Canned Tuna Market Insights: Size, Share, Growth Analysis & Forecast (2024-2029)

The market report offers a detailed analysis segmented by Type (Skipjack Tuna, Yellowfin Tuna, Albacore Tuna, Others); by Distribution Channel (Store-Based, Non-Store-Based); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

- The canned tuna market is estimated to be at USD 11,287.28 Mn in 2025 and is anticipated to reach USD 14,047.69 Mn in 2030.

- The canned tuna market is registering a CAGR of 4.47% during the forecast period 2025-2030.

- The global canned tuna market is a significant segment within the seafood industry. It is characterized by consistent demand due to its affordability, nutritional value, and convenience. The popularity of ready-to-eat and preserved foods and growing consumer awareness regarding protein-rich diets continue to fuel market expansion.

Request a free sample.

Ecosystem

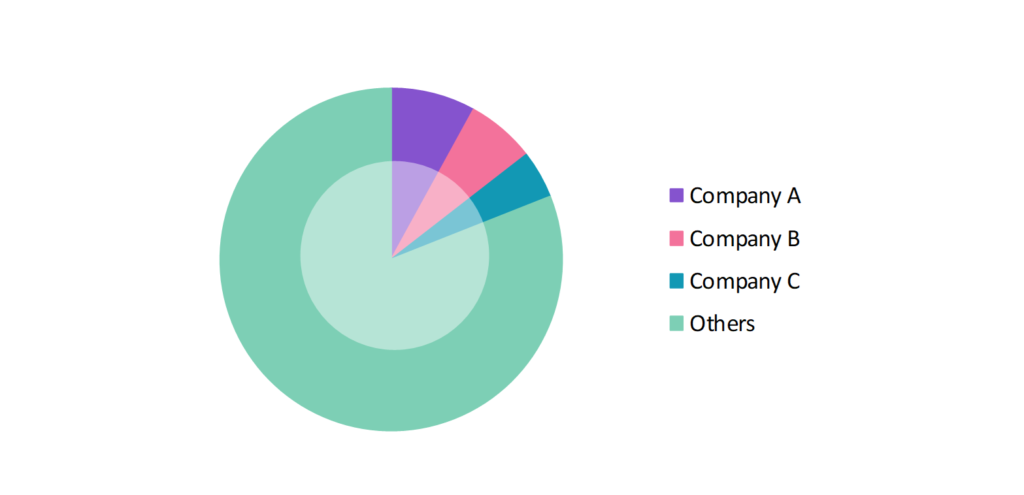

- The participants in the global canned tuna industry are always developing their strategies to preserve a competitive advantage.

- These companies primarily use acquisitions, research & developments, investments, partnerships, and technological launches.

- Several important entities in the canned tuna market include Bolton Group; Thai Union Group PCL; Grupo Calvo; Ocean Brands; American Tuna, Inc.; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2019-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Market Size (2025) | USD 11,287.28 Mn |

| Market Size (2030) | USD 14,047.69 Mn |

| Growth Rate | 4.47% CAGR from 2025 to 2030 |

| Key Segments | Type (Skipjack Tuna, Yellowfin Tuna, Albacore Tuna, Others); Distribution Channel (Store-Based, Non-Store-Based); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | Bolton Group; Thai Union Group PCL; Grupo Calvo; Ocean Brands; American Tuna, Inc. |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; Chile; China; India; Japan; The UK; Germany; Italy; France; Spain; UAE; Saudi Arabia; Egypt; South Africa |

| Largest Market | Europe |

Get a free quote.

Trends

- Premium and Flavored Varieties: There is a clear trend toward premium and innovative canned tuna products that feature unique flavors and health benefits. Companies are expanding their offerings to include options like spicy, lemon-infused, and low-sodium varieties. This diversification caters to evolving consumer tastes and preferences.

- Emergence of Sustainable Fishing Practices: Sustainability is becoming a priority in the canned tuna market as consumers and regulatory bodies emphasize the need for responsible sourcing. In response, many brands are collaborating with initiatives like the Marine Stewardship Council (MSC) to adopt environmentally friendly practices. This shift reflects a growing commitment to protecting marine resources and promoting ethical sourcing.

- Technological Advancements in Packaging: Innovations in packaging, such as BPA-free cans and easy-open lids, are attracting health-conscious consumers and enhancing product appeal. In 2022, companies like John West Foods adopted more sustainable and user-friendly packaging solutions, aligning with consumer preferences for safe and convenient products.

Speak to analyst.

Catalysts

- Increasing Demand for Ready-to-Eat Foods: The fast-paced urban lifestyle is driving demand in the canned tuna market as consumers increasingly seek quick and convenient meal options. With busy schedules and dual-income households on the rise, ready-to-eat and easy-to-prepare foods are essential. Canned tuna’s versatility makes it a nutritious choice for salads, sandwiches, and pasta dishes. Its long shelf life and affordability further enhance its appeal, while its reputation as a lean protein source aligns with health-conscious consumer preferences.

- Nutritional Benefits Boosting Popularity: Canned tuna is a nutritious choice, rich in essential nutrients like protein and omega-3 fatty acids, making it particularly appealing to health-conscious consumers. The increasing popularity of high-protein diets further drives interest in canned tuna as a convenient and healthy option. As consumers prioritize nutritional value in their food choices, the demand for canned tuna is likely to continue rising.

- Expansion in Retail Infrastructure: The growth of modern retail formats, such as supermarkets and hypermarkets, has facilitated easier access to canned tuna products. Retail providers are collaborating with canned seafood brands to introduce more options on their shelves. In 2022, Walmart expanded its range of canned tuna brands to meet rising consumer demand, propelling the canned tuna market’s growth.

Inquire before buying.

Restraints

- Overfishing and Environmental Concerns: The overfishing of tuna and its impact on marine ecosystems pose significant challenges. Regulatory bodies are imposing stricter fishing quotas, affecting the availability of raw materials. In 2023, the International Seafood Sustainability Foundation reported increased restrictions on tuna fishing to mitigate overfishing, restraining the market of canned tuna.

- Price Volatility of Raw Materials: Fluctuations in tuna prices and related expenses, such as fuel for fishing vessels, have a substantial impact on the profitability of the canned tuna market. Changes in fuel costs can raise operational expenses for fishing companies, potentially resulting in higher prices for consumers. Moreover, shifts in supply dynamics due to environmental factors and fishing regulations can lead to further price volatility. This uncertainty poses challenges for manufacturers in maintaining consistent pricing and profit margins, affecting the overall stability of the market.

- Regulatory Compliance and Trade Barriers: Canned tuna manufacturers must navigate complex international regulations and certifications to meet food safety standards, which can vary significantly across regions. Compliance adds to production costs, limiting market entry for smaller players. In 2023, new EU regulations on canned seafood importation increased scrutiny on suppliers, leading to delays for some exporters.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Canned Tuna Market (2019 – 2023) 2.2. Global Canned Tuna Market (2024 – 2030) 3. Market Segmentation 3.1. Global Canned Tuna Market by Type 3.1.1. Skipjack Tuna 3.1.2. Yellowfin Tuna 3.1.3. Albacore Tuna 3.1.4. Others 3.2. Global Canned Tuna Market by Distribution Channel 3.2.1. Store-Based 3.2.2. Non-Store-Based 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Chile 4.2.4. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Japan 4.3.4. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. Italy 4.4.4. France 4.4.5. Spain 4.4.6. Rest of Europe 4.5. The Middle East 4.5.1. UAE 4.5.2. Saudi Arabia 4.5.3. Rest of the Middle East 4.6. Africa 4.6.1. Egypt 4.6.2. South Africa 4.6.3. Rest of Africa 5. Value Chain Analysis of the Global Canned Tuna Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. Bolton Group 9.2. Thai Union Group PCL 9.3. Grupo Calvo 9.4. Ocean Brands 9.5. American Tuna, Inc. 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Canned Tuna Market – FAQs

1. What is the current size of the canned tuna market?

Ans. In 2025, the canned tuna market size is USD 11,287.28 Mn.

2. Who are the major vendors in the canned tuna market?

Ans. The major vendors in the canned tuna market are Bolton Group; Thai Union Group PCL; Grupo Calvo; Ocean Brands; American Tuna, Inc.

3. Which segments are covered under the canned tuna market segments analysis?

Ans. The canned tuna market report offers in-depth insights into Type, Distribution Channel, and Geography.