Wound Care Market Insights: Size, Share, Growth Analysis & Forecast (2024-2029)

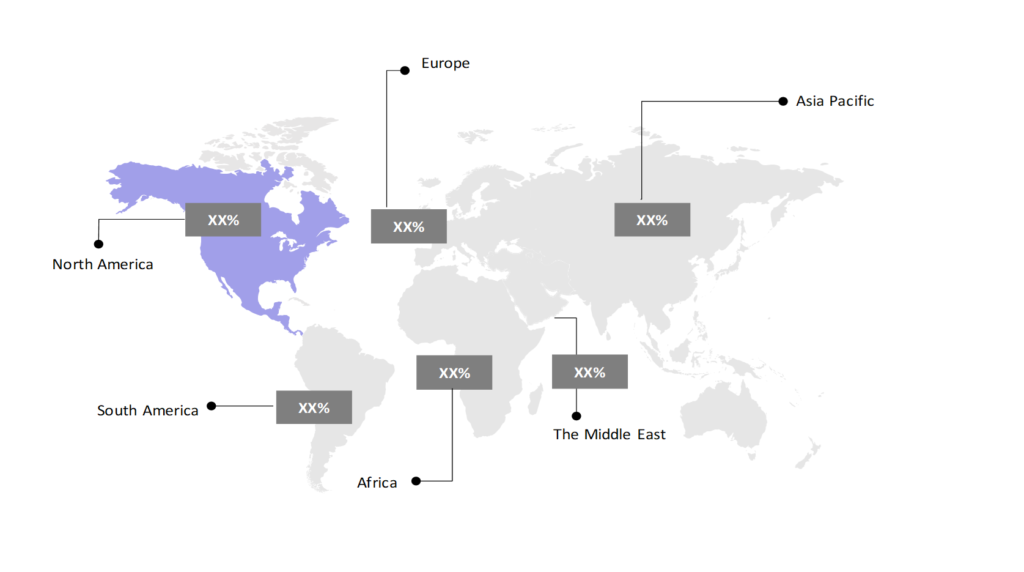

The market report offers a detailed analysis segmented by Product (Advanced Wound Care Products, Surgical Wound Care Products, Traditional Wound Care Products); by Wound Type (Acute Wound, Chronic Wound); by End User (Hospitals and Clinics, Long-term Patient Care, Home Care Settings, Others); by Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa).

Outlook

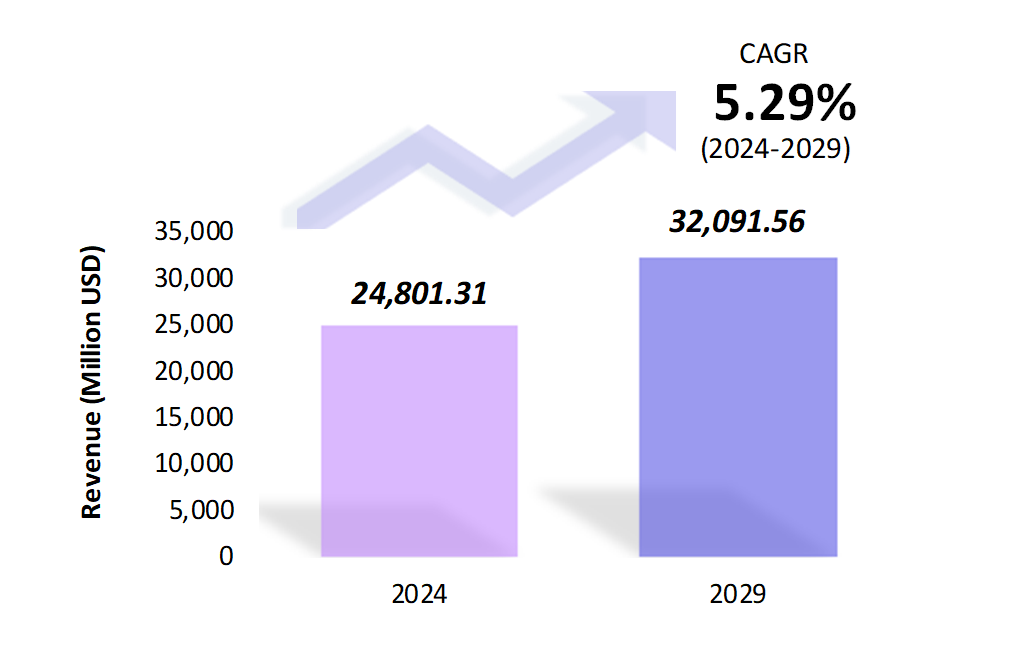

- The wound care market is estimated to be at USD 24,801.31 Mn in 2024 and is anticipated to reach USD 32,091.56 Mn in 2029.

- The wound care market is registering a CAGR of 5.29% during the forecast period of 2024-2029.

- The global wound care market is witnessing significant growth, driven by an increasing prevalence of chronic wounds, rising elderly populations, and advancements in wound care products and technologies. The market includes products for acute, chronic, and surgical wounds, with a growing emphasis on advanced wound care solutions that promote faster healing and reduce the risk of infections.

Request a free sample.

Ecosystem

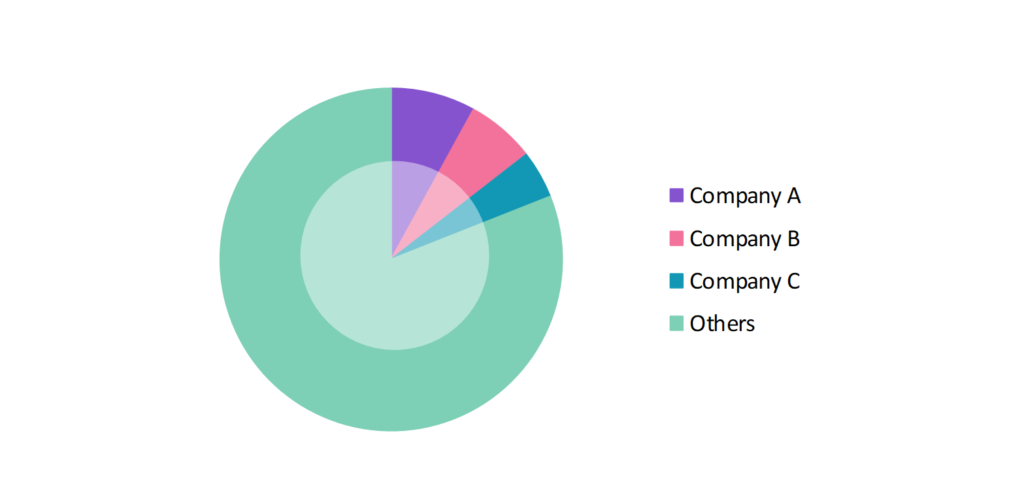

- The global wound care industry participants are always developing strategies to preserve a competitive advantage.

- These companies are driving the wound care market forward through continuous innovation, strategic partnerships, and a focus on meeting the evolving needs of patients and healthcare providers.

- Several important entities in the wound care market include Smith & Nephew Plc; 3M Co.; Cardinal Health, Inc.; Medtronic Public Ltd. Co.; Convatec Group Plc; and others.

Ask for customization.

Findings

| Attributes | Values |

|---|---|

| Historical Period | 2018-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Market Size (2024) | USD 24,801.31 Mn |

| Market Size (2029) | USD 32,091.56 Mn |

| Growth Rate | 5.29% CAGR from 2024 to 2029 |

| Key Segments | Product (Advanced Wound Care Products, Surgical Wound Care Products, Traditional Wound Care Products); Wound Type (Acute Wound, Chronic Wound); End User (Hospitals and Clinics, Long-term Patient Care, Home Care Settings, Others); Geography (North America, South America, Asia Pacific, Europe, The Middle East, Africa) |

| Key Vendors | Smith & Nephew Plc; 3M Co.; Cardinal Health, Inc.; Medtronic Public Ltd. Co.; Convatec Group Plc |

| Key Countries | The US; Canada; Mexico; Brazil; Argentina; Colombia; Chile; China; India; Japan; South Korea; The UK; Germany; Italy; France; Spain; Turkey; UAE; Saudi Arabia; Egypt; South Africa |

| Largest Market | North America |

Get a free quote.

Trends

- Adoption of Telemedicine in Wound Care: The adoption of telemedicine for wound care management is enhancing, providing patients with remote access to wound care specialists. Telemedicine platforms allow for regular monitoring of wound healing, reducing the need for frequent hospital visits.

- Development of Smart Wound Dressings: Smart wound dressings, equipped with sensors that monitor wound conditions such as moisture levels and pH, are becoming increasingly popular. These dressings provide real-time data, allowing for more precise and timely interventions. In 2023, researchers in the UK developed a new smart dressing capable of detecting infections early, demonstrating the potential of these innovations in improving wound care outcomes.

- Integration of Artificial Intelligence in Wound Care Tools: Artificial intelligence (AI) is being integrated into wound care for predictive analytics, treatment planning, and outcome assessment. AI-powered tools can analyze wound images and patient data to recommend optimal treatment strategies. In 2023, an AI-driven wound care platform was launched in Canada, enabling healthcare providers to predict wound healing trajectories and personalize care plans.

Speak to analyst.

Catalysts

- Rising Incidence of Chronic Diseases: The growing prevalence of chronic diseases, such as diabetes and obesity, is a major driver for the wound care market. These conditions often lead to chronic wounds, such as diabetic foot ulcers, which require advanced wound care solutions.

- Increasing Surgical Procedures: The rise in the number of surgical procedures globally is boosting the demand for wound care products, particularly for post-surgical wound management. As surgical interventions become more common, the need for effective wound care to prevent infections and promote healing is increasing.

- Technological Advancements in Wound Care: Innovations in wound care technologies, including the development of advanced wound dressings, bioactive therapies, and negative pressure wound therapy (NPWT), are driving market growth. These technologies improve healing outcomes and reduce complications. For example, in 2023, Smith & Nephew launched a new range of bioactive wound dressings designed to accelerate wound healing and reduce the risk of infection.

Inquire before buying.

Restraints

- High Cost of Advanced Wound Care Products: The high cost of advanced wound care products and technologies, such as bioactive dressings and Negative Pressure Wound Therapy (NPWT) devices, is a significant challenge, particularly in low- and middle-income countries. These costs limit access to effective wound care for patients who cannot afford these treatments.

- Risk of Infections and Complications: Despite advancements in wound care, the risk of infections and complications remains a significant challenge, particularly in chronic wounds. Infections can lead to prolonged healing times, increased healthcare costs, and, in severe cases, amputations.

- Regulatory Hurdles: Stringent regulatory requirements for wound care products, including the approval process for new products and compliance with safety standards, can delay the introduction of innovative wound care solutions. These regulatory challenges can increase costs and limit market entry for new players. In 2023, the European Union’s new Medical Device Regulation (MDR) created additional compliance challenges for wound care manufacturers, impacting the timely availability of new products.

Personalize this research.

Hotspot

Explore purchase options.

Table of Contents

| 1. Introduction 1.1. Research Methodology 1.2. Scope of the Study 2. Market Overview / Executive Summary 2.1. Global Wound Care Market (2018 – 2022) 2.2. Global Wound Care Market (2023 – 2029) 3. Market Segmentation 3.1. Global Wound Care Market by Product 3.1.1. Advanced Wound Care Products 3.1.2. Surgical Wound Care Products 3.1.3. Traditional Wound Care Products 3.2. Global Wound Care Market by Wound Type 3.2.1. Acute Wound 3.2.2. Chronic Wound 3.3. Global Wound Care Market by End User 3.3.1. Hospitals and Clinics 3.3.2. Long-term Patient Care 3.3.3. Home Care Settings 3.3.4. Others 4. Regional Segmentation 4.1. North America 4.1.1. The US 4.1.2. Canada 4.1.3. Mexico 4.2. South America 4.2.1. Brazil 4.2.2. Argentina 4.2.3. Colombia 4.2.4. Chile 4.2.5. Rest of South America 4.3. Asia Pacific 4.3.1. China 4.3.2. India 4.3.3. Japan 4.3.4. South Korea 4.3.5. Rest of Asia Pacific 4.4. Europe 4.4.1. The UK 4.4.2. Germany 4.4.3. Italy 4.4.4. France 4.4.5. Spain 4.4.6. Rest of Europe 4.5. The Middle East 4.5.1. Turkey 4.5.2. UAE 4.5.3. Saudi Arabia 4.5.4. Rest of the Middle East 4.6. Africa 4.6.1. Egypt 4.6.2. South Africa 4.6.3. Rest of Africa 5. Value Chain Analysis of the Global Wound Care Market 6. Porter Five Forces Analysis 6.1. Threats of New Entrants 6.2. Threats of Substitutes 6.3. Bargaining Power of Buyers 6.4. Bargaining Power of Suppliers 6.5. Competition in the Industry 7. Trends, Drivers and Challenges Analysis 7.1. Market Trends 7.1.1. Market Trend 1 7.1.2. Market Trend 2 7.1.3. Market Trend 3 7.2. Market Drivers 7.2.1. Market Driver 1 7.2.2. Market Driver 2 7.2.3. Market Driver 3 7.3. Market Challenges 7.3.1. Market Challenge 1 7.3.2. Market Challenge 2 7.3.3. Market Challenge 3 8. Opportunities Analysis 8.1. Market Opportunity 1 8.2. Market Opportunity 2 8.3. Market Opportunity 3 9. Competitive Landscape 9.1. Smith & Nephew Plc 9.2. 3M Co. 9.3. Cardinal Health, Inc. 9.4. Medtronic Public Ltd. Co. 9.5. Convatec Group Plc 9.6. Company 6 9.7. Company 7 9.8. Company 8 9.9. Company 9 9.10. Company 10 |

Know the research methodology.

Wound Care Market – FAQs

1. What is the current size of the wound care market?

Ans. In 2024, the wound care market size is USD 24,801.31 Mn.

2. Who are the major vendors in the wound care market?

Ans. The major vendors in the wound care market are Smith & Nephew Plc; 3M Co.; Cardinal Health, Inc.; Medtronic Public Ltd. Co.; Convatec Group Plc.

3. Which segments are covered under the wound care market segments analysis?

Ans. The wound care market report offers in-depth insights into Product, Wound Type, End User, and Geography.