Cigars And Cigarillos Market Outlook: Size, Share, Trends & Growth Analysis (2024-2029)

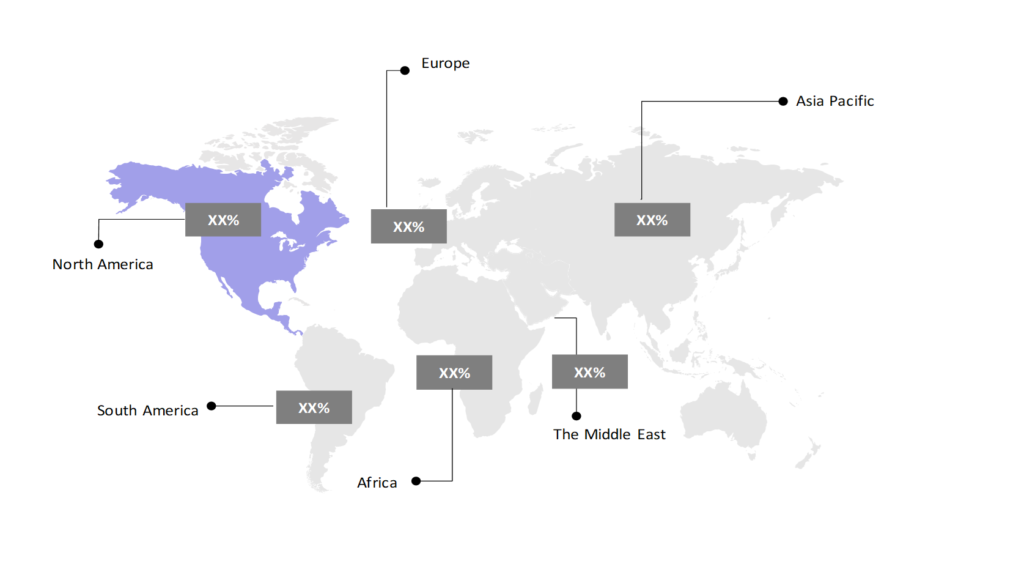

The market report presents a thorough analysis segmented by Product Outlook (Mass, Premium); by Flavor Outlook (Tobacco/No Flavor, Flavored); by Sales Channel (Direct Sales, Cigar Specialty Stores, Hypermarkets/Supermarkets, Online Retailers, Others); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

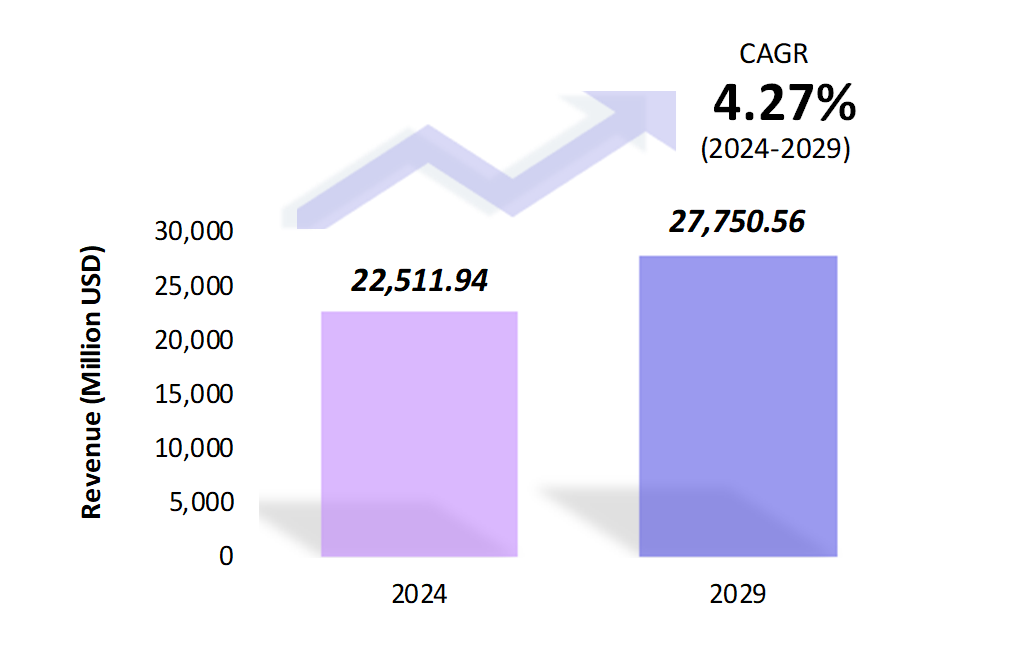

- The cigars and cigarillos market is estimated to be at USD 22,511.94 Mn in 2024 and is anticipated to reach USD 27,750.56 Mn in 2029.

- The cigars and cigarillos market is registering a CAGR of 4.27% during the forecast period 2024-2029.

- The global cigars and cigarillos market has shown steady growth, driven by increased demand for premium tobacco products and rising disposable incomes, particularly in developing regions. Cigarillos appeal to price-sensitive consumers, and cigars are more popular among premium buyers.

Request a free sample.

Ecosystem

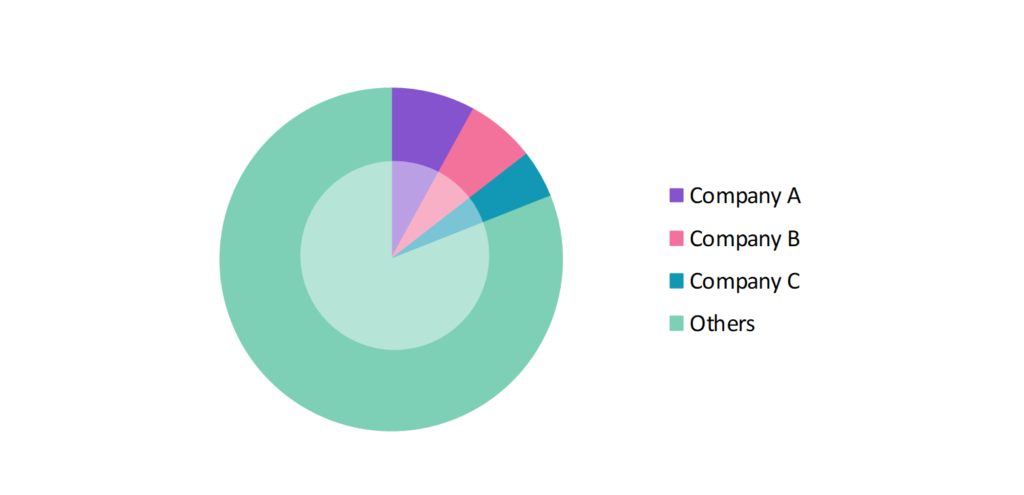

- The global cigars and cigarillos industry participants are constantly developing strategies to preserve a competitive advantage.

- These companies focus on product diversification, premium cigars, and flavored offerings catering to mass-market and high-end consumers with a global distribution network.

- Several important entities in the cigars and cigarillos market include Altria Group, Inc.; Habanos S.A.; Scandinavian Tobacco Group A/S; Gurkha Cigar Group; Swisher International Group Inc.; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2018-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Market Size (2024) | USD 22,511.94 Mn |

| Market Size (2029) | USD 27,750.56 Mn |

| Growth Rate | 4.27% CAGR from 2024 to 2029 |

| Key Segments | Product Outlook (Mass, Premium); Flavor Outlook (Tobacco/No Flavor, Flavored); Sales Channel (Direct Sales, Cigar Specialty Stores, Hypermarkets/Supermarkets, Online Retailers, Others); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | Altria Group, Inc.; Habanos S.A.; Scandinavian Tobacco Group A/S; Gurkha Cigar Group; Swisher International Group Inc. |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; Colombia; Chile; China; India; Japan; South Korea; The UK; Germany; Italy; France; Spain; Turkey; UAE; Saudi Arabia; Egypt; South Africa |

| Largest Market | North America |

Get a free quote.

Trends

- Premiumization of Cigars: The premiumization of cigars reflects a shift towards higher quality, exclusivity, and craftsmanship. Enthusiasts increasingly seek out limited editions and artisanal blends, valuing intricate production processes and rare tobaccos. This trend underscores a growing emphasis on luxury and sophistication in the cigar experience.

- Experimentation with Tobacco Blends: Manufacturers are experimenting with unique tobacco blends, combining leaves from different regions to create distinctive flavors and aromas. This trend caters to experienced cigar enthusiasts seeking novel tasting experiences. In 2023, major brands such as Altria and Habanos introduced new blends combining tobacco from Nicaragua and the Dominican Republic.

- Focus on Non-Tobacco Alternatives: There’s a growing interest in non-tobacco cigars, such as those made from hemp or other natural ingredients. These alternatives cater to consumers who enjoy the ritual of smoking but prefer to avoid traditional tobacco. This shift reflects changing consumer habits and awareness around health and wellness.

Speak to analyst.

Catalysts

- Rising E-commerce and Online Sales: E-commerce has revolutionized the cigar industry by giving consumers convenient access to various brands and varieties worldwide. Online retail platforms make it easy for enthusiasts to browse, compare, and buy cigars from home, broadening market reach for well-known and niche brands. This digital transformation has allowed a global audience to discover and enjoy cigars with personalized recommendations and user reviews.

- Growth in Cigar Lounges: The rise of cigar lounges has significantly boosted cigar popularity by providing dedicated social spaces for enthusiasts. These lounges foster a community atmosphere and enhance the overall cigar experience, leading to increased consumption. As a result, the demand for premium cigars is growing, compelling manufacturers to focus on quality and unique offerings to cater to this expanding market segment.

- Cultural Acceptance of Cigar Smoking: In many regions, cigars are associated with celebrations, luxury, and leisure. This cultural acceptance supports steady demand, particularly during events such as weddings and business gatherings. For example, the Dominican Republic reported a rise in cigar tourism in 2023, with many international visitors engaging in cigar-related activities.

Inquire before buying.

Restraints

- Stringent Government Regulations: Governments worldwide are increasingly imposing strict regulations on tobacco products, including cigars and cigarillos. For example, in 2022, the European Union expanded its anti-tobacco directive, mandating stricter packaging requirements and banning flavored cigarillos.

- Rising Costs of Tobacco Production: Rising costs across various sectors are increasingly challenging the production of high-quality tobacco for premium cigars. Escalating prices for raw materials, labor, and transportation drive production expenses and squeeze profit margins. This financial pressure impacts the availability and affordability of premium cigars, prompting producers to seek cost-effective solutions while maintaining the high standards consumers expect.

- Illicit Trade and Counterfeit Products: The illicit trade of counterfeit cigars and cigarillos continues to pose a challenge. Black market products threaten legitimate businesses, particularly in Asia and Latin America. Habanos S.A., the Cuban state-owned company, has been actively addressing the issue of counterfeit products. In 2023, the company seized over 500,000 counterfeit cigars in a significant crackdown on illicit cigar production.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Cigars and Cigarillos Market (2018 – 2022) 2.2. Global Cigars and Cigarillos Market (2023 – 2029) 3. Market Segmentation 3.1. Global Cigars and Cigarillos Market by Product Outlook 3.1.1. Mass 3.1.2. Premium 3.2. Global Cigars and Cigarillos Market by Flavor Outlook 3.2.1. Tobacco/No Flavor 3.2.2. Flavored 3.3. Global Cigars and Cigarillos Market by Sales Channel 3.3.1. Direct Sales 3.3.2. Cigar Specialty Stores 3.3.3. Hypermarkets/Supermarkets 3.3.4. Online Retailers 3.3.5. Others 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Colombia 4.2.4. Chile 4.2.5. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Japan 4.3.4. South Korea 4.3.5. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. Italy 4.4.4. France 4.4.5. Spain 4.4.6. Rest of Europe 4.5. The Middle East 4.5.1. Turkey 4.5.2. UAE 4.5.3. Saudi Arabia 4.5.4. Rest of the Middle East 4.6. Africa 4.6.1. Egypt 4.6.2. South Africa 4.6.3. Rest of Africa 5. Value Chain Analysis of the Global Cigars and Cigarillos Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. Altria Group, Inc. 9.2. Habanos S.A. 9.3. Scandinavian Tobacco Group A/S 9.4. Gurkha Cigar Group 9.5. Swisher International Group Inc. 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Cigars and Cigarillos Market – FAQs

1. What is the current size of the cigars and cigarillos market?

Ans. In 2024, the cigars and cigarillos market size is USD 22,511.94 Mn.

2. Who are the major vendors in the cigars and cigarillos market?

Ans. The major vendors in the cigars and cigarillos market are Altria Group, Inc.; Habanos S.A.; Scandinavian Tobacco Group A/S; Gurkha Cigar Group; Swisher International Group Inc.

3. Which segments are covered under the cigars and cigarillos market segments analysis?

Ans. The cigars and cigarillos market report offers in-depth insights into Product Outlook, Flavor Outlook, Sales Channel, and Geography.