Fintech Market Outlook: Size, Share, Trends & Growth Analysis (2024-2029)

The report covers a comprehensive analysis segmented by Service Programs (Money Transfer and Payments, Savings and Investments, Digital Lending and Lending Marketplaces, Online Insurance and Insurance Marketplaces, and Other Service Programs), by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

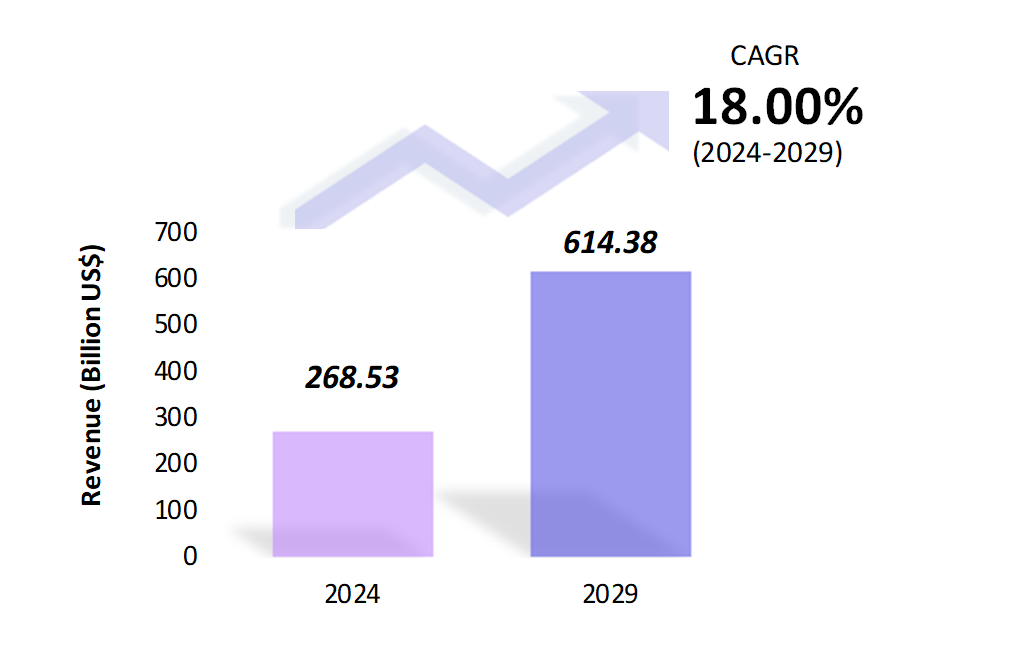

Fintech Market Snapshot

Fintech Market Overview

The global fintech market is estimated to be at $268.53 Bn in 2024 and is anticipated to reach $614.38 Bn in 2029. The global fintech market is registering a CAGR of 18% during the forecast period 2024-2029. The fintech market is a dynamic and rapidly evolving sector that is transforming traditional financial services through technology. It encompasses a wide range of applications, from digital payments and mobile banking to blockchain and cryptocurrency. One significant aspect of fintech is its ability to enhance financial inclusion by providing access to banking services for underserved populations. For example, mobile payment solutions like Kenya’s M-Pesa have revolutionized financial transactions in regions with limited banking infrastructure, allowing millions of users to conduct secure financial transactions via mobile phones.

Fintech also includes innovations in personal finance management and investment. Robo-advisors, such as Betterment and Wealthfront, utilize algorithms to provide personalized financial advice and portfolio management, making investing accessible to a broader audience. These platforms democratize investment opportunities by lowering the barriers to entry traditionally associated with wealth management services (Mordor Intelligence). Additionally, peer-to-peer lending platforms like LendingClub and Prosper connect borrowers directly with lenders, offering more flexible lending terms and potentially lower interest rates than conventional banks.

Moreover, fintech is significantly impacting the insurance industry through insurtech. Companies like Lemonade and Oscar Health leverage technology to streamline underwriting, claims processing, and customer service, resulting in more efficient and user-friendly insurance products. These innovations not only enhance customer experiences but also reduce operational costs for insurers.

The fintech market is revolutionizing the financial services landscape by leveraging technology to provide more efficient, inclusive, and accessible financial solutions. From improving access to banking in underserved regions to democratizing investment and transforming insurance services, fintech continues to drive significant changes across various aspects of finance. As the industry evolves, it promises to further enhance how financial services are delivered and consumed globally.

Fintech Market Coverage

| Historical & Forecast Period | 2018-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units | Billion US$ |

| Segments | By Service Proposition |

| Geographies | North America, South America, Asia Pacific, Europe, The Middle East, Africa |

| Key Vendors | Ant Group Co., Ltd., Adyen N.V., Coinbase, Inc., Robinhood Financial LLC, PayPal Holdings, Inc. |

Key Geographies of Fintech Market, 2023

Porter’s 5 Forces Analysis of Fintech Market

Fintech Market Trends

The fintech landscape is rapidly evolving, marked by significant trends that are reshaping financial services. With the increased adoption of fintech applications driven by the COVID-19 pandemic and ongoing economic uncertainties, consumers are relying more on digital financial tools. On average, users now employ three to four fintech apps for various financial tasks such as budgeting, saving, and investing. This growing dependence is setting new standards in consumer banking, with expectations for seamless integration between traditional bank accounts and fintech services.

Emerging payment technologies are also gaining traction. Real-time payment systems like FedNow and peer-to-peer (P2P) payment platforms are becoming mainstream, offering faster, more secure, and efficient transaction methods. By 2025, it is anticipated that nearly 178 million US mobile users will make P2P payments, highlighting the convenience and speed of these new payment methods (Plaid, Clifford Chance). Additionally, blockchain technology continues to enhance fintech by providing secure, transparent, and efficient processes for cross-border payments, decentralized lending, and trade finance. Blockchain reduces operational costs and replaces legacy systems, driving significant savings and broader adoption of secure financial services.

India’s Unified Payments Interface (UPI) is also a major fintech trend. It revolutionizes digital payments with seamless, instant money transfers between bank accounts via mobile devices. Launched in 2016, UPI achieved massive adoption, processing billions of transactions monthly and supporting multiple payment apps like Bhim UPI, Google Pay, and PhonePe.

Furthermore, alternative credit scoring is revolutionizing access to credit. Traditional credit scores are being supplemented with alternative data such as cash flow, pay stubs, and utility bills. This approach benefits those without traditional credit histories, such as recent immigrants and the underbanked, enabling lenders to make more informed decisions and expand financial inclusion. API-based fintech tools facilitate this by connecting lenders with various data sources for faster and more accurate credit assessments.

Overall, the fintech sector is poised for continued growth and transformation, driven by increased app adoption, advanced payment technologies, blockchain integration, and innovative credit scoring methods. These trends collectively enhance financial inclusion, efficiency, and consumer convenience, setting the stage for a more dynamic financial ecosystem.

Fintech Market Driving Factors

The growth of the Fintech market is propelled by a blend of technological advancements, evolving consumer behaviors, and favorable regulatory environments. Technologies such as blockchain and cryptocurrencies are revolutionizing transaction security and transparency, as seen with companies like Ripple and Bitcoin facilitating faster and more secure cross-border payments. Artificial Intelligence (AI) and Machine Learning (ML) are transforming customer service and fraud detection; for instance, companies like ZestFinance use AI to improve credit underwriting processes, making financial services more accessible and tailored. Big data analytics is enabling firms like Plaid to offer personalized financial insights by analyzing consumer transaction data, while cloud computing solutions from providers like Amazon Web Services (AWS) allow fintech startups to scale their operations efficiently and cost-effectively.

Mobile payment apps like PayPal and Venmo have seen exponential growth as consumers shift towards digital transactions. Moreover, fintech is playing a crucial role in financial inclusion; companies like M-Pesa in Kenya are providing banking services to unbanked populations, significantly impacting local economies. Supportive regulatory environments, such as the European Union’s PSD2 directive, are fostering innovation by promoting open banking, which encourages data sharing among financial institutions and third-party developers, leading to the creation of new financial services and products.

Economic factors and investment trends also contribute significantly. The drive to reduce operational costs through automation and efficiency has made fintech solutions attractive to traditional financial institutions, leading to partnerships and acquisitions, like Goldman Sachs’ acquisition of Clarity Money. Additionally, venture capital and private equity investments are pouring into the fintech sector, with startups like Stripe and Robinhood receiving substantial funding to fuel their growth and international expansion. Social and demographic trends, such as the tech-savvy preferences of Millennials and Gen Z, further bolster the fintech market, ensuring its continued evolution and expansion in response to dynamic consumer needs.

Fintech Market Challenges

The fintech market faces significant challenges, particularly in regulatory compliance and cybersecurity. Operating across multiple jurisdictions, fintech companies must navigate complex and varying regulatory landscapes, such as the GDPR in Europe and similar regulations in other regions. Compliance is costly and requires ongoing vigilance to avoid penalties, as seen with the recent intensification of data protection laws worldwide. For instance, the implementation of the General Data Protection Regulation (GDPR) in Europe has required companies to significantly invest in compliance measures to avoid hefty fines.

Additionally, cybersecurity remains a critical concern. Fintechs handle vast amounts of sensitive financial data, making them prime targets for cyberattacks. The need for robust security measures is paramount, especially with the adoption of innovative technologies like biometric payments, which require stringent protocols to protect against data breaches and build consumer trust. For example, companies adopting biometric payments must implement end-to-end encryption to minimize risks and reassure users about their data’s security. Moreover, the rapid pace of technological change demands continuous innovation, posing a challenge for fintechs to integrate new technologies such as AI, blockchain, and machine learning into their existing systems. This necessity highlights the importance of attracting and retaining skilled tech professionals, which can be difficult for smaller fintech startups competing against larger tech companies and established financial institutions.

Fintech Market – Key Industry News

- In May 2024, Papara, a Turkish fintech company announced its acquisition of SadaPay, a Pakistani Electronic Money Institution (EMI), for its expansion in the South Asian market. It aims to place SadaPay as the leading fintech player in the region by bolstering its innovative and bold initiatives.

- In May 2024, Razorpay launched a new payment solution Q-Zap for offline retailers to reduce billing time. The Q-Zap suite encompasses handheld devices, which store staff can use to accept payment from consumers anywhere within the store.

- In May 2024, FIS, an American international fintech company, launched its new innovative Fintech platform Atelio. It enables users to embed financial services into their products and workflows in a secure and conformable manner and empowers companies to simply and fluently offer financial services to their clients at the point of financial need.

Fintech Market Competitive Landscape

The fintech market is highly competitive, driven by both traditional financial institutions and newer fintech companies. Major players include established banks like Ant Group Co., Ltd., Adyen N.V., Coinbase, Inc., Robinhood Financial LLC, PayPal Holdings, Inc., and others. Additionally, tech giants such as Apple, Google, and Amazon are making significant inroads into financial services, leveraging their technological prowess and large user bases. Key trends shaping the industry include the use of blockchain, AI, and machine learning for enhanced security, personalized services, and efficient operations.

Consumer demand for digital financial solutions and a dynamic regulatory environment are key market drivers. Investment in fintech remains robust, with substantial venture capital inflows and active mergers and acquisitions. Companies are focusing on continuous innovation, technology integration, and partnerships to enhance their service offerings and expand their market reach. A customer-centric approach, emphasizing user experience and personalized services, is essential for success in this rapidly evolving landscape. The future growth of fintech will likely be driven by advancements in technology and expansion into emerging markets.

Fintech Market Company Share Analysis, 2023 (%)

Fintech Market – Key Companies

Reason to Buy from us

Table of Contents

| 1. Introduction |

|---|

| 1.1. Research Methodology |

| 1.2. Scope of the Study |

| 2. Market Overview / Executive Summary |

| 2.1. Global Fintech Market (2018 – 2022) |

| 2.2. Global Fintech Market (2023 – 2029) |

| 3. Market Segmentation |

| 3.1. Global Fintech Market by Service Programs |

| 3.1.1. Money Transfer and Payments |

| 3.1.2. Savings and Investments |

| 3.1.3. Digital Lending and Lending Marketplaces |

| 3.1.4. Online Insurance and Insurance Marketplaces |

| 3.1.5. Other Service Programs |

| 4. Regional Segmentation |

| 4.1. North America |

| 4.1.1. The U.S |

| 4.1.2. Canada |

| 4.1.3. Mexico |

| 4.2. South America |

| 4.2.1. Brazil |

| 4.2.2. Argentina |

| 4.2.3. Colombia |

| 4.2.4. Chile |

| 4.2.5. Rest of South America |

| 4.3. Asia Pacific |

| 4.3.1. China |

| 4.3.2. India |

| 4.3.3. Japan |

| 4.3.4. South Korea |

| 4.3.5. Rest of Asia Pacific |

| 4.4. Europe |

| 4.4.1. UK |

| 4.4.2. Germany |

| 4.4.3. Italy |

| 4.4.4. France |

| 4.4.5. Spain |

| 4.4.6. Rest of Europe |

| 4.5. The Middle East |

| 4.5.1. Turkey |

| 4.5.2. UAE |

| 4.5.3. Saudi Arabia |

| 4.5.4. Rest of the Middle East |

| 4.6. Africa |

| 4.6.1. Egypt |

| 4.6.2. South Africa |

| 4.6.3. Rest of Africa |

| 5. Value Chain Analysis of the Global Fintech Market |

| 6. Porter Five Forces Analysis |

| 6.1. Threats of New Entrants |

| 6.2. Threats of Substitutes |

| 6.3. Bargaining Power of Buyers |

| 6.4. Bargaining Power of Suppliers |

| 6.5. Competition in the Industry |

| 7. Trends, Drivers, and Challenges Analysis |

| 7.1. Market Trends |

| 7.1.1. Market Trend 1 |

| 7.1.2. Market Trend 2 |

| 7.1.3. Market Trend 3 |

| 7.1.4. Market Trend 4 |

| 7.1.5. Market Trend 5 |

| 7.2. Market Drivers |

| 7.2.1. Market Driver 1 |

| 7.2.2. Market Driver 2 |

| 7.2.3. Market Driver 3 |

| 7.2.4. Market Driver 4 |

| 7.2.5. Market Driver 5 |

| 7.3. Market Challenges |

| 7.3.1. Market Challenge 1 |

| 7.3.2. Market Challenge 2 |

| 7.3.3. Market Challenge 3 |

| 7.3.4. Market Challenge 4 |

| 7.3.5. Market Challenge 5 |

| 8. Regulatory Landscape |

| 9. Competitive Landscape |

| 9.1. Ant Group Co., Ltd. |

| 9.2. Adyen N.V. |

| 9.3. Coinbase, Inc. |

| 9.4. Robinhood Financial LLC |

| 9.5. PayPal Holdings, Inc. |

| 9.6. Company 6 |

| 9.7. Company 7 |

| 9.8. Company 8 |

| 9.9. Company 9 |

| 9.10. Company 10 |

Fintech Market – Frequently Asked Questions (FAQs)

What is the current size of the global fintech market?

The market size for the global fintech market in 2024 is $268.53 Bn.

Who are the major vendors in the global fintech market?

The major vendors in the global fintech market are Ant Group Co., Ltd., Adyen N.V., Coinbase, Inc., Robinhood Financial LLC, and PayPal Holdings, Inc.

Which segments are covered under the global fintech market segments analysis?

This report offers in-depth insights into each service program.