Polyethylene Furanoate (PEF) Market Analysis: Growth, Size, Share & Future Trends (2024-2029)

The market report offers a detailed analysis segmented by Source (Plant Based, Bio-Based); by End Use Industry (Packaging, Fiber & Textile, Electronic & Electrical Components, Automotive Components, Others); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

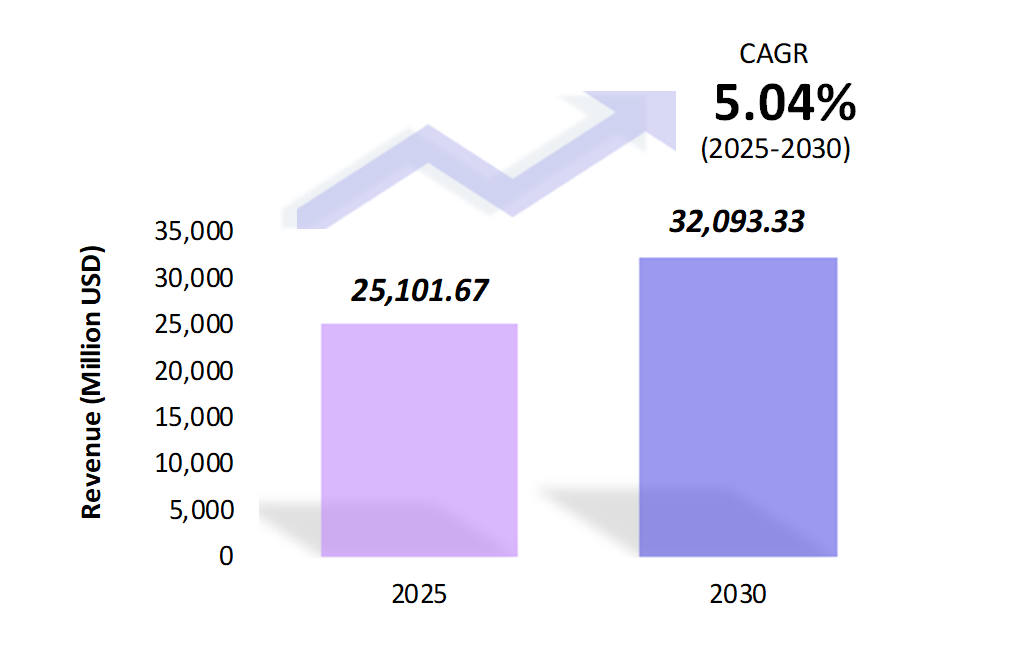

- The polyethylene furanoate (PEF) market is estimated to be at USD 25,101.67 Mn in 2025 and is anticipated to reach USD 32,093.33 Mn in 2030.

- The polyethylene furanoate (PEF) market is registering a CAGR of 5.04% during the forecast period 2025-2030.

- The global polyethylene furanoate (PEF) market’s growth is driven by increased environmental awareness and sustainability demands. PEF’s recyclability and compatibility with the circular economy have positioned it as a material of the future, supporting eco-friendly initiatives across industries, especially food and beverages.

Request a free sample.

Ecosystem

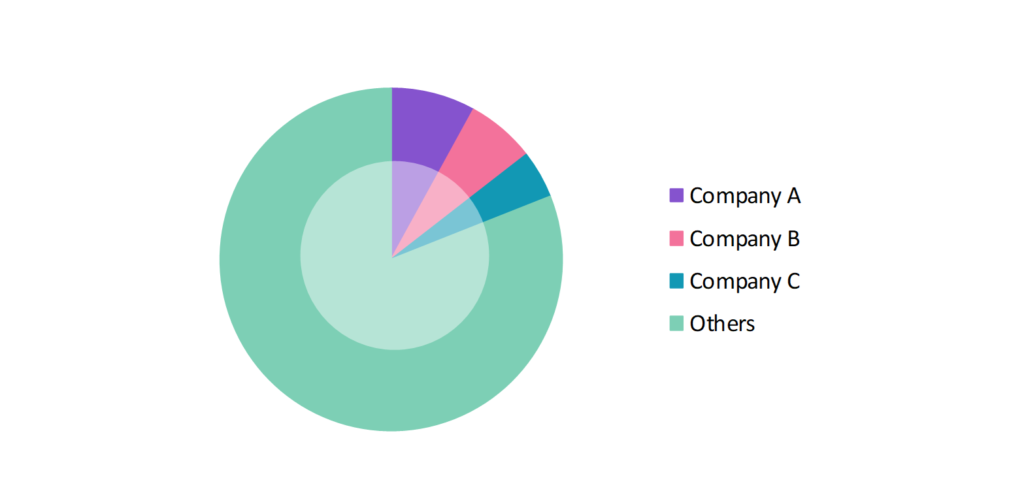

- The participants in the global polyethylene furanoate (PEF) industry are focusing on expanding PEF applications, particularly in packaging, and investing in sustainable packaging solutions.

- These companies focus on R&D to improve the production process and cost-effectiveness, along with partnerships between PEF producers and major consumer brands to maintain a competitive edge in the market.

- Several important entities in the polyethylene furanoate (PEF) market include Avantium N.V.; Sulzer Management Ltd.; AVA Biochem AG; Swicofil AG; Toyobo Co., Ltd.; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2019-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Market Size (2024) | USD 25,101.67 Mn |

| Market Size (2029) | USD 32,093.33 Mn |

| Growth Rate | 5.04% CAGR from 2025 to 2030 |

| Key Segments | Source (Plant Based, Bio-Based); End Use Industry (Packaging, Fiber & Textile, Electronic & Electrical Components, Automotive Components, Others); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | Avantium N.V.; Sulzer Management Ltd.; AVA Biochem AG; Swicofil AG; Toyobo Co., Ltd. |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; China; India; The UK; Germany; Turkey; UAE; Saudi Arabia; South Africa |

| Largest Market | Asia Pacific |

Get a free quote.

Trends

- Focus on Reducing Carbon Footprint: With an increasing emphasis on sustainability, industries are looking for materials with a lower carbon footprint. PEF, being derived from renewable resources, aligns well with global efforts to reduce dependency on fossil fuels and decrease greenhouse gas emissions. In 2023, Danone announced its commitment to incorporate PEF-based packaging into its product lines to reduce the company’s overall carbon emissions.

- Innovation in Barrier Properties: Research is focusing on enhancing the barrier properties of PEF to further improve its use in packaging, particularly in high-end applications where shelf life and product integrity are crucial. Enhanced oxygen and CO2 barrier properties make PEF highly desirable for use in carbonated beverages.

- Shift Towards Bio-Based Materials: Bio-based materials are gaining prominence in industrial development efforts. Polyethylene furanoate (PEF) is emerging as a frontrunner in the pursuit of fully renewable material alternatives. In 2022, Avantium announced its development of a 100% plant-based PEF solution, which could further transform the sustainable packaging industry.

Speak to analyst.

Catalysts

- Government Regulations on Plastic Waste Reduction: Regulatory bodies worldwide are increasingly enforcing laws to reduce plastic waste, particularly single-use plastics. This is pushing companies to adopt bio-based materials like PEF to comply with regulations and reduce environmental impact. In 2023, the European Union introduced stricter packaging regulations, which boosted the demand for PEF-based alternatives.

- Support for Circular Economy Initiatives: PEF’s compatibility with circular economy principles, particularly its recyclability and biodegradability, has driven interest among companies seeking to reduce waste. Organizations committed to zero-waste goals are rapidly adopting PEF-based products. In 2023, Nestlé announced a shift toward using PEF packaging in Europe to align with its zero-waste packaging goals by 2025.

- Adoption by Major Food and Beverage Companies: Global food and beverage companies are adopting PEF for packaging due to its enhanced properties, such as higher durability and recyclability. This has led to substantial demand for PEF in packaging. In 2022, Danone partnered with Avantium to incorporate PEF into its packaging line, focusing on reducing its plastic footprint.

Inquire before buying.

Restraints

- High Production Costs: One of the most significant barriers to widespread PEF adoption is its high production cost, which is considerably higher than conventional PET. Limited raw material availability and costly production processes have hindered its large-scale application.

- Limited Industrial Production Infrastructure: The infrastructure for large-scale PEF production is still underdeveloped compared to traditional plastics like PET. This limits its commercial viability and the ability to meet growing demand. In 2022, BASF highlighted that the global production capacity for PEF remains limited, preventing its full-scale commercial rollout.

- Slow Consumer Acceptance: Despite growing awareness of sustainability, the high cost of PEF-based products can deter consumers, particularly in price-sensitive markets. Until production costs decrease, consumer adoption will likely be slower compared to cheaper alternatives.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Polyethylene Furanoate (PEF) Market (2019 – 2023) 2.2. Global Polyethylene Furanoate (PEF) Market (2024 – 2030) 3. Market Segmentation 3.1. Global Polyethylene Furanoate (PEF) Market by Source 3.1.1. Plant Based 3.1.2. Bio-Based 3.2. Global Polyethylene Furanoate (PEF) Market by End Use Industry 3.2.1. Packaging 3.2.2. Fiber & Textile 3.2.3. Electronic & Electrical Components 3.2.4. Automotive Components 3.2.5. Others 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.4. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. Rest of Europe 4.5. The Middle East 4.5.1. Turkey 4.5.2. UAE 4.5.3. Saudi Arabia 4.5.4. Rest of the Middle East 4.6. Africa 4.6.1. South Africa 4.6.2. Rest of Africa 5. Value Chain Analysis of the Global Polyethylene Furanoate (PEF) Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. Avantium N.V. 9.2. Sulzer Management Ltd. 9.3. AVA Biochem AG 9.4. Swicofil AG 9.5. Toyobo Co., Ltd. 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Polyethylene Furanoate (PEF) Market – FAQs

1. What is the current size of the polyethylene furanoate (PEF) market?

Ans. In 2025, the polyethylene furanoate (PEF) market size is USD 25,101.67 Mn.

2. Who are the major vendors in the polyethylene furanoate (PEF) market?

Ans. The major vendors in the polyethylene furanoate (PEF) market are Avantium N.V.; Sulzer Management Ltd.; AVA Biochem AG; Swicofil AG; Toyobo Co., Ltd.

3. Which segments are covered under the polyethylene furanoate (PEF) market segments analysis?

Ans. The polyethylene furanoate (PEF) market report offers in-depth insights into Source, End Use Industry, and Geography.