Digital Payments Market: Size, Share, Trends & Forecast (2024-2029)

The report covers a comprehensive analysis segmented by Offering Solutions (Payment Processor, Payment Gateway, Payment Wallet, POS Solution), by Services (Professional, Managed), by Transaction Model (Domestic, Cross Border), by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

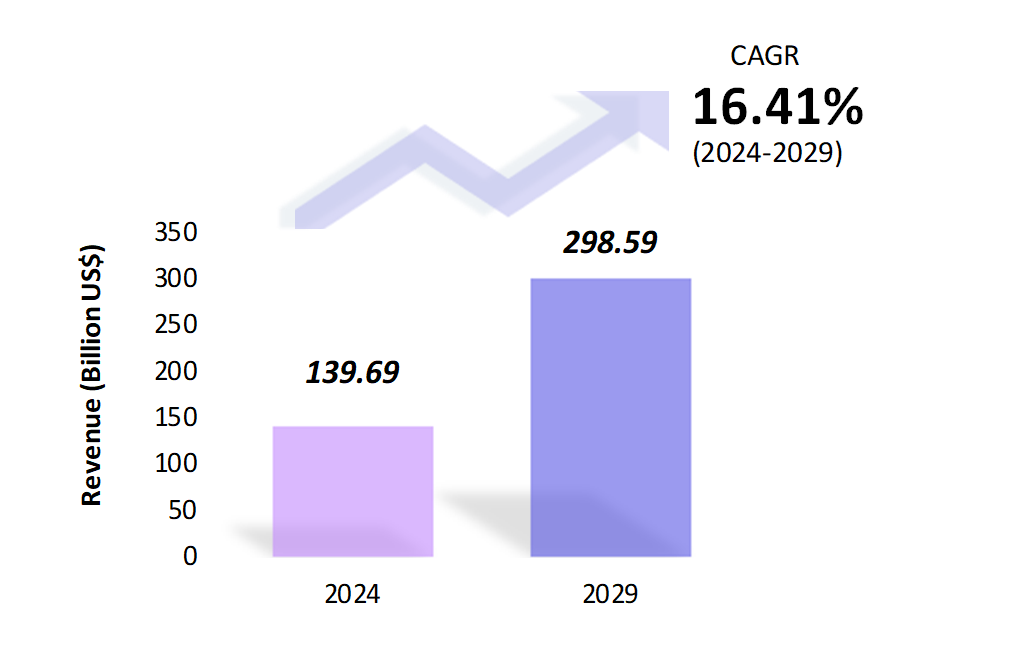

Digital Payments Market Snapshot

Digital Payments Market Overview

The global digital payments market is estimated to be at $139.69 Bn in 2024 and is anticipated to reach $298.59 Bn in 2029. The global digital payments market is registering a CAGR of 16.41% during the forecast period 2024-2029. Digital payment refers to transactions made through electronic means, eliminating the need for physical cash. This includes various methods like online banking, mobile payments, contactless cards, and e-wallets. Digital payments offer numerous advantages including convenience, speed, and enhanced security features compared to traditional cash transactions. Whether buying for goods and services online, sending money to others, or even paying bills using apps and websites, users can conduct transactions at any time and from any location. Digital technologies and internet connectivity make these transactions possible, guaranteeing quick and easy swaps.

The digital payment market is a vast and dynamic ecosystem that includes a wide range of participants, from traditional banks and financial institutions to fintech companies and technology giants. This market encompasses various payment platforms and services, such as mobile wallets, peer-to-peer payment applications, and digital banking solutions. For instance, consumers can use their smartphones to make purchases with mobile wallets like Apple Pay, Google Pay, and Samsung Pay, which easily integrate with other online services and apps. Users can send money directly to one another via peer-to-peer payment apps like Venmo and Cash App, which offer a practical substitute for cash and cheques.

Additionally, digital payment methods have become integral to the operations of various sectors, including retail, e-commerce, transportation, and even public services. For example, contactless payment techniques have been implemented by public transportation systems in major cities such as New York and London, enabling commuters to pay for their fares with contactless cards or mobile phones. The fact that digital payment methods are so widely used demonstrates their adaptability and importance in contemporary economies.

Digital Payments Market Coverage

| Historical & Forecast Period | 2018-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units | Billion US$ |

| Segments | Offering Solutions, Services, Transaction Model |

| Geographies | North America, South America, Asia Pacific, Europe, The Middle East, Africa |

| Key Vendors | PayPal Payments Pvt. Ltd., Square Capital, LLC, Stripe, Inc., Dreamplug Technologies Pvt. Ltd., ACI Worldwide, Inc. |

Key Geographies of Digital Payments Market, 2023

Porter’s 5 Forces Analysis of Digital Payments Market

Digital Payments Market Trends

The rapid adoption of biometric authentication methods, for instance, in 2024, Apple Pay and Google Pay integrated facial recognition and fingerprint scanning technologies to enhance security and user convenience. The banking industry is also witnessing this trend, as institutions such as HSBC are introducing mobile banking apps and biometric-enabled ATMs. The increased use of biometric authentication is not only boosting security but also improving the overall user experience by providing faster and more reliable payment methods.

With the introduction of payment tools that let users transfer money directly within the app, social media platforms like WhatsApp were able to integrate digital payment systems. Because of the app’s widespread use and ease, WhatsApp Pay has acquired tremendous popularity in areas like India. Similarly, by integrating payment features into their social networks and streamlining user transactions, WeChat Pay and Alipay in China have set the bar high. Through the usage of social media platforms’ large user bases, these integrations are increasing engagement and transaction volumes.

Additionally, the rise of contactless payments has been a significant trend, especially accelerated by the COVID-19 pandemic. Contactless payment methods, including NFC-enabled cards and mobile wallets, have seen a substantial increase in usage as consumers and businesses seek safer transaction methods. Retailers globally are upgrading their point-of-sale systems to support contactless payments, reflecting a broader shift towards hygienic and efficient transaction processes. This trend is expected to continue as consumers become more accustomed to the speed and convenience of contactless payments.

These patterns demonstrate how the digital payment sector is ever-evolving due to both shifting customer behavior and technology breakthroughs. These developments will probably open the door for new ideas and a deeper incorporation of digital payments into daily life.

Digital Payments Market Driving Factors

The digital payment market is being propelled by several key drivers, with technological advancements at the forefront. The widespread availability of affordable smartphones and increasing internet penetration have made digital payment solutions more accessible to a broader audience. This technological infrastructure enables users to make transactions swiftly and securely, driving the adoption of digital payments across various demographics.

Globally, financial regulatory agencies and governments are putting laws into place to improve the dependability and security of digital transactions. In the European Union, the implementation of the Revised Payment Services Directive (PSD2) mandates strong customer authentication and open banking, encouraging competition and innovation in the payment sector. Comparably, the Reserve Bank of India in India has released guidelines to encourage the use of digital payments, along with precautions against cyberthreats and fraud. These legal frameworks, which guarantee consumer protection and confidence, create a favorable atmosphere for the expansion of digital payments.

Furthermore, the trend towards a cashless economy is a major motivator, as digital payment methods are becoming more and more preferred by both businesses and customers over traditional cash transactions. This change was expedited by the COVID-19 pandemic, as preserving social separation, and minimizing physical contact required the use of contactless and online payments. For instance, the Federal Reserve of the United States observed a decrease in the usage of cash for transactions and a discernible rise in the use of digital payment methods like mobile wallets and contactless cards. To satisfy customer demands for ease and security, businesses are also changing by integrating digital payment solutions, which is further propelling market growth.

Digital Payments Market Challenges

Despite advancements in security technologies, digital payment systems remain vulnerable to cyberattacks. For instance, millions of consumers’ financial and personal information was compromised in a number of high-profile data breaches in 2023, one of which involved a significant e-wallet provider. These cases demonstrate the constant struggle that security measures face from hackers, highlighting the necessity of continued security protocol improvements and consumer education regarding secure digital payment behaviors.

While regulations like PSD2 in the European Union aim to enhance security and innovation, they also impose stringent compliance requirements on payment service providers. A number of fintech businesses were hit with substantial fines in 2023 for failing to comply with changing rules in North American and European markets. It takes a lot of effort to navigate these complicated and occasionally contradictory regulatory regimes, and it can be especially difficult for smaller businesses and recent market entrants.

Although digital payments offer the potential to provide financial services to unbanked populations, many regions still lack the necessary infrastructure. For instance, the adoption of digital payment systems is hampered in several regions of Africa and South Asia by low internet connectivity and low smartphone prevalence. Though development is sluggish and the divide between disadvantaged and technologically sophisticated areas remains a major obstacle, efforts to rectify these imbalances are still underway.

Digital Payments Market – Key Industry News

- In June 2024, The Reserve Bank of India has introduced guidelines to promote the use of digital payments, including measures to safeguard against fraud and cyber threats.

- The Reserve Bank of India (RBI) Governor, Shaktikanta Das, declared in March 2024 that the bank would implement Internet banking interoperability in 2024, allowing for smooth transactions across a range of digital payment platforms.

- With the implementation of the Revised Payment Services Directive (PSD2) in June 2023, the European Union aims to promote competition and innovation in the payment sector by requiring strong consumer authentication and open banking.

Digital Payments Market Competitive Landscape

There is fierce competition amongst different players in the digital payment business, such as tech giants, fintech startups, and traditional financial institutions. To provide integrated payment solutions, traditional banks are partnering with fintech startups and making more investments in their digital infrastructure. This collaboration aims to leverage the banks’ established customer bases and the fintechs’ innovative technologies. On the other side, peer-to-peer payments, cryptocurrency transactions, and AI-driven fraud detection are just a few of the innovative products that fintech entrepreneurs are bringing to market to meet the changing demands of customers. Because they can swiftly adjust to shifts in the market and customer preferences, these firms frequently place an emphasis on user experience and agility.

Moreover, technology giants are exerting significant influence in the digital payment space by integrating payment functionalities into their ecosystems. Businesses like Dreamplug Technologies Pvt. Ltd., ACI Worldwide, Inc., Square Capital, LLC, PayPal Payments Pvt. Ltd., Stripe, Inc., and others have integrated payment alternatives into their platforms to give users a seamless experience. This integration not only enhances user convenience but also fosters customer loyalty by keeping them within the respective ecosystems for their financial transactions. Additionally, regional players are emerging strong, particularly in markets like China and India, where companies like Alipay and Paytm dominate the landscape. These regional firms can customize their products to meet particular market demands and keep a competitive edge over international rivals because they frequently profit from local regulatory support and market expertise. The dynamic interplay of innovation, strategic collaborations, and regional advantages shapes the competitive landscape and propels ongoing evolution in the digital payment business.

Digital Payments Market Company Share Analysis, 2023 (%)

Digital Payments Market – Key Companies

Reason to Buy from us

Table of Contents

| 1. Introduction |

|---|

| 1.1. Research Methodology |

| 1.2. Scope of the Study |

| 2. Market Overview / Executive Summary |

| 2.1. Global Digital Payments Market (2018 – 2022) |

| 2.2. Global Digital Payments Market (2023 – 2029) |

| 3. Market Segmentation |

| 3.1. Global Digital Payments Market by Offering Solutions |

| 3.1.1. Payment Processor |

| 3.1.2. Payment Gateway |

| 3.1.3. Payment Wallet |

| 3.1.4. POS Solution |

| 3.2. Global Digital Payments Market by Services |

| 3.2.1. Professional |

| 3.2.2. Managed |

| 3.3. Global Digital Payments Market by Transaction Model |

| 3.3.1. Domestic |

| 3.3.2. Cross Border |

| 4. Regional Segmentation |

| 4.1. North America |

| 4.1.1. The U.S |

| 4.1.2. Canada |

| 4.1.3. Mexico |

| 4.2. South America |

| 4.2.1. Brazil |

| 4.2.2. Argentina |

| 4.2.3. Colombia |

| 4.2.4. Chile |

| 4.2.5. Rest of South America |

| 4.3. Asia Pacific |

| 4.3.1. China |

| 4.3.2. India |

| 4.3.3. Japan |

| 4.3.4. South Korea |

| 4.3.5. Rest of Asia Pacific |

| 4.4. Europe |

| 4.4.1. UK |

| 4.4.2. Germany |

| 4.4.3. Italy |

| 4.4.4. France |

| 4.4.5. Spain |

| 4.4.6. Rest of Europe |

| 4.5. The Middle East |

| 4.5.1. Turkey |

| 4.5.2. UAE |

| 4.5.3. Saudi Arabia |

| 4.5.4. Rest of the Middle East |

| 4.6. Africa |

| 4.6.1. Egypt |

| 4.6.2. South Africa |

| 4.6.3. Rest of Africa |

| 5. Value Chain Analysis of the Global Digital Payments Market |

| 6. Porter Five Forces Analysis |

| 6.1. Threats of New Entrants |

| 6.2. Threats of Substitutes |

| 6.3. Bargaining Power of Buyers |

| 6.4. Bargaining Power of Suppliers |

| 6.5. Competition in the Industry |

| 7. Trends, Drivers, and Challenges Analysis |

| 7.1. Market Trends |

| 7.1.1. Market Trend 1 |

| 7.1.2. Market Trend 2 |

| 7.1.3. Market Trend 3 |

| 7.2. Market Drivers |

| 7.2.1. Market Driver 1 |

| 7.2.2. Market Driver 2 |

| 7.2.3. Market Driver 3 |

| 7.3. Market Challenges |

| 7.3.1. Market Challenge 1 |

| 7.3.2. Market Challenge 2 |

| 7.3.3. Market Challenge 3 |

| 8. Regulatory Landscape |

| 9. Competitive Landscape |

| 9.1. PayPal Payments Pvt |

| 9.2. Square Capital, LLC |

| 9.3. Stripe, Inc. |

| 9.4. Dreamplug Technologies Pvt |

| 9.5. ACI Worldwide, Inc. |

| 9.6. Company 6 |

| 9.7. Company 7 |

| 9.8. Company 8 |

| 9.9. Company 9 |

| 9.10. Company 10 |

Digital Payments Market – Frequently Asked Questions (FAQs)

What is the current size of the global digital payments market?

The market size for the global digital payments market in 2024 is $139.69 Bn.

Who are the major vendors in the global digital payments market?

The major vendors in the global digital payments market are PayPal Payments Pvt. Ltd., Square Capital, LLC, Stripe, Inc., Dreamplug Technologies Pvt. Ltd., and ACI Worldwide, Inc.

Which segments are covered under the global digital payments market segments analysis?

This report offers in-depth insights into each offering solutions, services, and transaction model.