Tissue Engineering Market Insights: Size, Share, Growth Analysis & Forecast (2024-2029)

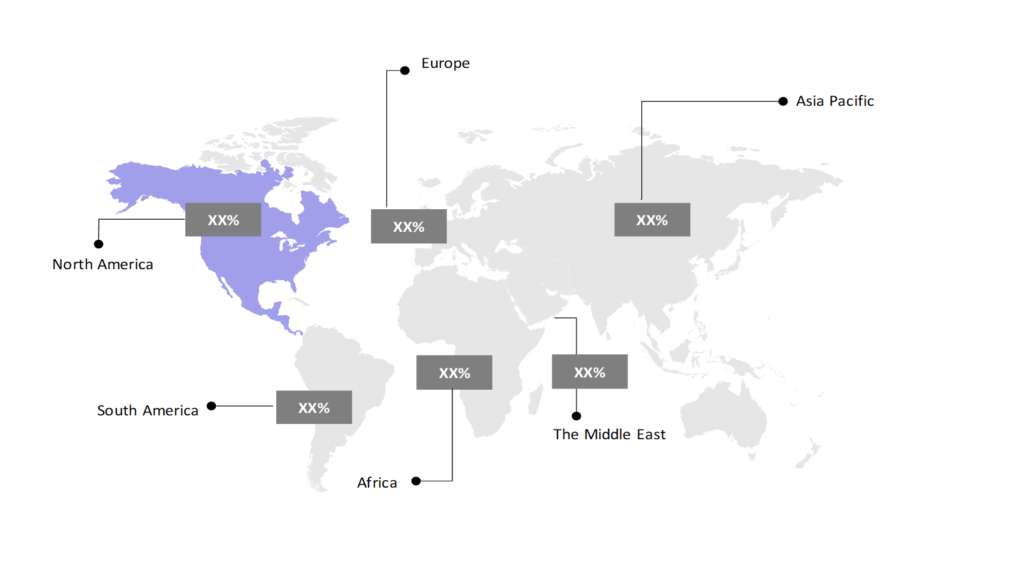

The market report provided a comprehensive analysis segmented by Material (Synthetic Material, Biologically Derived Material); by End User (Hospitals, Specialty Centers and Clinics, Ambulatory Surgical Centers); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

- The tissue engineering market is estimated to be at USD 16,125.08 Mn in 2025 and is anticipated to reach USD 27,640.51 Mn in 2030.

- The tissue engineering market is registering a CAGR of 11.38% during the forecast period 2025-2030.

- Tissue engineering combines cells, engineering, and materials science to create biological tissues for regenerative medicine applications. The global market is growing due to advancements in stem cell technologies, biomaterials, and 3D bioprinting, driven by the need for organ transplants and advanced wound healing solutions.

Request a free sample.

Ecosystem

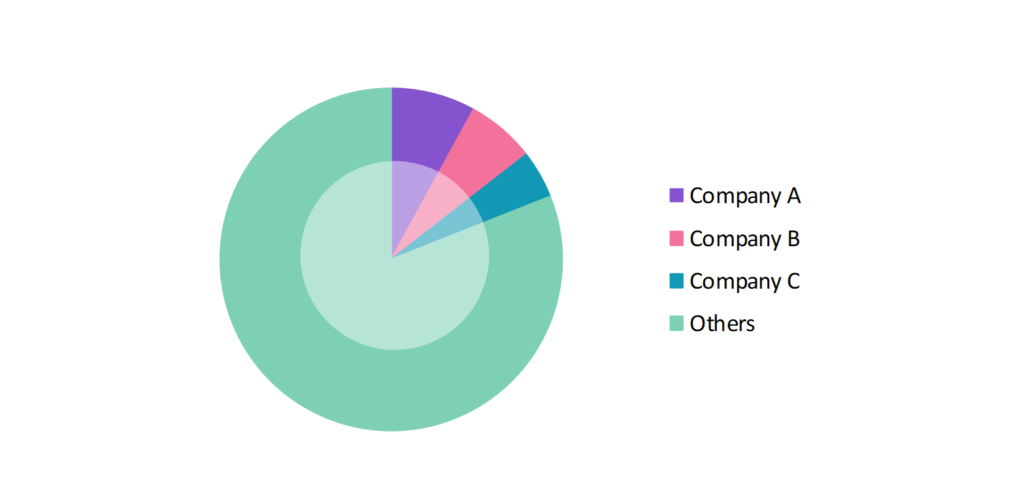

- The participants in the global tissue engineering industry are at the forefront of developing innovative tissue regeneration technologies for clinical applications.

- These companies primarily focus on innovations in 3D bioprinting, aimed at reducing production time and precision of engineered tissues, along with collaborations between biotech companies, academic institutions, and healthcare providers to maintain a competitive edge in the market.

- Several important entities in the tissue engineering market include Organogenesis Inc.; AbbVie Inc.; Baxter International, Inc.; B. Barun SE; Zimmer Biomet Holdings, Inc.; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2019-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Market Size (2025) | USD 16,125.08 Mn |

| Market Size (2030) | USD 27,640.51 Mn |

| Growth Rate | 11.38% CAGR from 2025 to 2030 |

| Key Segments | Material (Synthetic Material, Biologically Derived Material); End User (Hospitals, Specialty Centers and Clinics, Ambulatory Surgical Centers); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | Organogenesis Inc.; AbbVie Inc.; Baxter International, Inc.; B. Barun SE; Zimmer Biomet Holdings, Inc. |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; China; India; Japan; South Korea; The UK; Germany; Italy; France; Israel; UAE; Saudi Arabia; South Africa |

| Largest Market | North America |

Get a free quote.

Trends

- Integration of 3D Bioprinting: The use of 3D bioprinting in tissue engineering is becoming more prevalent as it allows for the precise layering of cells to create functional tissue structures. This technology is transforming tissue production, especially for organ and tissue scaffolding. In 2023, Organovo, a leader in bioprinting, announced advancements in 3D-printed liver tissues for drug testing and transplant research, highlighting the potential of bioprinting in regenerative medicine.

- Stem Cell Research Advancements: Stem cells, particularly induced pluripotent stem cells (iPSCs), are becoming a central component in tissue engineering, allowing for patient-specific tissue regeneration. These cells provide a renewable source of replacement cells and tissues. In 2022, Cellectis made strides in using iPSCs to develop cartilage for osteoarthritis treatments, opening new possibilities in personalized regenerative therapies.

- Smart Biomaterials Development: Smart biomaterials capable of interacting with cells and their surroundings are gaining traction in tissue engineering. These materials enhance the regeneration process by promoting cell growth and differentiation in targeted areas. In 2023, CollPlant developed collagen-based biomaterials that mimic the extracellular matrix, aiding in tissue repair for skin and organ regeneration.

Speak to analyst.

Catalysts

- Increasing Demand for Organ Transplants: The global shortage of donor organs is driving the need for tissue engineering solutions, especially in the context of organ regeneration and repair. Tissue engineering offers a promising alternative to traditional organ transplants, which often involve long waiting times and risks of rejection.

- Rising Prevalence of Chronic Diseases: Chronic diseases, such as diabetes and cardiovascular conditions, are increasing globally, boosting demand for tissue engineering applications in wound healing, cardiovascular repair, and organ regeneration. In 2022, the American Diabetes Association reported that chronic wounds related to diabetes are leading to increased adoption of tissue-engineered products for skin regeneration.

- Growth in Personalized Medicine: Personalized medicine is influencing tissue engineering, as it allows for the development of patient-specific tissues and organs. This is particularly important for organ transplants and treatments where rejection is a concern. In 2023, TissueTech implemented personalized tissue grafts for corneal regeneration, ensuring a better patient response with reduced rejection risks.

Inquire before buying.

Restraints

- High Cost of Tissue Engineering Procedures: The cost of tissue engineering procedures and products remains a significant barrier to market growth, especially in developing regions. Advanced technologies like 3D bioprinting and stem cell therapies come with high production costs, limiting accessibility for some patients. In 2022, Acelity reported that the high costs associated with tissue-engineered skin grafts deterred adoption in lower-income markets, especially for burn treatments.

- Regulatory Challenges: Tissue engineering faces strict regulatory scrutiny, particularly concerning the use of stem cells and genetic manipulation. Additionally, ethical concerns about the use of embryonic stem cells continue to pose challenges for market adoption. In 2023, the Food and Drug Administration (FDA) imposed stricter regulations on stem cell-based therapies, impacting several tissue engineering projects aimed at organ regeneration.

- Supply Chain Disruptions: Disruptions in the supply chain of essential materials like biomaterials, cells, and growth factors can impact the production and delivery of tissue engineering products. The reliance on complex international supply chains for specialized components has led to occasional shortages. In 2022, Baxter International experienced delays in delivering key materials used in tissue engineering products due to disruptions caused by global shipping challenges.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Tissue Engineering Market (2019 – 2023) 2.2. Global Tissue Engineering Market (2024 – 2030) 3. Market Segmentation 3.1. Global Tissue Engineering Market by Material 3.1.1. Synthetic Material 3.1.2. Biologically Derived Material 3.2. Global Tissue Engineering Market by End User 3.2.1. Hospitals 3.2.2. Specialty Centers and Clinics 3.2.3. Ambulatory Surgical Centers 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Japan 4.3.4. South Korea 4.3.5. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. Italy 4.4.4. France 4.4.5. Rest of Europe 4.5. The Middle East 4.5.1. UAE 4.5.2. Israel 4.5.3. Saudi Arabia 4.5.4. Rest of the Middle East 4.6. Africa 4.6.1. South Africa 4.6.2. Rest of Africa 5. Value Chain Analysis of the Global Tissue Engineering Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. Organogenesis Inc. 9.2. AbbVie Inc. 9.3. Baxter International, Inc. 9.4. B. Barun SE 9.5. Zimmer Biomet Holdings, Inc. 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Tissue Engineering Market – FAQs

1. What is the current size of the tissue engineering market?

Ans. In 2025, the tissue engineering market size is USD 16,125.08 Mn.

2. Who are the major vendors in the tissue engineering market?

Ans. The major vendors in the tissue engineering market are Organogenesis Inc.; AbbVie Inc.; Baxter International, Inc.; B. Barun SE; Zimmer Biomet Holdings, Inc.

3. Which segments are covered under the tissue engineering market segments analysis?

Ans. The tissue engineering market report offers in-depth insights into Material, End User, and Geography.