Middle East Anti-Money Laundering (AML) Market: Size, Share, Trends & Forecast (2024-2029)

The report covers a comprehensive analysis segmented by Component (Services, Solutions), By Deployment Mode (On-Premises, Cloud), By Organization Size (Large Enterprises, Small Enterprises), By End User (Banking & Financials Institutions, Insurance, Gaming & Gambling, Government, Others), By Geography (Turkey, UAE, Saudi Arabia, Rest of the Middle East).

Anti-Money Laundering (AML) Market Snapshot

Anti-Money Laundering (AML) Market Overview

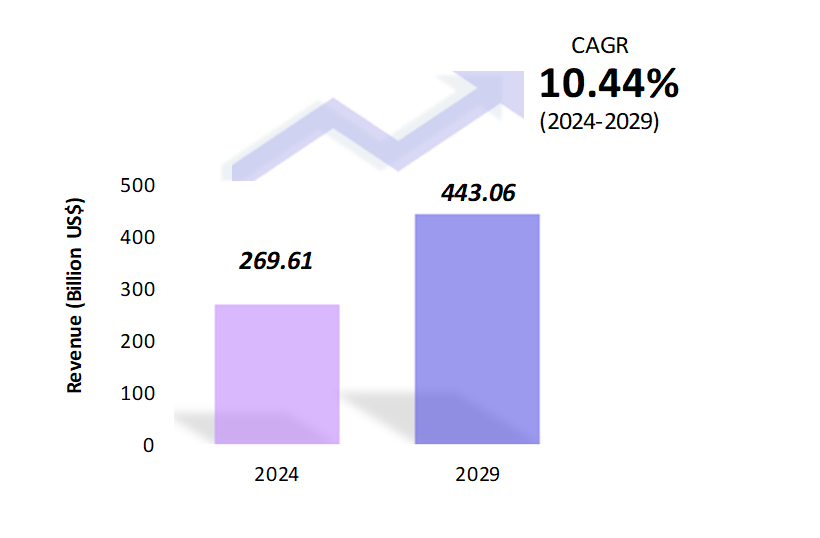

The anti-money laundering market in the Middle East is estimated to be at $269.61 Mn in 2024 and is anticipated to reach $443.06 Mn in 2029. The global anti-money laundering market is registering a CAGR of 10.44% during the forecast period 2024-2029.

The Middle East’s Anti-Money Laundering (AML) market is expanding rapidly due to greater governmental oversight, technical breakthroughs, and the expansion of the region’s financial industry. Effective AML solutions are now critical since the Middle East is a major region in the global banking sector and a hub for cross-border activities. The Middle Eastern AML landscape is largely shaped by regulatory mandates. To combat financial crime and comply with international standards set by groups such as the Financial Action Task Force (FATF), governments throughout the area are implementing strict anti-money laundering laws and regulations.

These rules necessitate that financial institutions and businesses set up robust AML compliance systems, which increases the demand for AML services and solutions. The Middle Eastern AML market is changing thanks to technological improvements. The use of blockchain, artificial intelligence, machine learning, and big data analytics solutions is growing to improve money laundering detection and prevention. These technologies provide more advanced and effective ways to keep an eye on transactions, spot suspicious patterns, and reduce the dangers related to financial crime. The demand for AML solutions is also fueled by the Middle East’s developing financial industry and overall economic growth and development. Financial institutions and enterprises are investing in comprehensive AML strategies and technologies to protect their operations from illicit financial activity and to preserve regulatory compliance. Taking everything into account, the Middle Eastern AML market is expected to keep expanding as the region’s financial landscape changes, regulatory demands get more intense, and technological advancements progress.

Anti-Money Laundering (AML) Market Coverage

| Historical & Forecast Period | 2018-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units | Million US$ |

| Segments | Component, Deployment Mode, Organization Size, End User |

| Geographies | Turkey, UAE, Saudi Arabia, Rest of the Middle East. |

| Key Vendors |

Accenture plc, Oracle Corp., IBM Middle East FZ LLC, Experian Information Solutions, Inc., SAS Institute Inc. |

Porter’s 5 Forces Analysis of Anti-Money Laundering (AML) Market

Anti-Money Laundering (AML) Market Trends

The Middle East’s anti-money laundering (AML) sector has grown significantly in recent years due to several important trends and reasons. The Middle East has been fortifying its regulatory structure to counteract the financing of terrorism and money laundering. Governments have started enforcing strict anti-money laundering laws in line with global guidelines established by organizations such as the Financial Action Task Force (FATF). Advanced technologies like blockchain, big data analytics, machine learning, and artificial intelligence are becoming more and more popular. The market is growing because these technologies provide more advanced means of identifying and stopping money laundering operations. The region’s economic development and expansion have resulted in a rise in financial activities. Strong AML solutions are now more important than ever to reduce the risk of illegal financial activity.

Middle Eastern nations are working more closely with their foreign counterparts to improve their AML capacities. In the fight against international money laundering networks, increased collaboration and information exchange are essential. Businesses, including financial institutions, are under increasing pressure to adhere to AML laws. As a result, there is an increasing need for AML compliance services and solutions, such as reporting, risk assessment, due diligence, and transaction monitoring. AML compliance now faces additional difficulties as a result of the fintech industry’s and digital payment services’ explosive growth in the area.

Because of this, there is an increasing demand for Anti-Money Laundering solutions that are specifically designed to address the dangers connected to digital financial services. Overall, the anti-money laundering market in the Middle East is poised for continued growth, driven by regulatory mandates, technological advancements, and increasing awareness of financial crime risks.

Anti-Money Laundering (AML) Market Driving Factors

Multiple major factors impact the growth and dynamics of the Middle Eastern Anti-Money Laundering (AML) market. Organizations are investing in creative anti-money laundering (AML) solutions because of the increased effectiveness of money laundering detection and prevention made possible by the adoption of inventive technology like artificial intelligence, machine learning, and big data analytics. As a result of the Middle East’s growing economic integration with the rest of the world, there is a greater demand for strong anti-money laundering (AML) regulations to counteract the financing of terrorism and other illegal activities.

The growing financial industry in the area, together with economic growth and an increase in investment activity, highlights the significance of AML compliance in preventing financial crime and upholding regulatory compliance. Cybersecurity threats present serious obstacles to AML efforts due to the widespread use of digital banking and online transactions. This has led to the adoption of cybersecurity-integrated AML solutions, which help reduce the risks associated with money laundering schemes that use cyberspace to launder money.

Anti-Money Laundering (AML) Market Challenges

Since the Middle East is home to several nations with disparate legal systems, it is difficult to harmonize and standardize anti-money laundering compliance throughout the area. The implementation of strong anti-money laundering (AML) measures is impeded by the lack of resources and competence in many Middle Eastern organizations, especially smaller financial institutions, and corporations. Detection and prevention efforts are hampered by the way criminal networks constantly change and modify their strategies to get around AML regulations. Traditional AML techniques are severely challenged by intricate money laundering schemes combining cryptocurrency, trade-based laundering, and shell corporations.

While effective information sharing and collaboration in the region can be hampered by geopolitical conflicts and variations in legal systems, cooperation among nations is crucial in the fight against transnational money laundering. As technology gets better, recent problems like the wrong use of cryptocurrencies and ways to hide what you are doing come up. But at the same time, these technologies can also help us do a better job to stop money laundering. This means we need to produce new ideas and be ready to change the way we fight money laundering. To meet these problems and remain ahead of the ever-evolving financial crime risks, governments, regulatory agencies, financial institutions, and technology providers must work together more closely, invest in resources and knowledge, and use creative problem-solving techniques.

Anti-Money Laundering (AML) Market – Key Industry News

- In October 2023, Nymcard, a financial service company in the Middle East and Africa, has enhanced its fraud platform with ACI Fraud Management to better protect its customers from the growing threat of financial fraud.

- In August 2023, Sadu Capital, a venture capital company, has chosen Apex Group Ltd. a financial solution provider, to handle its fund administration and help with preventing money laundering.

- In February 2024, The United Arab Emirates (UAE) has been removed from the list of countries with concerns about money laundering. A report from the Financial Action Task Force (FATF) has recommended that the UAE be removed from the list of countries that need close monitoring. This decision has occurred at a meeting of the FATF members in Paris.

Anti-Money Laundering (AML) Market Competitive Landscape

The participants in the anti-money laundering industry are always developing their strategies to preserve a competitive advantage. Companies are focusing on developing advanced AML solutions to effectively combat financial crimes. Major players in the market are investing significantly in research and development activities to enhance their product offerings and stay ahead of the competition. Several important entities in the anti-money laundering market include Accenture plc, Oracle Corp., IBM Middle East FZ LLC, Experian Information Solutions, Inc., SAS Institute Inc., and others.

Additionally, partnerships, collaborations, and strategic alliances are being formed among key players to leverage each other’s strengths and broaden their customer base. Regulatory compliance and adherence to stringent AML laws are driving the demand for comprehensive AML solutions in the region. With increasing awareness about the importance of preventing money laundering activities, the competitive landscape in the Middle East AML market is expected to remain dynamic, with players continuously innovating and adapting to evolving market needs.

Anti-Money Laundering (AML) Market – Key Companies

Reason to Buy from us

Table of Contents

| 1. Introduction |

|---|

| 1.1. Research Methodology |

| 1.2. Scope of the Study |

| 2. Market Overview / Executive Summary |

| 2.1. Anti-Money Laundering (AML) Market in the Middle East (2018 – 2022) |

| 2.2. Anti-Money Laundering (AML) Market in the Middle East (2023 – 2029) |

| 3. Market Segmentation |

| 3.1. Anti-Money Laundering (AML) Market in the Middle East by Component |

| 3.1.1. Services |

| 3.1.2. Solutions |

| 3.2. Anti-Money Laundering (AML) Market in the Middle East by Deployment Mode |

| 3.2.1. On Premises |

| 3.2.2. Cloud |

| 3.3. Anti-Money Laundering (AML) Market in the Middle East by Organization Size |

| 3.3.1. Large Enterprises |

| 3.3.2. Small Enterprises |

| 3.4. Anti-Money Laundering Market (AML) in the Middle East by End User |

| 3.4.1. Banking & Financials Institutions |

| 3.4.2. Insurance |

| 3.4.3. Gaming & Gambling |

| 3.4.4. Government |

| 3.4.5. Others |

| 4. Regional Segmentation |

| 4.1. Turkey |

| 4.2. UAE |

| 4.3. Saudi Arabia |

| 4.4. Rest of the Middle East |

| 5. Value Chain Analysis of the Anti-Money Laundering (AML) Market in the Middle East |

| 6. Porter Five Forces Analysis |

| 6.1. Threats of New Entrants |

| 6.2. Threats of Substitutes |

| 6.3. Bargaining Power of Buyers |

| 6.4. Bargaining Power of Suppliers |

| 6.5. Competition in the Industry |

| 7. Trends, Drivers and Challenges Analysis |

| 7.1. Market Trends |

| 7.1.1. Market Trend 1 |

| 7.1.2. Market Trend 2 |

| 7.1.3. Market Trend 3 |

| 7.1.4. Market Trend 4 |

| 7.1.5. Market Trend 5 |

| 7.2. Market Drivers |

| 7.2.1. Market Driver 1 |

| 7.2.2. Market Driver 2 |

| 7.2.3. Market Driver 3 |

| 7.2.4. Market Driver 4 |

| 7.2.5. Market Driver 5 |

| 7.3. Market Challenges |

| 7.3.1. Market Challenge 1 |

| 7.3.2. Market Challenge 2 |

| 7.3.3. Market Challenge 3 |

| 7.3.4. Market Challenge 4 |

| 7.3.5. Market Challenge 5 |

| 8. Regulatory Landscape |

| 9. Competitive Landscape |

| 9.1. Accenture plc |

| 9.2. Oracle Corp. |

| 9.3. IBM Middle East FZ LLC |

| 9.4. Experian Information Solutions, Inc. |

| 9.5. SAS Institute Inc. |

| 9.6. Company 6 |

| 9.7. Company 7 |

| 9.8. Company 8 |

| 9.9. Company 9 |

| 9.10. Company 10 |

Anti-Money Laundering Market – Frequently Asked Questions (FAQs)

What is the current size of the anti-money laundering (AML) market in the Middle East?

The market size for the anti-money laundering market in the Middle East in 2024 is $269.61 Mn.

Who are the major vendors in the anti-money laundering (AML) market in the Middle East?

The major vendors in the anti-money laundering market in the Middle East are Accenture plc, Oracle Corp., IBM Middle East FZ LLC, Experian Information Solutions, Inc., SAS Institute Inc.

Which segments are covered under the anti-money laundering (AML) market in the Middle East segments analysis?

This report offers in-depth insights into each component, deployment mode, organization size, end user.