Dental Chair Market Insights: Size, Share, Growth Analysis & Forecast (2024-2029)

The market report provided a comprehensive analysis segmented by Product (Powered Dental Chairs, Non-Powered Dental Chairs); by Type (Fixed Dental Chairs, Portable Dental Chairs); by End User (Examinations, Oral Surgery, Orthodontics); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

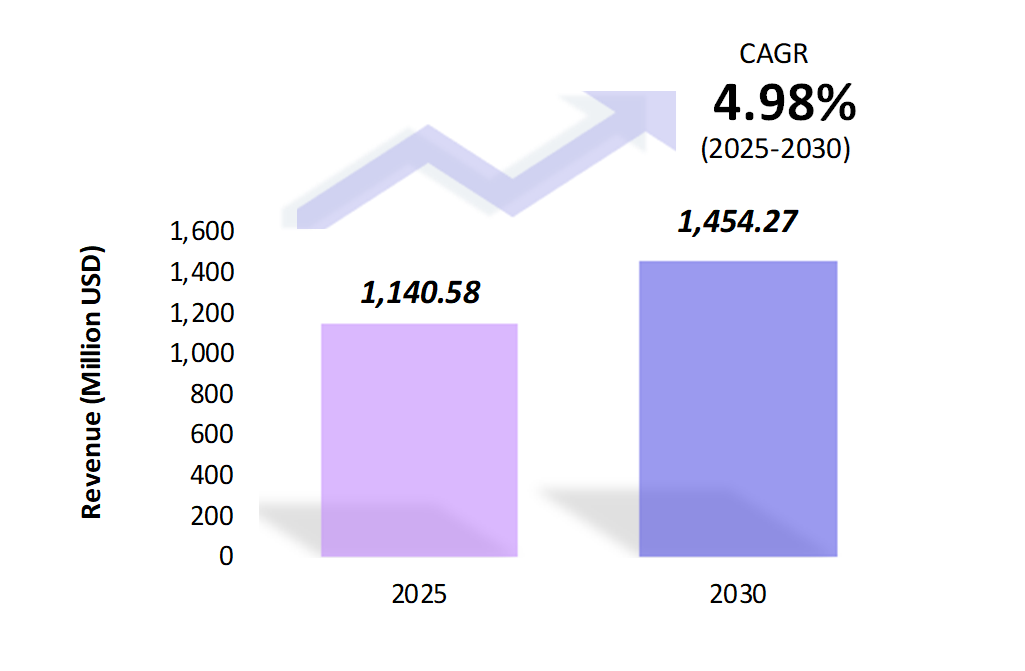

- The dental chair market is estimated to be at USD 1,140.58 Mn in 2025 and is anticipated to reach USD 1,454.27 Mn in 2030.

- The dental chair market is registering a CAGR of 4.98% during the forecast period 2025-2030.

- The dental chair market is seeing significant growth due to the increasing prevalence of dental issues and the expansion of dental care facilities globally. The market is influenced by advancements in ergonomic designs and technology to enhance patient comfort and operational efficiency.

Request a free sample.

Ecosystem

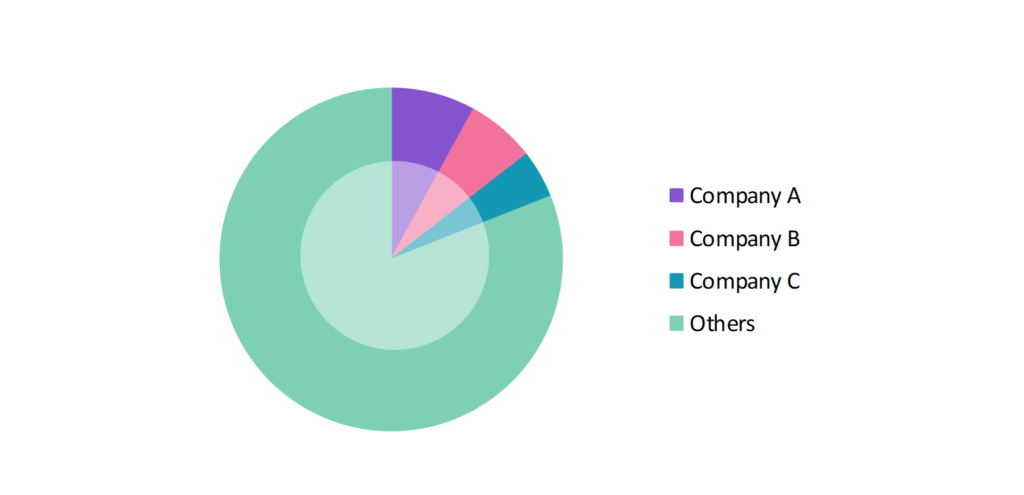

- The participants in the global dental chair industry are always developing their strategies to preserve a competitive advantage.

- These companies primarily use acquisitions, investments, Research and Developments, partnerships, and technological launches.

- Several important entities in the dental chair market include Dentsply Sirona Inc.; Planmeca Group; Henry Schein, Inc.; ADEC Inc.; Envista Holdings Corp.; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2019-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Market Size (2025) | USD 1,140.58 Mn |

| Market Size (2030) | USD 1,454.27 Mn |

| Growth Rate | 4.98% CAGR from 2025 to 2030 |

| Key Segments | Product (Powered Dental Chairs, Non-Powered Dental Chairs); Type (Fixed Dental Chairs, Portable Dental Chairs); End User (Examinations, Oral Surgery, Orthodontics); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | Dentsply Sirona Inc.; Planmeca Group; Henry Schein, Inc.; ADEC Inc.; Envista Holdings Corp. |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; Chile; China; India; Japan; The UK; Germany; France; UAE; Saudi Arabia; Nigeria; South Africa |

| Largest Market | North America |

Get a free quote.

Trends

- Integration of Advanced Technologies: Dental chairs are now incorporating modern technologies such as touch screens, digital imaging, and software integration for seamless dental workflows. For example, in 2023, A-dec launched an advanced model with a touch-control system that allows for real-time adjustments, simplifies procedures, and improves precision.

- Focus on Ergonomics and Patient Comfort: Dental chair manufacturers are emphasizing ergonomic designs to minimize dentist fatigue and maximize patient comfort. In 2022, Dentsply Sirona introduced a chair with fully adjustable armrests and cushioning that conforms to patient anatomy, ensuring long procedure comfort.

- Adoption of Eco-Friendly Materials: The trend of using sustainable and eco-friendly materials in dental chairs reflects manufacturers’ efforts to comply with global environmental regulations. This shift not only reduces the ecological impact of dental practices but also promotes a healthier workspace for both patients and practitioners. As the industry embraces these materials, it sets a standard for environmental responsibility in healthcare settings.

Speak to analyst.

Catalysts

- Rising Demand for Mobile and Portable Dental Units: The growth of community dental programs and increased demand in remote areas have spurred the development of portable and mobile dental chairs. In 2023, the Indian market saw an uptick in sales for mobile dental units equipped with foldable chairs and lightweight designs to facilitate outreach programs.

- Rising Prevalence of Dental Disorders: The rising prevalence of dental caries, periodontal disease, and various oral health issues worldwide is driving a significant increase in the demand for dental chairs. As more people seek dental care to address these concerns, dental practices are investing in advanced equipment, including ergonomic and technologically enhanced chairs, to provide better patient comfort and treatment efficiency.

- Government Initiatives and Healthcare Investments: Investments in public health and government-supported programs to improve dental care access, especially in developing regions, are boosting market demand. For instance, in 2022, the Indian government launched a rural health initiative focusing on oral health, stimulating demand for dental equipment.

Inquire before buying.

Restraints

- High Cost of Advanced Dental Chairs: One of the primary challenges facing the market is the high cost associated with technologically advanced dental chairs. The high prices deter smaller clinics from upgrading their equipment. For example, a premium dental chair equipped with modern tools and software can cost upwards of USD 15,000, making affordability a concern for small practices.

- Maintenance and Repair Issues: The increasing complexity of modern dental chairs, which combine advanced digital technology with mechanical components, presents a significant market challenge. This intricate design often leads to maintenance difficulties, requiring specialized knowledge and skills for repairs. As dental practices seek reliable and efficient equipment, the need for ongoing support and training for maintenance becomes crucial, impacting purchasing decisions and overall market growth.

- Supply Chain Disruptions: The dental chair market has faced significant supply chain disruptions due to factors such as global shipping delays, shortages of key materials, and increased demand post-pandemic. These challenges have led to longer lead times, rising costs, and limited availability of certain models. As a result, dental practices are experiencing difficulties in upgrading or expanding their equipment, which could impact patient care and operational efficiency.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Dental Chair Market (2019 – 2023) 2.2. Global Dental Chair Market (2024 – 2030) 3. Market Segmentation 3.1. Global Dental Chair Market by Product 3.1.1. Powered Dental Chairs 3.1.2. Non-Powered Dental Chairs 3.2. Global Dental Chair Market by Type 3.2.1. Fixed Dental Chairs 3.2.2. Portable Dental Chairs 3.3. Global Dental Chair Market by End User 3.3.1. Examinations 3.3.2. Oral Surgery 3.3.3. Orthodontics 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Chile 4.2.4. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Japan 4.3.4. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. France 4.4.4. Rest of Europe 4.5. The Middle East 4.5.1. UAE 4.5.2. Saudi Arabia 4.5.3. Rest of the Middle East 4.6. Africa 4.6.1. Nigeria 4.6.2. South Africa 4.6.3. Rest of Africa 5. Value Chain Analysis of the Global Dental Chair Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. Dentsply Sirona Inc. 9.2. Planmeca Group 9.3. Henry Schein, Inc. 9.4. ADEC Inc. 9.5. Envista Holdings Corp. 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Dental Chair Market – FAQs

1. What is the current size of the dental chair market?

Ans. In 2025, the dental chair market size is USD 1,140.58 Mn.

2. Who are the major vendors in the dental chair market?

Ans. The major vendors in the dental chair market are Dentsply Sirona Inc.; Planmeca Group; Henry Schein, Inc.; ADEC Inc.; Envista Holdings Corp.

3. Which segments are covered under the dental chair market segments analysis?

Ans. The dental chair market report offers in-depth insights into Product, Type, End User, and Geography.