Switchgear Market Analysis: Growth, Size, Share & Future Trends (2024-2029)

The market report offers a detailed analysis segmented by Insulation Type (Air Insulated, Gas Insulated, Others); by End User (Transmission & Distribution Utilities, Industries, Commercial & Residential, Others); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

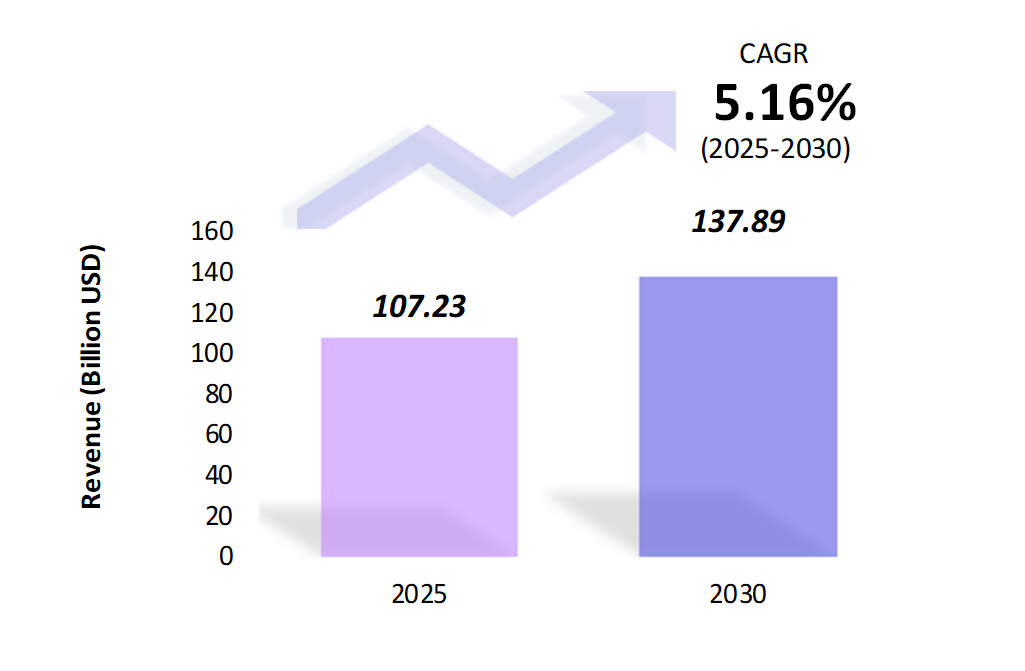

- The switchgear market is estimated to be at USD 107.23 Bn in 2025 and is anticipated to reach USD 137.89 Bn in 2030.

- The switchgear market is registering a CAGR of 5.16% during the forecast period 2025-2030.

- The global switchgear market is critical in the electrical distribution systems used across industries, utilities, and residential sectors. The market is expanding due to rising energy demand, industrial automation, and infrastructure development.

Request a free sample.

Ecosystem

- Participants in the global switchgear industry are continuously developing strategies to preserve a competitive advantage.

- These companies focus on smart grids and digitalization, innovative switchgear solutions, acquisitions, R&D, partnerships, and technological launches.

- Several important entities in the switchgear market include ABB Group; General Electric Co.; Siemens AG; Schneider Electric; Mitsubishi Electric Group; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2019-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Market Size (2025) | USD 107.23 Bn |

| Market Size (2030) | USD 137.89 Bn |

| Growth Rate | 5.16% CAGR from 2025 to 2030 |

| Key Segments | Insulation Type (Air Insulated, Gas Insulated, Others); End User (Transmission & Distribution Utilities, Industries, Commercial & Residential, Others); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | ABB Group; General Electric Co.; Siemens AG; Schneider Electric; Mitsubishi Electric Group |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; Colombia; China; India; Japan; The UK; Germany; France; UAE; Saudi Arabia; South Africa; Ghana |

| Largest Market | Asia Pacific |

Get a free quote.

Trends

- Integration of Smart Grids: The integration of smart grids drives the adoption of advanced switchgear systems. These systems are embedded with digital components for remote monitoring, automation, and enhanced efficiency. In 2022, ABB introduced smart switchgear, enabling real-time data collection and predictive maintenance for better energy management.

- Focus on Eco-friendly Solutions: There is an emphasis on reducing the environmental impact of switchgear, especially in terms of the gases used for insulation. SF6-free switchgear, which reduces greenhouse gas emissions, is increasingly being emphasized. In 2023, GE launched its “Green Gas for Grid” (g3) switchgear, which uses eco-friendly alternatives to SF6.

- Incorporation of IoT in Switchgear: The incorporation of the Internet of Things in Switchgear enables advanced analytics to monitor performance metrics and detect anomalies, enhancing operational efficiency. These smart systems can also integrate with other networked devices, allowing for automated fault detection and quicker response times, ultimately improving system reliability.

Speak to analyst.

Catalysts

- Increasing Industrial Automation and Electrification: As industries adopt automation and electrification to enhance productivity, the demand for switchgear systems is increasing. Switchgear is crucial for ensuring safety and reliability in sectors like manufacturing, oil & gas, and utilities.

- Expansion of Infrastructure Projects: The push for sustainable infrastructure, particularly in smart cities, is driving the need for efficient energy management solutions, such as switchgear systems, to support advanced technologies. Moreover, expanding transportation networks requires robust power distribution to handle increased electrical demands and facilitate the integration of electric vehicles and smart grid solutions.

- Government Initiatives for Grid Modernization: Governments worldwide are investing in modernizing their electrical grids to improve efficiency and reliability. These initiatives often include upgrades to existing switchgear systems. In 2023, the U.S. Department of Energy announced plans to invest in modern grid technologies, including switchgear upgrades, as part of its clean energy push.

Inquire before buying.

Restraints

- High Installation and Maintenance Costs: The installation and maintenance of advanced switchgear systems in remote or industrial locations are costly due to logistical challenges and specialized labor. Smaller utility companies also struggle with the financial burden of upgrading to modern digital switchgear, which exceeds their budgetary constraints despite its efficiency and monitoring benefits.

- Complexities in Retrofitting Existing Systems: Retrofitting outdated electrical infrastructure with modern switchgear systems poses significant technical and financial challenges, particularly in developing regions where many industries still depend on legacy systems. These upgrades often require extensive planning, skilled labor, and investment, complicating the transition to more efficient and reliable power management solutions.

- Environmental Regulations on SF6 Emissions: SF6 gas, commonly used for insulation in switchgear, has been identified as a potent greenhouse gas, prompting stricter regulations. Manufacturers are under pressure to develop alternatives, which can be costly and time-consuming. In 2023, Europe introduced regulations more stringent on SF6 usage, pushing manufacturers to transition to eco-friendly options.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Switchgear Market (2019 – 2023) 2.2. Global Switchgear Market (2024 – 2030) 3. Market Segmentation 3.1. Global Switchgear Market by Insulation Type 3.1.1. Air Insulated 3.1.2. Gas Insulated 3.1.3. Others 3.2. Global Switchgear Market by End User 3.2.1. Transmission & Distribution Utilities 3.2.2. Industries 3.2.3. Commercial & Residential 3.2.4. Others 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Colombia 4.2.4. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Japan 4.3.4. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. France 4.4.4. Rest of Europe 4.5. The Middle East 4.5.1. UAE 4.5.2. Saudi Arabia 4.5.3. Rest of the Middle East 4.6. Africa 4.6.1. South Africa 4.6.2. Ghana 4.6.3. Rest of Africa 5. Value Chain Analysis of the Global Switchgear Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. ABB Group 9.2. General Electric Co. 9.3. Siemens AG 9.4. Schneider Electric 9.5. Mitsubishi Electric Group 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Switchgear Market – FAQs

1. What is the current size of the switchgear market?

Ans. In 2025, the switchgear market size is USD 107.23 Bn.

2. Who are the major vendors in the switchgear market?

Ans. The major vendors in the switchgear market are ABB Group; General Electric Co.; Siemens AG; Schneider Electric; Mitsubishi Electric Group.

3. Which segments are covered under the switchgear market segments analysis?

Ans. The switchgear market report offers in-depth insights into Insulation Type, End User, and Geography.