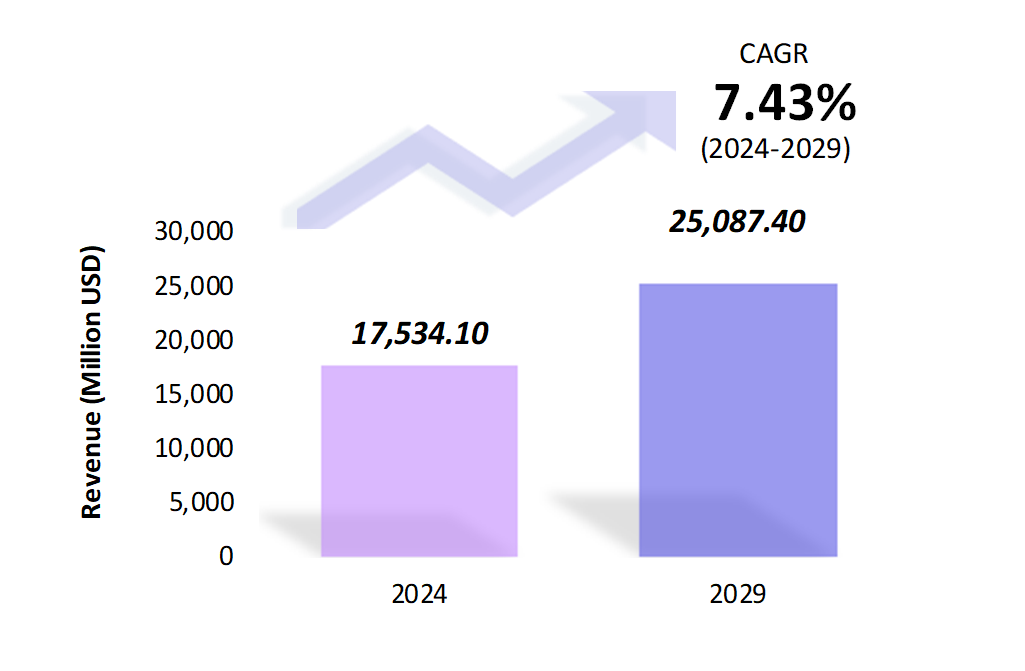

- The electric scooter market is estimated to be at USD 17,534.10 Mn in 2024 and is anticipated to reach USD 25,087.40 Mn in 2029.

- The electric scooters market is registering a CAGR of 7.43% during the forecast period of 2024-2029.

- The global electric scooter market is poised for significant growth, driven by environmental concerns, technological advancements, and urbanization. There is an increased focus on expanding in emerging markets and leveraging government incentives to boost adoption rates.

Request a free sample.

Ecosystem

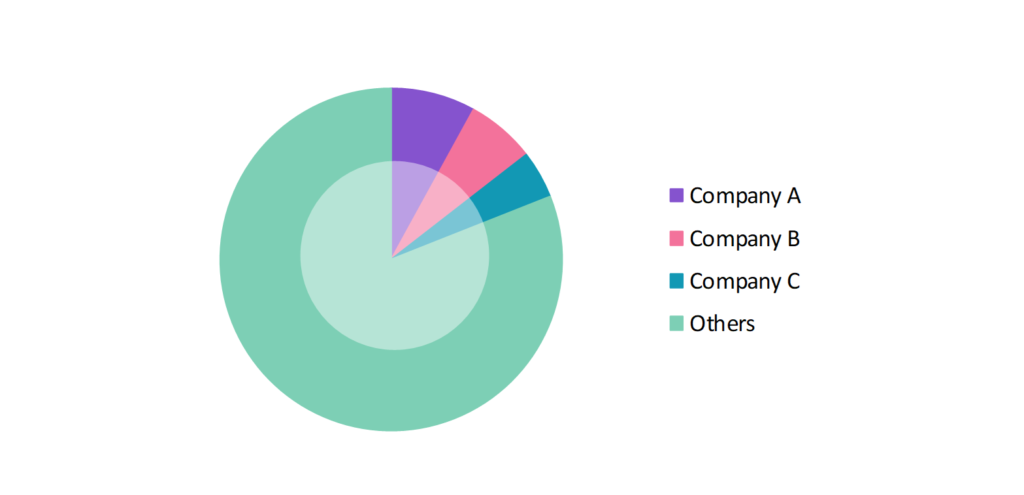

- The global electric scooter industry participants are always developing strategies to preserve a competitive advantage.

- These companies primarily use acquisitions, R&D, partnerships, and technological launches.

- Several important entities in the electric scooter market include Yadea Group Holdings Ltd.; OLA Electric Mobility Ltd.; TVS Motor Co., Ltd.; Ather Energy Pvt., Ltd.; Gogoro Inc.; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2018-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Market Size (2024) | USD 17,534.10 Mn |

| Market Size (2029) | USD 25,087.40 Mn |

| Growth Rate | 7.43% CAGR from 2024 to 2029 |

| Key Segments | Type (E-scooters/Mopeds, E-motorcycles, Others); Battery (Sealed Lead-acid, Lithium-ion, Others); Motor Type (Hub Motors, Mid-drive Motors, Others); End-User (Private, Commercial, Others); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | Yadea Group Holdings Ltd.; OLA Electric Mobility Ltd.; TVS Motor Co., Ltd.; Ather Energy Pvt., Ltd.; Gogoro Inc. |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; Colombia; Chile; China; India; Japan; South Korea; The UK; Germany; Italy; France; Spain; Turkey; UAE; Saudi Arabia; Egypt; South Africa |

| Largest Market | Asia Pacific |

Get a free quote.

Trends

- Shared Mobility Services: The growth of shared mobility services, including electric scooter sharing programs, rapidly expands due to increasing urbanization and the demand for eco-friendly transportation options. This trend is driven by advancements in technology and infrastructure, which enhance the convenience and efficiency of these services.

- Focus on Lightweight and Foldable Designs: Manufacturers increasingly focus on lightweight and foldable designs to enhance portability and user convenience. For example, in April 2024, Segway introduced a new foldable electric scooter weighing just 15 kg, catering to urban commuters who need a portable and easily storable transportation option.

- Customization and Connectivity Features: Including customizable features and connectivity options, such as app-based controls and GPS tracking, enhances the user experience. In 2023, Xiaomi introduced an electric scooter with a companion app that allows users to customize settings and track performance metrics.

Speak to analyst.

Catalysts

- Urbanization and Traffic Congestion: Rising urbanization and growing traffic congestion in cities are driving the adoption of electric scooters as an efficient mode of transport, offering a flexible solution to navigate congested streets and reduce commuting time. Additionally, the shift towards sustainable living and the need for last-mile connectivity are further accelerating the popularity of electric scooters in urban areas.

- Government Incentives and Subsidies: Government initiatives and subsidies are supporting the growth of the electric scooter market. For instance, in 2023, the Indian government announced increased subsidies for electric vehicle purchases, resulting in a 40% surge in electric scooter sales.

- Battery-swapping Technology: Innovations in battery technology, including improved energy density and faster charging times, enhance electric scooters’ performance and appeal. For example, in 2023, Gogoro introduced a new battery-swapping network, reducing charging time and extending the range of their electric scooters, making them more convenient for users and driving the electric scooter market.

Inquire before buying.

Restraints

- Limited Charging Infrastructure: The lack of adequate charging infrastructure remains a significant challenge for the widespread adoption of electric scooters. Insufficient charging stations lead to inconvenience and limit the scooters’ range. This issue hampers user confidence and limits the effectiveness of electric scooters as a reliable means of transportation.

- Battery Life and Performance Issues: Concerns about battery life and performance, particularly in extreme weather conditions, pose challenges for the market, as fluctuating temperatures can significantly affect battery efficiency and range. These issues can lead to reduced reliability and higher maintenance costs, potentially deterring consumers from adopting electric scooters in varying environmental conditions.

- Regulatory and Safety Concerns: Varying regulations and safety concerns regarding the use of electric scooters in urban areas can hinder market growth. For instance, in 2023, several cities in the U.S. implemented stricter regulations on electric scooter usage due to safety concerns, impacting their deployment and acceptance.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Electric Scooters Market (2018 – 2022) 2.2. Global Electric Scooters Market (2023 – 2029) 3. Market Segmentation 3.1. Global Electric Scooters Market by Type 3.1.1. E-scooters/Mopeds 3.1.2. E-motorcycles 3.1.3. Others 3.2. Global Electric Scooters Market by Battery 3.2.1. Sealed Lead-acid 3.2.2. Lithium-ion 3.2.3. Others 3.3. Global Electric Scooters Market by Motor Type 3.3.1. Hub Motors 3.3.2. Mid-drive Motors 3.3.3. Others 3.4. Global Electric Scooters Market by End-User 3.4.1. Private 3.4.2. Commercial 3.4.3. Others 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Colombia 4.2.4. Chile 4.2.5. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Japan 4.3.4. South Korea 4.3.5. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. Italy 4.4.4. France 4.4.5. Spain 4.4.6. Rest of Europe 4.5. The Middle East 4.5.1. Turkey 4.5.2. UAE 4.5.3. Saudi Arabia 4.5.4. Rest of the Middle East 4.6. Africa 4.6.1. Egypt 4.6.2. South Africa 4.6.3. Rest of Africa 5. Value Chain Analysis of the Global Electric Scooters Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. Yadea Group Holdings Ltd. 9.2. OLA Electric Mobility Ltd. 9.3. TVS Motor Co., Ltd. 9.4. Ather Energy Pvt., Ltd. 9.5. Gogoro Inc. 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Electric Scooters Market – FAQs

1. What is the current size of the electric scooter market?

Ans. In 2024, the electric scooter market size is $17,534.10 Mn.

2. Who are the major vendors in the electric scooter market?

Ans. The major vendors in the electric scooter market are Yadea Group Holdings Ltd.; OLA Electric Mobility Ltd.; TVS Motor Co., Ltd.; Ather Energy Pvt., Ltd.; and Gogoro Inc.

3. Which segments are covered under the analysis of the electric scooter market segments?

Ans. The electric scooters market report offers in-depth insights into Type, Battery, Motor Type, End-User, and Geography.