Logistics Automation Market: Size, Share, Trends & Forecast (2024-2029)

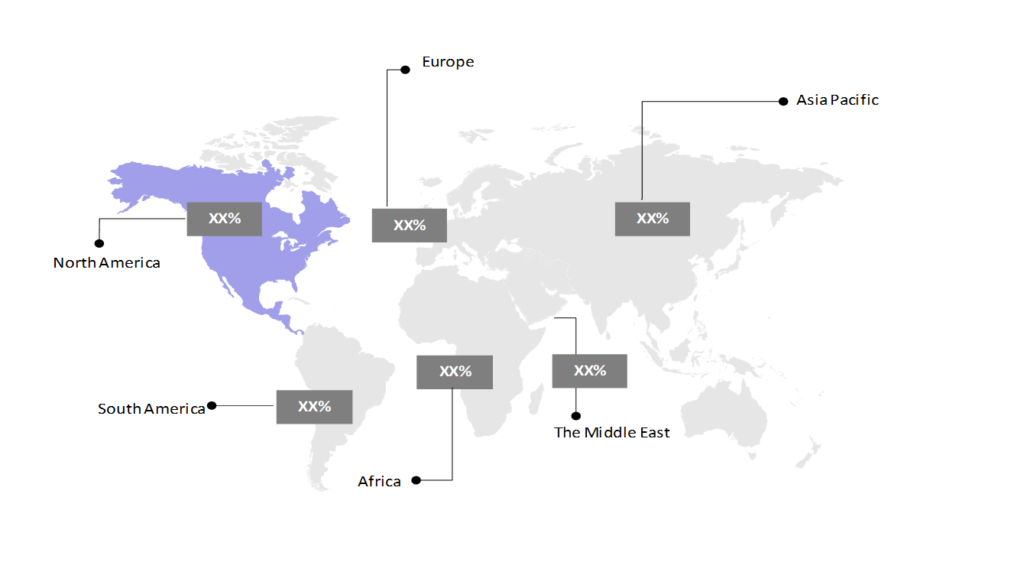

The market report offers a detailed analysis segmented by Component (Hardware, Software, Services); by End-User Industry (Food and Beverages, Post and Parcels, Groceries, General Merchandise, Apparels, Manufacturing, Others); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

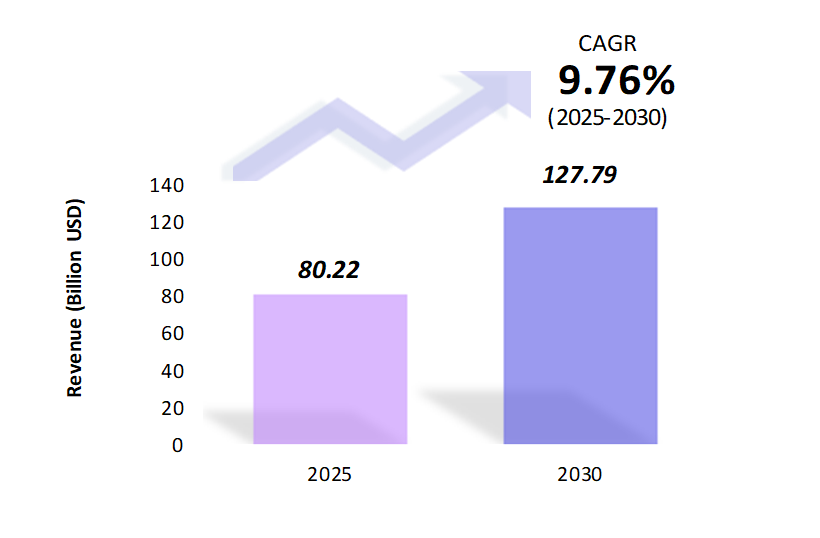

- The logistics automation market is estimated to be at USD 80.22 Bn in 2025 and is anticipated to reach USD 127.79 Bn in 2030.

- The logistics automation market is registering a CAGR of 9.76% during the forecast period 2025-2030.

- The logistics automation market is rapidly expanding, driven by demand for faster, more efficient, and cost-effective supply chain solutions. Advancements in AI (artificial intelligence), robotics, IoT (Internet of Things), and data analytics are transforming warehousing, distribution, and last-mile delivery. Despite high capital investment requirements and skilled labor shortages, automation offers substantial benefits in operational efficiency and scalability. As global e-commerce grows, logistics automation is set to play a crucial role in meeting rising consumer expectations for speed and reliability.

Request a free sample.

Ecosystem

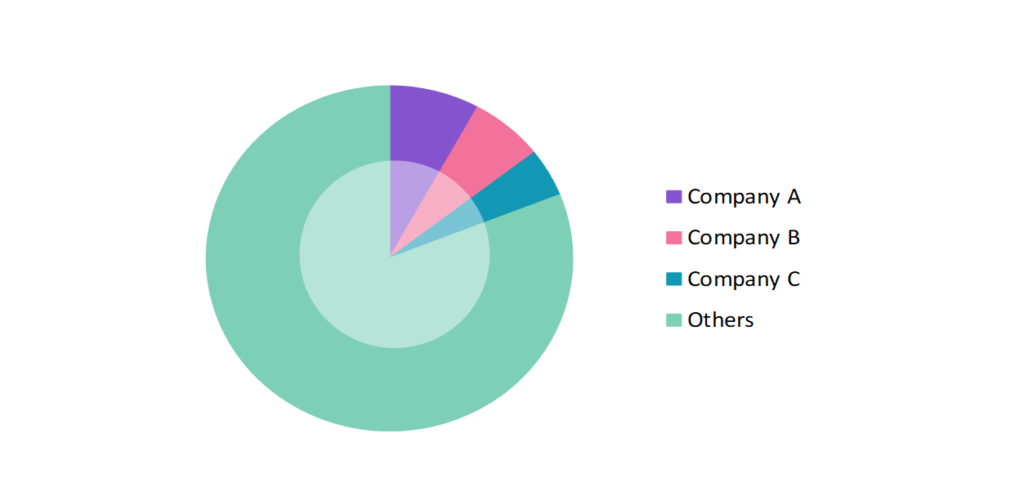

- The participants in the global logistics automation industry are always developing their strategies to preserve a competitive advantage.

- To maintain a competitive edge, companies invest heavily in research & development, focusing on developing advanced AI, robotics, and IoT solutions. This innovation-driven competition emphasizes cost reduction, faster operations, and improved safety, which are increasingly essential in winning market share.

- Several important entities in the logistics automation market include Kion Group (Dematic Holding S.à r.l.); Daifuku Co., Ltd.; Swisslog Holding AG; Honeywell International Inc.; Jungheinrich AG; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2019-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Market Size (2025) | USD 80.22 Bn |

| Market Size (2030) | USD 127.79 Bn |

| Growth Rate | 9.76% CAGR from 2025 to 2030 |

| Key Segments | Component (Hardware, Software, Services); End-User Industry (Food and Beverages, Post and Parcels, Groceries, General Merchandise, Apparels, Manufacturing, Others); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | Kion Group (Dematic Holding S.à r.l.); Daifuku Co., Ltd.; Swisslog Holding AG; Honeywell International Inc.; Jungheinrich AG |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; Chile; Peru; China; India; Japan; South Korea; The UK; Germany; Italy; France; Turkey; UAE; Saudi Arabia; Egypt; South Africa |

| Largest Market | North America |

Get a free quote.

Trends

- Development of Autonomous Delivery Vehicles: Autonomous trucks and drones are revolutionizing last-mile delivery by reducing dependency on human drivers and enabling 24/7 operations. The Nuro company is deploying small, driverless delivery vehicles for groceries in partnership with Kroger. Similarly, Amazon and Walmart have tested drone deliveries, which cut down delivery times and costs, particularly in urban and suburban areas.

- Use of Robotic Process Automation (RPA) for Inventory Management: RPA helps automate repetitive inventory tasks, optimizing stock counts and reducing human error. For example, United Parcel Care (UPS) company, uses RPA to streamline its warehouse inventory processes, which improves tracking accuracy and speeds up the distribution process. These automated systems enhance productivity, which ensures that goods are always available without overstocking.

- Incorporation of Artificial Intelligence in Route Optimization: AI algorithms analyze traffic, weather, and delivery patterns to identify the fastest, most efficient routes in real-time. DHL has integrated AI-powered route optimization, which leads to lower fuel consumption and quicker deliveries. This has been particularly impactful for last-mile logistics, where even small efficiency gains translate into significant cost and time savings.

Speak to analyst.

Catalysts

- Technological Advancements Reshaping Logistics: Innovations such as Internet of Things (IoT) devices and blockchain are transforming logistics operations by providing real-time visibility, security, and automation. For instance, Maersk and IBM use blockchain to track shipping containers worldwide, which increases transparency and security in the supply chain. IoT sensors are also increasingly used for live tracking of goods, which improves delivery accuracy and customer satisfaction.

- Increasing Manufacturing Complexity and Technology Integration: The push toward personalized products and flexible production lines adds complexity to logistics, as manufacturers need advanced technology to manage more diverse product flows and custom orders. Automotive companies like Tesla rely on automated supply chain systems to coordinate just-in-time delivery of parts and materials, which allows them to quickly adapt to new production requirements. This complexity drives demand for sophisticated logistics solutions capable of handling custom orders and rapid design changes.

- Enhanced Workforce Safety through Advanced Technology: Technologies like collaborative robots (cobots), wearable devices, and automated forklifts improve worker safety by taking on hazardous tasks and monitoring worker health in real-time. Amazon has introduced cobots in its warehouses to assist workers with heavy lifting and repetitive tasks, which significantly reduces injuries.

Inquire before buying.

Restraints

- High Capital Investment: Implementing advanced logistics automation requires substantial upfront capital for purchasing, installing, and maintaining technology like robotics, AI systems, and IoT infrastructure. Small and mid-sized logistics firms often struggle to afford these investments, which makes it difficult to compete with larger players who can scale their automated systems more easily.

- Skilled Labor Shortages and Training Requirements: As automation technology becomes more sophisticated, the demand for skilled technicians, engineers, and operators who can install, maintain, and troubleshoot these systems is rising. The labor pool with these specialized skills is limited, and training costs can be high, which creates a barrier for companies adopting new technology.

- Cybersecurity and Data Privacy Concerns: Logistics automation relies heavily on data collection, IoT devices, and cloud computing, which increases the vulnerability to cyberattacks and data breaches. A cyberattack on automated systems can disrupt supply chains, which can lead to significant operational and financial losses. For example, Maersk faced a major cyberattack in 2017 that temporarily shut down its global operations; securing these systems against cyber threats is a significant ongoing challenge that requires investment in robust cybersecurity measures.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Logistics Automation Market (2019 – 2023) 2.2. Global Logistics Automation Market (2024 – 2030) 3. Market Segmentation 3.1. Global Logistics Automation Market by Component 3.1.1. Hardware 3.1.2. Software 3.1.3. Services 3.2. Global Logistics Automation Market by End-User Industry 3.2.1. Food and Beverages 3.2.2. Post and Parcels 3.2.3. Groceries 3.2.4. General Merchandise 3.2.5. Apparels 3.2.6. Manufacturing 3.2.7. Others 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Chile 4.2.4. Peru 4.2.5. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Japan 4.3.4. South Korea 4.3.5. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. Italy 4.4.4. France 4.4.5. Rest of Europe 4.5. The Middle East 4.5.1. Turkey 4.5.2. UAE 4.5.3. Saudi Arabia 4.5.4. Rest of the Middle East 4.6. Africa 4.6.1. Egypt 4.6.2. South Africa 4.6.3. Rest of Africa 5. Value Chain Analysis of the Global Logistics Automation Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. Kion Group (Dematic Holding S.à r.l.) 9.2. Daifuku Co., Ltd. 9.3. Swisslog Holding AG 9.4. Honeywell International Inc. 9.5. Jungheinrich AG 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Logistics Automation Market – FAQs

1. What is the current size of the logistics automation market?

Ans. In 2025, the logistics automation market size is USD 80.22 Bn.

2. Who are the major vendors in the logistics automation market?

Ans. The major vendors in the logistics automation market are Kion Group (Dematic Holding S.à r.l.); Daifuku Co., Ltd.; Swisslog Holding AG; Honeywell International Inc.; Jungheinrich AG.

3. Which segments are covered under the logistics automation market segments analysis?

Ans. The logistics automation market report offers in-depth insights into Component, End-User Industry, and Geography.