Snack Food Market: Size, Share, Trends & Forecast (2024-2029)

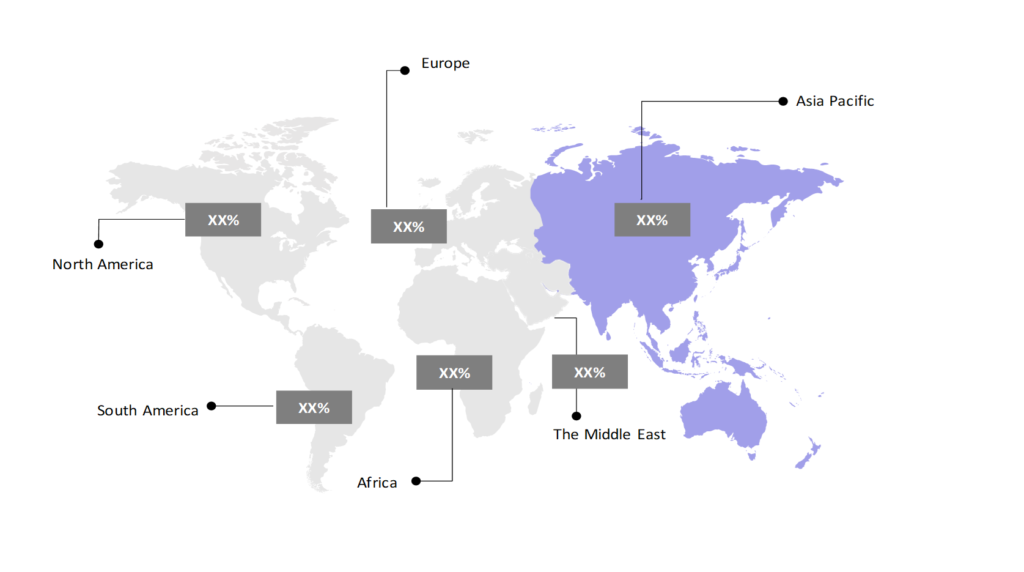

The market report presents a thorough analysis segmented by Type (Frozen Snacks, Savory Snacks, Fruit Snacks, Confectionery Snacks, Bakery Snacks, Others); by Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail Stores); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

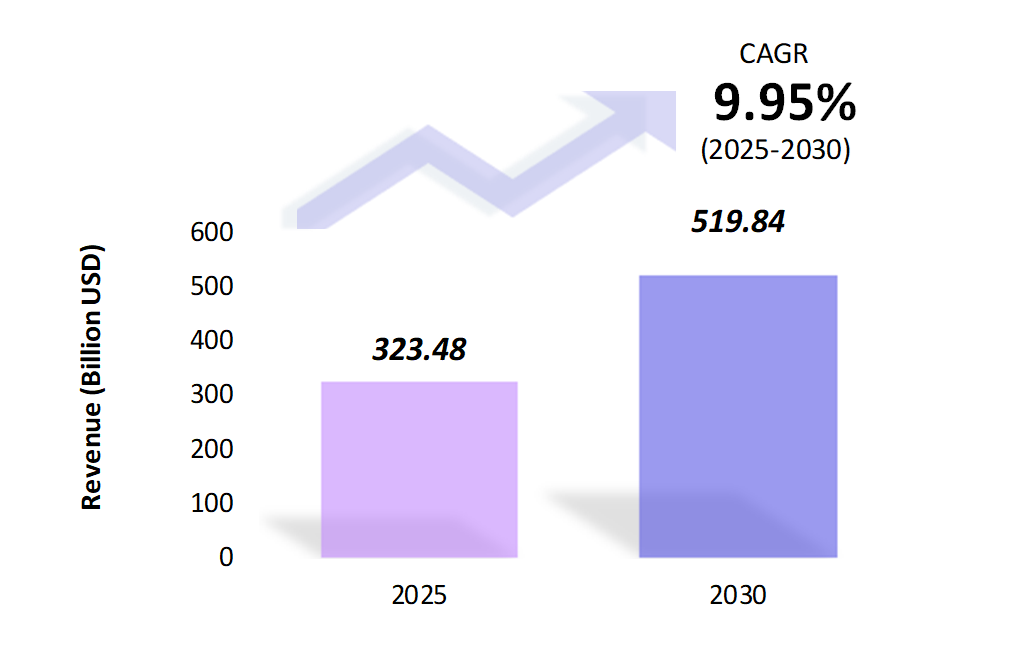

- The snack food market is estimated to be at USD 323.48 Bn in 2025 and is anticipated to reach USD 519.84 Bn in 2030.

- The snack food market is registering a CAGR of 9.95% during the forecast period 2025-2030.

- The global snack food market has been growing steadily, driven by changing consumer lifestyles, increasing demand for convenience foods, and a rise in snacking as a meal replacement.

Request a free sample.

Ecosystem

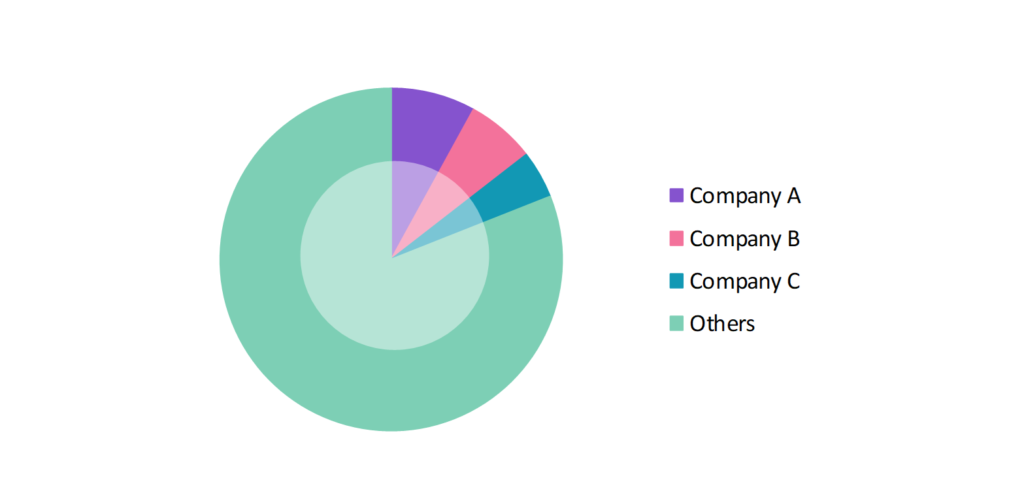

- The participants in the global snack food industry are always developing their strategies to preserve a competitive advantage.

- These companies primarily use acquisitions, research & developments, partnerships, and technological launches.

- Several important entities in the snack food market include General Mills, Inc.; PepsiCo, Inc.; Kellanova; Unilever Plc; Nestle S.A.; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2019-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Market Size (2025) | USD 323.48 Bn |

| Market Size (2030) | USD 519.84 Bn |

| Growth Rate | 9.95% CAGR from 2025 to 2030 |

| Key Segments | Type (Frozen Snacks, Savory Snacks, Fruit Snacks, Confectionery Snacks, Bakery Snacks, Others); Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail Stores); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | General Mills, Inc.; PepsiCo, Inc.; Kellanova; Unilever Plc; Nestle S.A. |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; Colombia; China; India; Japan; The UK; Germany; France; UAE; Saudi Arabia; Egypt; South Africa |

| Largest Market | Asia Pacific |

Get a free quote.

Trends

- Development of Healthier Snack Options: Consumers increasingly prefer healthier options, including plant-based, gluten-free, and low-sugar snacks. In 2023, companies like PepsiCo and Nestlé introduced new product lines featuring low-calorie snacks and sugar alternatives, reflecting consumer emphasis on better nutritional profiles in snacks.

- Emergence of Functional Snacks: Functional snacks that provide added health benefits, like protein bars and vitamin-fortified snacks, are becoming increasingly popular among consumers. This trend reflects a growing emphasis on convenient options that support overall wellness, particularly those aimed at boosting immune health.

- Sustainability and Eco-Friendly Packaging: Sustainability increasingly influences the snack food market, with brands prioritizing eco-friendly sourcing, packaging, and production practices. Consumers actively seek snacks that align with their values, leading to emphasizing ethical and sustainable ingredients. This shift reflects a broader commitment to environmental responsibility within the food industry.

Speak to analyst.

Catalysts

- Changing Lifestyles and Increased Snacking Habits: As fast-paced lifestyles and extended working hours become the norm, many consumers opt for snacks instead of traditional meals. This shift drives the snack food market growth as people seek convenient, on-the-go options that fit their busy schedules. The growth reflects a changing approach to eating habits and meal structures.

- Growing Consumer Interest in On-the-Go Snacks: The growing consumer preference for convenience is significantly driving the demand for portable, single-serving snack packs. Busy lifestyles and on-the-go eating habits have made these easily accessible options increasingly appealing. As people look for quick, satisfying snacks that require minimal preparation, brands are responding with a diverse range of individually packaged choices to meet this rising need.

- Increased Demand for Plant-Based and Organic Snacks: As more consumers adopt vegetarian, vegan, and clean-eating diets, the market for plant-based and organic snacks has seen significant growth. Innovations like pea-protein chips, veggie crisps, and nut-based snack bars have garnered interest, highlighting a shift towards healthier choices. Beyond Meat’s early 2023 launch of its pea-protein chips exemplifies this trend, addressing the rising demand for convenient, plant-based options.

Inquire before buying.

Restraints

- Rising Ingredient Costs and Supply Chain Disruptions: The prices of raw materials such as nuts, grains, and oils have risen due to supply chain disruptions from the pandemic and geopolitical tensions. Global inflation has driven up the costs of essential snack ingredients, making it difficult for manufacturers to sustain profit margins without increasing consumer prices, which is hindering the growth of the snack food market.

- Health and Wellness Trends Impacting Traditional Snacks: A significant challenge in the snack food market is the growing consumer scrutiny over the high fat, sugar, and salt levels found in traditional snacks like chips and candy. As health-conscious choices become a priority, manufacturers face pressure to reformulate their products to align with these demands while preserving flavor and consumer appeal. Failure to adapt could result in lost market share in an increasingly health-focused environment.

- Stringent Regulatory Standards on Food Labeling: Governments worldwide are implementing stricter regulations on food labeling, particularly concerning nutritional content and health claims. For instance, in 2022, the European Union introduced new regulations on the use of certain additives and clear labeling of sugar content, which forced many snack brands to reformulate their products.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Snack Food Market (2019 – 2023) 2.2. Global Snack Food Market (2024 – 2030) 3. Market Segmentation 3.1. Global Snack Food Market by Type 3.1.1. Frozen Snacks 3.1.2. Savory Snacks 3.1.3. Fruit Snacks 3.1.4. Confectionery Snacks 3.1.5. Bakery Snacks 3.1.6. Others 3.2. Global Snack Food Market by Distribution Channel 3.2.1. Supermarkets/Hypermarkets 3.2.2. Convenience Stores 3.2.3. Specialty Stores 3.2.4. Online Retail Stores 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Colombia 4.2.4. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Japan 4.3.4. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. France 4.4.4. Rest of Europe 4.5. The Middle East 4.5.1. UAE 4.5.2. Saudi Arabia 4.5.3. Rest of the Middle East 4.6. Africa 4.6.1. Egypt 4.6.2. South Africa 4.6.3. Rest of Africa 5. Value Chain Analysis of the Global Snack Food Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. General Mills, Inc. 9.2. PepsiCo, Inc. 9.3. Kellanova 9.4. Unilever Plc 9.5. Nestle S.A. 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Snack Food Market – FAQs

1. What is the current size of the snack food market?

Ans. In 2025, the snack food market size is USD 323.48 Bn.

2. Who are the major vendors in the snack food market?

Ans. The major vendors in the snack food market are General Mills, Inc.; PepsiCo, Inc.; Kellanova; Unilever Plc; Nestle S.A.

3. Which segments are covered under the snack food market segments analysis?

Ans. The snack food market report offers in-depth insights into Type, Distribution Channel, and Geography.