Transformer Monitoring System Market Analysis: Growth, Size, Share & Future Trends (2024-2029)

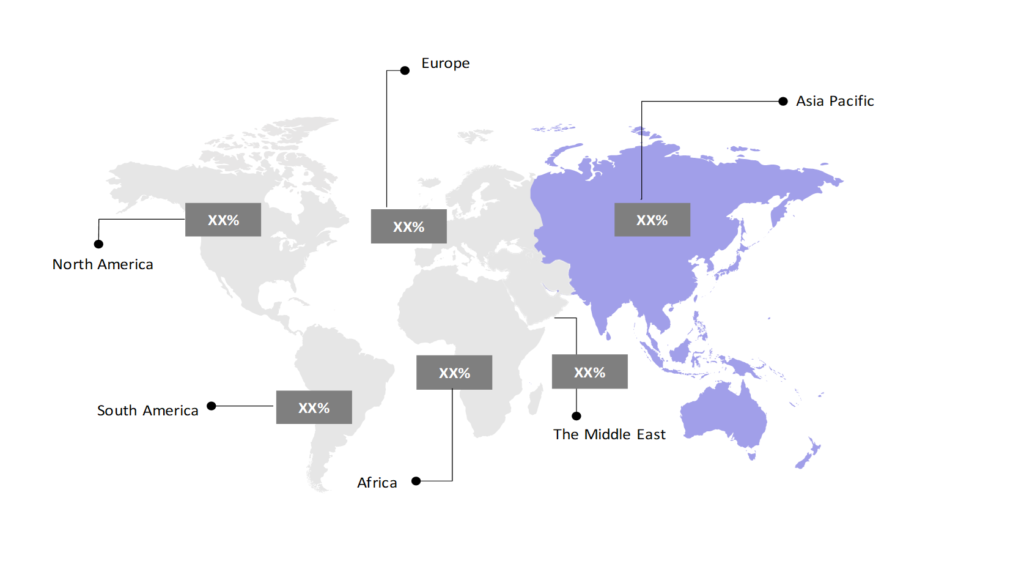

The market report offers a detailed analysis segmented by Component (Hardware Solutions, Software Solutions); by Services (Oil Monitoring, Bushing Monitoring, Partial Discharge Monitoring, On-Load Tap Changer (OLTC) Monitoring, Others); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

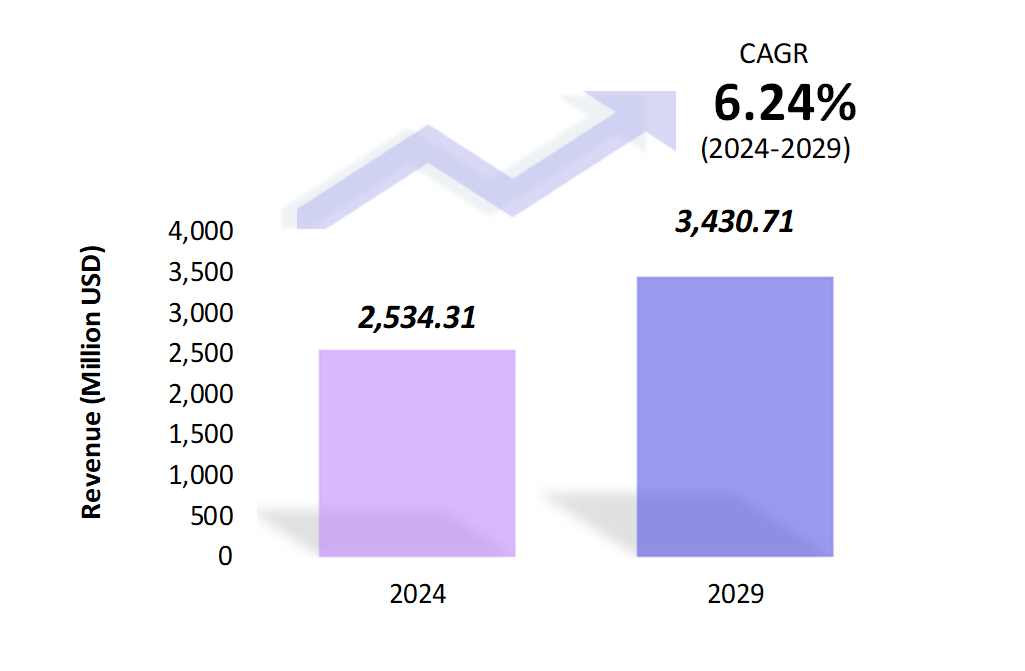

- The transformer monitoring system market is estimated to be at USD 2,534.31 Mn in 2024 and is anticipated to reach USD 3,430.71 Mn in 2029.

- The transformer monitoring system market is registering a CAGR of 6.24% during the forecast period 2024-2029.

- The global transformer monitoring system market growth is driven by the increasing demand for reliable power transmission, coupled with the aging transformer infrastructure. Transformer monitoring systems (TMS) are widely used in power grids and industrial applications to ensure the optimal operation of transformers.

Request a free sample.

Ecosystem

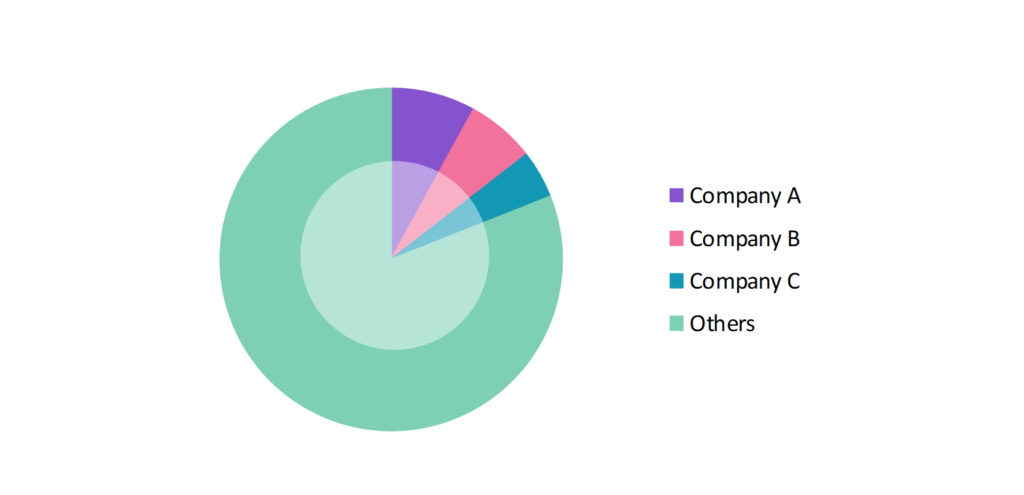

- The participants in the global transformer monitoring system industry are focusing on R&D and collaboration with power utilities to develop innovative TMS solutions.

- These companies are focusing on integrating advanced technologies like artificial intelligence (AI) and the Internet of Things (IoT) into their monitoring systems, along with strategic partnerships to maintain a competitive edge in the market.

- Several important entities in the transformer monitoring system market include GE Vernova Inc.; Siemens Energy AG; Schneider Electric SE; Mistras Group; Vaisala Group; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2018-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Market Size (2024) | USD 2,534.31 Mn |

| Market Size (2029) | USD 3,430.71 Mn |

| Growth Rate | 6.24% CAGR from 2024 to 2029 |

| Key Segments | Component (Hardware Solutions, Software Solutions); Services (Oil Monitoring, Bushing Monitoring, Partial Discharge Monitoring, On-Load Tap Changer (OLTC) Monitoring, Others); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | GE Vernova Inc.; Siemens Energy AG; Schneider Electric SE; Mistras Group; Vaisala Group |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; Colombia; China; India; Japan; South Korea; The UK; Germany; Italy; Turkey; UAE; Egypt; South Africa |

| Largest Market | Asia Pacific |

Get a free quote.

Trends

- Focus on Environmental Sustainability: With the increasing focus on environmental sustainability, transformer monitoring systems are evolving to monitor environmental impacts, such as oil leaks and gas emissions. In 2023, GE Grid Solutions launched a green monitoring system that tracks transformer oil levels to prevent leaks and improve sustainability efforts.

- Shift Toward Cloud-Based Monitoring: Cloud-based transformer monitoring solutions are gaining traction due to their ability to store and analyze vast amounts of data. ABB introduced a cloud-based monitoring platform in 2023, allowing utility companies to access transformer data remotely and predict potential failures, enhancing grid reliability.

- Emphasis on Remote Monitoring: Remote monitoring capabilities are becoming increasingly essential in transformer monitoring systems, particularly in regions with vast and difficult-to-access power infrastructure. In 2023, Schneider Electric expanded its remote monitoring system, enabling power companies to maintain real-time supervision of transformers in remote areas.

Speak to analyst.

Catalysts

- Aging Power Infrastructure: The necessity to upgrade and maintain aging power infrastructure is increasing demand for transformer monitoring systems. This focus on modernization is essential for efficiency and reliability. In 2023, U.S. utility companies, including Con Edison and PG&E, announced investments to upgrade their grid infrastructure with advanced monitoring technologies to ensure reliability.

- Demand for Predictive Maintenance Solutions: Transformer monitoring systems with predictive maintenance capabilities are in high demand. Their ability to anticipate issues enhances reliability and efficiency. In 2023, ABB and Honeywell developed advanced monitoring tools that predict potential transformer issues before they cause disruptions, leading to reduced maintenance costs and downtime.

- Government Initiatives for Smart Grid Development: Various governments are investing in smart grid projects that necessitate the deployment of advanced transformer monitoring systems. In 2023, the Chinese government committed significant funding to modernize its power grid, including the integration of TMS technology to ensure the stability of renewable energy supply.

Inquire before buying.

Restraints

- High Initial Costs of Implementation: The high cost of installing and maintaining transformer monitoring systems remains a significant challenge, particularly for smaller utility companies and industries. In 2023, NextEra Energy cited the steep upfront investment as a barrier to adopting TMS in smaller grids, despite long-term benefits.

- Data Security Concerns: As transformer monitoring systems increasingly utilize cloud-based solutions and IoT integration, concerns over data privacy and cybersecurity have emerged. In 2023, multiple U.S. utility companies, including Entergy, raised concerns about the vulnerability of grid data to cyberattacks, impacting the widespread adoption of cloud-based TMS.

- Integration with Legacy Systems: Many older power grids use legacy infrastructure, making it challenging to integrate modern transformer monitoring systems seamlessly. In 2023, Southern Company reported difficulties in retrofitting their older grid systems with advanced TMS solutions, delaying the full implementation of their smart grid upgrades.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Transformer Monitoring System Market (2018 – 2022) 2.2. Global Transformer Monitoring System Market (2023 – 2029) 3. Market Segmentation 3.1. Global Transformer Monitoring System Market by Component 3.1.1. Hardware Solutions 3.1.2. Software Solutions 3.2. Global Transformer Monitoring System Market by Services 3.2.1. Oil Monitoring 3.2.2. Bushing Monitoring 3.2.3. Partial Discharge Monitoring 3.2.4. On-Load Tap Changer (OLTC) Monitoring 3.2.5. Others 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Colombia 4.2.4. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Japan 4.3.4. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. Italy 4.4.4. Rest of Europe 4.5. The Middle East 4.5.1. Turkey 4.5.2. UAE 4.5.3. Rest of the Middle East 4.6. Africa 4.6.1. Egypt 4.6.2. South Africa 4.6.3. Rest of Africa 5. Value Chain Analysis of the Global Transformer Monitoring System Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. GE Vernova Inc. 9.2. Siemens Energy AG 9.3. Schneider Electric SE 9.4. Mistras Group 9.5. Vaisala Group 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Transformer Monitoring System Market – FAQs

1. What is the current size of the transformer monitoring system market?

Ans. In 2024, the transformer monitoring system market size is USD 2,534.31 Mn.

2. Who are the major vendors in the transformer monitoring system market?

Ans. The major vendors in the transformer monitoring system market are GE Vernova Inc.; Siemens Energy AG; Schneider Electric SE; Mistras Group; Vaisala Group.

3. Which segments are covered under the transformer monitoring system market segments analysis?

Ans. The transformer monitoring system market report offers in-depth insights into Component, Services, and Geography.