CT Scanner Market: Size, Share, Trends & Forecast (2024-2029)

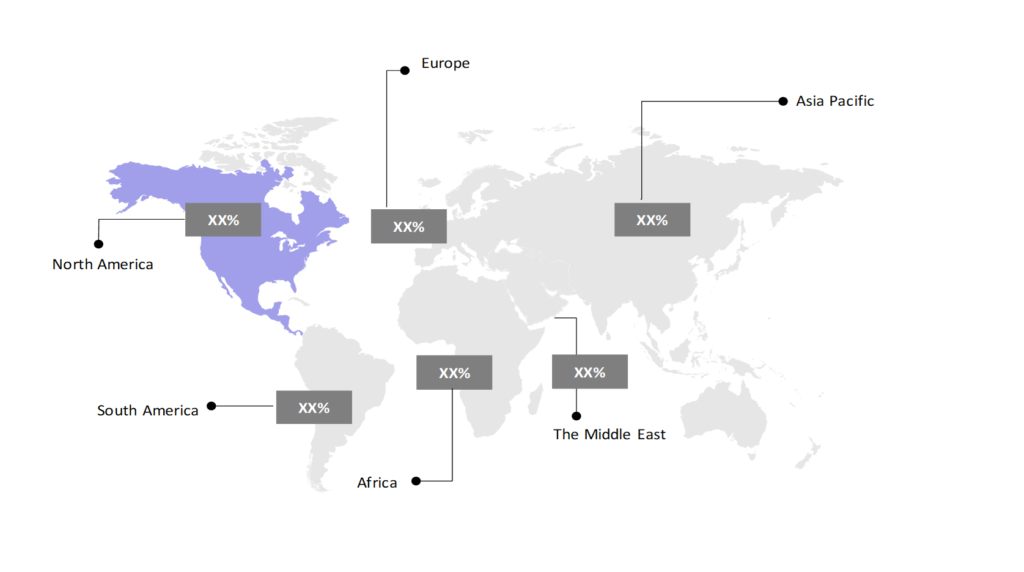

The market report offers a detailed analysis segmented by Application (Orthopedics, Cardiovascular, Oncology, Neurology, Others); by End User (Hospitals & Ambulatory Surgical Centers (ASCs), Diagnostic Imaging Centers, Others); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

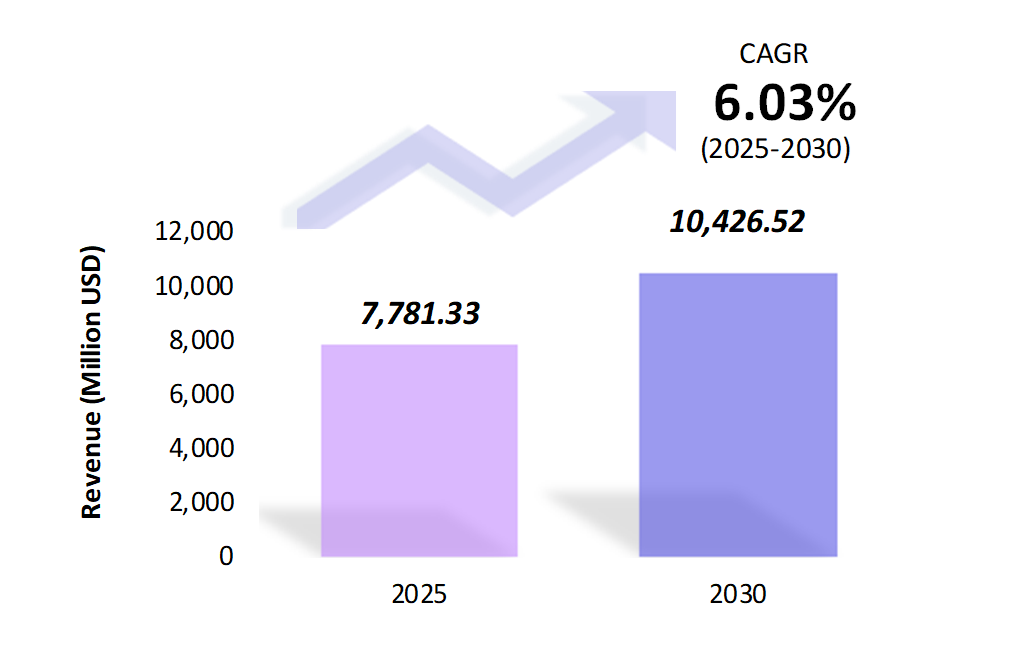

- The CT scanner market is estimated to be at USD 7,781.33 Mn in 2025 and is anticipated to reach USD 10,426.52 Mn in 2030.

- The CT scanner market is registering a CAGR of 6.03% during the forecast period 2025-2030.

- The global CT (Computed Tomography) scanner market is expected to experience robust growth due to the rising demand for advanced imaging technology in diagnostics, increasing incidences of chronic diseases, and technological advancements in imaging modalities.

Request a free sample.

Ecosystem

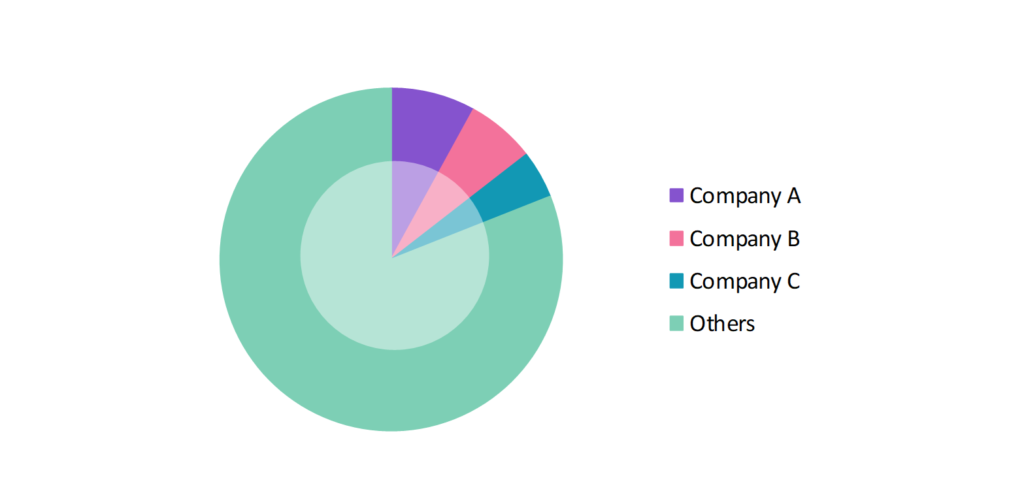

- The participants in the global CT scanner industry are continuously developing their strategies to preserve a competitive advantage.

- These companies focused on AI-driven innovations, dose reduction, high-end CT scanners, investments, acquisitions, R&D, partnerships, and technological launches.

- Several important entities in the CT scanner market include GE Healthcare; Toshiba Group; Siemens AG; Koninklijke Philips N.V.; Neusoft Corp.; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2019-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Market Size (2025) | USD 7,781.33 Mn |

| Market Size (2030) | USD 10,426.52 Mn |

| Growth Rate | 6.03% CAGR from 2025 to 2030 |

| Key Segments | Application (Orthopedics, Cardiovascular, Oncology, Neurology, Others); End User (Hospitals & Ambulatory Surgical Centers (ASCs), Diagnostic Imaging Centers, Others); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | GE Healthcare; Toshiba Group; Siemens AG; Koninklijke Philips N.V.; Neusoft Corp. |

| Key Countries | The US; Canada; Brazil; Argentina; Colombia; China; South Korea; Japan; The UK; Germany; France; Turkey; Israel; Morocco; South Africa |

| Largest Market | North America |

Get a free quote.

Trends

- Emergence of Portable CT Scanners: Portable CT scanners are gaining emphasis due to their convenience, especially in emergency settings and ICUs. These systems allow bedside imaging, reducing the need to move critically ill patients. In 2022, NeuroLogica launched the latest version of its portable CT scanner, BodyTom, for better patient mobility and accessibility.

- Advancements in AI Integration for Image Enhancement: Artificial intelligence (AI) is revolutionizing computed tomography (CT) by enhancing imaging capabilities and streamlining workflows. By employing advanced algorithms, AI-driven image reconstruction reduces scan time and minimizes radiation exposure, ensuring patient safety.

- Shift Toward Low-Dose CT Scanning: The growing focus on low-dose CT scanners addresses concerns about radiation exposure. Manufacturers are implementing advanced dose-reduction technologies, like iterative reconstruction and adaptive filtering, to minimize radiation while preserving image quality. These innovations enhance patient safety and comfort, making low-dose CT an essential tool in modern diagnostics.

Speak to analyst.

Catalysts

- Expansion of Cardiac CT Imaging: Cardiac CT is gaining popularity as a non-invasive imaging modality for evaluating coronary arteries and assessing cardiovascular disease risk. With the rising prevalence of heart diseases globally, there is a growing demand for specialized cardiac CT scanners that offer high-resolution images and faster scan times. This technology aids in early detection, enabling timely interventions and better managing cardiovascular conditions. As awareness of heart health increases, cardiac CT is becoming a critical tool in preventative cardiology.

- Rising Healthcare Expenditure and Infrastructure: Increasing healthcare spending, particularly in emerging economies, promotes the adoption of advanced medical equipment like CT scanners. Governments like China and India are investing heavily in upgrading healthcare infrastructure. In 2023, China’s healthcare spending significantly enhanced the accessibility of CT scanners in its healthcare system.

- Rising Incidence of Chronic Diseases: The rising prevalence of chronic diseases like cancer, cardiovascular disorders, and respiratory diseases is significantly fueling the demand for early diagnosis, which is critical for effective treatment. As healthcare providers focus on proactive care, advanced imaging technologies, including CT scanners, are becoming essential for timely and accurate diagnoses. Enhanced imaging capabilities allow for better disease detection at earlier stages, improving patient outcomes and driving innovations in CT technology.

Inquire before buying.

Restraints

- High Costs of CT Scanners: The high initial investment and ongoing maintenance costs of CT scanners present substantial challenges for smaller healthcare facilities, particularly in developing regions. Many of these facilities may struggle to allocate sufficient resources for such advanced technology, limiting their ability to offer comprehensive diagnostic services.

- Radiation Exposure Concerns: Despite advancements in dose-reduction technology, radiation exposure remains a significant concern, especially for pediatric patients and those requiring repeated imaging studies. Children are more sensitive to radiation, making it crucial to minimize exposure to prevent long-term health risks. Additionally, patients who undergo multiple scans may accumulate significant radiation doses over time, raising safety concerns among healthcare providers.

- Regulatory Hurdles and Approval Delays: Strict regulatory requirements from agencies like the Food and Drug Administration and the European Medicines Agency can delay the introduction of new CT scanner technologies. In 2023, companies like Siemens Healthineers faced setbacks securing approvals for their advanced AI-integrated CT systems. These delays hinder product launches and limit healthcare providers’ access to the latest imaging technologies that could improve patient outcomes.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global CT Scanner Market (2019 – 2023) 2.2. Global CT Scanner Market (2024 – 2030) 3. Market Segmentation 3.1. Global CT Scanner Market by Application 3.1.1. Orthopedics 3.1.2. Cardiovascular 3.1.3. Oncology 3.1.4. Neurology 3.1.5. Others 3.2. Global CT Scanner Market by End User 3.2.1. Hospitals & Ambulatory Surgical Centers (ASCs) 3.2.2. Diagnostic Imaging Centers 3.2.3. Others 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Colombia 4.2.4. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. South Korea 4.3.3. Japan 4.3.4. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. France 4.4.4. Rest of Europe 4.5. The Middle East 4.5.1. Turkey 4.5.2. Israel 4.5.3. Rest of the Middle East 4.6. Africa 4.6.1. Morocco 4.6.2. South Africa 4.6.3. Rest of Africa 5. Value Chain Analysis of the Global CT Scanner Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. GE Healthcare 9.2. Toshiba Group 9.3. Siemens AG 9.4. Koninklijke Philips N.V. 9.5. Neusoft Corp. 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

CT Scanner Market – FAQs

1. What is the current size of the CT scanner market?

Ans. In 2025, the CT scanner market size is USD 7,781.33 Mn.

2. Who are the major vendors in the CT scanner market?

Ans. The major vendors in the CT scanner market are GE Healthcare; Toshiba Group; Siemens AG; Koninklijke Philips N.V.; Neusoft Corp.

3. Which segments are covered under the CT scanner market segments analysis?

Ans. The CT scanner market report offers in-depth insights into Application, End User, and Geography.