Self-Adhesive Labels Market Outlook: Size, Share, Trends & Growth Analysis (2024-2029)

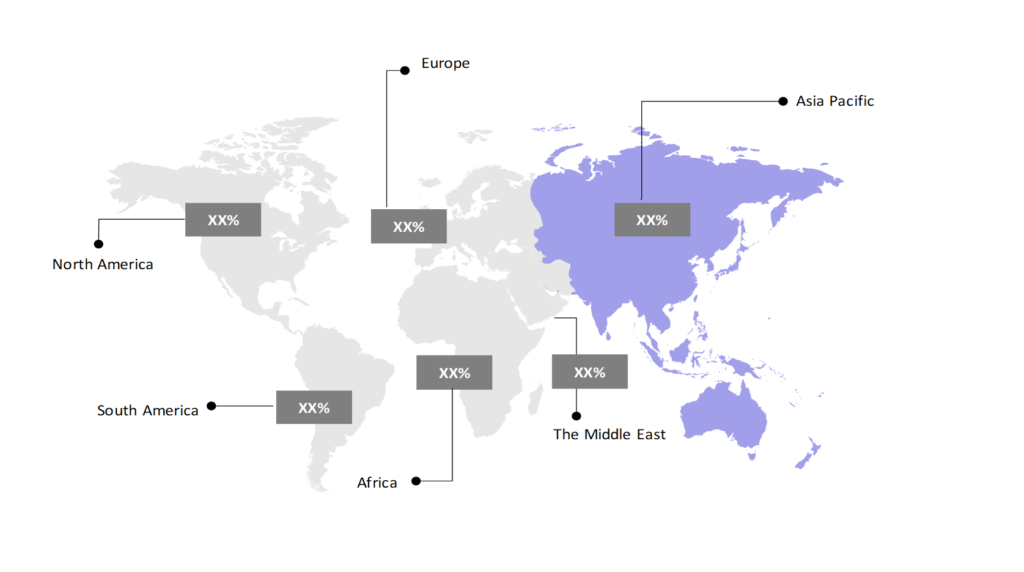

The market report presents a thorough analysis segmented by Nature (Permanent, Removable, Repositionable); by Application (Food & Beverages, Consumer Durables, Pharmaceuticals, E-commerce, Others); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

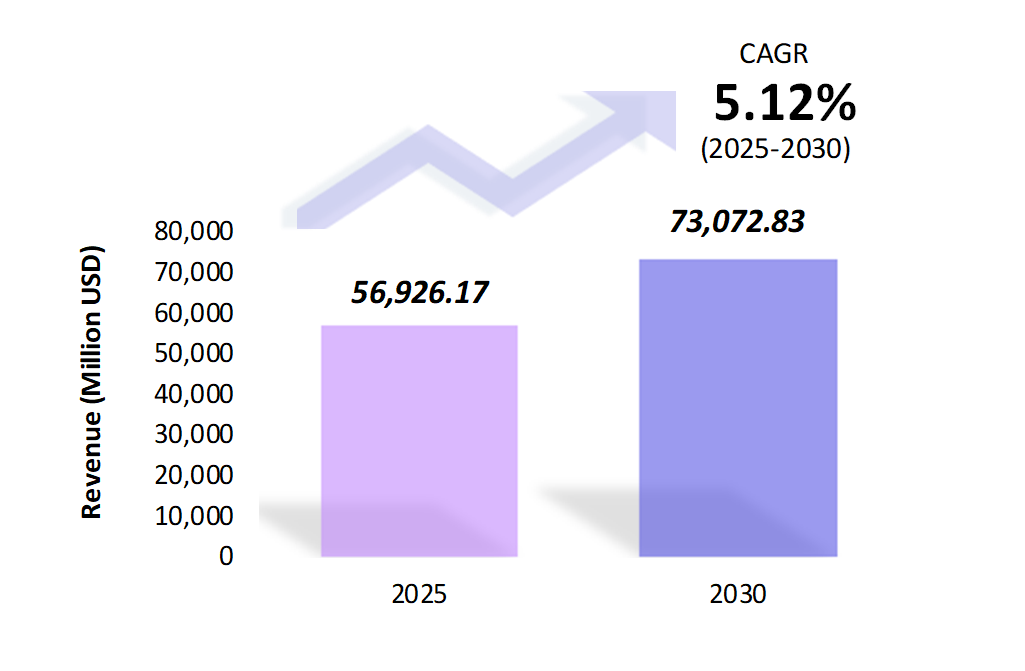

- The self-adhesive labels market is estimated to be at USD 56,926.17 Mn in 2025 and is anticipated to reach USD 73,072.83 Mn in 2030.

- The self-adhesive labels market is registering a CAGR of 5.12% during the forecast period 2025-2030.

- Self-adhesive labels, featuring a built-in adhesive layer, are versatile labeling solutions widely used across industries like food, healthcare, and logistics. The market is growing due to e-commerce expansion, increased focus on branding, and demand for sustainable materials.

Request a free sample.

Ecosystem

- The participants in the global self-adhesive labels industry are focusing on innovations in sustainable materials and expanding their production capacities to meet growing demand.

- These companies primarily focus on investing in digital printing technologies to offer more customized and flexible label solutions, along with collaborations between self-adhesive label manufacturers such as food & beverages and pharmaceuticals to maintain a competitive edge in the market.

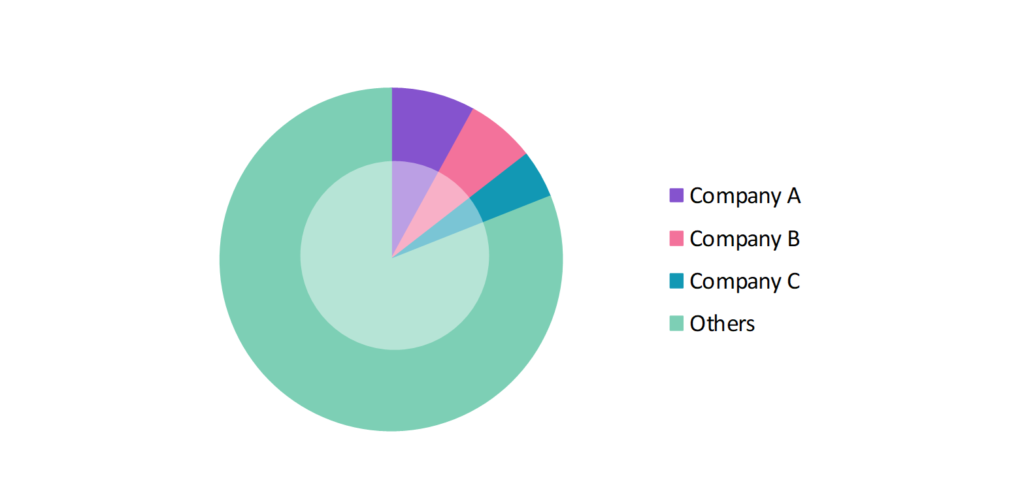

- Several important entities in the self-adhesive labels market include 3M; Asteria Group; CPC Group; Lecta Group Co.; Herma GmbH; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2019-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Market Size (2025) | USD 56,926.17 Mn |

| Market Size (2030) | USD 73,072.83 Mn |

| Growth Rate | 5.12% CAGR from 2025 to 2030 |

| Key Segments | Nature (Permanent, Removable, Repositionable); Application (Food & Beverages, Consumer Durables, Pharmaceuticals, E-commerce, Others); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | 3M; Asteria Group; CPC Group; Lecta Group Co.; Herma GmbH |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; China; India; Japan; South Korea; The UK; Germany; Italy; Turkey; UAE; Saudi Arabia; South Africa |

| Largest Market | Asia Pacific |

Get a free quote.

Trends

- Sustainability in Labeling Materials: With growing environmental concerns, the demand for eco-friendly self-adhesive labels is on the rise. Manufacturers are increasingly focusing on using biodegradable and recyclable materials in their labels, aligning with sustainability goals. In 2023, UPM Raflatac introduced a new range of eco-friendly labels made from recycled materials, targeting the European market, which has stringent environmental regulations.

- Digital Label Printing: Digital printing technologies are being increasingly adopted for self-adhesive labels, allowing for faster production times and more personalized labeling. This trend is particularly relevant in industries like food & beverage, cosmetics, and pharmaceuticals where customized, small-batch label printing is in high demand.

- Smart Labels with Integrated Technology: Self-adhesive labels are evolving beyond traditional uses with the integration of technologies such as QR codes and NFC (near-field communication) chips for product tracking and consumer engagement. These smart labels are increasingly used in logistics, retail, and pharmaceuticals for inventory management and anti-counterfeiting measures.

Speak to analyst.

Catalysts

- Focus on Product Identification: The importance of product branding and identification is driving the demand for high-quality, customizable self-adhesive labels in sectors such as food & beverages, cosmetics, and retail. Labels are used not only for identification but also as a branding tool to enhance shelf appeal. In 2022, Coca-Cola invested in new label designs using self-adhesive labels for a more personalized branding approach in European markets.

- Growing E-commerce Sector: The boom in e-commerce is fueling the demand for self-adhesive labels for packaging and logistics purposes. With millions of packages being shipped daily, the need for reliable labeling solutions for tracking, inventory management, and consumer communication has increased.

- Rising Demand for Sustainable Packaging Solutions: As consumers and businesses push for greener packaging solutions, self-adhesive labels made from recycled or biodegradable materials are gaining traction. Companies are opting for labels that align with their sustainability goals and contribute to reduced environmental impact. In 2023, Procter & Gamble shifted to using self-adhesive labels made from recycled materials for its household cleaning products in North America.

Inquire before buying.

Restraints

- Waste Management Issues: Despite the push for sustainability, managing waste from self-adhesive labels, especially release liners, poses a challenge. Release liners, used to protect the adhesive layer, often end up as non-recyclable waste, contributing to environmental concerns. In 2023, Avery Dennison acknowledged challenges in reducing release liner waste, highlighting the need for more sustainable linerless label solutions.

- Limited Adoption in Developing Markets: Adoption of self-adhesive labels in developing regions is limited due to factors like high production costs, a lack of advanced printing infrastructure, and limited awareness of the benefits of these labels. This restricts market growth in regions like Africa and parts of South Asia. In 2023, Kenya reported slow uptake of self-adhesive labels in its industrial sector due to high import costs and limited local production capabilities.

- High Raw Material Costs: The rising cost of raw materials, such as paper, plastic, and adhesives, is a significant challenge for the self-adhesive labels market. These increased costs have led to higher production expenses, putting pressure on manufacturers to maintain profitability.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Self-Adhesive Labels Market (2019 – 2023) 2.2. Global Self-Adhesive Labels Market (2024 – 2030) 3. Market Segmentation 3.1. Global Self-Adhesive Labels Market by Nature 3.1.1. Permanent 3.1.2. Removable 3.1.3. Repositionable 3.2. Global Self-Adhesive Labels Market by Application 3.2.1. Food & Beverages 3.2.2. Consumer Durables 3.2.3. Pharmaceuticals 3.2.4. E-commerce 3.2.5. Others 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Japan 4.3.4. South Korea 4.3.5. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. Italy 4.4.4. Rest of Europe 4.5. The Middle East 4.5.1. Turkey 4.5.2. UAE 4.5.3. Saudi Arabia 4.5.4. Rest of the Middle East 4.6. Africa 4.6.1. South Africa 4.6.2. Rest of Africa 5. Value Chain Analysis of the Global Self-Adhesive Labels Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. 3M 9.2. Asteria Group 9.3. CPC Group 9.4. Lecta Group Co. 9.5. Herma GmbH 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Self-Adhesive Labels Market – FAQs

1. What is the current size of the self-adhesive labels market?

Ans. In 2025, the self-adhesive labels market size is USD 56,926.17 Mn.

2. Who are the major vendors in the self-adhesive labels market?

Ans. The major vendors in the self-adhesive labels market are 3M; Asteria Group; CPC Group; Lecta Group Co.; Herma GmbH.

3. Which segments are covered under the self-adhesive labels market segments analysis?

Ans. The self-adhesive labels market report offers in-depth insights into Nature, Application, and Geography.