Biopsy Devices Market: Size, Share, Trends & Forecast (2024-2029)

The market report offers a detailed analysis segmented by Product (Needle-based Biopsy Instruments, Procedure Trays, Localization Wires, Others); by Application (Breast Biopsy, Lung Biopsy, Colorectal Biopsy, Prostate Biopsy, Others); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

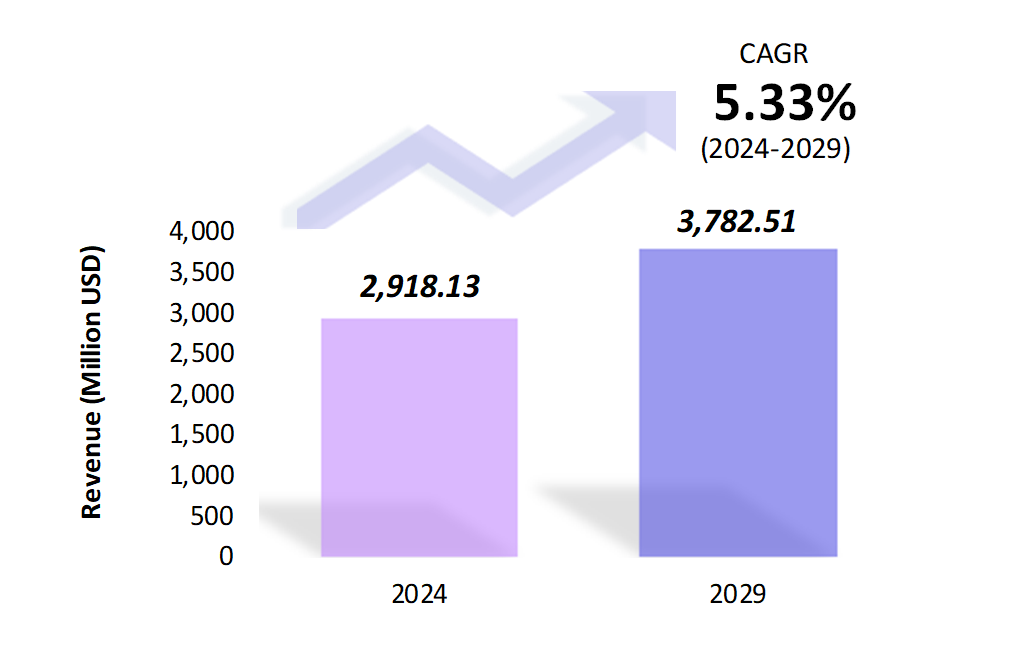

- The biopsy devices market is estimated to be at USD 2,918.13 Mn in 2024 and is anticipated to reach USD 3,782.51 Mn in 2029.

- The biopsy devices market is registering a CAGR of 5.33% during the forecast period of 2024-2029.

- The global biopsy devices market is experiencing significant growth due to the rising prevalence of cancer, advancements in diagnostic technologies, and increased awareness of early disease detection. Biopsy devices are essential for extracting tissue samples for diagnostic purposes, particularly in oncology.

Request a free sample.

Ecosystem

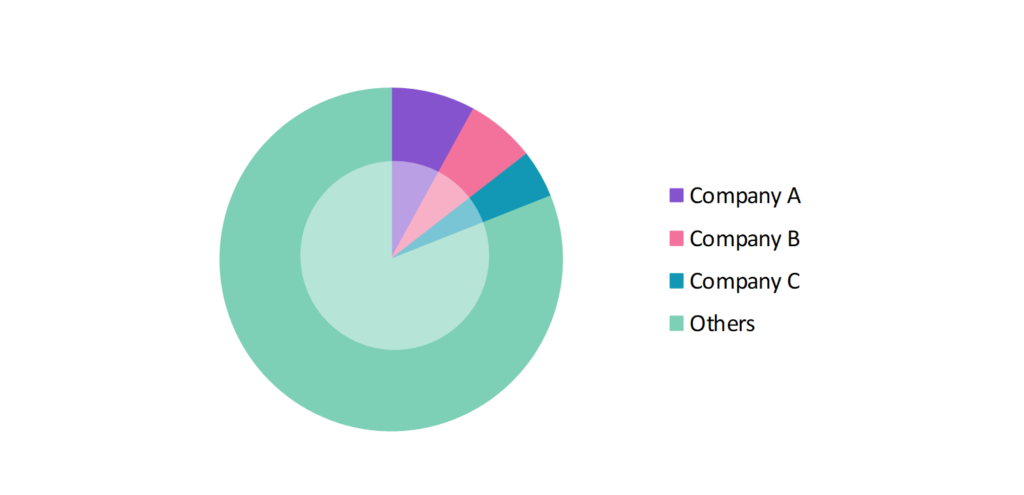

- The global biopsy devices industry participants are constantly developing strategies to preserve a competitive advantage.

- These companies are focused on continuous innovation, strategic partnerships, and acquisitions to strengthen their market position.

- Several important market entities for biopsy devices include Argon Medical Devices Danmark ApS; Danaher Corp.; Hologic, Inc.; Boston Scientific; Becton, Dickinson, and Co.; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2018-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Market Size (2024) | USD 2,918.13 Mn |

| Market Size (2029) | USD 3,782.51 Mn |

| Growth Rate | 5.33% CAGR from 2024 to 2029 |

| Key Segments | Product (Needle-based Biopsy Instruments, Procedure Trays, Localization Wires, Others); Application (Breast Biopsy, Lung Biopsy, Colorectal Biopsy, Prostate Biopsy, Others); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | Argon Medical Devices Danmark ApS; Danaher Corp.; Hologic, Inc.; Boston Scientific; Becton, Dickinson and Co. |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; China; India; Japan; South Korea; The UK; Germany; Italy; France; Spain; Israel; UAE; Saudi Arabia; Egypt; South Africa |

| Largest Market | North America |

Get a free quote.

Trends

- Shift Toward Minimally Invasive Procedures: Minimally invasive biopsy procedures are increasingly favored due to their ability to minimize patient discomfort, reduce recovery times, and lower the risk of complications. These techniques, such as needle biopsies and image-guided procedures, are gaining popularity for their precision and reduced invasiveness.

- Adoption of Liquid Biopsies: Liquid biopsy, a non-invasive diagnostic method that detects cancer-related biomarkers in blood, is gaining popularity. This trend is driven by its ability to provide real-time monitoring of tumor progression and treatment response. In 2023, Guardant Health launched a new liquid biopsy test for early cancer detection, marking a significant advancement in this technology.

- Advancements in Imaging-Guided Biopsy Devices: Innovations in imaging technology, such as 3D imaging and AI-assisted ultrasound, are enhancing the accuracy and efficiency of biopsy procedures. In 2023, GE Healthcare introduced an AI-powered ultrasound system designed to improve the precision of needle placement during biopsies, reducing the need for repeat procedures.

Speak to analyst.

Catalysts

- Increasing Prevalence of Cancer: The rising global incidence of cancer is a primary driver for the biopsy devices market. Early and accurate diagnosis is critical for effective treatment, leading to increased demand for biopsy procedures.

- Growing Awareness of Early Disease Detection: Increasing awareness of the importance of early disease detection, particularly for cancer, is boosting the demand for biopsy devices. Government initiatives and public health campaigns are encouraging regular screenings. For example, in 2023, the American Cancer Society launched a nationwide campaign promoting early cancer detection through regular biopsies, leading to a surge in demand for these devices.

- Rising Geriatric Population: The aging global population is contributing to the growth of the biopsy devices market, as older adults are at a higher risk of developing chronic diseases, including cancer. This demographic shift is driving increased demand for diagnostic procedures, with healthcare systems prioritizing early detection and intervention to manage age-related health conditions effectively.

Inquire before buying.

Restraints

- High Cost of Advanced Biopsy Devices: The high cost of advanced biopsy devices, such as robotic-assisted systems and liquid biopsy tests, is a significant challenge, particularly in developing countries. Limited financial resources and inadequate healthcare infrastructure further exacerbate the issue, making these technologies inaccessible to many patients in low-income regions.

- Risk of Complications and Misdiagnosis: Although biopsy procedures have advanced, they still pose risks such as bleeding, infection, and misdiagnosis, which can cause patient hesitation and hinder market adoption. The possibility of false negatives or inconclusive results may necessitate repeat procedures, adding to patient concerns and complicating treatment decisions.

- Regulatory and Ethical Concerns: Stringent regulatory requirements and ethical concerns about patient consent and data privacy challenge the biopsy devices market. In 2023, the U.S. FDA introduced stricter guidelines for approving new biopsy devices, which delayed the market entry of several innovative products.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Biopsy Devices Market (2018 – 2022) 2.2. Global Biopsy Devices Market (2023 – 2029) 3. Market Segmentation 3.1. Global Biopsy Devices Market by Product 3.1.1. Needle-based Biopsy Instruments 3.1.2. Procedure Trays 3.1.3. Localization Wires 3.2. Global Biopsy Devices Market by Application 3.2.1. Breast Biopsy 3.2.2. Lung Biopsy 3.2.3. Colorectal Biopsy 3.2.4. Prostate Biopsy 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Colombia 4.2.4. Chile 4.2.5. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Japan 4.3.4. South Korea 4.3.5. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. Italy 4.4.4. France 4.4.5. Spain 4.4.6. Rest of Europe 4.5. The Middle East 4.5.1. Turkey 4.5.2. UAE 4.5.3. Saudi Arabia 4.5.4. Rest of the Middle East 4.6. Africa 4.6.1. Egypt 4.6.2. South Africa 4.6.3. Rest of Africa 5. Value Chain Analysis of the Global Biopsy Devices Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. Argon Medical Devices Danmark ApS 9.2. Danaher Corp. 9.3. Hologic, Inc. 9.4. Boston Scientific 9.5. Becton, Dickinson and Co. 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Biopsy Devices Market – FAQs

1. What is the current size of the biopsy devices market?

Ans. In 2024, the biopsy devices market size is USD 2,918.13 Mn.

2. Who are the major vendors in the biopsy devices market?

Ans. The major vendors in the biopsy devices market are Argon Medical Devices Danmark ApS; Danaher Corp.; Hologic, Inc.; Boston Scientific; Becton, Dickinson and Co.

3. Which segments are covered under the biopsy devices market segments analysis?

Ans. The biopsy devices market report offers in-depth insights into Product, Application, and Geography.