Business Process Outsourcing (BPO) Market Insights: Size, Share, Growth Analysis & Forecast (2024-2029)

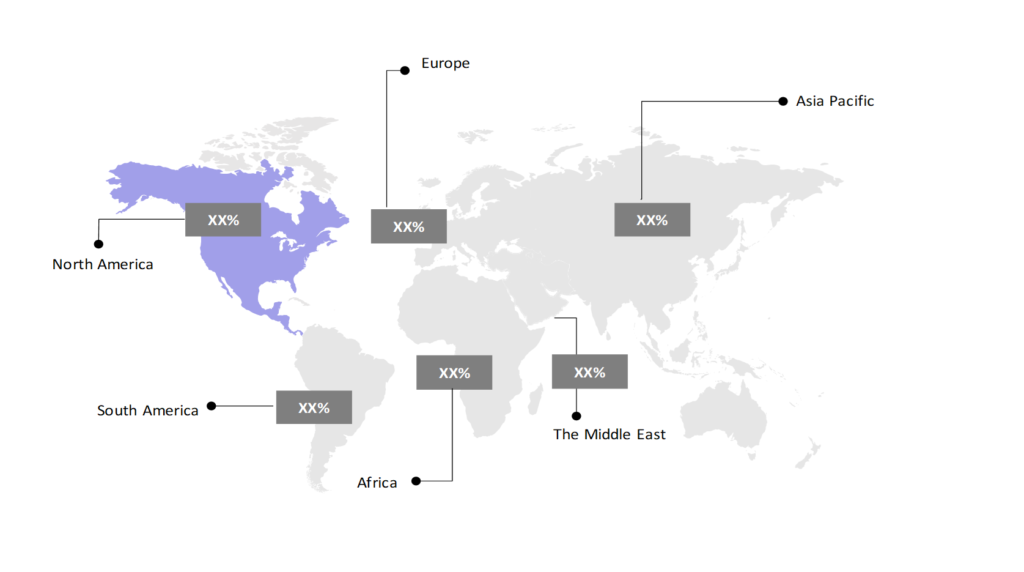

The market report provided a comprehensive analysis segmented by Service Type (Finance & Accounting, Human Resources, Procurement & Supply Chain, Customer Services, Others); by Enterprise Size (Small & Medium Enterprises, Large Enterprises); by End User (BFSI, Healthcare, Manufacturing, IT & Telecom, Retail, Others); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

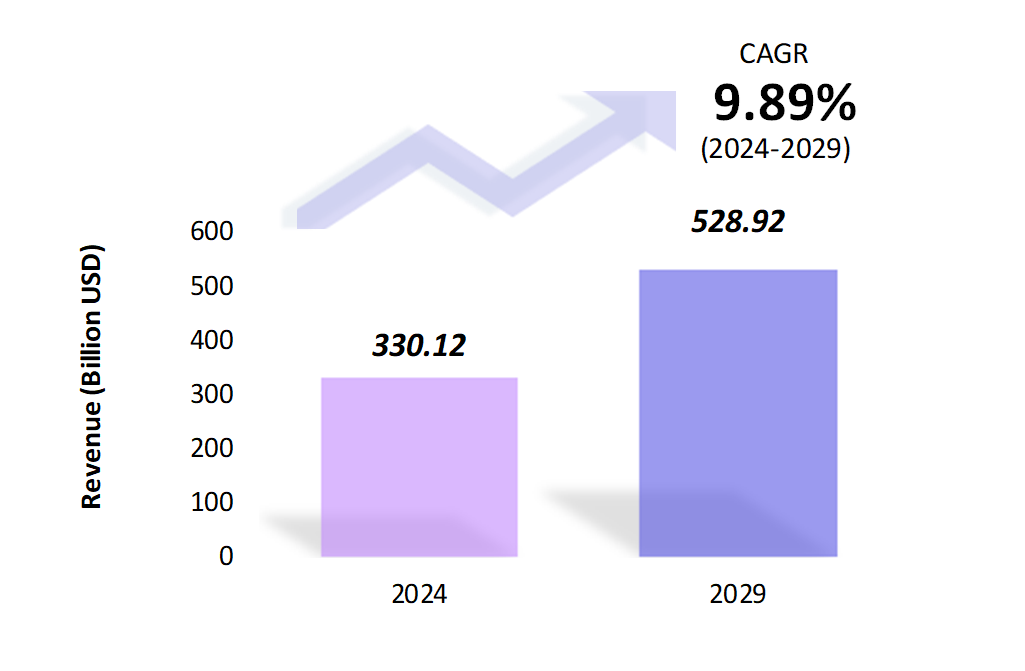

- The business process outsourcing market is estimated to be at USD 330.12 Bn in 2024 and is anticipated to reach USD 528.92 Bn in 2029.

- The business process outsourcing market is registering a CAGR of 9.89% during the forecast period of 2024-2029.

- The global business process outsourcing (BPO) market is driven by increased demand for cost efficiency and process optimization across various industries.

Request a free sample.

Ecosystem

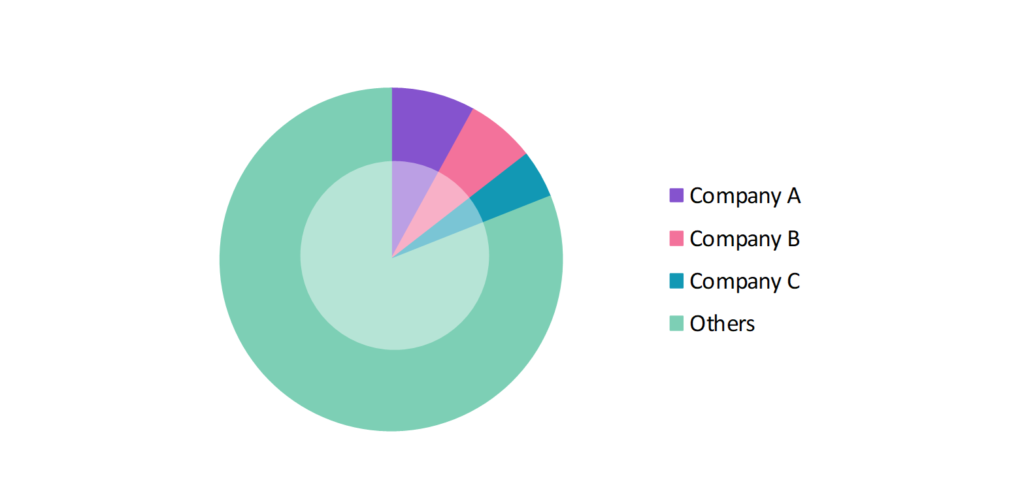

- The participants in the global business process outsourcing industry dominate the market through their comprehensive service offerings, global reach, and continuous innovation.

- These companies primarily focus on vertical specialization to cater to specific industry needs, along with mergers and acquisitions to expand service capabilities and maintain a competitive edge in the market.

- Several important entities in the business process outsourcing market include Accenture Plc; IBM Corp.; Amdocs Group Co.; Wipro Ltd.; HCLTech Ltd.; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2018-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Market Size (2024) | USD 330.12 Bn |

| Market Size (2029) | USD 528.92 Bn |

| Growth Rate | 9.89% CAGR from 2024 to 2029 |

| Key Segments | Service Type (Finance & Accounting, Human Resources, Procurement & Supply Chain, Customer Services, Others); Enterprise Size (Small & Medium Enterprises, Large Enterprises); End User (BFSI, Healthcare, Manufacturing, IT & Telecom, Retail, Others); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | Accenture Plc; IBM Corp.; Amdocs Group Co.; Wipro Ltd.; HCLTech Ltd. |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; Colombia; Chile; China; India; Japan; South Korea; The UK; Germany; Italy; France; Spain; Turkey; UAE; Saudi Arabia; Egypt; South Africa |

| Largest Market | North America |

Get a free quote.

Trends

- Focus on Cybersecurity: With the rise of data breaches and cyber threats, BPO providers are increasingly focusing on enhancing cybersecurity measures. In 2023, Infosys launched a new cybersecurity division dedicated to safeguarding outsourced processes, reflecting the growing importance of data protection in the industry.

- Adoption of Robotic Process Automation (RPA): The integration of RPA is becoming a standard practice in the BPO industry, enabling companies to automate repetitive tasks. In 2023, Wipro implemented RPA in its BPO services, leading to increased efficiency and accuracy in handling customer queries and back-office operations.

- Focus on Employee Well-being: The BPO industry is increasingly emphasizing employee well-being to reduce attrition rates. In 2023, Concentrix launched a mental health program for its employees, offering counseling services and flexible work arrangements, highlighting the trend towards better work-life balance in the sector.

Speak to analyst.

Catalysts

- Focus on Core Competencies: Companies are increasingly outsourcing non-core functions to focus on their core business areas. In 2023, IBM outsourced its customer service operations to TeleTech, allowing the company to concentrate on its core technology and innovation efforts.

- Cloud-Powered BPaaS: Cloud computing has revolutionized BPO through Business Process as a Service (BPaaS). As defined by Gartner, BPaaS delivers cloud-sourced, multitenant BPO services. It offers IT platforms, solutions, and support for back-office operations, providing global access to trained personnel and cloud-based data. This model enhances accessibility and efficiency in outsourced business processes.

- Demand for Scalability: BPO services offer scalability, allowing companies to adjust their operations based on demand. In 2023, WNS Global Services helped a leading e-commerce company scale its customer support operations during peak shopping seasons, demonstrating the flexibility provided by outsourcing.

Inquire before buying.

Restraints

- Data Privacy Concerns: Data privacy remains a significant challenge in the BPO market, especially with the increasing volume of sensitive information being outsourced. In 2023, a data breach at Atos raised concerns about the security of outsourced processes, highlighting the ongoing risk of data exposure in the industry.

- High Attrition Rates: The BPO industry faces high attrition rates, leading to challenges in maintaining service quality. In 2023, Concentrix reported a 25% attrition rate, which impacted its ability to deliver consistent services, reflecting the need for better employee retention strategies.

- Regulatory Compliance: Navigating different regulatory environments across countries is a challenge for BPO providers. In 2023, Wipro faced difficulties in complying with new data protection regulations in the European Union, underscoring the complexities of operating in a global market.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Business Process Outsourcing Market (2018 – 2022) 2.2. Global Business Process Outsourcing Market (2023 – 2029) 3. Market Segmentation 3.1. Global Business Process Outsourcing Market by Service Type 3.1.1. Finance & Accounting 3.1.2. Human Resources 3.1.3. Procurement & Supply Chain 3.1.4. Customer Services 3.1.5. Others 3.2. Global Business Process Outsourcing Market by Enterprise Size 3.2.1. Small & Medium Enterprises 3.2.2. Large Enterprises 3.3. Global Business Process Outsourcing Market by End User 3.3.1. BFSI 3.3.2. Healthcare 3.3.3. Manufacturing 3.3.4. IT & Telecom 3.3.5. Retail 3.3.6. Others 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Colombia 4.2.4. Chile 4.2.5. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Japan 4.3.4. South Korea 4.3.5. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. Italy 4.4.4. France 4.4.5. Spain 4.4.6. Rest of Europe 4.5. The Middle East 4.5.1. Turkey 4.5.2. UAE 4.5.3. Saudi Arabia 4.5.4. Rest of the Middle East 4.6. Africa 4.6.1. Egypt 4.6.2. South Africa 4.6.3. Rest of Africa 5. Value Chain Analysis of the Global Business Process Outsourcing Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. Accenture Plc 9.2. IBM Corp. 9.3. Amdocs Group Co. 9.4. Wipro Ltd. 9.5. HCLTech Ltd. 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Business Process Outsourcing Market – FAQs

1. What is the current size of the business process outsourcing market?

Ans. In 2024, the business process outsourcing market size is USD 330.12 Bn.

2. Who are the major vendors in the business process outsourcing market?

Ans. The major vendors in the business process outsourcing market are Accenture Plc; IBM Corp.; Amdocs Group Co.; Wipro Ltd.; HCLTech Ltd.

3. Which segments are covered under the business process outsourcing market segments analysis?

Ans. The business process outsourcing market report offers in-depth insights into Service Type, Enterprise Size, End User, and Geography.