Washing Machine Market: Size, Share, Trends & Forecast (2024-2029)

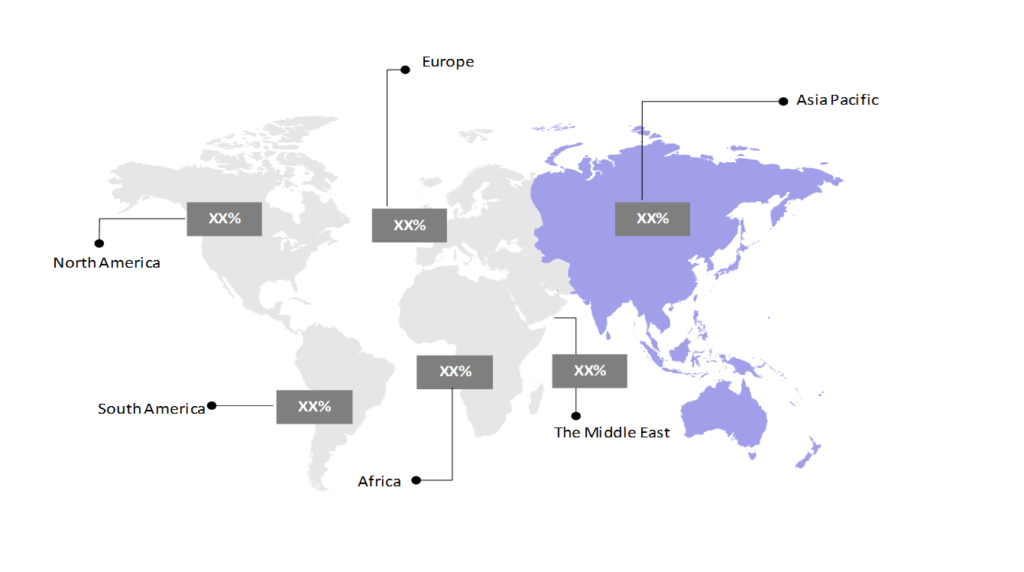

The market report offers a detailed analysis segmented by Product (Fully Automatic, Semi-automatic, Dryer); by Capacity (Below 6 kg, 6.1-8 kg, above 8 kg); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

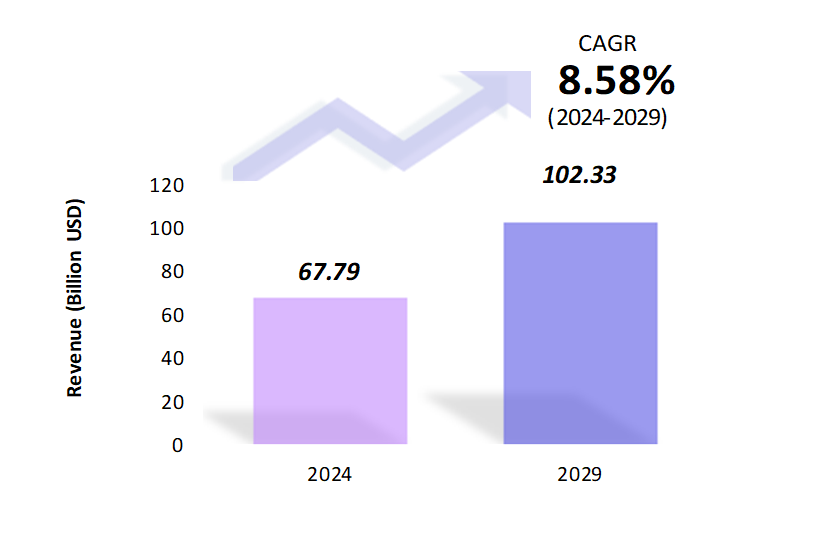

- The washing machine market is estimated to be at USD 67.79 Bn in 2024 and is anticipated to reach USD 102.33 Bn in 2029.

- The washing machine market is registering a CAGR of 8.58% during the forecast period of 2024-2029.

- The washing machine market is experiencing steady growth, driven by increasing urbanization, technological advancements, and rising consumer demand for energy-efficient and smart appliances. Manufacturers are focusing on innovation, sustainability, and enhancing user comfort to meet evolving consumer preferences.

Request a free sample.

Ecosystem

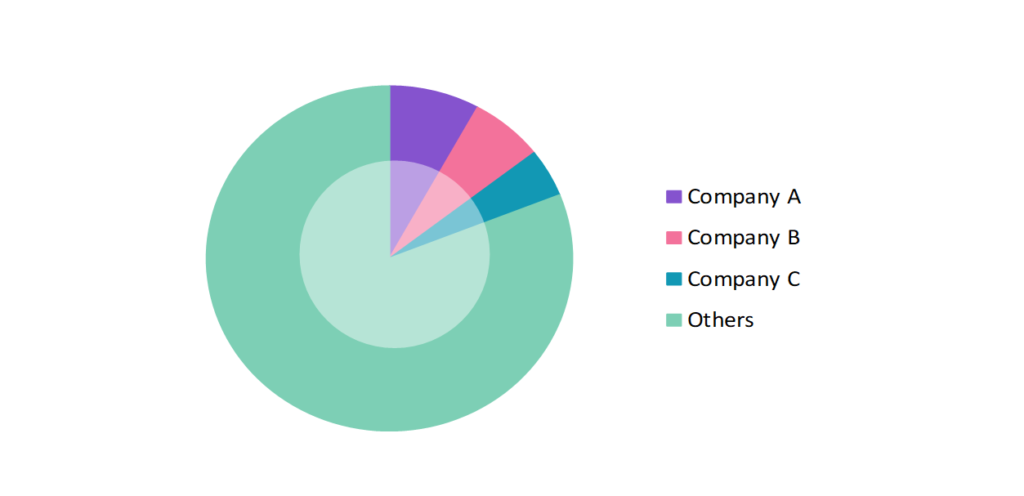

- The participants in the global washing machine industry are always developing their strategies to preserve a competitive advantage.

- These companies primarily use acquisitions, R&D, partnerships, and technological launches.

- Several important entities in the washing machine market include Whirlpool Corp.; Samsung Electronics Co., Ltd.; LG Electronics Inc.; Godrej Industries Ltd.; Electrolux Group; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2018-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Market Size (2024) | USD 67.79 Bn |

| Market Size (2029) | USD 102.33 Bn |

| Growth Rate | 8.58% CAGR from 2024 to 2029 |

| Key Segments | Product (Fully Automatic, Semi-automatic, Dryer); Capacity (Below 6 kg, 6.1-8 kg, Above 8 kg); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | Whirlpool Corp.; Samsung Electronics Co., Ltd.; LG Electronics Inc.; Godrej Industries Ltd.; Electrolux Group |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; Colombia; Chile; China; India; Japan; South Korea; The UK; Germany; Italy; France; Spain; Turkey; UAE; Saudi Arabia; Egypt; South Africa |

| Largest Market | Asia Pacific |

Get a free quote.

Trends

- Smart Technology Integration: Manufacturers are now incorporating smart technology into washing machines, which enables users to control and monitor their laundry remotely via smartphones. With features like Wi-Fi connectivity, voice commands, and AI-driven laundry recommendations, these appliances offer enhanced convenience.

- Focus on Sustainability and Energy Efficiency: There is a growing emphasis on eco-friendly washing machines that prioritize energy and water efficiency. Consumers are increasingly opting for models with features like load sensing, reduced water usage, and energy-saving modes. Samsung Eco bubble washing machine uses cool water and special bubble technology to effectively clean clothes while significantly reducing energy consumption.

- Humanization of the Washing Machine Experience: Manufacturers are increasingly focusing on improving the user experience by addressing the common issues of noise and vibration in washing machines. Traditional models often generate disruptive sounds and vibrations. This approach reflects a shift towards designing appliances that prioritize user comfort, which makes the laundry process more pleasant and aligned with consumer expectations for a more humane and user-friendly experience.

Speak to analyst.

Catalysts

- Rising Demand for Energy-Efficient Appliances: The push towards energy conservation and sustainability is driving the demand for energy-efficient washing machines. Consumers are increasingly aware of their carbon footprint and are opting for appliances that reduce energy consumption and utility costs. Government incentives and rebates for energy-saving appliances further encourage the adoption of these models, fueling market growth.

- Increasing Urbanization and Smaller Households: As more people move to urban areas, the demand for washing machines that cater to smaller households is rising. Compact, space-saving designs are particularly in demand among urban dwellers who have limited living space. This urbanization trend contributes to the growth of the washing machine market as manufacturers develop products that meet the needs of a growing urban population.

- Introduction of Innovative Washing Technologies: Advanced washing technologies, such as steam cleaning, fabric-specific cycles, and anti-bacterial wash features, are becoming more common in the market. These innovations enhance washing performance, protect delicate fabrics, and improve hygiene. For instance, LG’s TurboWash 360° technology uses powerful jets to thoroughly clean clothes while being gentle on fabrics.

Inquire before buying.

Restraints

- High Initial Costs of Advanced Models: While smart and energy-efficient washing machines offer long-term savings, their higher upfront costs can be a barrier for some consumers. These advanced models often come with premium pricing, which makes them less accessible to price-sensitive customers. The high initial investment required for these appliances can slow market adoption, particularly in developing regions.

- Supply Chain Disruptions and Component Shortages: Global supply chain challenges, including transportation delays and shortages of essential components, can hinder market growth. These disruptions can lead to increased manufacturing costs and delays in product availability. The reliance on imported components can make the market vulnerable to geopolitical and economic uncertainties.

- Regulatory Compliance and Environmental Standards: Strict regulations regarding energy efficiency and environmental impact can pose challenges for manufacturers. Compliance with these regulations often requires significant investment in research and development, which can increase production costs. Companies that fail to meet these standards may face fines, recalls, or reputational damage, potentially restraining market growth.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Washing Machine Market (2018 – 2022) 2.2. Global Washing Machine Market (2023 – 2029) 3. Market Segmentation 3.1. Global Washing Machine Market by Product 3.1.1. Fully Automatic 3.1.2. Semi-automatic 3.1.3. Dryer 3.2. Global Washing Machine Market by Capacity 3.2.1. Below 6 kg 3.2.2. 6.1-8 kg 3.2.3. Above 8 kg 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Colombia 4.2.4. Chile 4.2.5. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Japan 4.3.4. South Korea 4.3.5. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. Italy 4.4.4. France 4.4.5. Spain 4.4.6. Rest of Europe 4.5. The Middle East 4.5.1. Turkey 4.5.2. UAE 4.5.3. Saudi Arabia 4.5.4. Rest of the Middle East 4.6. Africa 4.6.1. Egypt 4.6.2. South Africa 4.6.3. Rest of Africa 5. Value Chain Analysis of the Global Washing Machine Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. Whirlpool Corp. 9.2. Samsung Electronics Co., Ltd. 9.3. LG Electronics Inc. 9.4. Godrej Industries Ltd. 9.5. Electrolux Group 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Washing Machine Market – FAQs

1. What is the current size of the washing machine market?

Ans. In 2024, the washing machine market size is USD 67.79 Bn.

2. Who are the major vendors in the washing machine market?

Ans. The major vendors in the washing machine market are Whirlpool Corp.; Samsung Electronics Co., Ltd.; LG Electronics Inc.; Godrej Industries Ltd.; Electrolux Group.

3. Which segments are covered under the washing machine market segments analysis?

Ans. The washing machine market report offers in-depth insights into Product, Capacity, and Geography.