Oil And Gas Pumps Market Insights: Size, Share, Growth Analysis & Forecast (2024-2029)

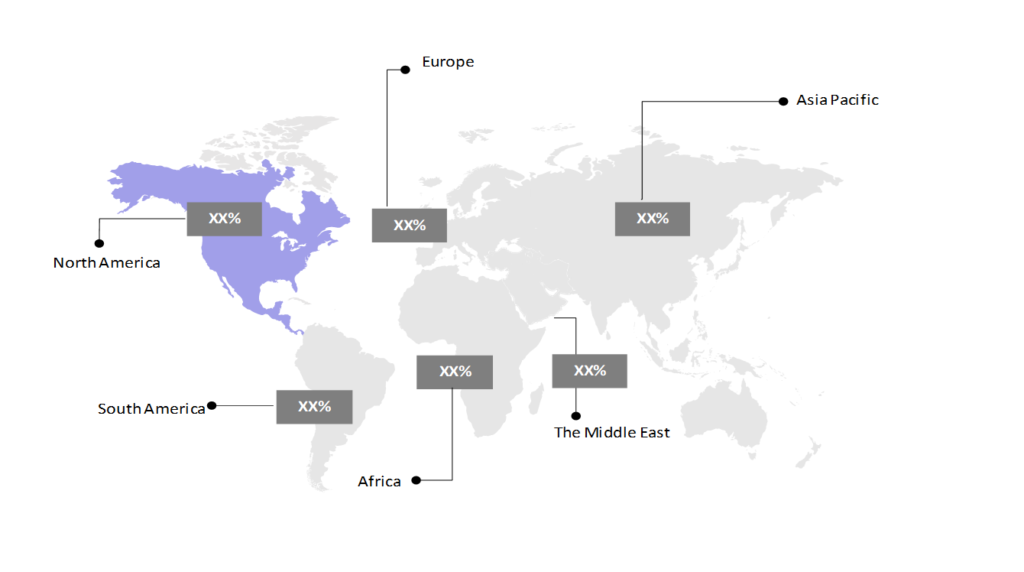

The market report provided a comprehensive analysis segmented by Pump Type (Centrifugal Pumps, Positive Displacement Pumps, Others); by Application (Upstream, Midstream, Downstream); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

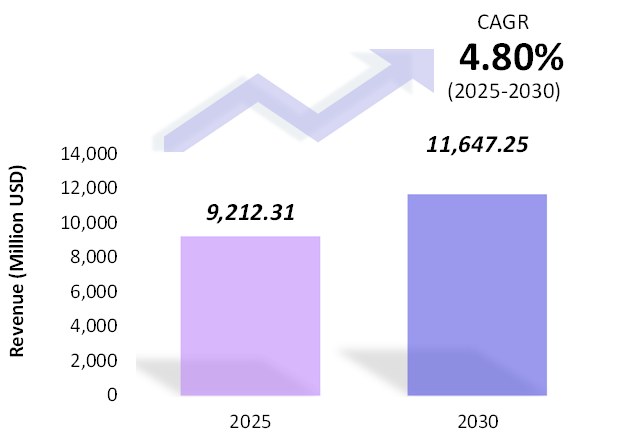

- The oil and gas pumps market is estimated to be at USD 9,212.31 Mn in 2025 and is anticipated to reach USD 11,647.25 Mn in 2030.

- The oil and gas pumps market is registering a CAGR of 4.8% during the forecast period 2025-2030.

- The oil and gas pump market is fueled by the expansion of shale extraction, LNG terminal construction, and the rising global demand for oil and gas. Despite challenges from volatile oil prices and increasing renewable energy adoption, continued investment in advanced technologies like smart pumps and energy-efficient systems sustains market growth.

Request a free sample.

Ecosystem

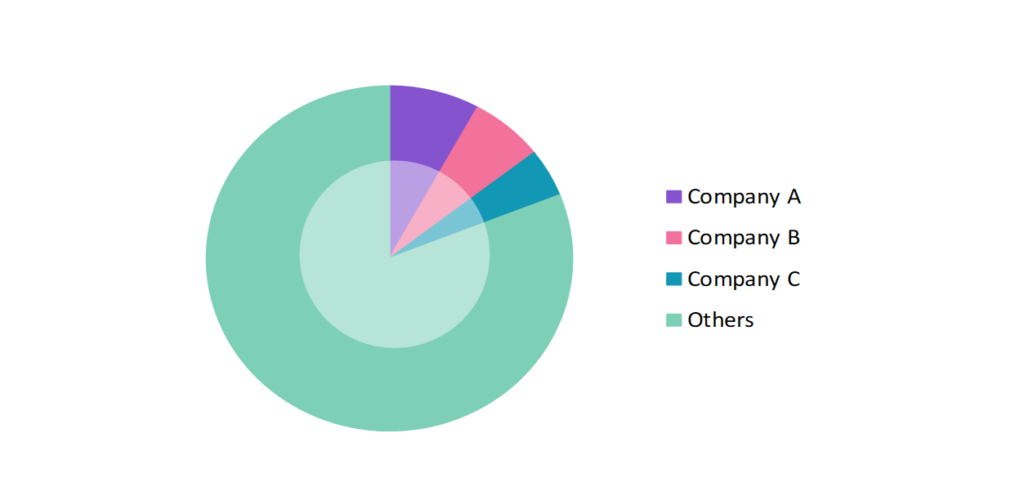

- The participants in the global oil and gas pump industry are always developing their strategies to preserve a competitive advantage.

- Companies are increasingly investing in smart pumps and Internet of Things (IoT) enabled systems to improve operational efficiency, gaining a competitive edge through advanced features like real-time monitoring and predictive maintenance.

- Several important entities in the oil and gas pumps market include Atlas Copco Group; Flowserve Corp.; Sulzer Ltd.; KSB Group; Nikkiso Co., Ltd.; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2019-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Market Size (2025) | USD 9,212.31 Mn |

| Market Size (2030) | USD 11,647.25 Mn |

| Growth Rate | 4.8% CAGR from 2025 to 2030 |

| Key Segments | Pump Type (Centrifugal Pumps, Positive Displacement Pumps, Others); Application (Upstream, Midstream, Downstream); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | Atlas Copco Group; Flowserve Corp.; Sulzer Ltd.; KSB Group; Nikkiso Co., Ltd. |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; China; India; The UK; Germany; Turkey; UAE; Saudi Arabia; Egypt; South Africa |

| Largest Market | North America |

Get a free quote.

Trends

- Smart Pumping Systems: Integration of Internet of Things (IoT) technology enables real-time monitoring and predictive maintenance. Sensors embedded in pumps track performance metrics, reducing downtime by alerting operators of potential failures before they occur. For instance, Siemens introduced smart pumps capable of adjusting flow rates automatically to optimize energy consumption.

- Energy-Efficient Pumps: New pump designs prioritize energy conservation, often using variable frequency drives (VFDs) that adjust pump speed to match demand. The Sulzer company developed advanced centrifugal pumps that reduce energy usage, which makes operations more sustainable.

- Corrosion-Resistant Materials: Pumps made from advanced materials like duplex stainless steel and non-metallic components are gaining popularity due to their ability to withstand harsh chemicals and abrasive environments. The Flowserve company is using these materials to extend pump life in corrosive applications, which reduces maintenance needs.

Speak to analyst.

Catalysts

- Continuous Shale Development Activities: Ongoing shale extraction efforts, especially in regions like North America, are driving demand for pumps capable of handling high-pressure environments. The rise in hydraulic fracturing and horizontal drilling necessitates advanced pumps for efficient oil and gas recovery. For instance, Halliburton deployed advanced fracturing pumps in the Permian Basin, enhancing oil extraction through high-pressure fracking operations. These developments highlight the critical role of pumps in maximizing output from shale reserves.

- Rapid Expansion of Gas Terminals: The global construction of new liquefied natural gas (LNG) terminals to meet the increasing demand for gas export and import facilities is boosting the need for specialized pumps. These terminals require cryogenic pumps designed to handle LNG at extremely low temperatures. The expansion of the Qatar LNG terminal in 2023 involved the installation of advanced cryogenic pumps from Cryostar to manage LNG transfer efficiently. This demonstrates the critical need for specialized pumps in large-scale LNG infrastructure projects.

- Increased Global Demand for Oil: Rising global energy consumption, especially in emerging economies, is fueling demand for oil and gas. This drives the need for reliable and high-capacity pumps to ensure efficient transportation, extraction, and refining of petroleum products to meet market requirements.

Inquire before buying.

Restraints

- High Competition and Volatile Crude Oil Prices: Intense competition among pump manufacturers, combined with fluctuating crude oil prices, creates uncertainty in demand. Price volatility affects capital investments in oil and gas projects, which leads to unpredictable pump procurement cycles.

- Difficulties in Reducing Delivery/Lead Time: Supply chain disruptions and complex manufacturing processes make it challenging for pump manufacturers to reduce delivery and lead times. Delays in component availability and logistical bottlenecks can slow down project timelines, which impacts customer satisfaction.

- Increasing Focus on the Use of Renewable Energy: The global shift toward renewable energy sources is putting pressure on the oil and gas industry. As governments and companies invest in cleaner energy alternatives, demand for oil and gas-related infrastructure, including pumps, faces long-term challenges.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Oil and Gas Pumps Market (2019 – 2023) 2.2. Global Oil and Gas Pumps Market (2024 – 2030) 3. Market Segmentation 3.1. Global Oil and Gas Pumps Market by Pump Type 3.1.1. Centrifugal Pumps 3.1.2. Positive Displacement Pumps 3.1.3. Others 3.2. Global Oil and Gas Pumps Market by Application 3.2.1. Upstream 3.2.2. Midstream 3.2.3. Downstream 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. Rest of Europe 4.5. The Middle East 4.5.1. Turkey 4.5.2. UAE 4.5.3. Rest of the Middle East 4.6. Africa 4.6.1. Egypt 4.6.2. South Africa 4.6.3. Rest of Africa 5. Value Chain Analysis of the Global Oil and Gas Pumps Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. Atlas Copco Group 9.2. Flowserve Corp. 9.3. Sulzer Ltd. 9.4. KSB Group 9.5. Nikkiso Co., Ltd. 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Oil and Gas Pumps Market – FAQs

1. What is the current size of the oil and gas pumps market?

Ans. In 2025, the oil and gas pumps market size is USD 9,212.31 Mn.

2. Who are the major vendors in the oil and gas pumps market?

Ans. The major vendors in the oil and gas pumps market are Atlas Copco Group; Flowserve Corp.; Sulzer Ltd.; KSB Group; Nikkiso Co., Ltd.

3. Which segments are covered under the oil and gas pumps market segments analysis?

Ans. The oil and gas pumps market report offers in-depth insights into Pump Type, Application, and Geography.