Carbon Black Market Analysis: Growth, Size, Share & Future Trends (2024-2029)

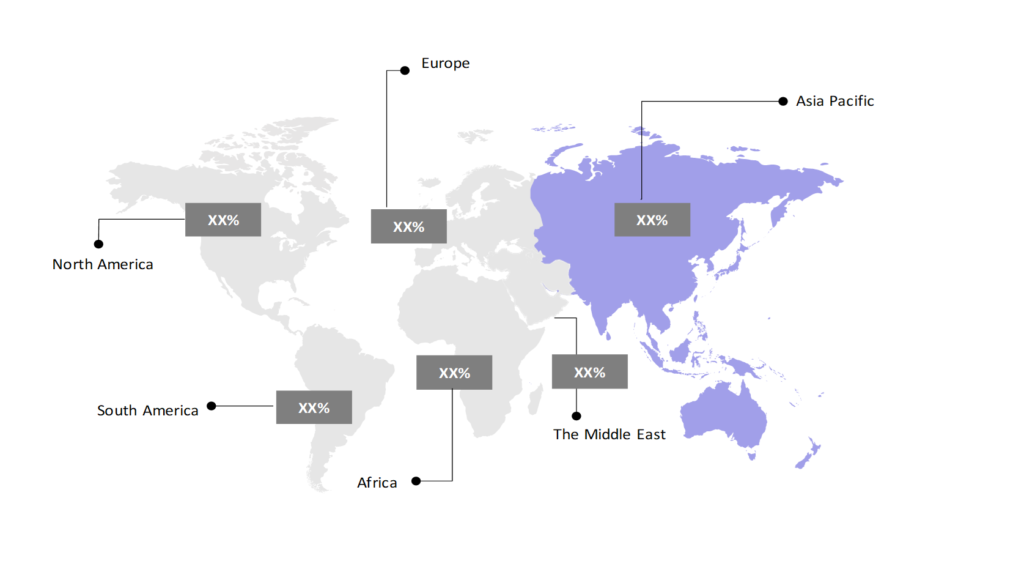

The market report offers a detailed analysis segmented by Process Type (Furnace Black, Gas Black, Lamp Black, Thermal Black); by Application (Tires and Industrial Rubber Products, Plastic, Toners and Printing Inks, Coatings, Textile Fibers, Others); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

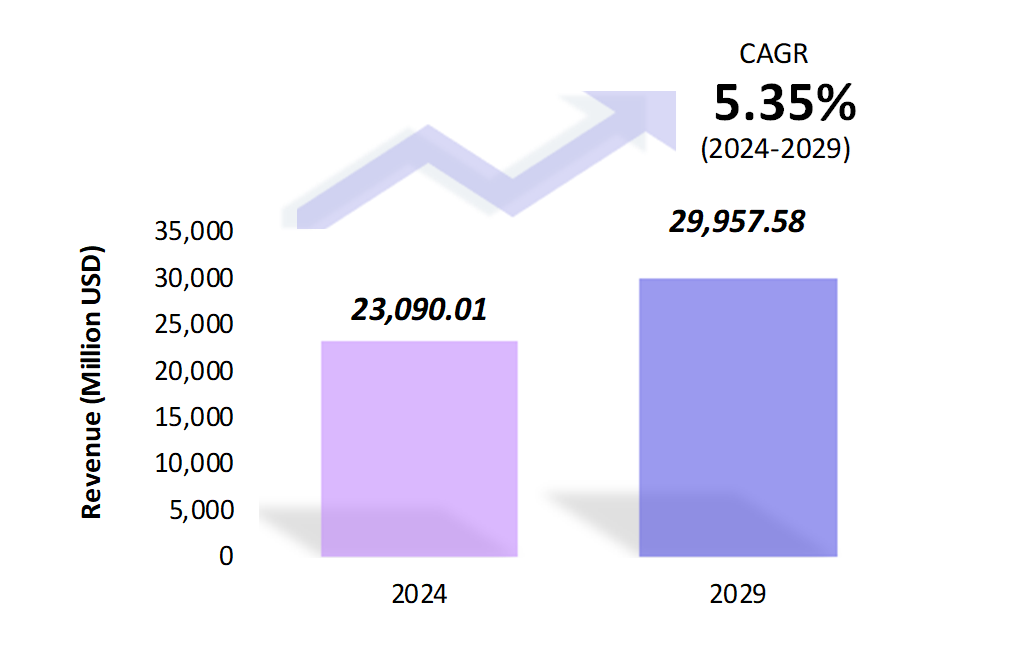

- The carbon black market is estimated to be at USD 23,090.01 Mn in 2024 and is anticipated to reach USD 29,957.58 Mn in 2029.

- The carbon black market is registering a CAGR of 5.35% during the forecast period of 2024-2029.

- The global carbon black market’s growth is driven by increased demand from the automotive and tire industries, which are the primary consumers of carbon black.

Request a free sample.

Ecosystem

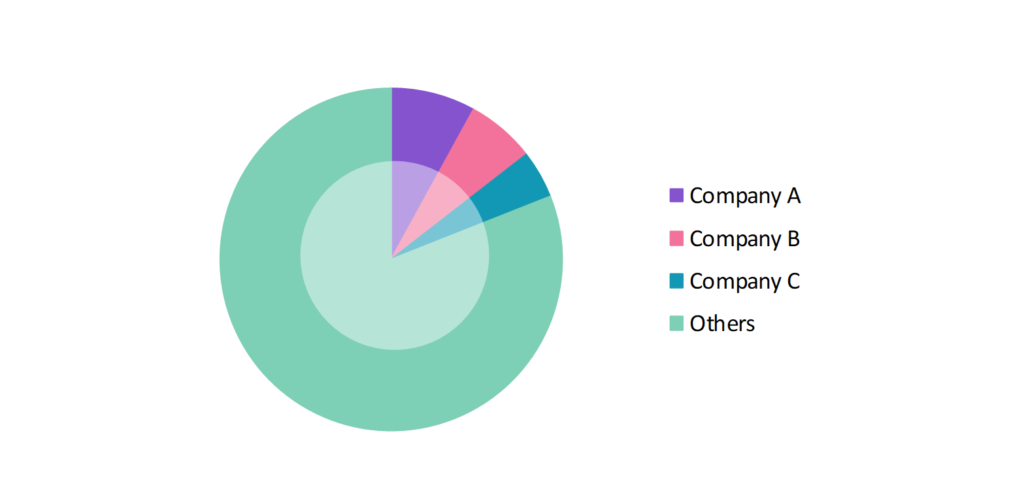

- The participants in the global carbon black industry dominate the market through extensive product portfolios and global distribution networks.

- These companies primarily focus on sustainability, along with strategic partnerships and collaborations to enhance market reach and technological capabilities.

- Several important entities in the carbon black market include Cabot Corp.; Aditya Birla Group; Orion Engineered Carbons GmbH; Jiangxi Black Cat Carbon black Inc., Ltd.; Asahi Carbon Co., Ltd.; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2018-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Market Size (2024) | USD 23,090.01 Mn |

| Market Size (2029) | USD 29,957.58 Mn |

| Growth Rate | 5.35% CAGR from 2024 to 2029 |

| Key Segments | Process Type (Furnace Black, Gas Black, Lamp Black, Thermal Black); Application (Tires and Industrial Rubber Products, Plastic, Toners and Printing Inks, Coatings, Textile Fibers, Others); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | Cabot Corp.; Aditya Birla Group; Orion Engineered Carbons GmbH; Jiangxi Black Cat Carbon black Inc., Ltd.; Asahi Carbon Co., Ltd. |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; Colombia; Chile; China; India; Japan; South Korea; The UK; Germany; Italy; France; Spain; Turkey; UAE; Saudi Arabia; Egypt; South Africa |

| Largest Market | Asia Pacific |

Get a free quote.

Trends

- Shift Towards Sustainable Manufacturing: There is a growing trend towards sustainable production methods for carbon black, driven by environmental concerns. In 2023, Orion Engineered Carbons announced a shift to more eco-friendly manufacturing processes, focusing on reducing emissions and energy consumption.

- Recycling and Reuse Initiatives: Recycling of carbon black is gaining traction, especially in the tire industry. In 2023, Scandinavian Enviro Systems partnered with Michelin to develop a tire recycling process that recovers carbon black, emphasizing the trend toward circular economy practices in the industry.

- Digitalization in Production: Digital transformation is increasingly being adopted in carbon black manufacturing processes. In 2023, Continental Carbon implemented IoT solutions to monitor and optimize production efficiency, highlighting the move towards Industry 4.0 in the carbon black sector.

Speak to analyst.

Catalysts

- Automotive Industry Demand: The automotive industry’s demand for carbon black, particularly for tire manufacturing, is a major market driver. In 2023, Goodyear increased its carbon black procurement to meet the rising production of electric vehicles (EVs), which require specialized tire compounds.

- Expansion of the Plastics Industry: The global plastics industry is a significant consumer of carbon black, used as a colorant and UV stabilizer. In 2023, BASF expanded its carbon black supply contracts with leading plastic manufacturers in Europe to cater to the growing demand in packaging and consumer goods.

- Urbanization and Industrialization: Rapid urbanization and industrialization, particularly in Asia-Pacific, are fueling the demand for carbon black in various sectors. In 2023, China Synthetic Rubber Corporation (CSRC) expanded its production capacity to cater to the rising demand from the automotive and construction industries.

Inquire before buying.

Restraints

- Environmental Regulations: Stringent environmental regulations regarding carbon black production are a significant challenge. In 2023, Orion Engineered Carbons faced fines in Europe for non-compliance with emission standards, highlighting the growing regulatory pressure on manufacturers.

- Competition from Alternative Materials: The rise of alternative materials, such as silica, which can replace carbon black in some applications, poses a threat to the market. In 2023, Michelin increased its use of silica in tire production to reduce environmental impact, potentially reducing demand for carbon black.

- Fluctuating Raw Material Prices: The carbon black market is highly dependent on the price of raw materials like petroleum and natural gas. In 2023, Cabot Corporation reported a 10% increase in production costs due to fluctuating oil prices, affecting its profit margins and pricing strategies.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Carbon Black Market (2018 – 2022) 2.2. Global Carbon Black Market (2023 – 2029) 3. Market Segmentation 3.1. Global Carbon Black Market by Process Type 3.1.1. Furnace Black 3.1.2. Gas Black 3.1.3. Lamp Black 3.1.4. Thermal Black 3.2. Global Carbon Black Market by Application 3.2.1. Tires and Industrial Rubber Products 3.2.2. Plastic 3.2.3. Toners and Printing Inks 3.2.4. Coatings 3.2.5. Textile Fiber 3.2.6. Others 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Colombia 4.2.4. Chile 4.2.5. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Japan 4.3.4. South Korea 4.3.5. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. Italy 4.4.4. France 4.4.5. Spain 4.4.6. Rest of Europe 4.5. The Middle East 4.5.1. Turkey 4.5.2. UAE 4.5.3. Saudi Arabia 4.5.4. Rest of the Middle East 4.6. Africa 4.6.1. Egypt 4.6.2. South Africa 4.6.3. Rest of Africa 5. Value Chain Analysis of the Global Carbon Black Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. Cabot Corp. 9.2. Aditya Birla Group 9.3. Orion Engineered Carbons GmbH 9.4. Jiangxi Black Cat Carbon balck Inc., Ltd. 9.5. Asahi Carbon Co., Ltd. 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Carbon Black Market – FAQs

1. What is the current size of the carbon black market?

Ans. In 2024, the carbon black market size is USD 23,090.01 Mn.

2. Who are the major vendors in the carbon black market?

Ans. The major vendors in the carbon black market are Cabot Corp.; Aditya Birla Group; Orion Engineered Carbons GmbH; Jiangxi Black Cat Carbon black Inc., Ltd.; Asahi Carbon Co., Ltd.

3. Which segments are covered under the carbon black market segments analysis?

Ans. The carbon black market report offers in-depth insights into Process Type, Application, and Geography.