Marine Port Services Market Analysis: Growth, Size, Share & Future Trends (2024-2029)

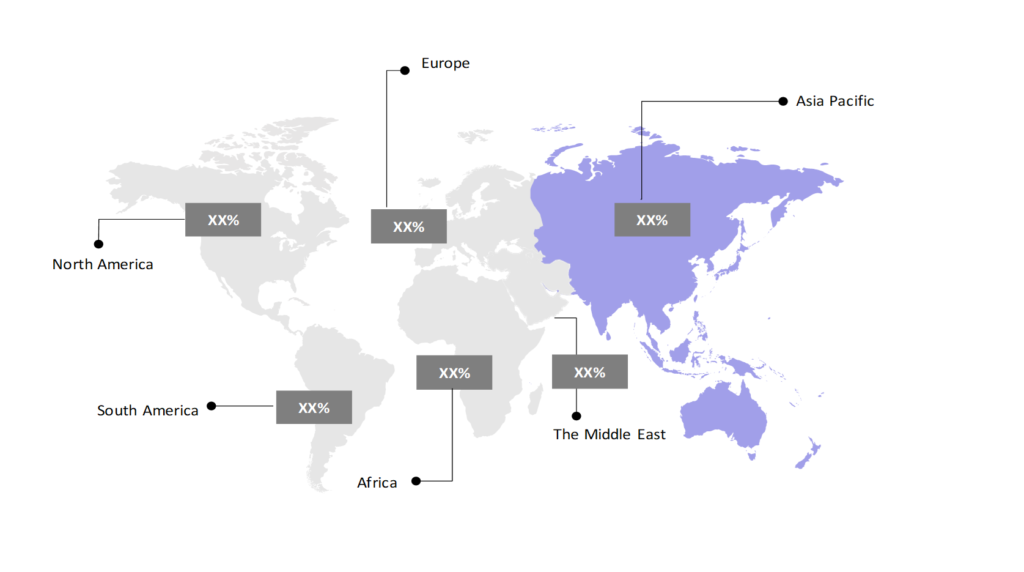

The market report presents a thorough analysis segmented by Port Types (Dry Ports, Bulk Cargo Ports, Passenger Ports, Fishing Ports, Others); by Service Types (Container Handling Services, Warehousing and Storage Services, Ship Repair and Maintenance, Vessel Agency Services, Others); by End-users (Tourism, Military, Logistics, Oil and Gas, Others); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Market Dimensions & Growth Potential

- The marine port services market is estimated to be at USD 90,424.91 Mn in 2024 and is anticipated to reach USD 116,919.10 Mn in 2029.

- The marine port services market is registering a CAGR of 5.27% during the forecast period of 2024-2029.

- The marine port services market is characterized by robust growth driven by several key factors. The rapid growth of e-commerce and the expansion of global trade are significantly increasing the demand for efficient and reliable port services.

Request a free sample.

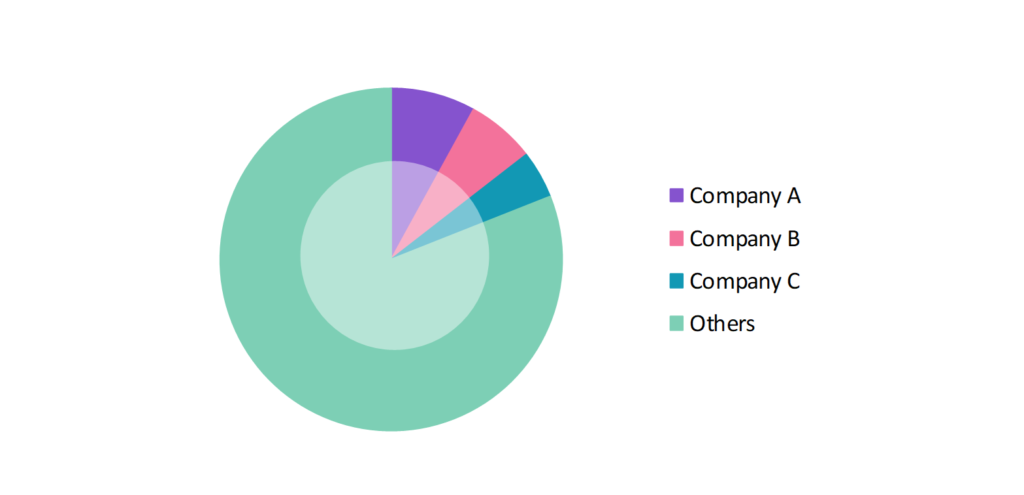

Competitive Landscape & Market Positioning in 2023

- The global marine port services industry participants always develop strategies to preserve a competitive advantage.

- These companies primarily use acquisitions, R&D, partnerships, and technological launches.

- Several important entities in the marine port services market include DP World Ltd.; A.P. Moller-Maersk A/S; Hamburger Hafen Und Logistik AG; SIPG Bayport Terminal Co., Ltd.; Shipping Solutions and Services Ltd.; and others.

Ask for customization.

Report Objectives & Insights

| Attributes | Values |

| Historical Period | 2018-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Market Size (2024) | USD 90,424.91 Mn |

| Market Size (2029) | USD 116,919.10 Mn |

| Growth Rate | 5.27% CAGR from 2024 to 2029 |

| Key Segments | Port Types (Dry Ports, Bulk Cargo Ports, Passenger Ports, Fishing Ports, Others); Service Types (Container Handling Services, Warehousing and Storage Services, Ship Repair and Maintenance, Vessel Agency Services, Others); End-users (Tourism, Military, Logistics, Oil and Gas, Others); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | DP World Ltd.; A.P. Moller-Maersk A/S; Hamburger Hafen Und Logistik AG; SIPG Bayport Terminal Co., Ltd.; Shipping Solutions and Services Ltd. |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; Colombia; Chile; China; India; Japan; South Korea; The UK; Germany; Italy; France; Spain; Turkey; UAE; Saudi Arabia; Egypt; South Africa |

| Largest Market | Asia Pacific |

Get a free quote.

Market Trends & Future Outlook

- Automation and Smart Ports: The integration of automated systems and smart technologies is transforming port operations. For example, in February 2024, the Port of Rotterdam implemented a fully automated container terminal using AI and robotics to enhance efficiency and reduce human error.

- Adopting Green Technology: Ports are increasingly adopting green technologies and practices to reduce its environmental impact. For example, in December 2023, the Port of Los Angeles announced a partnership with Toyota to deploy hydrogen-powered trucks for cargo transportation, significantly cutting down emissions.

- Infrastructure Modernization: Ports are upgrading significantly to accommodate larger vessels and increased cargo volumes. New technologies, such as automated cranes and advanced logistics systems, are being implemented to streamline operations and reduce turnaround times.

Speak to analyst.

Key Market Influencers & Growth Drivers

- Modernizing and Expanding Port Infrastructure: Investments in modernizing and expanding port infrastructure are boosting market growth. For instance, in January 2024, the Indian government announced a USD 14 billion investment plan to develop its port infrastructure to enhance capacity and efficiency.

- Public-Private Partnerships: Investments in port infrastructure and partnerships between the public and private sectors further stimulate market growth, allowing ports to expand capacity and improve service offerings. For instance, in July 2023, International Container Terminal Services Inc. (ICTSI) was awarded a 25-year contract to manage and enhance operations at Durban Container Terminal (DCT) Pier 2 in the Port of Durban, South Africa.

- Increasing Global Trade: The increasing global trade volumes are fueling a greater need for efficient port services. This heightened demand requires significant improvements in port infrastructure and operations. Additionally, the expansion of e-commerce and the trend towards larger, more sophisticated container ships intensify the urgency for ports to rapidly and effectively adapt.

Inquire before buying.

Market Obstacles & Growth Barriers

- Regulatory Compliance: Port operators face challenges in navigating complex and varying regulatory environments across different regions. For instance, in December 2023, the International Maritime Organization (IMO) introduced stricter emissions regulations, requiring ports to invest heavily in compliance measures.

- Infrastructure Bottlenecks: Deteriorating infrastructure and capacity constraints lead to inefficiencies and delays, hindering cargo processing and driving up costs. Outdated facilities and equipment may be inadequate for handling larger vessels and increased cargo volumes, causing slower turnaround times and higher maintenance expenses. These issues create bottlenecks, disrupt supply chains, and escalate operational costs.

- Cybersecurity Threats: Rising cyber threats are a significant concern for ports that depend on digital systems. As ports adopt advanced technologies like automated cargo handling and real-time tracking, they become more susceptible to cyberattacks, disrupting operational efficiency and supply chains and threatening national security.

Personalize this research.

Map Highlighting Key Region in 2023

Explore purchase options.

Table of Contents

| 1. Introduction |

|---|

| 1.1. Research Methodology |

| 1.2. Scope of the Study |

| 2. Market Overview / Executive Summary |

| 2.1. Global Marine Port Services Market (2018 – 2022) |

| 2.2. Global Marine Port Services Market (2023 – 2029) |

| 3. Market Segmentation |

| 3.1. Global Marine Port Services Market by Port Types |

| 3.1.1. Dry Ports |

| 3.1.2. Bulk Cargo Ports |

| 3.1.3. Passenger Ports |

| 3.1.4. Fishing Ports |

| 3.1.5. Others |

| 3.2. Global Marine Port Services Market by Service Types |

| 3.2.1. Container Handling Services |

| 3.2.2. Warehousing and Storage Services |

| 3.2.3. Ship Repair and Maintenance |

| 3.2.4. Vessel Agency Services |

| 3.2.5. Others |

| 3.3. Global Marine Port Services Market by End-users |

| 3.3.1. Tourism |

| 3.3.2. Military |

| 3.3.3. Logistics |

| 3.3.4. Oil and Gas |

| 3.3.5. Others |

| 4. Regional Segmentation |

| 4.1. North America |

| 4.1.1. The US |

| 4.1.2. Canada |

| 4.1.3. Mexico |

| 4.2. South America |

| 4.2.1. Brazil |

| 4.2.2. Argentina |

| 4.2.3. Colombia |

| 4.2.4. Chile |

| 4.2.5. Rest of South America |

| 4.3. Asia Pacific |

| 4.3.1. China |

| 4.3.2. India |

| 4.3.3. Japan |

| 4.3.4. South Korea |

| 4.3.5. Rest of Asia Pacific |

| 4.4. Europe |

| 4.4.1. The UK |

| 4.4.2. Germany |

| 4.4.3. Italy |

| 4.4.4. France |

| 4.4.5. Spain |

| 4.4.6. Rest of Europe |

| 4.5. The Middle East |

| 4.5.1. Turkey |

| 4.5.2. UAE |

| 4.5.3. Saudi Arabia |

| 4.5.4. Rest of the Middle East |

| 4.6. Africa |

| 4.6.1. Egypt |

| 4.6.2. South Africa |

| 4.6.3. Rest of Africa |

| 5. Value Chain Analysis of the Global Marine Port Services Market |

| 6. Porter Five Forces Analysis |

| 6.1. Threats of New Entrants |

| 6.2. Threats of Substitutes |

| 6.3. Bargaining Power of Buyers |

| 6.4. Bargaining Power of Suppliers |

| 6.5. Competition in the Industry |

| 7. Trends, Drivers and Challenges Analysis |

| 7.1. Market Trends |

| 7.1.1. Market Trend 1 |

| 7.1.2. Market Trend 2 |

| 7.1.3. Market Trend 3 |

| 7.2. Market Drivers |

| 7.2.1. Market Driver 1 |

| 7.2.2. Market Driver 2 |

| 7.2.3. Market Driver 3 |

| 7.3. Market Challenges |

| 7.3.1. Market Challenge 1 |

| 7.3.2. Market Challenge 2 |

| 7.3.3. Market Challenge 3 |

| 8. Opportunities Analysis |

| 8.1. Market Opportunity 1 |

| 8.2. Market Opportunity 2 |

| 8.3. Market Opportunity 3 |

| 9. Competitive Landscape |

| 9.1. DP World Ltd. |

| 9.2. A.P |

| 9.3. Hamburger Hafen Und Logistik AG |

| 9.4. SIPG Bayport Terminal Co., Ltd. |

| 9.5. Shipping Solutions and Services Ltd. |

| 9.6. Company 6 |

| 9.7. Company 7 |

| 9.8. Company 8 |

| 9.9. Company 9 |

| 9.10. Company 10 |

Know the research methodology.

Marine Port Services Market – FAQs

What is the current size of the marine port services market?

In 2024, the marine port services market size is $90,424.91 Mn.

Who are the major vendors in the marine port services market?

The major vendors in the marine port services market are DP World Ltd.; A.P. Moller-Maersk A/S; Hamburger Hafen Und Logistik AG; SIPG Bayport Terminal Co., Ltd.; Shipping Solutions and Services Ltd.

Which segments are covered under the marine port services market segments analysis?

The marine port services market report offers in-depth insights into Port Types, Service Types, End-users, and Geography.