Tea Market Outlook: Size, Share, Trends & Growth Analysis (2024-2029)

The market report presents a thorough analysis segmented by Product (Green Tea, Black Tea, Oolong Tea, Others); by Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Convenience Stores, Online); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

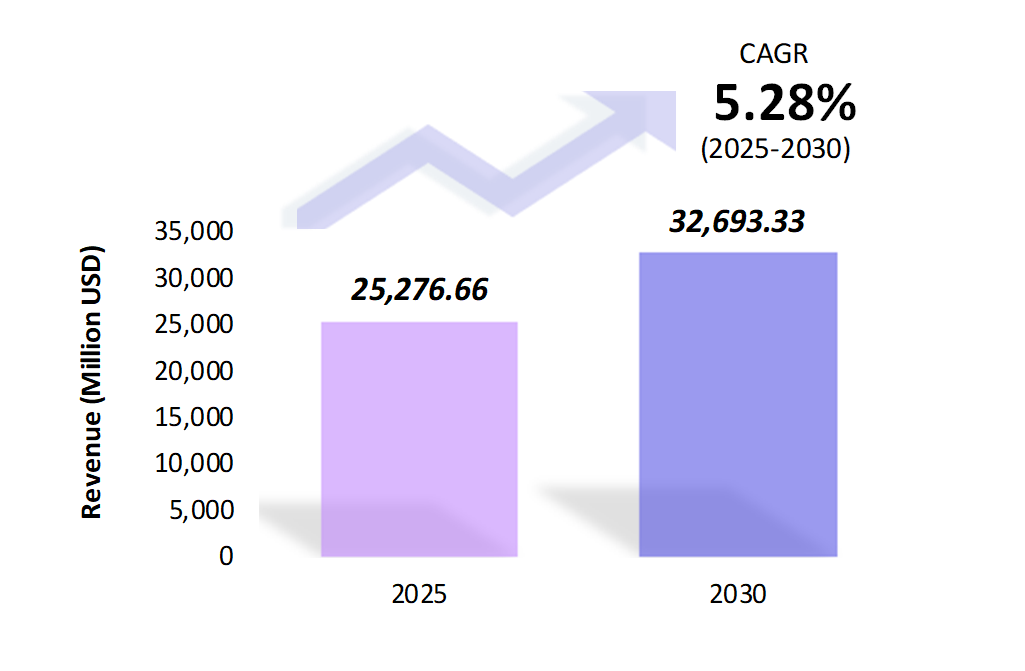

- The tea market is estimated to be at USD 25,276.66 Mn in 2025 and is anticipated to reach USD 32,693.33 Mn in 2030.

- The tea market is registering a CAGR of 5.28% during the forecast period 2025-2030.

- The global tea market is expected to grow, driven by health and wellness trends, increasing consumption in emerging markets, and innovative product offerings.

Request a free sample.

Ecosystem

- The global tea industry participants are continually developing strategies to preserve a competitive advantage.

- These companies focus on expanding their range of herbal and flavored teas and integrating sustainability practices, investments, acquisitions, research & developments, partnerships, and technological launches.

- Several important entities in the tea market include Yunnan Dayi Tea Group Co., Ltd.; Tata Consumer Products Ltd.; Unilever Group; Barry’s Tea; Associated British Foods Plc; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2019-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Market Size (2025) | USD 25,276.66 Mn |

| Market Size (2030) | USD 32,693.33 Mn |

| Growth Rate | 5.28% CAGR from 2025 to 2030 |

| Key Segments | Product (Green Tea, Black Tea, Oolong Tea, Others); Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Convenience Stores, Online); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | Yunnan Dayi Tea Group Co., Ltd.; Tata Consumer Products Ltd.; Unilever Group; Barry’s Tea; Associated British Foods Plc |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; Colombia; China; India; Japan; The UK; Germany; France; UAE; Saudi Arabia; Egypt; Kenya |

| Largest Market | Asia Pacific |

Get a free quote.

Trends

- Flavored and Herbal Tea Innovations: Flavored and herbal tea innovations capture consumer interest with unique blends and creative flavor combinations. Brands are experimenting with natural ingredients to create distinctive profiles, catering to diverse tastes and enhancing the tea experience. This trend showcases a shift towards more personalized beverage options.

In 2022, Twinings and Lipton launched new flavors like chamomile-lavender and turmeric-ginger, designed to offer relaxation and immune-boosting benefits.

- Emergence of Ready-to-Drink (RTD) Teas: The popularity of ready-to-drink (RTD) teas is rising among millennials and Gen Z consumers who prioritize convenience and health-conscious choices. These ready-made beverages cater to their on-the-go lifestyles, offering a refreshing and flavorful alternative to traditional drinks. This trend highlights a growing preference for accessible and nutritious options.

- Premiumization of Tea Products: The premiumization of tea products is gaining traction as consumers seek high-quality, artisanal offerings. This trend emphasizes unique flavors, single-origin sourcing, and luxurious packaging, appealing to those who appreciate a refined tea experience. As a result, brands are focusing on crafting distinctive blends that elevate the tea-drinking ritual.

Speak to analyst.

Catalysts

- Rising Demand for Specialty Teas: Consumers increasingly seek specialty teas, such as green tea, herbal blends, and organic varieties, driven by a growing awareness of their health benefits. The global demand for green tea has surged as individuals prioritize healthier lifestyles, attracted by its antioxidant properties and overall wellness contributions. This shift reflects a broader growth toward health-conscious consumption in the beverage market.

- Increasing Awareness of Health Benefits Associated with Tea: The growing awareness of the health benefits associated with tea serves as a significant catalyst in the market. As consumers learn more about tea’s positive effects on wellness, including its antioxidant and anti-inflammatory properties, demand for various tea types is increasing. This heightened interest drives sales of traditional and specialty teas and encourages brands to innovate and expand their product offerings, contributing to overall revenue growth in the tea market.

- Government Initiatives Promoting Tea Production: Governments in major tea-producing countries implement policies to boost production and exports. These initiatives enhance productivity and quality in the tea industry by providing support through subsidies, training programs, and infrastructure development. In 2023, India launched the Tea Development and Promotion Scheme to modernize tea plantations and increase output, further supporting the growth of the tea market.

Restraints

- Climate Change Impacting Tea Production: Unpredictable weather patterns and extreme climate conditions present significant challenges for tea cultivation, impacting both tea quality and production costs. These environmental factors lead to reduced yields and inconsistencies in flavor profiles, forcing producers to adapt their practices. As a result, the increased production costs strain margins, ultimately affecting the overall stability of the tea market.

- Fluctuating Raw Material Prices: The price volatility of tea leaves and related agricultural inputs is significantly affecting the profitability of tea producers. Fluctuating prices lead to uncertain revenue streams, making it challenging for growers to plan and invest in their operations. This instability impacts individual producers and has broader implications for the tea market, as it can deter new investments and affect supply chains.

- Stringent Regulatory Requirements: Food safety and pesticide usage regulatory frameworks, particularly in the European Union and North America, are becoming increasingly stringent. In 2022, several batches of imported tea were rejected in the European Union due to high pesticide residues, prompting producers to adopt more sustainable and compliant farming practices, which increased operational costs and hindered market growth.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Tea Market (2019 – 2023) 2.2. Global Tea Market (2024 – 2030) 3. Market Segmentation 3.1. Global Tea Market by Product 3.1.1. Green Tea 3.1.2. Black Tea 3.1.3. Oolong Tea 3.1.4. Others 3.2. Global Tea Market by Distribution Channel 3.2.1. Supermarkets/Hypermarkets 3.2.2. Specialty Stores 3.2.3. Convenience Stores 3.2.4. Online 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Colombia 4.2.4. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Japan 4.3.4. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. France 4.4.4. Rest of Europe 4.5. The Middle East 4.5.1. UAE 4.5.2. Saudi Arabia 4.5.3. Rest of the Middle East 4.6. Africa 4.6.1. Egypt 4.6.2. Kenya 4.6.3. Rest of Africa 5. Value Chain Analysis of the Global Tea Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. Yunnan Dayi Tea Group Co., Ltd. 9.2. Tata Consumer Products Ltd. 9.3. Unilever Group 9.4. Barry’s Tea 9.5. Associated British Foods Plc 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Tea Market – FAQs

1. What is the current size of the tea market?

Ans. In 2025, the tea market size is USD 25,276.66 Mn.

2. Who are the major vendors in the tea market?

Ans. The major vendors in the tea market are Yunnan Dayi Tea Group Co., Ltd.; Tata Consumer Products Ltd.; Unilever Group; Barry’s Tea; Associated British Foods Plc.

3. Which segments are covered under the tea market segments analysis?

Ans. The tea market report offers in-depth insights into Product, Distribution Channel, and Geography.